Chapter 4

Office/Occupier

U.S. Real Estate Market Outlook 2021

3 Minute Read

Office Downturn To Stabilize

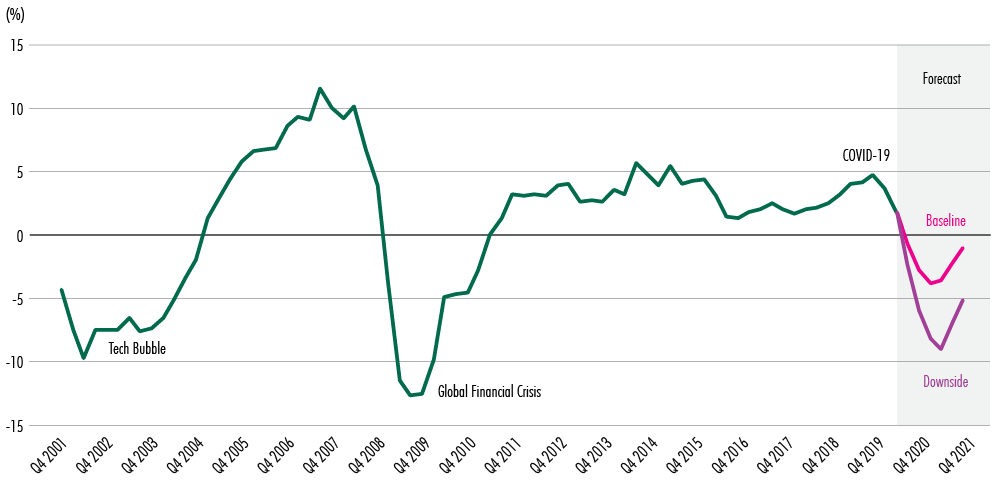

Deteriorating office market fundamentals amid the sharpest downturn since the Global Financial Crisis (GFC) should stabilize next year. Continued economic recovery and an accelerated pace of hiring will counter occupancy declines and negative demand expected to start the year. The nation’s largest, most dense office markets have been disproportionately impacted by logistical constraints in tenant occupancy posed by COVID-19 and likely will struggle the most to emerge from the recession in 2021.

Office vacancy will persist at a stubbornly high rate and rent increases will be difficult to achieve as market conditions remain decidedly in favor of tenants. An overhang of sublease space brought to the market in H2 2020, as well as an elevated level of new office completions, will contribute to persistently high vacancy in 2021. However, the office cycle will bottom out in 2021 as positive net absorption resumes.

Urban VS Surburban

Suburban office markets are expected to recover faster than their CBD counterparts next year. While suburban office demand lagged that of CBDs after the GFC, the downturn in CBD office markets has been considerably more severe in this recession with disruptions to mass transit. Logistical barriers posed by COVID-19 to higher downtown occupancy will constrain CBDs’ recovery. In addition, a considerable amount of available downtown office supply will cause high vacancy to persist through 2021 at a rate only 80 basis points (bps) below its peak after the GFC.

While suburban office markets also will see increased vacancy, the rate will remain some 3.7 percentage points below its peak after the GFC. Several megatrends such as shifting demographics support a brighter future for suburban offices, but there has yet to be any significant increase in leasing transactions that indicate a major shift by tenants to the suburbs is underway.

Figure 8: U.S. Office Market Rent Forecast (Y-O-Y Change)

Source: CBRE Econometric Advisors, Q3 2020.

Flight-To-Quality May Accelerate

Early evidence suggests that the COVID-induced recession has had a more severe impact on Class A office occupancy than on Class B. In times of recession, Class A properties have historically experienced more volatility and rapidly deteriorating market fundamentals. Once the recovery accelerates in 2021, we expect Class A properties to experience much faster improvement in demand, vacancy and rents, as they have done in past recovery periods.

ccupiers are increasingly demanding flexible space options, shared meeting space, indoor air quality, connected building apps and touchless technology when considering new leases. Buildings that provide these desired amenities may find more favor by enterprise tenants as leasing volume resumes. Occupiers may reduce their amount of leased space in the future, but the quality of that space will become more important.

Impact Of Remote Working On Space Demand

The largest impact of COVID-19 on the office sector is undoubtedly the mass shift to remote working for previously office-based employees. A recent CBRE analysis suggests that remote working could cut the overall need for office space by 15%. But office-using employment will continue to grow after the recession and there may be some reversal of recent trends toward diversification. In short, it is too soon to know what the impact of remote working will be on the overall demand for office space, but it may not be anywhere near as much as some analysts suggest.

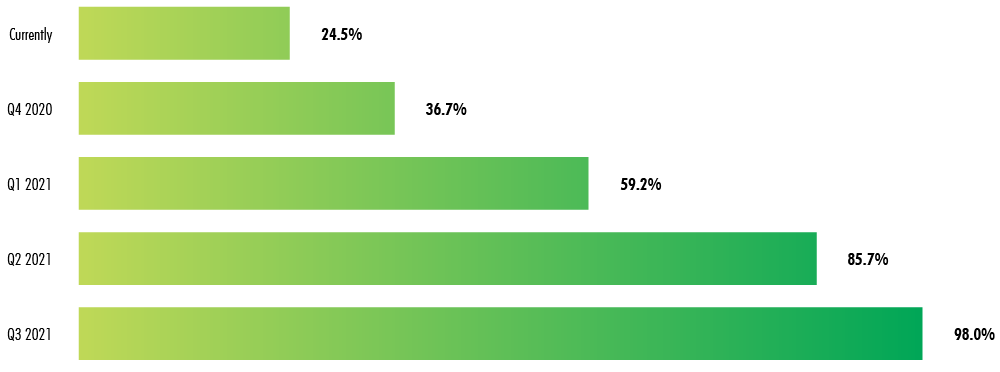

Despite the easing of certain occupancy restrictions, most companies have not yet returned to the office. Many are planning to gradually allow access to the office next year in hopes that a vaccine is delivered or at the very least there are more effective therapies to control the virus.

When they do return to the office, companies may favor a hybrid work style that combines remote working with office use. Until then, companies are deferring leasing decisions and are reducing their space usage in line with lower economic growth expectations. Negative net absorption, which characterized the second half of 2020, will persist in the first half of 2021.

Figure 9: Office Re-Entry Plans By % Of Respondents – Likelihood Of Returning To The Office In The Near Term

Note: Respondents who said they’d return to the office. Excludes responses of “unsure”.

Source: CBRE Occupier Sentiment Survey, September 2020.

Despite a challenging 2020, there were fewer-than-expected flexible office space closures. The industry is expected to rebound in 2021 as occupiers shift their strategies away from long-term capital-intensive commitments. Many say they will strategically incorporate more flexible space options in their portfolios to satisfy temporary space needs, support a more mobile workforce and enter new markets to source talent. Flex space usage is expected to increase in 2021.

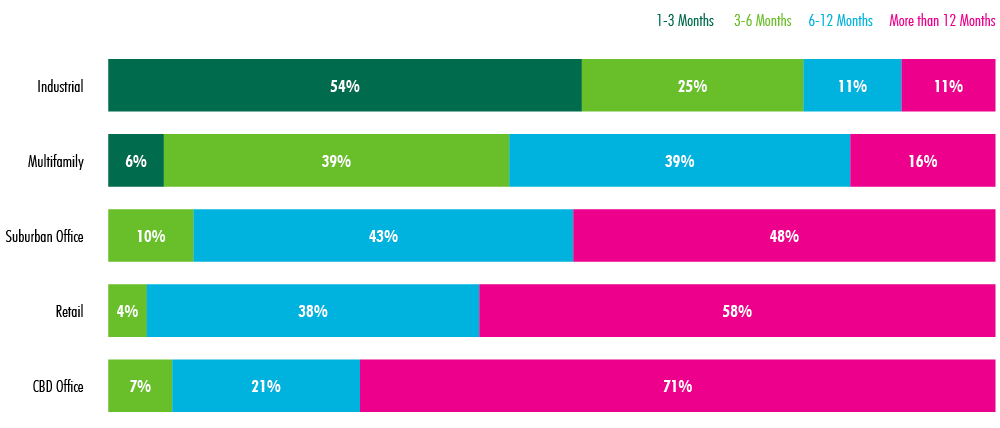

Uncertain Space Demand Will Cause Less Investment

The office sector is expected to have among the slowest recoveries to pre-pandemic investment volumes. This sentiment is likely driven by the uncertainty around office space demand and which markets will benefit most from evolving trends, especially remote working. Investment volume is down significantly in 2020 and likely will remain well below pre-pandemic levels through 2021. Tenant credit quality, length of remaining lease term and building occupancy levels have become particularly important criteria for office investors.

Markets To Watch

Secondary markets, particularly in the business-friendly Southeast, will perform more favorably in 2021. Raleigh-Durham, Nashville, Tampa and Charlotte will benefit from relatively resilient demand, lower costs and persistent demographic and employment growth. Some larger markets, such as Phoenix and Dallas-Fort Worth, will also benefit from these same demand drivers to a lesser degree. Markets with a high concentration of tech companies like San Jose, Austin and Seattle may stage an unexpectedly strong rebound in demand next year but will still have to absorb a significant amount of new office supply. At the other end of the spectrum, markets with high densities and a dependence on mass transit like San Francisco and New York City will have a slower recovery.

Figure 10: Survey Question: How Long Do You Think It Will Be Before Investment Activity Returns To Pre-Pandemic Levels?

Note: Cap Rate Survey Special Report Q3 2020 conducted during August 2020.

Source: CBRE Research, September 2020.

.jpg)