Chapter 9

Alternatives

U.S. Real Estate Market Outlook 2021

3 Minute Read

Data Centers

Continued Growth In 2021

Absorption among primary U.S. data center markets (Atlanta, Chicago, Dallas/Ft. Worth, New York Tri-State, Northern Virginia, Phoenix and Silicon Valley) totaled 134.9 MW in H1 2020. Hyperscale companies, large cloud service providers and content providers leased space in wholesale colocation facilities to meet a spike in demand from their customers during the COVID-19 pandemic.

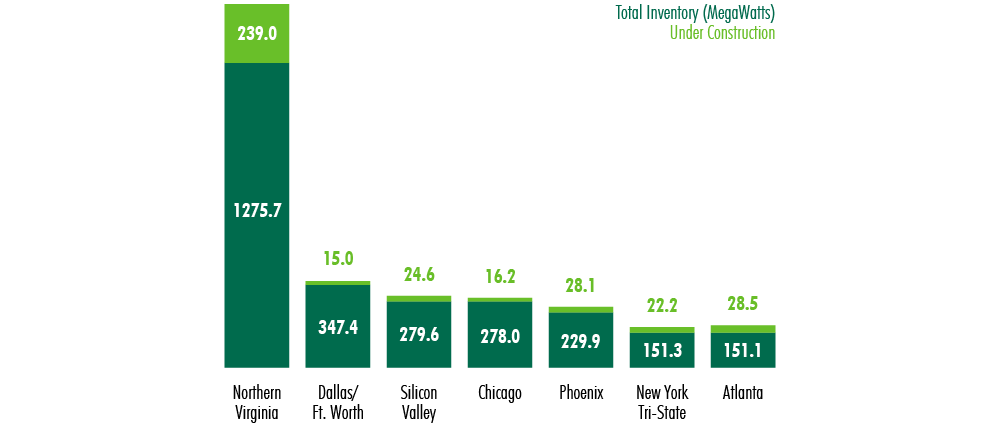

Hyperscale activity likely will level out in 2021 as demand drivers that spiked in 2020 begin to plateau, including enterprise clients leveraging hybrid IT solutions to accommodate remote working mandates. This trend likely will continue, albeit at a slower pace than in 2020. With more than 373 MW of wholesale colocation currently under construction across the seven primary markets, data center supply is expected to grow next year.

Enterprise users continue to renew colocation leases, often for shorter terms, while they consider long-term options. Cloud adoption among enterprise users has also reinforced the notion that not all assets are created equal. The facilities with potential for scalability, high connectivity and proximity to cloud on-ramps are better positioned in the market than older, smaller assets with less ability to support the evolution of data center technology. As new technologies like 5G and Edge computing emerge, high-quality and highly connected assets in secondary markets likely will see more activity. The ability to customize delivered services to meet specific client requirements will be imperative.

Investor Interest Accelerates

Investor interest in the data center sector has increased based on the success of the five core data center REITs, which have recorded more than 28% revenue growth year-to-date. Most investors are looking for high-quality assets from providers with strong credit ratings that offer facilities with high client retention and low churn rates. Many enterprise users continue to leverage partial-sale leasebacks as they reevaluate their IT spend next year.

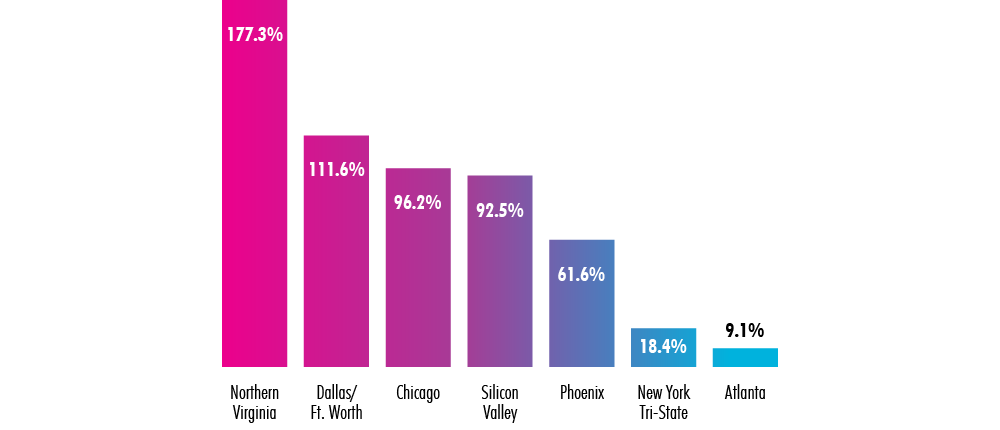

Figure 20: Inventory Growth Of Primary Data Center Markets Since 2015

Source: CBRE Research, CBRE Data Center Solutions, H1 2020.

Figure 21: Total Inventory And Under Construction, Primary Markets

Source: CBRE Research, H1 2020.

Affordable Clean Energy Top Of Mind

As data center technology evolves and allows for more power-dense facilities, many providers are looking to expand in markets that offer affordable clean energy. Montreal and Hillsboro (Portland), OR provide hydroelectric power at rates well below those in other markets. Data centers also stand to benefit from increased efficiencies with regards to power and energy storage.

What To Watch

- Hyperscale Cloud Providers: Will hyperscale companies continue to take space in wholesale colocation facilities or move back to more traditional hyperscale facilities, or will they continue to leverage both?

- Pricing Trends: Will asking rates remain stable or will there be increased bifurcation of pricing trends between large hyperscale users and smaller enterprise clients?

- Cloud Migration: How will increased cloud services affect the leasing numbers for enterprise users who have decided to migrate to a hybrid IT approach?

- COVID-19: What lasting effects will the pandemic and the economic recession have on new investment? How will enterprise users’ IT spend change in 2021?

Alternatives

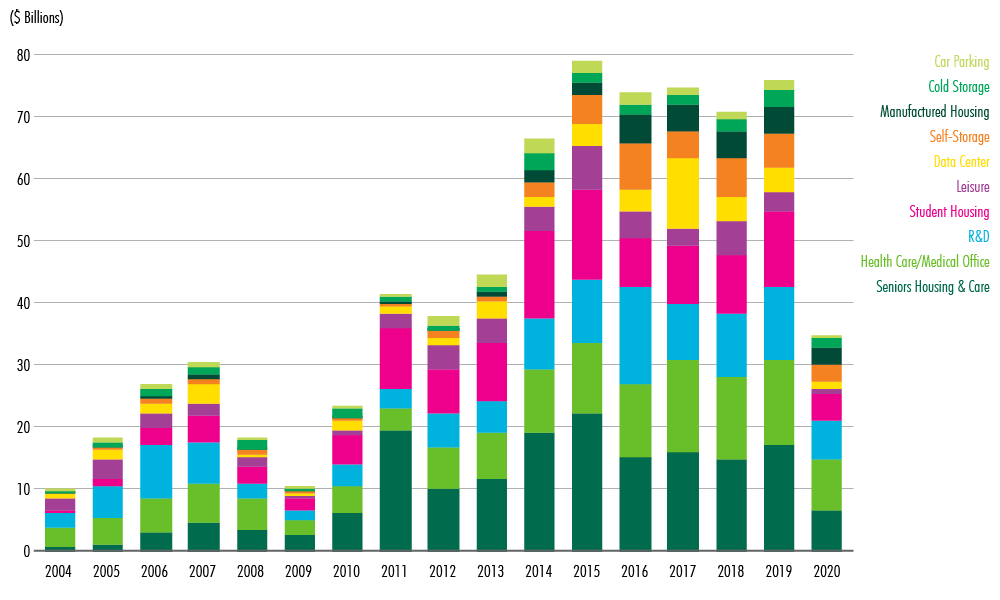

Alternatives are specialty operational real estate with relatively low inventory, less turnover and higher yield. Globally, alternatives investment has averaged about $90 billion annually over the past five years, more than double the peak in the previous cycle. Recent CBRE investor surveys found that 60% of respondents are actively pursuing one or more alternative sectors, led by data centers and health-care facilities.

Investors are attracted to alternatives by their relatively high yields, stable income and diversification. Some alternative sectors, such as life sciences and student housing, historically offer downturn protection.

Long-term demographic, technological and social changes present generational opportunities for specialty players to grow the market as well as their market shares. Growth of the elderly population is driving demand for seniors housing and nursing care. And the recent explosive growth of online grocery and pharmaceuticals has fueled the cold-storage industry, while the ever-growing digital economy and widespread adoption of cloud-based services supports the growth of data centers.

Figure 22: Investment To U.S. Alternatives

Source: CBRE Research, Real Capital Analytics, 2020.

Life Sciences

Technological changes and medical discoveries have caused the life sciences sector to cluster near the nation’s premier research universities and health-care centers. COVID-19 has accelerated growth of the life sciences industry.

COVID-19 has led to new requirements for lab/R&D and biomanufacturing space, increased production and manufacturing domestically and more support from policymakers. New lab/R&D and biomanufacturing space is being completed in markets with previously limited supply, as well as in leading life sciences clusters such as Boston-Cambridge and the San Francisco Bay Area. Lab conversions from other property types have also accelerated, especially in CBD markets. The strong supply growth of R&D space over the past several years has produced a growing need for more biomanufacturing space to produce many of the solutions and innovations devised in the lab.

The strong correlation between venture capital funding and employment growth in the life sciences industry means there should be more hiring and demand for life sciences commercial real estate next year. Nevertheless, there are always risks for a burgeoning industry fueled by early growth stage and venture capital-funded companies. There is also the risk of a pullback in demand once greater progress emerges toward a viable vaccine or therapeutics to address COVID-19.

Cold Storage

One of the most sought-after asset classes by opportunistic and institutional investors, this niche industrial subsector is poised for growth from e-commerce expansion into the grocery business. However, investors remain primarily focused on facilities with credit worthy tenants and long-term leases in core industrial markets.

Interest in cold storage assets has heightened during the pandemic. While developers are exploring speculative opportunities, most projects are still done on a build-to-suit (BTS) basis given specific user requirements. Growth in online food sales, particularly for perishables and refrigerated/frozen foods, have piqued investor interest, leading to yield compression. Opportunities include sale/leasebacks, joint ventures with cold-chain operators and BTS development near major population clusters. Conversions from dry to cold warehousing may also present opportunities for experienced investors and developers. Despite higher CAPEX and OPEX, cold storage commands higher rent premiums than do dry warehouses.

Without specialized knowledge or strong partnership with an experienced cold storage operator, investors may find it difficult to capitalize on opportunities. Since these facilities require highly specialized amenities, capital expenditures are significant. Refrigerated warehouses have one of the highest electric consumption rates in the commercial building sector. The sector has a variety of highly unique, expensive facility buildouts, each with their own nuances.

Single-Family Rentals

The build-to-rent single-family housing sector (BTR) is a rapidly growing alternative for both multifamily and single-family renters. It was one of the betterperforming alternative sectors in 2020 with mostly positive demand drivers. The 2021 outlook is highly favorable.

BTR housing communities are meeting a growing housing demand niche: multifamily renters who want more space due to growing families, increased remote work and other lifestyle-related factors. BTR housing also appeals to single-family renters and some owners who desire new housing plus community amenities and services. The product appeals to all who want low-density housing but cannot afford to buy a house. BTR is becoming more readily available, thereby increasing market awareness and investment opportunities.

The single-family rental (SFR) sector had stronger rent growth and lower vacancy than multifamily this year, although the recession did moderate rent gains. Next year will begin with less robust conditions than before the COVID-19 period. The BTR sector is still very small and offers only limited investment opportunities, which could lead to some missteps and market imbalances down the road. Competition is also growing from homebuilders constructing new SFR housing to sell to institutional owners of stand-alone (noncommunity based) rentals.

Single-Seniors Housing

COVID-19 impacted this sector more than most with little new leasing activity for much of 2020. Deteriorating property fundamentals in Q2 and Q3 reduced investment activity significantly in 2020, but the 2021 outlook for both market performance and investment is brighter.

Demand for seniors housing began to pick up in Q4 and should improve in 2021. Baby boomers have reached the active adult segment’s target age range, increasing investor interest in this asset type along with assisted living. Pricing discounts may be found for some seniors housing assets in 2021 but not for the best ones.

The seniors housing market should slowly improve in 2021 but a full recovery won’t occur before 2022. New supply has moderated from recent years, but there are some markets with more supply than can be readily absorbed. Real or perceived added COVID-19 risk could keep investment activity lighter than usual and financing harder than usual to obtain.

Student Housing

The student housing market weathered 2020 better than expected though uncertainty greatly reduced investment. Enrollment, which fell about 3.0% in fall 2020, should rebound in 2021. The new academic year will bring gains in occupancy and leasing, thereby attracting investors.

Despite higher education transitioning to online and hybrid (online, on-campus) structures, enrollment held up quite well in fall 2020, dropping by only 3.0% overall and only 1.4% at the public four-year universities where a large portion of student housing is located. Enrollment could rise in January as more international students return. Enrollment in fall 2021 should rise further, capturing more international students and 2020 high school graduates who took a gap year. With only moderate supply growth, renewed demand could put student housing back to pre-COVID performance levels by fall 2021. With stronger leasing and more clarity on students returning to campus, both investment and financing activity will rise notably.

American Community Campus, the only student housing REIT and an industry barometer, reported 91.0% of its units leased in September, down from 97.4% a year ago. Some smaller and second-tier colleges that were struggling to maintain enrollments and finances prior to COVID-19 remain at risk, though have only a small portion of the country’s total student housing inventory. Longer-term trends point to a modest decline in the number of 18-year-olds in the U.S.

.jpg)