Chapter 1

Economy

U.S. Real Estate Market Outlook 2021

3 Minute Read

Real Estate Recovery Will Lag That Of Broader Economy

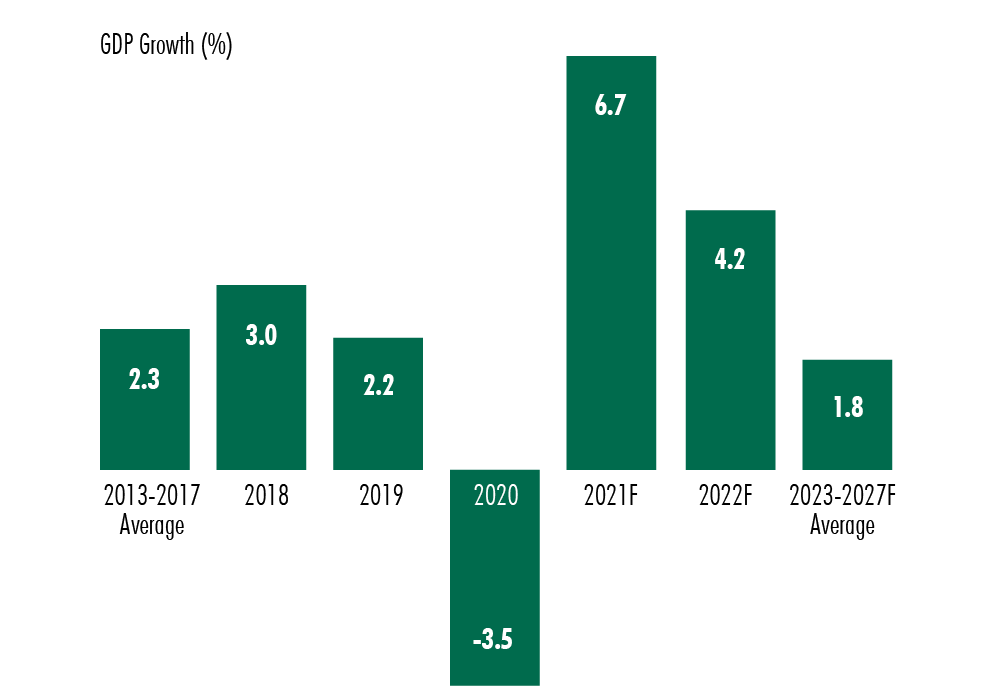

After a deep recession last year due to the COVID-19 pandemic, the rebounding U.S. economy is expected to show robust growth in 2021. CBRE forecasts that GDP will grow by 6.7% in 2021, with the strongest gains occurring in Q2 (12.6%) and Q3 (8.5%). CBRE expects the real estate recovery to lag that of the broader economy, particularly for the office, retail and hotel sectors.

Figure 1: U.S. Economic Outlook – CBRE House View (Percentage Changes)

Source: CBRE Research, April 2021.

Full Recovery Depends On Vaccine Implementation & Containment Of New Virus Strains

A full economic recovery depends on the continued strong deployment of vaccinations throughout the population and new, more contagious virus strains remaining under control. CBRE’s view is that a successful rollout of vaccines in the U.S. and additional usage of therapeutics will allow further loosening of economic restrictions in the second half of 2021.

Additional Government Support Buoys Economic Recovery

The $2.2 trillion economic stimulus package delivered by Congress in late March 2020 was extremely effective in stabilizing the U.S. economy amid the depths of the COVID-19 crisis. This was on top of a $900 billion aid package in late 2020, which helped a slowing recovery. More recently, the $1.9 trillion American Rescue Plan (ARP) injected more money into the economy at the same time vaccines and loosened restrictions on the economy were providing tailwinds. The ARP is particularly important over the near-term for the multifamily (rent payments) and retail (consumer spending) sectors. A strong fiscal response has laid the foundation for a more rapid recovery across all property types, including office and hotels.

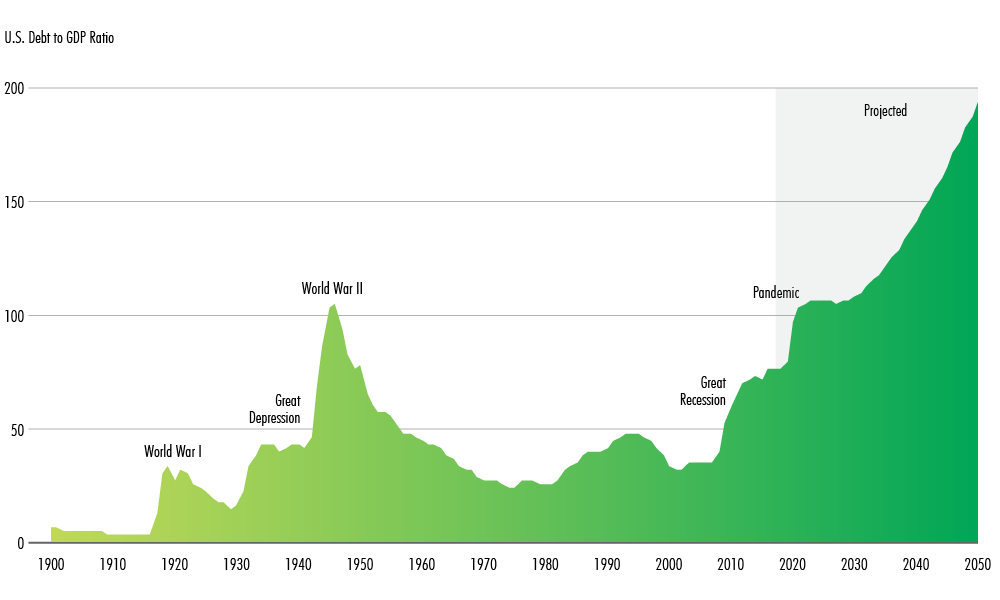

Paying For Government Spending

Government debt levels sharply increased in 2020 as emergency aid flowed into the economy. While this may be concerning, there is no immediate danger that large developed economies such as the U.S. will be unable to fund their debt because of the surplus of global savings that flows into low-risk sovereign debt. Although rising debt is unsustainable over the longer-term, the federal government has various means to address this, including structural reform to entitlement programs.

Additionally, central banks have been purchasing government debt to keep long-term interest rates down and the economy stimulated. They also can tighten monetary policy through interest rate increases and balance sheet reductions when economic conditions allow. Still, governments cannot rely on quantitative easing (asset purchases) alone. Renewed economic growth will generate revenue to service debts. Combined with fiscal policy adjustments (increased taxes and spending cuts), this will reduce overall debt-to-GDP ratios. Over the long term, there is a risk that governments could allow inflation to rise significantly to reduce their debt loads.

Figure 2: Federal Debt Held By The Public, 1900 To 2050 (% of GDP)

Source: U.S. Congressional Budget Office.

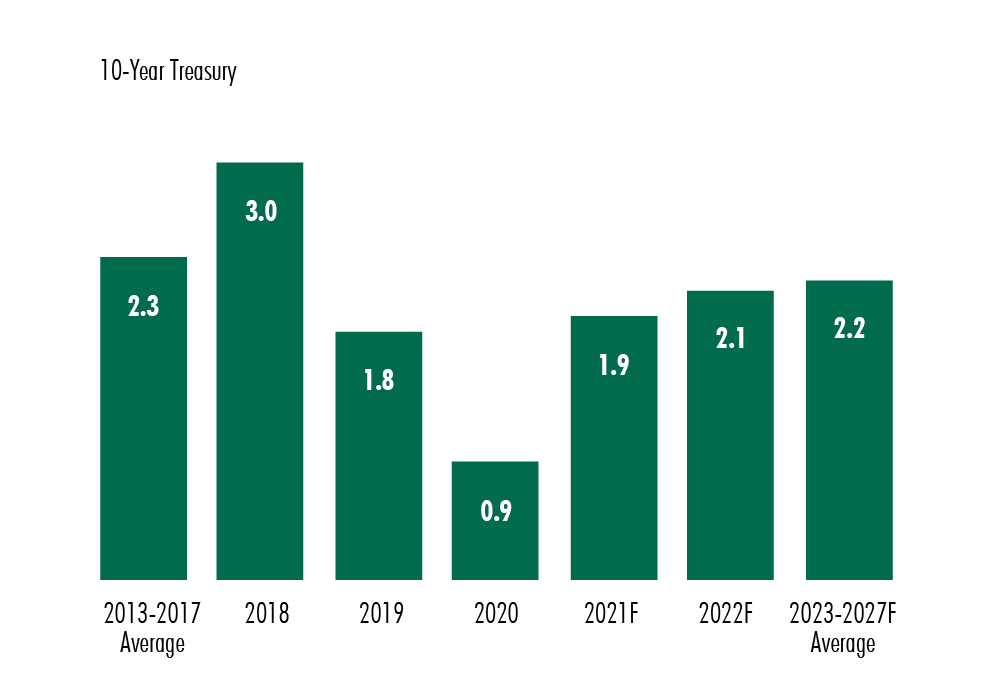

Fed Policy Change And ‘Lower-For-Longer’

The Federal Reserve recently announced that it would allow inflation to move above the 2% target for several quarters after periods of low inflation. Consequently, the Fed likely will take a much more patient approach to rate hikes, essentially ensuring a “lower-for-longer” rate environment as the economy recovers. For commercial real estate, this likely will translate into greater downward pressure on long-term cap rates.

Though low interest rates are generally good for commercial real estate, there could be other impacts not widely considered. For example, amid extended periods of extraordinarily accommodative monetary policy, central bankers have become more vigilant about preventing asset bubbles that could destabilize the financial system. This could include requiring banks to set aside more reserves and tighten underwriting standards. Such actions likely would impact loan-to-value (LTV) ratios for real estate.

Another secondary impact of this policy relates to foreign exchange rates. A lower-for-longer environment could weaken the U.S. dollar. This could make U.S. commercial real estate assets more attractive to foreign investors—particularly in gateway markets—and put additional downward pressure on cap rates in those markets.

Figure 3: 10-Year Treasury Forecast

Source: CBRE Research, April 2021.

Bottom Line

GDP contracted by 3.5% in 2020 and is expected to grow by 6.7% in 2021. This recovery will be facilitated by a medical resolution of the COVID-19 pandemic by the second half of 2021 and the abundant fiscal support for the economy. In addition, we expect that interest rates will remain lower for longer with the timeline for initial rate increases pushed back by several quarters. This will put downward pressure on cap rates, but underwriting standards and LTVs could be affected by efforts to maintain financial stability amid low interest rates.

CBRE expects the recovery in property markets to lag the broader economy, due to the unique impact that the pandemic has exacted on the economy and how space is used. As such, with a medical resolution in sight and continued economic growth, CBRE expects that all commercial real estate sectors will start to recover by the end of 2021.

Contacts

Spencer Levy

Global Client Strategist & Senior Economic Advisor, CBRE

.jpg)

Darin Mellott

Vice President, Head of U.S. Capital Markets Research, CBRE