Chapter 7

Multifamily

U.S. Real Estate Market Outlook 2021

3 Minute Read

Path To Full Recovery In 2021

Multifamily weathered the 2020 recession better than most property sectors—only industrial held up better—and market deterioration was far less than in previous recessions. Still, it was a tough year for multifamily as many owners lost rental income plus ancillary income from waived fees, deferred rents and delinquencies.

CBRE forecasts a return to pre-COVID vacancy levels and a 6% increase in net effective rents next year, with a full market recovery occurring in early 2022. The economic rebound will lead to rising multifamily demand, largely from “unbundling”—certain renters moving out of their parents’ homes or those of friends as job opportunities provide more financial flexibility to live independently. Demand levels in 2021 likely will fall short of pre-COVID peaks in 2018 and 2019 but should rise significantly from 2020.

Vacancy rates for affordable multifamily housing will remain relatively low in 2021. Unlike in previous recessions, more affordable housing inventory (Class B and C) maintained low vacancy rates and modest rent growth in 2020. Class C properties had higher delinquencies.

Class A assets were impacted the most by COVID-19 this year due to higher turnover from young adults moving back home, steady delivery of new supply and renters seeking less expensive housing. Class B assets should continue to outperform in 2021 with low vacancy and steady rent growth. Class A assets may not begin recovering until midyear.

Development will remain robust next year. Most of 2021’s scheduled deliveries were started long before COVID-19 and likely will reach 280,000 units on top of the estimated 300,000-unit total this year. This level of new supply will temper improvement in Class A vacancies and rents in many markets.

Figure 14: Multifamily Urban Submarkets – Challenges And Considerations For Recovery

| FACTOR | CHALLENGES | RECOVERY PATH & CONSIDERATIONS IN 2021 | |

| Economy | Income | Loss of job, reduced income, loss of confidence in future income and employment opportunity. | Most industries recovering steadily (though not all, such as entertainment, tourism, hospitality, retail). |

| COVID-19 Related | WFH/WFA | With work-from-home/work-from-anywhere practices common for office workers, living near the workplace is far less relevant. | Most office workers back at office by Q1, but "new norm" more likely 30% to 60% at office translating to less emphasis on living in close proximity to work. |

| Urban Amenities | Limited availability of entertainment, restaurants/bars, cultural amenities, sports, etc. | Urban amenities continue to return through 2021 (pace partly dependent on vaccine diffusion process); 80-90% back by end of 2021. | |

| Public Transit | Many renters uncomfortable taking public transit; private transportation options limited, too expensive or impractical in many cities. | Once a vaccine is widely available and widely distributed, fear factor should subside fairly quickly. | |

| Living Space | More living space desired as renters spend more time at home. | This should diminish as people go back to school and work; however, hybrid nature of both will likely be a feature of the "new normal." | |

| Outdoor Space | Many renters desire greater access to outdoor options as an outlet for long hours in apartments. | Continued opening up of public outdoor amenities will mitigate this factor; still, some renters will continue to move to less dense areas. | |

| Secular Trends | High Rents | Cost-benefit calculus: with less benefits from urban living, justification of high cost of urban living comes into question. | As urban living conditions improve, high rent becomes less of factor; reductions in urban rents will entice some new residents; however, some renters who became accustomed to more affordable suburban rents may not return due to costs. |

| Lifestyle | Millennials moving into life stages where urban living is often traded in for less-dense housing options in other submarkets and/or markets. | Likely to continue to put downward pressure on urban multifamily demand; urban living seems to be appealing to Gen Z, but it's a smaller cohort (smaller number in each age group). |

Source: CBRE Research, Q4 2020.

An Urban To Suburban Shift

The COVID-induced recession impacted urban submarkets much more than suburban ones in 2020. As a result, suburban submarkets will lead the multifamily sector’s recovery in 2021 while urban submarkets will lag.

Five major COVID-19-related factors diminished the appeal of urban submarkets in 2020: remote working requirements, the closing of a portion of urban amenities, the reluctance to use public transit, a desire for more living space and a desire for greater access to the outdoors. Non-COVID-related factors exacerbated the situation, including the high cost of urban apartments and shifting demographics. Millennials are reaching life stages where urban living is often traded in for larger housing options in less-dense submarkets.

There are no indications that 2020’s decline in urban multifamily demand is permanent or there is an impending return to the hollowed-out cities of the 1970s and 1980s. Yet urban submarkets will lag in the multifamily sector’s overall recovery. Lower-density and less-expensive suburban submarkets held up remarkably well in 2020 and are positioned to lead overall market performance in 2021.

Increased Multifamily Investment In 2021

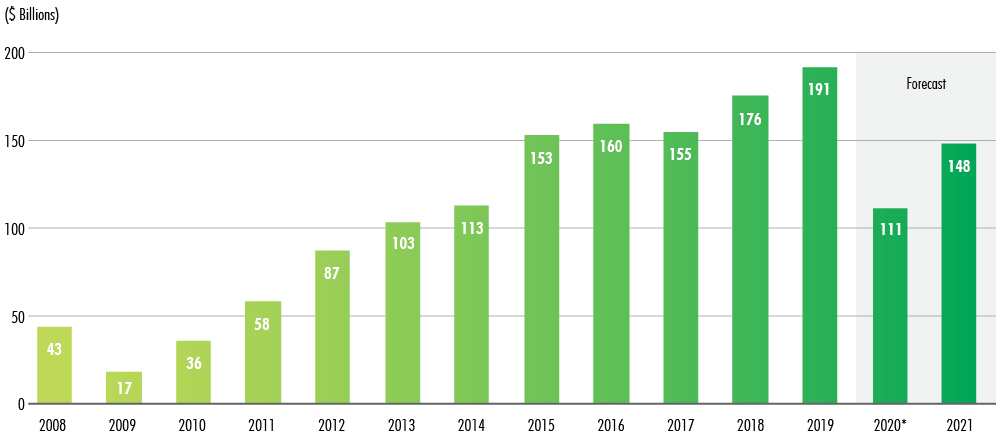

With steadily improving market conditions, multifamily investment volume is expected to increase in 2021. CBRE Research predicts U.S. multifamily investment volume will reach about $148 billion next year, lower than 2019’s record level of $191 billion but a 33% gain over the 2020 estimate of $111 billion.

Investor demand for multifamily assets this year was more than previous recessions would have indicated. Pricing held up quite well. Still, many investors moved to the sidelines as the COVID-19 pandemic spread. With greater clarity on future revenue streams, institutional buyers and value-add investors should become much more active next year. Offshore buyers likely will increase their activity, especially if travel restrictions are eased.

CBRE forecasts a continuation of low interest rates next year. Favorable mortgage rates will provide further incentive for increased investment. The two key multifamily lenders—Fannie Mae and Freddie Mac—should have sizeable capital availability to support increased buying activity.

Figure 15: Multifamily Investment To Rebound With 33% Growth In 2021

*2020 forecast is based on actual numbers through September.

Source: CBRE Research, Real Capital Analytics (historical), Q4 2020.

Investment Strategies For 2021

Suburban assets in the Midwest and Southeast regions will provide the best opportunities for solid market performance and achieving expected revenues next year. In the Midwest, Indianapolis was the best-performing market in 2020. Memphis, Detroit, Columbus, Cleveland, Cincinnati, Kansas City, Louisville and St. Louis also were among the best in the country.

Most Southeast metros weathered the 2020 recession relatively well. The leaders were Greensboro, Jacksonville, Richmond and Virginia Beach. Atlanta, Charlotte, Raleigh and Tampa also performed relatively well and are positioned for solid performance in 2021.

Multifamily segments that had greater market deterioration in 2020—such as Class A assets in urban submarkets, particularly in gateway cities—may not stabilize until well into 2021 and present more investment risk. Buyers may seek pricing discounts for such assets, but significantly discounted pricing will remain difficult to find.

The most impacted metros in 2020 were San Francisco, San Jose and New York. Other underperformers included Los Angeles, Boston, Seattle, Oakland, Austin, Miami, Chicago, Washington, D.C. and Orlando. Among these, investors may favor high-tech markets for their potential quicker economic recovery, but tech firms’ remote working policies may not restore multifamily demand as quickly.

While the large, diversified high-growth metros of Phoenix, Dallas/Ft. Worth and Denver performed at about the national average in 2020, their demand dynamics are so compelling that they will definitely be on investors’ radar in 2021.

.jpg)