Chapter 6

Retail

U.S. Real Estate Market Outlook 2021

3 Minute Read

Reversal Of Record E-Commerce Growth

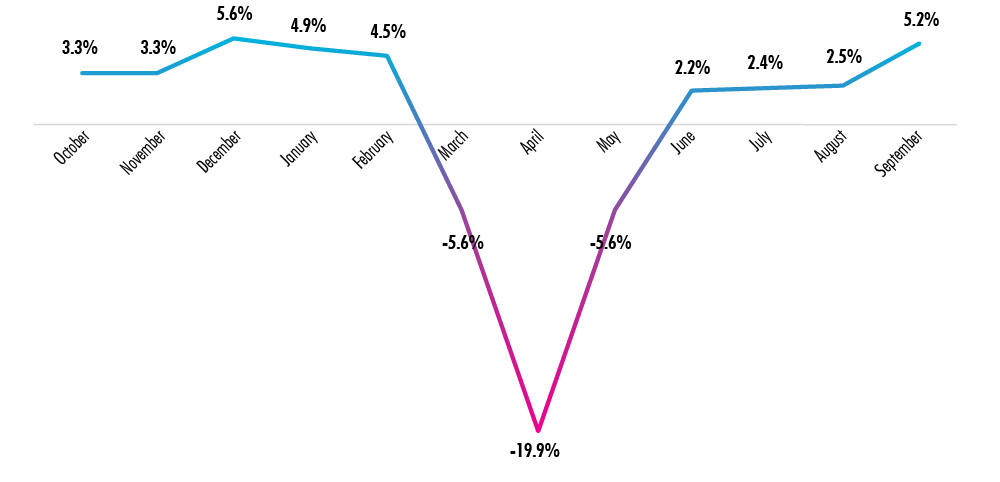

After falling in February, total retail sales growth resumed in June with the surge in e-commerce sales and the reopening of brick-and-mortar stores. Although e-commerce growth accelerated dramatically this year, the growth rate is unsustainable over the long term largely due to the operational and profitability limitations around shipping and logistics. Brick-and-mortar stores will be valuable in delivering the physical experience and deeper engagement that consumers want, as well as increased profit margins from the fulfillment of digital sales through buy-online/pick-up-in-store or curbside pick-up programs.

Figure 11: 2020 Total Retail Sales Growth (Y-o-Y)

Source: CBRE Research, U.S. Census Bureau, September 2020.

The tremendous pandemic-fueled growth in e-commerce sales this year has begun to stabilize. CBRE Research predicts the rate of e-commerce sales growth will decline in 2021 for the first time since 2008, according to the U.S. Census Bureau. Growth will resume in 2022 at a more moderate pace.

Bankruptcies & Store Closures Will Continue Next Year

Retail bankruptcies in the first eight months of 2020 nearly exceeded the 48 in all of 2010 following the Global Financial Crisis. CBRE Research forecasts that retail store closures in 2020 and 2021 each will exceed the 2019 record of 9,800 reported by the International Council of Shopping Centers (ICSC). Many of the bankruptcies and store closures will result from COVID-related failures of structurally declining categories such as department stores and apparel, along with an unexpected cyclical reversal in restaurants, gyms and entertainment.

New retail concepts will absorb some of the vacancies left by failed retailers. Digitally native brands, medical uses, health and wellness, automotive showrooms and service centers, pet services, franchisee-driven operations and salon suites will capitalize on opportunistic market conditions. Grocers, convenience stores and quick-service restaurants will also grow aggressively. Greater availability of prime second-generation space, declining rental rates and motivated landlords offering concessions and pandemic-related protections will drive lease transactions in 2021. Additionally, private equity and venture capital funds are actively seeking to finance new retail ventures provided they offer justifiable risk-return rewards.

Adaptive Reuse/Conversion Of Class B & C Malls

CBRE Research predicts up to a 20% reduction in total U.S. retail real estate inventory by 2025 from the current level of 56 square feet per capita, according to ICSC. This will be triggered by large-scale adaptive reuse and conversion beginning next year, particularly among Class B and C malls that have been the most impacted by failing department stores and apparel retailers causing co-tenancy exposure. Further consolidation among mall REITs is expected in 2021, along with increasing sales of non-core assets as pricing resets under the duress and rising risk of receivership and insolvency.

While mall owners have made bold moves with signature tenants to preserve occupancy and differentiate their properties through merchandising, the current problems facing malls can no longer be solved solely through leasing. Malls will require a strategic evaluation of the highest and best use of the underlying land and demand drivers for adaptive reuse and conversion. While the fastest-growing conversion category is retail to industrial, adaptive reuse with multifamily, office and hotel components will still be viable on a market and asset-specific basis. Alternative uses also include medical, education, cultural centers and open space. Off-mall big-box retailers will increasingly consider acquisition of mall sites for redevelopment given favorable pricing for prime locations.

Successful adaptive reuse and conversion require overcoming complex regulatory issues, as well as greater flexibility in municipal zoning and department store cooperation granting consent and modifications to reciprocal easement agreements permitting redevelopment. To avoid the further loss of retail uses and sales tax revenue, some local and state jurisdictions may provide more public financing and subsidies for these redevelopments.

Clear Investment Bifurcation Across Property Types & Markets

Lack of clarity around rent rolls and net operating income make it difficult to assess the value of retail properties, furthering a pricing disconnect between buyers and sellers that kept investment activity stagnant in 2020. Investors will approach retail cautiously and selectively in 2021 while there is ongoing rent roll instability due to collection issues and vacancies and until there is greater income and pricing transparency. COVID-related rent negotiations and lease restructuring will continue in 2021 as some retailers will be unable to make balloon payments of deferred rent and will require additional deferral or abatement to stay open. Distressed assets are expected to rise in the first half of 2021, especially for those with debt coming due.

There will be a clear bifurcation between property types and markets. Single-tenant net-leased properties and suburban neighborhood and grocery-anchored centers will continue to be the most resilient. Demand and greater debt availability in these sectors may lead to cap rate compression next year in certain high-growth markets with low supply.

Malls and urban-core retail are facing the steepest declines in occupancy, term length, rent and subsequent valuation. Investors will be reluctant to make any short-term urban retail commitments until office workers and tourists return to cities and there is a determination of whether suburban migration patterns during the pandemic will be longer lasting.

Institutional investors will continue their retreat from retail except for quality core assets like grocery-anchored centers. Private capital will remain active and pave the way for the emergence of a new class of opportunistic investors and private equity firms seeking attractively priced distressed retail assets for stabilization, redevelopment or conversion.

Markets To Watch

There has been a clear bifurcation in consumer spending, retailer performance and market resilience between suburban and urban-core markets. Recovery is uneven and will take much longer in urban markets like New York City and San Francisco, where demand drivers are still severely handicapped. The suburbs will lead the recovery.

Sun Belt and secondary cities like Phoenix, Austin, Denver, Sacramento and Charlotte will benefit from faster office re-occupancy, increased inward migration, less impact to mobility and a greater prevalence of open-air shopping centers and outdoor space to enhance capacities. These markets will see less rent decline and likely will bottom out sooner than other markets. While availability will increase due to rising bankruptcies and store closures, there is better potential for absorption and adaptive reuse/conversion based on market strength. New “Zoom towns” are also emerging during the pandemic. Cities like Bend, Oregon and St. Louis with a smaller population base are benefitting from a rapid influx of residents relocating from larger cities for a lower cost of living as their jobs become more remote-friendly.

.jpg)