Chapter 8

Hotels

U.S. Real Estate Market Outlook 2021

3 Minute Read

Bumpy Road Ahead

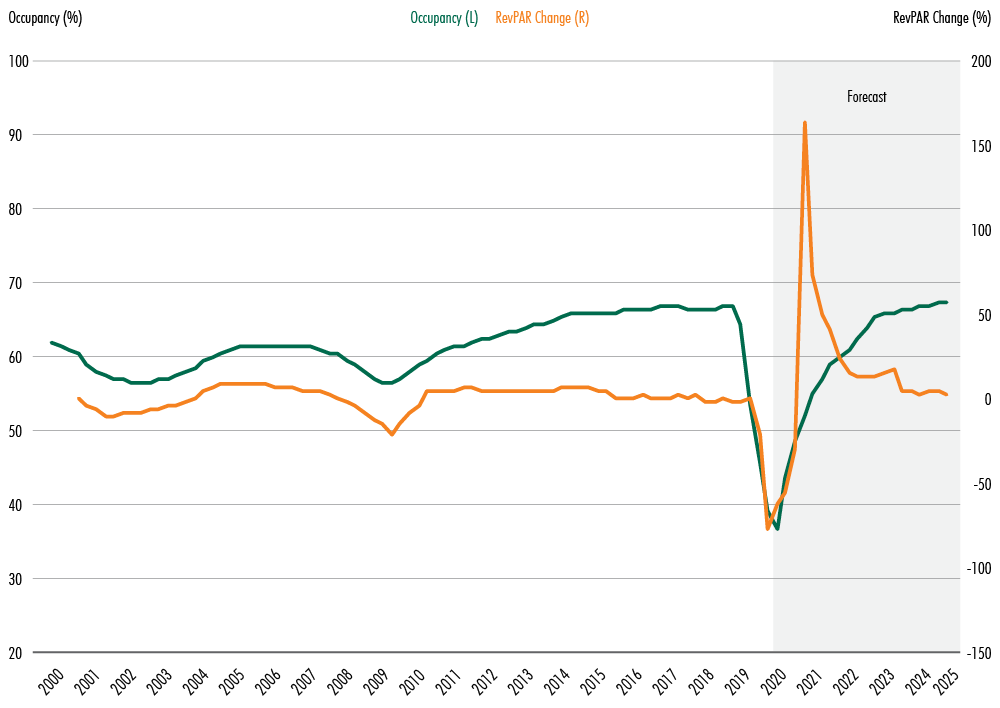

Since the outbreak of COVID-19 in Q1, hotels have seen a dramatic downturn in demand. Fear of infection, mandated closures and reduced business travel caused a dramatic drop in the lodging business. Figure 16 illustrates the precipitous drops in occupancy and RevPAR this year, and forecasts the path to recovery through 2025.

Effects of the pandemic on the hotel industry were felt most strongly in Q2, as lockdown mandates peaked in April and May and caused drops in occupancy and RevPAR not seen since the Great Depression of the 1930s. Occupancy is not expected to return to pre-COVID-19 levels until 2023, followed by RevPAR in 2024.

Figure 16: National Hotel Occupancy (Q4-Centered Average) And Revpar Change

Sources: CBRE Hotels, Kalibri Labs, Q2 2020.

Chain Scale Recovery

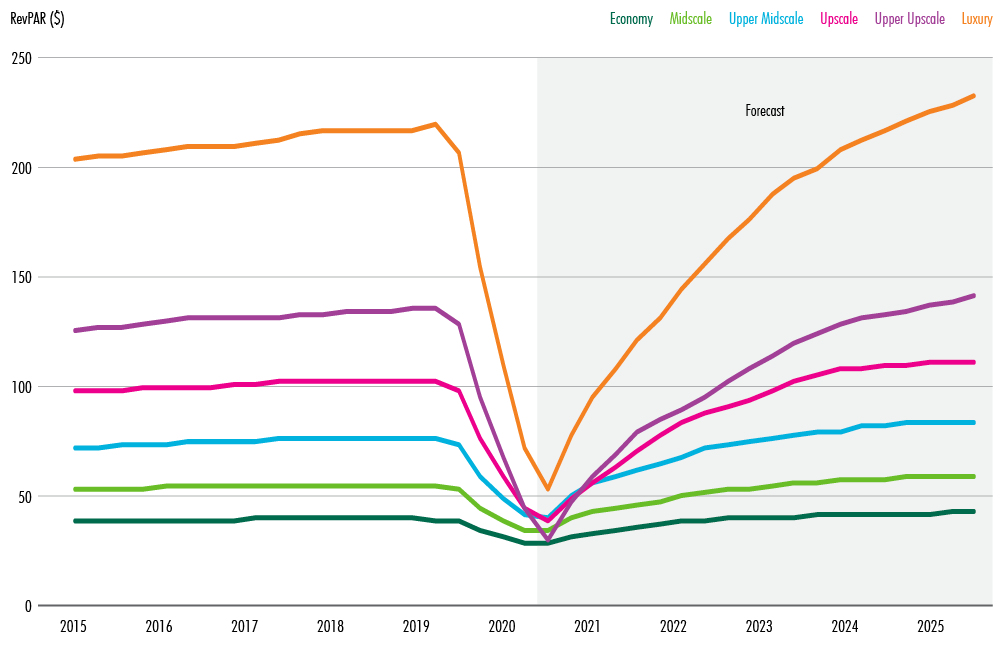

Higher chain scales have suffered the largest percentage and absolute drops in RevPAR this year. Upper upscale chains were particularly hard hit, with RevPAR briefly dropping below all other chain scales except for economy. Higher chain scales will take the longest to recover to pre-COVID levels. While economy and midscale chains are poised to regain pre-COVID RevPAR levels by late 2022, upper midscale and upscale chains will take until 2023 or 2024 to recover. Upper upscale and luxury chains will take the longest to regain pre-COVID RevPAR levels by late 2024 or 2025.

A distinguishing feature of the upper chain scales from the middle and lower scales is a dependence on business and group travel. Large groups and weekday business travelers traditionally are a source of steady and reliable room revenues, as well as opportunities for hoteliers to increase food & beverage and other ancillary revenues. CBRE forecasts that the resumption of group travel will take some time, involving a ramp-up period to restart, and thus will drive down occupancies and slow ADR growth for the higher-priced chain scales and property types that depend more heavily on food & beverage revenue.

Figure 17: National Nominal Revapr By Chain Scale (Q4-Centered Average)

Source: CBRE Hotels, Kalibri Labs, Q2 2020.

Drive-To Destinations Will Recover First

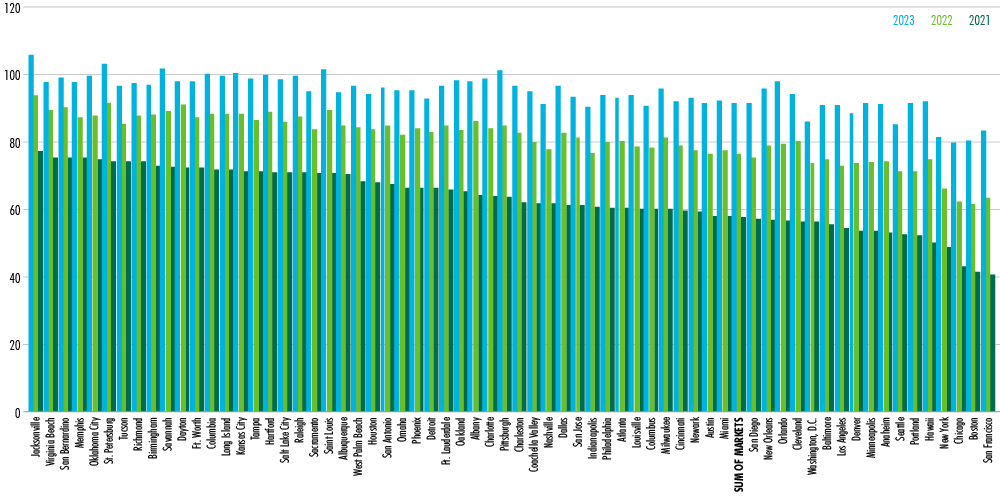

Figure 18 forecasts RevPAR recovery over the next three years for the 65 markets tracked by CBRE relative to their pre-COVID performance in 2019. Although most markets should regain the bulk of lost RevPAR by 2023, some that were especially hard hit in the initial stages of the outbreak and continue to have significant closures and restrictions will lag. Boston, Chicago, New York and San Francisco have significant dependence on group and business travel and thus will suffer lagging performance until a successful vaccine is found.

Markets forecast to have the swiftest recovery in 2021—Jacksonville, Virginia Beach and Inland Empire—have significant drive-to destination appeal and natural social-distancing leisure appeal as beach locations. More generally, secondary markets with less urban density and more drive-to availability will recover faster in 2021 than larger metropolitan areas.

By 2022 and 2023, RevPAR recovery will be more even among markets and more in line with long-term trends. By 2023, only the most severely affected markets will have less than 90% of 2019 RevPAR levels. In addition, some smaller markets such as Jacksonville, St. Petersburg and Savannah may gain additional demand as alternative destinations.

Figure 18: Revpar Performance As A % Of 2019 Nominal Revpar

Source: CBRE Hotels, Kalibri Labs, Q2 2020.

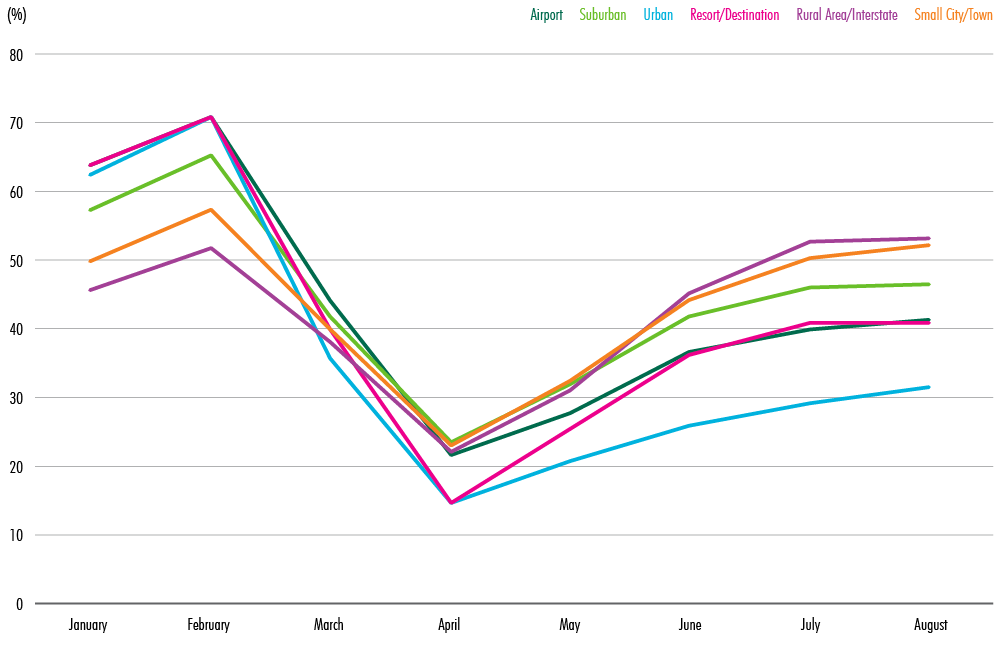

Population Density A Key Factor For Recovery

Rural and interstate hotels have outperformed other location types this year. These hotels are often located in low-population-density areas that recorded modest gains in occupancy and ADR after the public’s fear of COVID-19 had peaked in April. Recovery to pre-COVID performance should occur sooner in these locations. High-density and urban locations will take longer to recover until the public feels safe to travel to these populous locations.

Continued Leisure Travel Needed

While leisure travelers have helped prop up the hotel industry during the COVID crisis, a full recovery will not occur until group and business travel resumes. Small metros and rural areas are recovering faster, especially those that are drive-to destinations.

After the summer season, the gap between weekday and weekend occupancy widened. This is a reversal of historical patterns, in which summer leisure travel gives way to business and group travel that peaks in the fall. This reversal portends a difficult Q4 for the hotel industry if leisure travel does not keep pace.

Figure 19: 2020 Occupancy By Location

Source: CBRE Hotels, Kalibri Labs, Q2 2020.

.jpg)