Chapter 3

Capital Markets

U.S. Real Estate Market Outlook 2021

3 Minute Read

Capital Markets Continue Bumpy Recovery

The COVID-19 crisis has weighed heavily on commercial real estate investment activity. Investment volume in the first three quarters of 2020 fell by 44% from the same period last year. Nevertheless, activity is increasing as the year goes on. Investment volume increased to $61 billion in Q3 from a 10-year quarterly low of $46 billion in Q2.

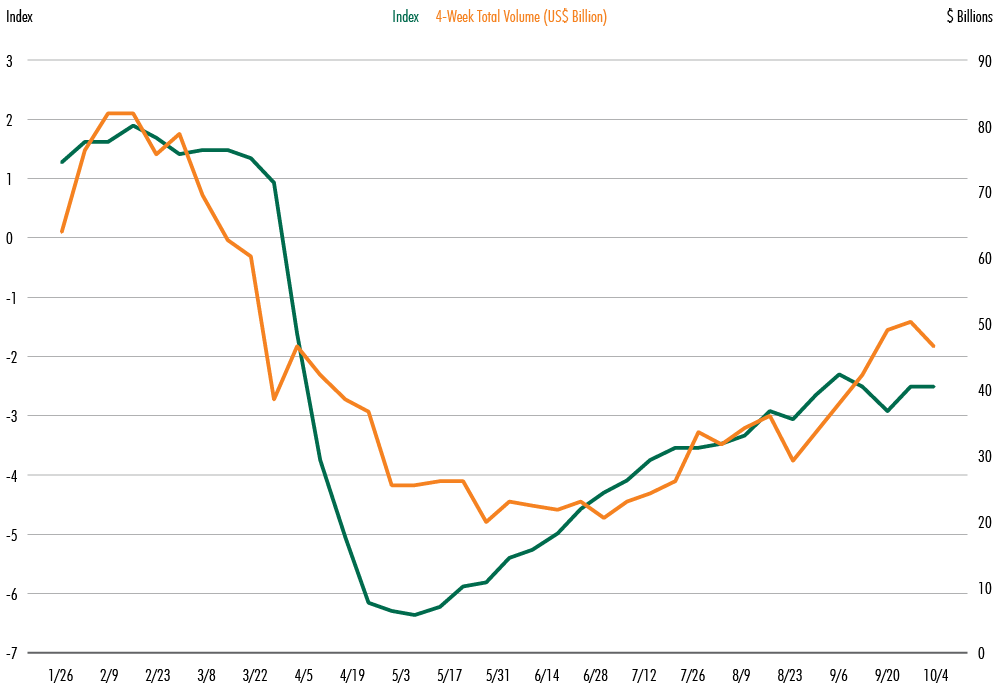

Investor sentiment also has recovered significantly. CBRE’s Capital Markets Recovery Index—a composite tracker of economic conditions, real estate listings and investor interest—shows a 60% rebound from the April/May bottom. The index is strongly correlated with investment volume.

Figure 5: Capital Markets Recovery Index With Transaction Volume

Source: CBRE Research, Real Capital Analytics, Q3 2020.

However, the capital markets remain soft relative to the pre-COVID normal, moving to a stage of price discovery and risk aversion. A disconnect on pricing has occurred between buyers and sellers. Based on CBRE’s latest Cap Rate Survey, 61% of buyers are seeking discounts while only 9% of sellers are willing to offer them. Lending activity has also been sluggish due to uncertainty over near-term rental income.

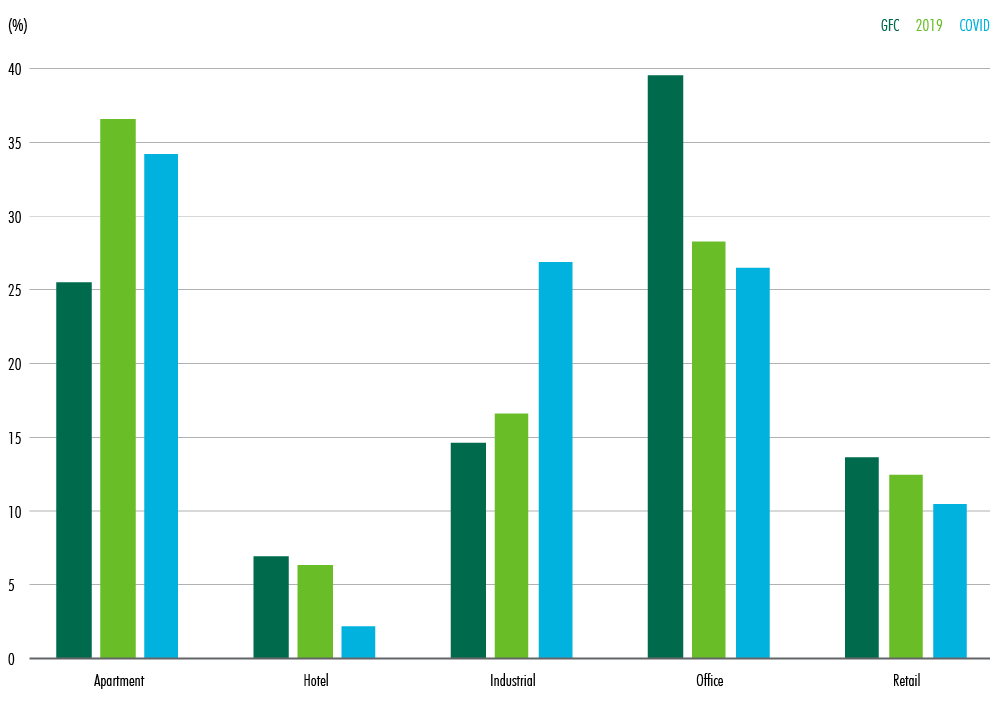

Such indicators suggest a bumpy road over the next six months. But not all real estate assets are equal. During this downturn, investor preferences have shifted strongly toward industrial & logistics assets. Apartment buildings, especially in certain markets like Dallas and Phoenix, have been resilient. Office, retail and hotel assets are called into question, but distressed sales have been very limited.

Figure 6: Investor Preferences Have Shifted

Note: Proportion of investment by property type during Global Financial Crisis (GFC), 2019 and COVID-19 era.

Source: CBRE Research, Real Capital Analytics, Q3 2020.

What Lies Ahead?

If a vaccine for COVID-19 is available by mid- to late-2021, the commercial real estate market will normalize based on abundant liquidity, low cost of capital and attractive returns.

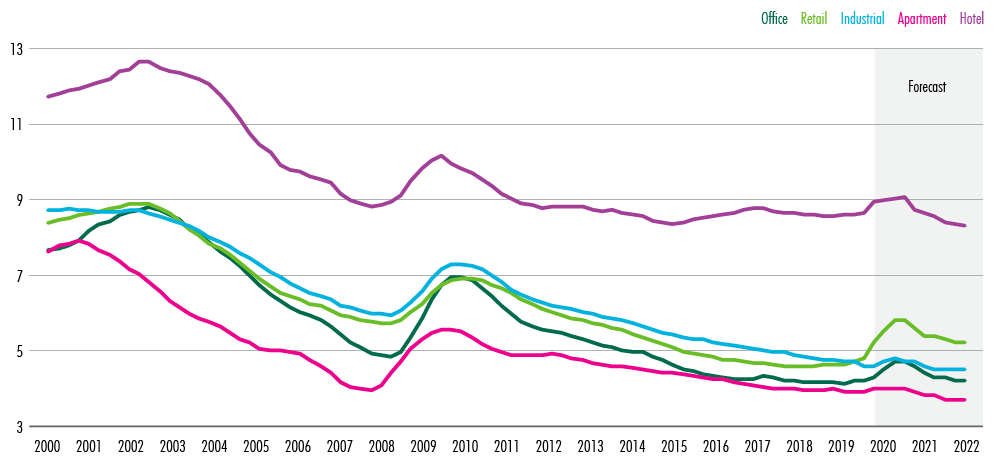

Available capital for real estate investment remains more than $300 billion globally, the majority of which is targeting North America. This wall of capital is a major contributor to the constrained expansion of cap rates. Industrial cap rates are at historic lows.

Meanwhile, the Fed plans to keep interest rates near zero until 2023. Both inflation and risk-free yield from 10-year Treasurys declined sharply of late. At the same time, real estate cap rates have remained relatively stable. This rewards investors with a wider yield spread and additional gains from asset value appreciation.

As underwriting and financing normalize, the ultra-low cost of borrowing will help offset potentially slow growth of rental income. To date, the pandemic’s impact on rent levels has been small, thanks to strong fiscal and other policy support that effectively reduced financial distress. However, these conditions could change if the government reduces its balance sheet with tax increases.

Lastly, hedging cost against dollar depreciation has remained low for foreign investors, providing additional cash-on-cash returns when they invest in the U.S. If this continues for the next two years, the U.S. will benefit from increased foreign capital inflows.

As the economy continues to recover, so does the overall demand for real estate. Long-term technological and demographic trends, such as digitalization, will change investor preferences and push the industry to evolve, but investment opportunities and capital for real estate will remain.

Figure 7: Cap Rates For Major Property Types In The U.S.

Source: CBRE Econometric Advisors, Q3 2020.

.jpg)