Chapter 9

Applying Occupancy Planning Concepts to Lab Planning

Global Occupancy Insights 2021-2022

2 Minute Read

Figure 51: What type of labs exist in your client portfolio?

Note: Based on 31 respondents who have lab space.

Source: CBRE Global Occupancy Insights Report, 2021.

Many life sciences users began working in shifts in the labs and carrying out non-lab work at home, allowing ample time for appropriate sanitation and safety protocols.

Lab needs increasing

Scientists and principal investigators have specific lab requirements in addition to needing traditional office space. Sixty-five percent of respondents have lab space in their portfolio for life sciences, technology and industrial uses. Of those respondents with lab space, many allocate a significant portion of their portfolio for labs.

Unlike traditional office workers, scientists still needed specialized lab space throughout the pandemic. Many life sciences users began working in shifts in the labs and carrying out non-lab work at home, allowing ample time for appropriate sanitization and safety protocols. Some of these rotations were week-on, week-off, or working through dedicated days per week (Monday/Wednesday/Friday or Tuesday/Thursday).

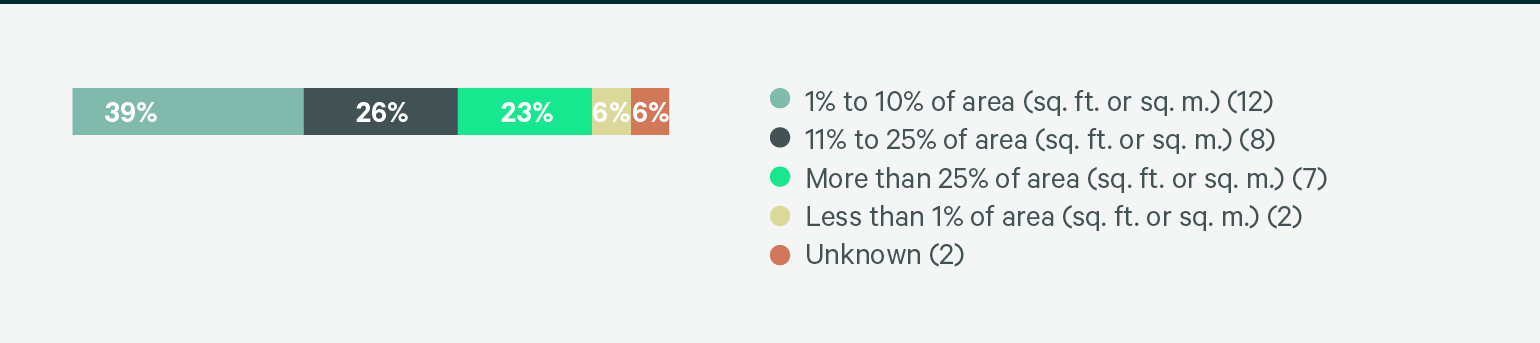

Figure 50: What percent of the total portfolio is dedicated to lab space?

Note: Based on 31 respondents who have lab space.

Case study

Optimizing lab space use for a pharmaceutical user

CBRE’s Occupancy Management team was tasked by a major pharmaceutical firm as a key member of an interdisciplinary team to revisit existing lab guidelines. The goal of the initiative was to enhance the scientific discovery experience and create a collaborative environment that advances sustainability targets, maximizes laboratory space and equipment and optimizes lab processes and services.

The CBRE team gathered quantitative data on how lab spaces, equipment and collaborative areas were utilized using a variety of sensing technologies to accomplish the following:

- Enable data-driven decision-making for lab space planning and investment strategies

- Identify bottlenecks and opportunities

- Understand optimal space type mix inside and outside the lab

- Evaluate equipment utilization and needs

- Influence global lab design standards and capacity metrics

- Contribute to overall continuous real estate footprint strategy

The CBRE team was also part of engaging researchers in workshops to understand their processes, concerns and requests. Opportunities identified included the following areas:

- Reduce equipment

- Remove write-up areas from within the lab footprint in order to increase bench space

- Implement both shared benches and write-up desks to increase occupancy

- Apply the lab activity-based-work model metrics for writeup desks and collaboration areas

As space experts, the CBRE team provided industry benchmarking from peers, calculated an increased laboratory capacity of 76% and reduced square footage per headcount of 64%.