Intelligent Investment

Debt funding gap arises in multifamily sector

Chart of the Week

October 25, 2023

Receive EA Insights Directly in your Inbox

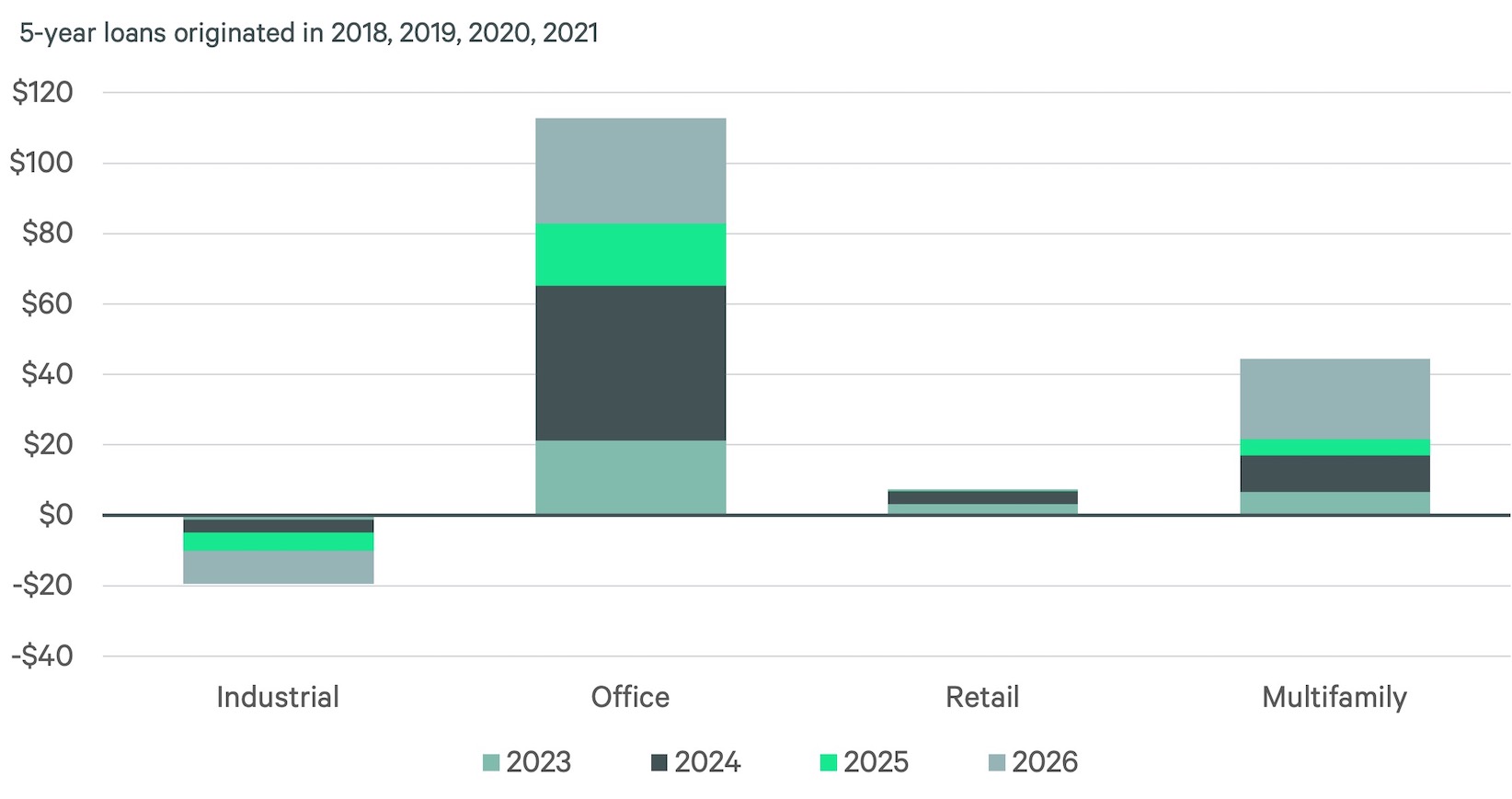

In June, CBRE Econometric Advisors published debt-funding gap estimates by sector for loans originated in the 2018-2020 period. At that time, we identified a substantial funding gap of $72.7 billion for office loans that would mature between this year and 2025. A funding gap did not exist for other property sectors.

We’ve updated our funding gap estimates in light of the dramatic run-up in yields since June. The funding gap for office has now increased to $82.9 billion, and a $21.7 billion funding gap emerged for multifamily properties.

We also added 2021-vintage loans — a big year for multifamily debt issuance — to our analysis. This balloons the funding gap for loans coming due between now and 2026 to $112.8 for office and $44.54 billion for multifamily. The volume of loans maturing, paired with rising cap rates, signal distress ahead for office and multifamily properties.

Figure 1: Debt-funding Gap by Maturity Year by Sector ($ Billions)

Source: CBRE Econometric Advisors.

Let's Talk

Dennis Schoenmaker, Ph.D.

Executive Director & Principal Economist, CBRE Econometric Advisors