Chapter 5

Industrial & Logistics

U.S. Real Estate Market Outlook 2021

3 Minute Read

E-Commerce Will Drive Demand Next Year

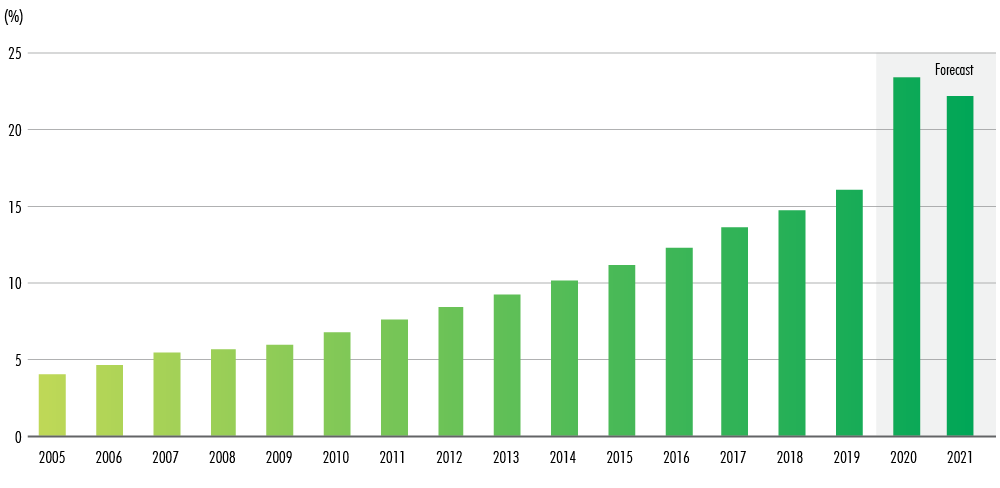

Industrial has been one of the most resilient real estate sectors amid the COVID-19 crisis, buoyed by rising e-commerce demand. Year-over-year e-commerce growth surged to 44.5% in Q2 from 14.8% in Q1. This has put pressure on retailers, wholesalers and third-party logistics companies (3PLs) to reach consumers while lowering transportation costs.

Demand for space in the near term will be driven by e-commerce. CBRE Research has found that $1 billion in incremental e-commerce sales generates 1.25 million sq. ft. of warehouse space demand. Therefore, net absorption is projected to reach nearly 250 million sq. ft. in 2021, more than the previous five-year annual average of 211 million sq. ft. This will spur new construction, which is already near-record levels, and strong preleasing of speculative projects.

More Retail-To-Industrial Conversions Next Year

Given the increase in online shopping, retail-to-industrial conversion projects likely will accelerate in 2021 but should not lead to any oversupply given the challenges with such conversions in residential areas.1 There is strong demand for infill warehouse space in urban cores, but land constraints and high costs have limited new development. Adaptive reuse of retail buildings for industrial occupiers is expected to accelerate in 2021.

Overall, new industrial completions are forecast to jump by 29% next year, according to CBRE Econometric Advisors. Given strong preleasing of speculative projects (38% as of Q3), demand is expected to keep pace with new supply, especially as occupiers flock to modern warehouse space.

Figure 12: E-Commerce Sales Penetration (% Of Total Retail Sales)

Source: CBRE Research, U.S. Census Bureau, October 2020.

Inventory Control A Top Concern

Inventory control will be a prime focus of industrial occupiers next year, as they increase their footprints to store “safety stock” in case of any supply chain disruptions. Many suppliers will increase inventories from 15 days to as high as 60 days. Wholesalers and outsourced 3PLs will be expected to significantly increase inventories onshore to avoid the disruptions from trade conflicts of the past year.

Many companies are utilizing a “China-plus-one” strategy to diversify product sourcing and limit any supply chain disruptions related to COVID-19. Source countries west of Singapore, including Europe, will generally use U.S. East Coast ports, while those east of Singapore will use West Coast ports and Central and South American countries will use Gulf and Southeast ports.2

Onshoring of product to the U.S. or Mexico is plausible but will present real estate, logistics and labor challenges. Diversifying or completely changing supply sources away from Asia is a long and arduous task with uncertainty over how much industrial real estate demand will be affected.

Markets To Watch

The Southwest and Southeast U.S. will have the highest rates of population growth over the next five years. In the Southwest, the Inland Empire will remain the dominant big-box industrial market. Phoenix, Las Vegas, Denver, Salt Lake City and Reno also are posting robust industrial fundamentals and development because of their proximity to burgeoning populations.

Texas will provide the most opportunities for investors and occupiers with forecast population growth of 9% over the next five years, largely benefiting the Dallas-Fort Worth, Houston and San Antonio industrial markets. Meanwhile, El Paso will benefit from its border location with Mexico and the recently enacted United States-Mexico-Canada Agreement (USMCA), which should increase its manufacturing and distribution base. Industrial asking rents in El Paso are forecast to increase by 28.5% over the next five years, according to CBRE Econometric Advisors.

The Southeast’s primary driver of demand will be pro-business state governments offering low taxes, location incentives and training programs for distribution employees. Robust investments to modernize logistics hubs will help occupiers reach a larger number of consumers surrounding the seaport markets of Charleston, Savannah and Virginia, as well as the inland port markets of Greenville, S.C., Atlanta and Central Florida.

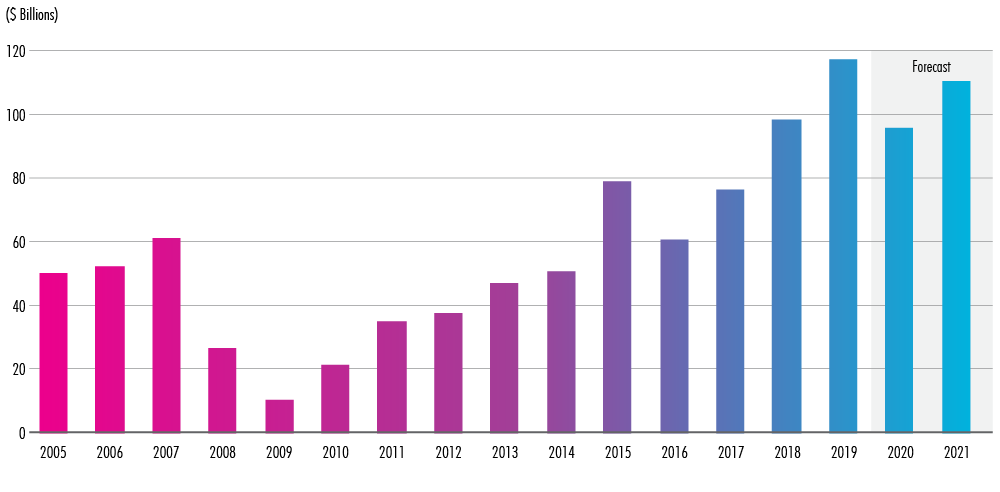

Investors Will Seek New Opportunities

Overall industrial investment sales volume increased by 17% in the first half of 2020; however, it declined by 39% year-over-year in Q2. Despite the Q2 decline due to COVID-19, sale prices were largely unchanged and cap rates were either stable or slightly lower. Despite record-low cap rates, capital is expected to continue flowing into the industrial market from both domestic and foreign investors. Most expect rental rate growth over their holding period, which will offset a low going-in cap rate. Industrial real estate will be a haven for investors compared with other commercial property types negatively impacted by the pandemic.

Many core industrial portfolios are institutionally owned, so it is difficult for other types of investors to expand into this segment of the national inventory. They will look for opportunities in two other segments:.

- Modern Class A buildings in emerging markets near logistics hubs and growing population centers, including Salt Lake City, Greenville-Spartanburg, Phoenix, Las Vegas, El Paso and Florida’s I-4 Corridor.

- Class B and C light-industrial buildings in urban markets with below-average vacancy rates, including Northern and Southern California, Chicago, the New York Tri-State Area and Miami.

Strong fundamentals will continue to put upward pressure on rents, fueling investor demand. Overall industrial rents grew by 6.3% year-over-year in Q2 and this level of growth is expected to continue in 2021. In some cases, rent growth will be higher by market and size segment. Nearly 80% of U.S. industrial markets will see positive rent growth over the next 12 months and most will exceed their historical average over the next several years, according to CBRE Econometric Advisors.

Figure 13: Total U.S. Industrial Sales Volume Forecast

Source: Real Capital Analytics, CBRE Research, Q3 2020.

Demand For New Design Features

Rising e-commerce fulfillment will require new design features for warehouse and distribution buildings, including ceiling heights upwards of 40 feet, multiple mezzanine floors and 3 million total square feet or more. In the short term, many of these buildings will be build-to-suits and significantly boost net absorption totals.

In addition to heightened awareness of safety and health measures due to COVID-19, there will be an increased need for technology and sustainability leading to bigger power requirements for machinery, robotics and other picking-and-sorting technology. More warehouses will have HVAC systems for employee comfort and to keep machinery at optimal operating temperatures. Taller, more environmentally conscious and tech-centric buildings will be the norm. Occupiers will demand more skylights and renewable energy sources. Other sustainable features will provide water savings, recycling capabilities and eventually charging units for electric trucks.

While product sourcing, inventory control and new building features will be top of mind for occupiers, the sources and volume of consumption will dictate where occupiers locate and their total space demand. As retail sales remain strong and the share of those sales from e-commerce increases, industrial demand from both occupiers and investors will remain robust for the foreseeable future.

.jpg)