Intelligent Investment

A Quadrant Approach to Commercial Real Estate Investing: Private Debt

August 7, 2024 5 Minute Read

Executive Summary

Receive EA Insights Directly in your Inbox

- Senior mortgage returns are far more correlated across property types than property investments.

- Senior mortgage returns are strongly correlated with returns on other fixed-income asset classes such as Baa corporate bonds.

- The majority of senior mortgage returns can be explained by returns on BBB CMBS, Baa corporate bonds, and the bond default premium.

Introduction

This Viewpoint is the third installment in a series exploring the relationship between the CRE quadrants of public debt, private debt, private equity and public equity. Specifically, we will analyze the historic performance of private debt (senior commercial mortgages) in relation to the quadrants.

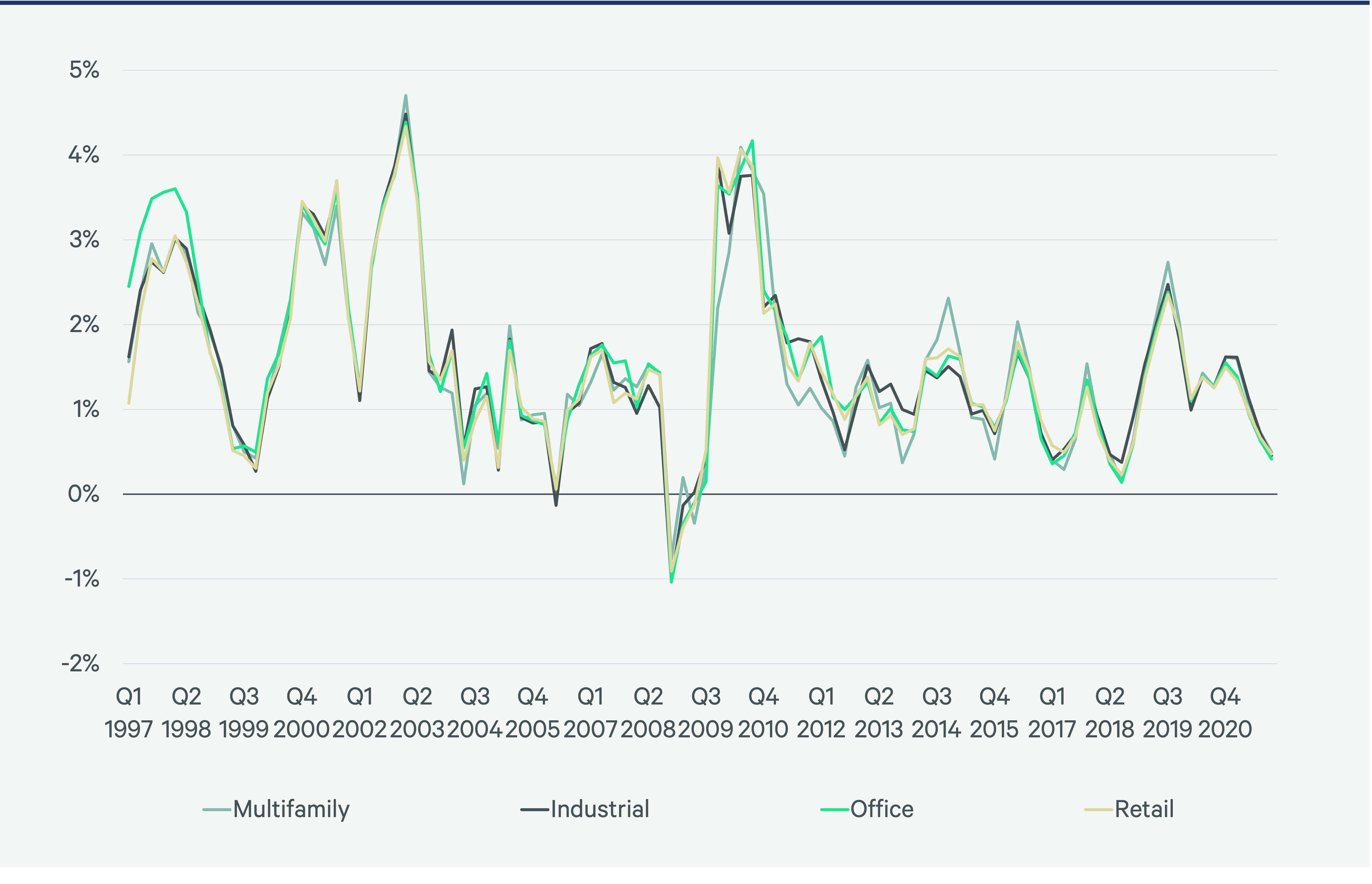

To measure senior mortgage returns, we will employ the credit-adjusted Giliberto-Levy Index. In Figure 1, we display the total return series along with a breakdown by sector. Senior mortgage returns are highly correlated across property groups, with an average correlation across these mortgages’ returns of 0.963. By contrast, the average correlation of property returns using the NPI property index is only 0.744. The lower the leverage, the less mortgage returns are affected by the likelihood of default (or by property market shocks).

Figure 1: Giliberto-Levy Credit Adjusted Index Moving Average Total Returns by Sector (%)

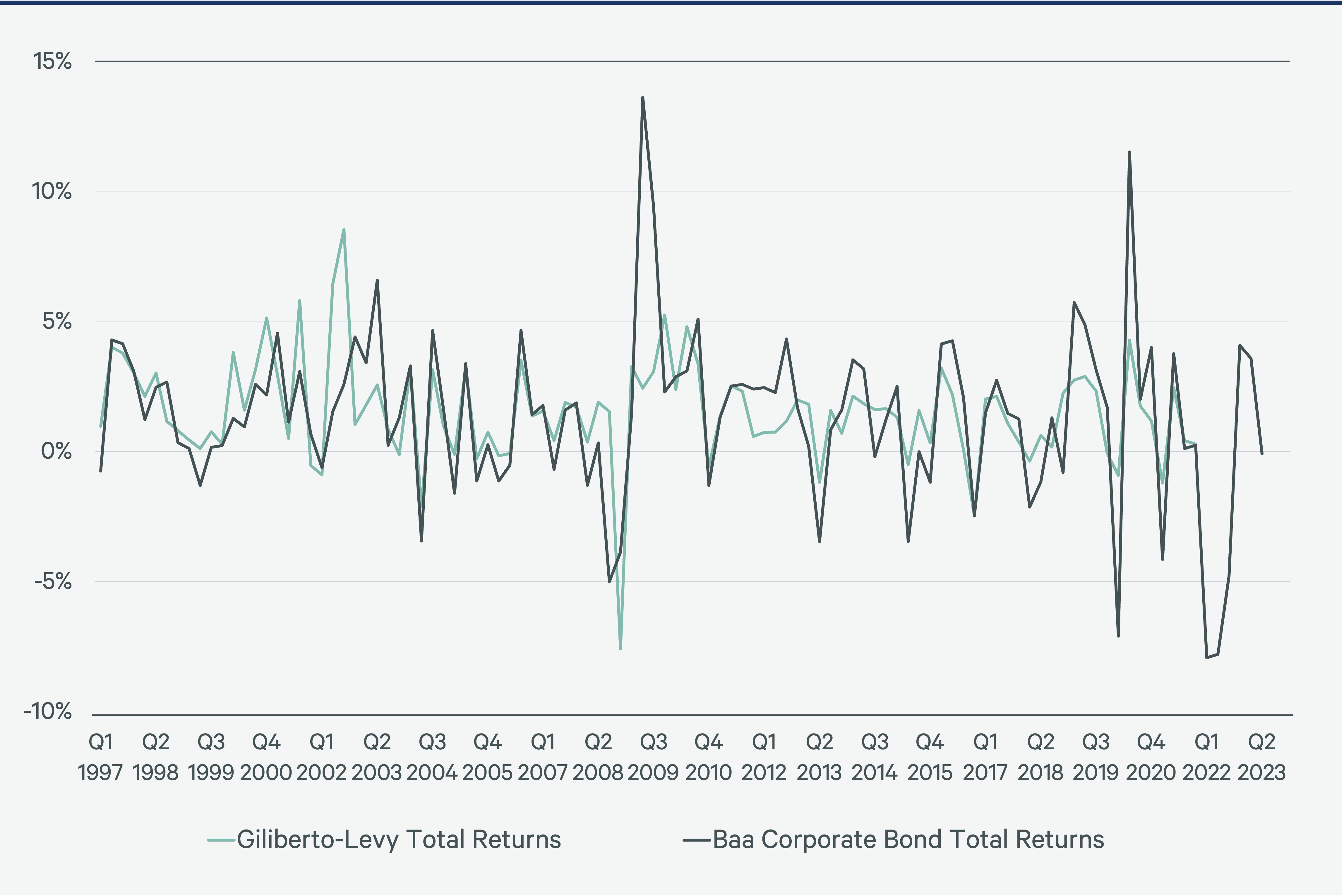

Mortgage losses rose dramatically, albeit with a lag after the Global Financial Crisis (GFC). Figure 2 shows the positive correlation between the total return for the Baa corporate bond and the CLA G-L mortgage.

Figure 2: Giliberto-Levy and Baa Corporate Bond Total Returns (%)

Model

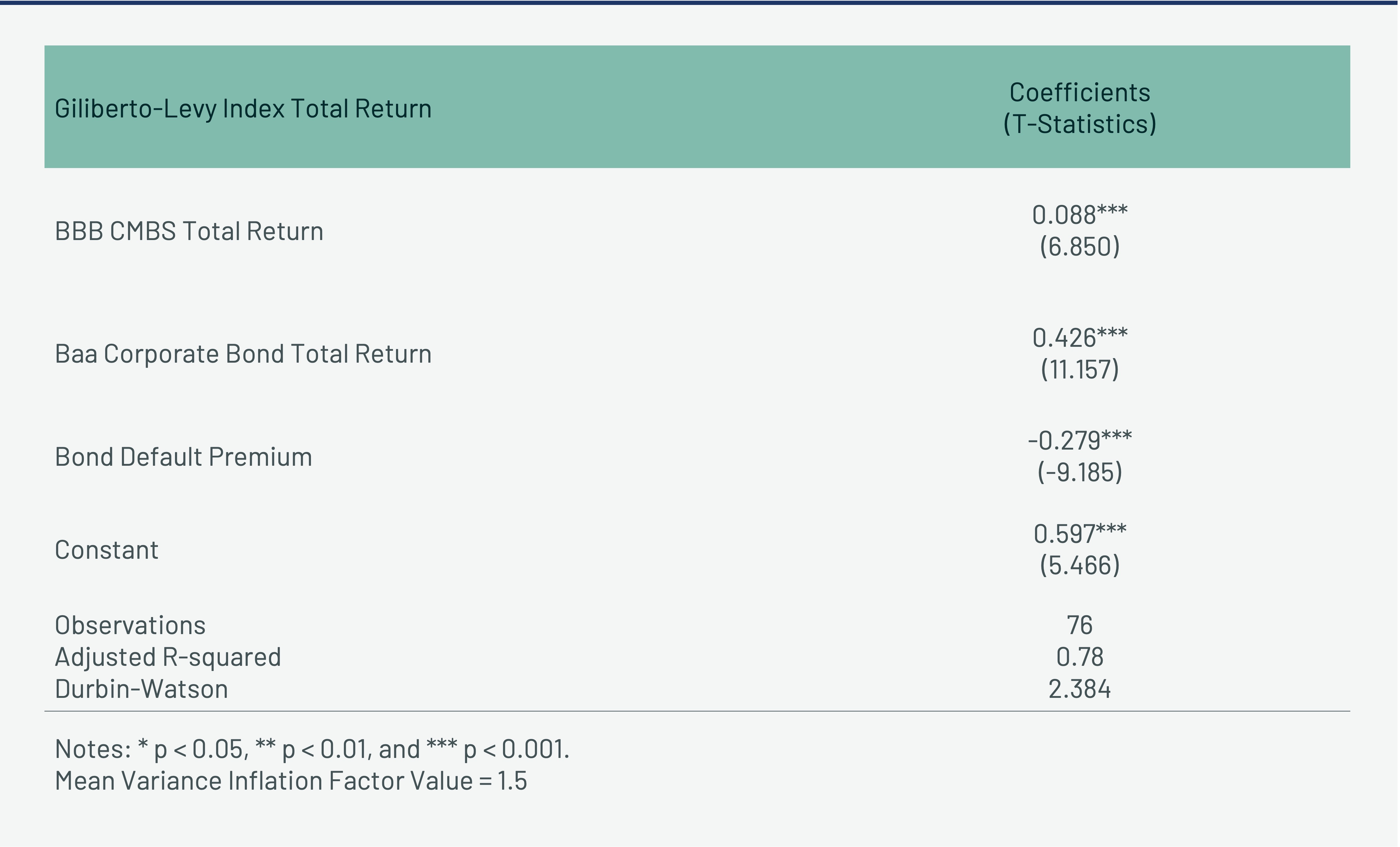

The total return of the Giliberto-Levy commercial mortgage index increases with the total return on BBB-rated CMBS and Baa corporate bonds. However, increases in the bond default premium—the geometric ratio of long-term Baa corporate bond total returns over long-term government bond returns—lower the total return for credit loss-adjusted (CLA) mortgage returns. Bond holders receive a premium for holding bonds with default risk. Callability risk, the potential for an investor to be forced into a lower yielding investment, is also subsumed within the bond default premium.

Neither NOI growth nor leveraged property returns, current or lagged, help explain senior mortgage total returns directly. This finding seems reasonable since the mortgages comprising the index are low leverage and are less sensitive to property or local market risk than leveraged equity. Hence, we exclude NOI growth and the leveraged property return from our model, but we stress that BBB-rated CMBS total returns are a significant proxy for property risk due to market rental rate volatility, vacancy rates, and countless other factors that affect total property risk.

The model explains 78% of the variation in the dependent variable, the t-statistics (in parentheses) are highly significant, and all variables have the right sign. The high Durbin-Watson statistic indicates low serial correlation, which contrasts with the high serial correlation associated with property returns. This result is remarkably compelling given our aim to explain the total returns of a privately traded, illiquid security.

Note that subordinate CMBS and lower-rated (but still investment-grade) CMBS returns have strong explanatory power. The Baa-rated corporate is more influential than the subordinate CMBS bond returns. If the default premium increases by 100 basis points (bps), then the total return on mortgages declines by 28 bps. A 1% increase in the BBB-rated CMBS bond return has a smaller impact on senior mortgage returns than increases in the Baa-rated corporate bond return. A 1% increase in the corporate bond return is associated with a 0.4% increase in the senior mortgage return. That a commercial mortgage is more closely associated with corporate bonds than a CRE-backed security is a striking finding.

Model 1 indicates that when investing in senior mortgages, it is a good idea to keep an eye on BBB CMBS returns, but it is even more important to monitor the Baa-rated corporate bond return and the bond default premium. Both variables explain most of senior mortgage returns. Mezzanine debt total returns, which we do not evaluate in this paper, would be much more sensitive to subordinate CMBS bond returns.

Model 1: Senior Mortgage Returns Explained (Q1 2003-Q4 2021)

Conclusion

This Viewpoint set out to explain the drivers of senior mortgage returns. Using CMBS and corporate bond returns and default premiums, we are able to explain nearly 80% of historic returns. This suggests that private lenders should be examining wider capital markets when forming return expectations, and not just pure property underwriting information. These results are new, but sensible given private mortgages back up commercial mortgage-backed securities. This confirms the strong interconnectedness of the real estate quadrants.

CBRE Econometric Advisors invited Dr. Randall Zisler to co-author this paper on the real estate quadrants. His unique approach reflects a multifaceted career as a Princeton University professor, Goldman Sachs research director, pension fund consultant, and investment banker.

Explore Other Viewpoints in This Series

-

Viewpoint | Intelligent Investment

A Quadrant Approach to Commercial Real Estate Investing: Private Equity

February 5, 2025

Property returns exhibit serial correlation, making them partially predictable based on past returns. This needs to be considered when comparing private and public property returns.

-

Viewpoint | Intelligent Investment

A Quadrant Approach to Commercial Real Estate Investing: Public Equity

November 5, 2024

This Viewpoint is the fourth in a series that examines the relationship between the CRE quadrants of public debt, private debt, private equity and public equity.

-

Viewpoint | Intelligent Investment

A Quadrant Approach to Commercial Real Estate Investing: Public Debt

July 12, 2024

Commercial mortgage-backed securities (CMBS) allow fixed-income investors to gain exposure to commercial mortgages based on their desired risk tolerance.

-

Viewpoint | Intelligent Investment

A Quadrant Approach to Commercial Real Estate Investing

June 17, 2024

The four primary ways investors can gain exposure to commercial real estate are private equity, public equity, private debt and public debt.

Related Services

Our trusted specialists in economics, data science, and forecasting deliver the most sought-after analytical real estate research in the world.

- Invest, Finance & Value

Capital Markets

Gain proactive insights and strategies that unlock value, drive returns and enhance outcomes for your real estat...

Related Insights

Contacts

Dennis Schoenmaker, Ph.D.

Executive Director & Principal Economist, CBRE Econometric Advisors