Chapter 6

Workplace & Occupancy Programs: Hybrid, Mobility and Activity-Based Work

Global Occupancy Insights 2021-2022

7 Minute Read

Of the 29% that report not having a mobile/agile program, 50% are considering deploying a program now (Figure 21). As for why they don’t have a mobility program, 36% cite culture and 21% lack of C-suite support as the reasons.

Figure 21: If no, why does your client not support a mobile/agile program?

Select all that apply

Note: Based on 14 "No" respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

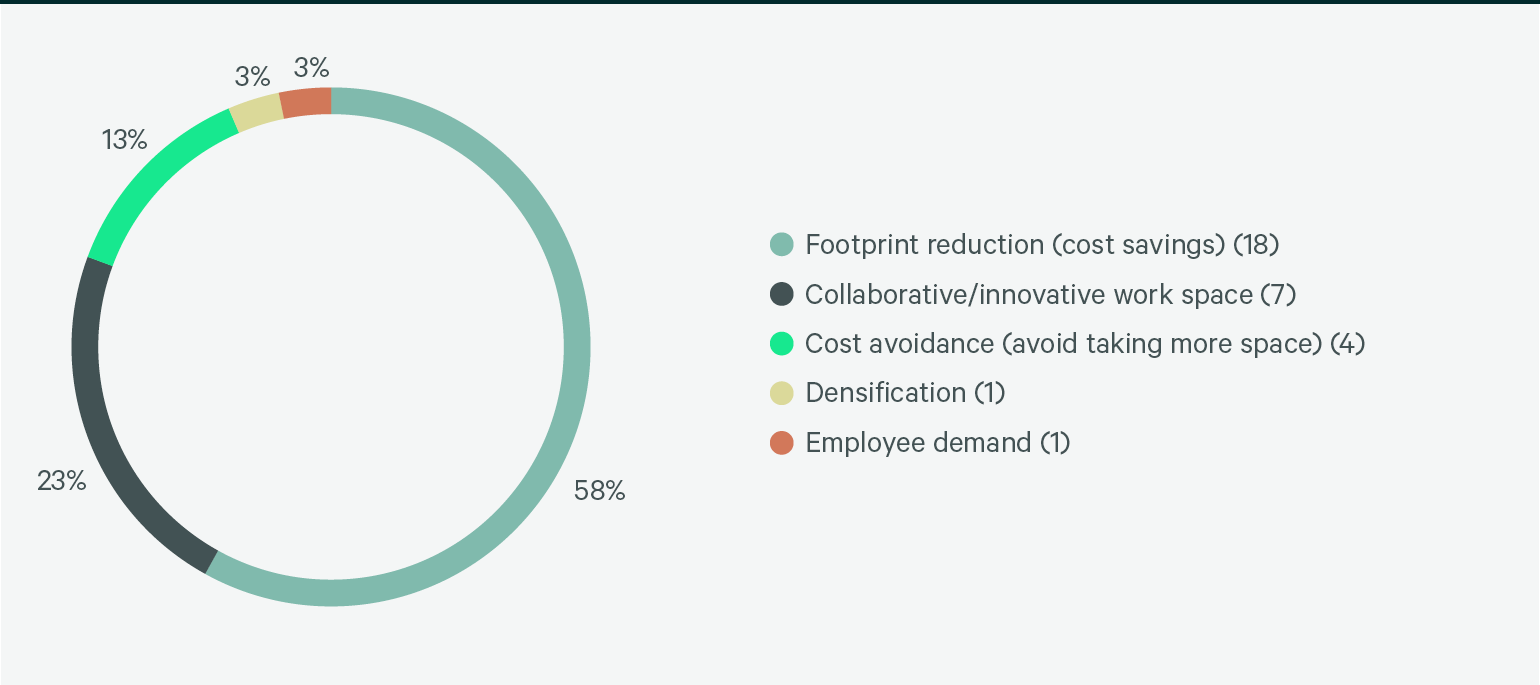

The top three goals for mobility/agile program among respondents (Figure 22) are to reduce footprints (58%), to use the space to build more collaborative/innovative workspaces (23%) and to avoid the cost of taking on more space (13%).

Figure 22: What is your client's real estate goals for its mobility/agile program?

Note: Not every respondent selected a 7 option.

Source: CBRE Global Occupancy Insights Report, 2021.

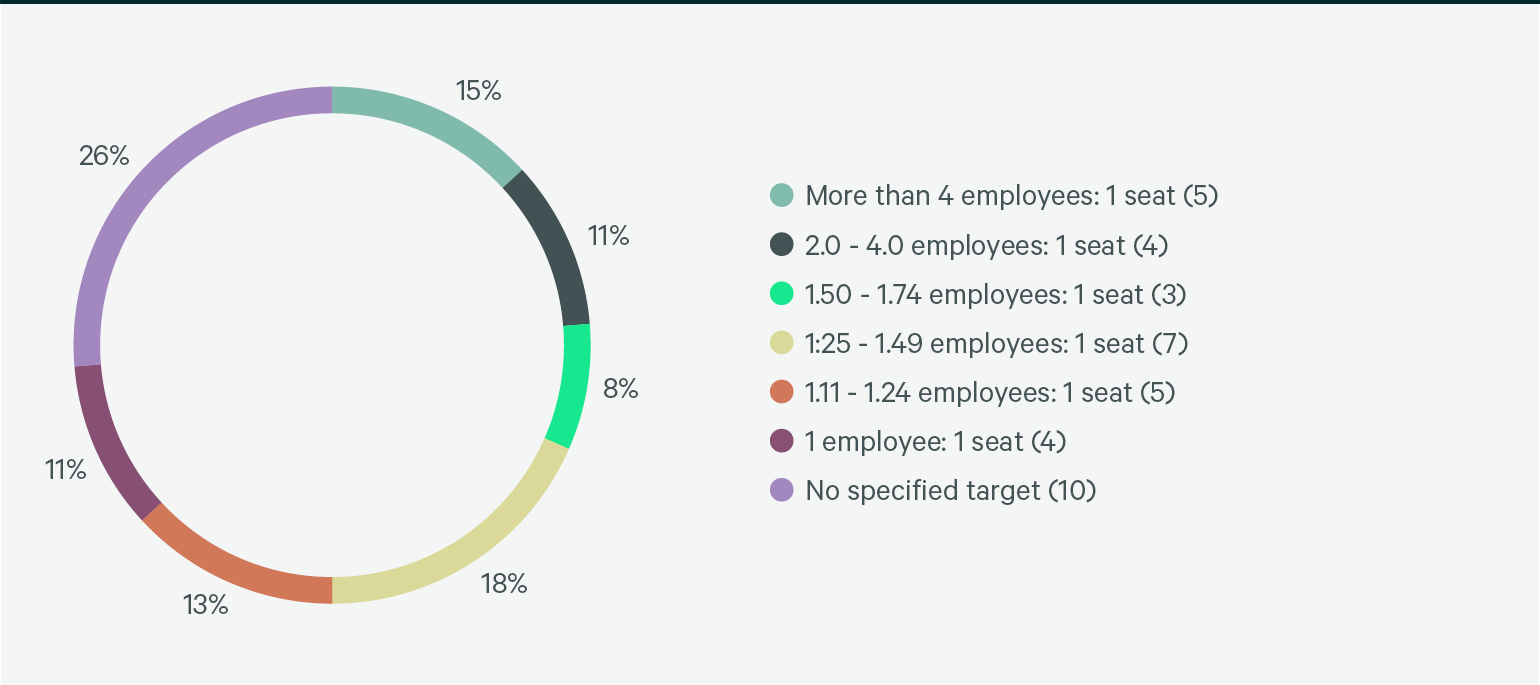

Determining how many seats are needed

Of those who have a target mobility ratio, most have a ratio of more than one seat per employee, with 18% using an employee-to-seat ratio of 1.25-1.49.

Figure 23: What is your target mobility ratio (# of employees per mobile seat)?

Based on 38 responses with mobile/agile program.

Source: CBRE Global Occupancy Insights Report, 2021.

Who gets to work from home?

The leading criteria used to determine employee eligibility for inclusion in a mobile/agile program (Figure 24) are job function (47%) and management discretion (41%).

Figure 24: What criteria is used to determine employee eligibility for the mobility/agile program? Select all that apply.

Note: Based on 34 responses with mobile/agile program.

Source: CBRE Global Occupancy Insights Report, 2021.

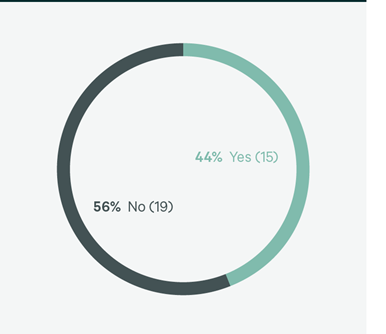

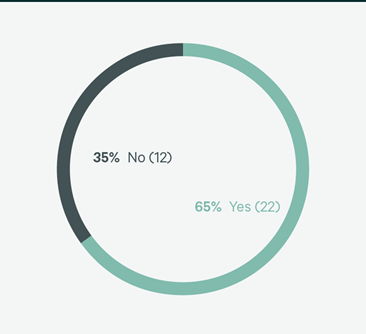

Forty-four percent of respondents report that they have a structured work-from-home component in addition to a mobile/agile program (Figure 25). Both mobile/agile and work-from-home programs are not easy to implement, so 65% of respondents include a change management component to help shepherd these programs and ensure employees are supported in these new ways of working (Figure 26).

Figure 25: Does the mobility/agile

program have a structured

work-from-home component?

Source: CBRE Global Occupancy Insights Report, 2021.

Figure 26: Does the mobility/agile

program include a change

management program?

Source: CBRE Global Occupancy Insights Report, 2021.

Forty-four percent of respondents report that they have a structured work-from-home component in addition to a mobile/agile program.

Forty-four percent of respondents report that they have a structured work-from-home component in addition to a mobile/agile program.

Tracking workspace use

To manage employees in this new agile environment, 74% note that they use the neighborhood concept to track employees with a CAFM/IWMS technology software (Figure 27).

Figure 27: Does your mobility/agile program use neighborhoods to track the following? Select all that apply.

Note: Based on 34 responses with mobile/agile program.

Source: CBRE Global Occupancy Insights Report, 2021.

Understanding CAFM/IWMS

CAFM refers to computer-aided facility management software or systems and typically focuses on understanding and managing the physical workplace through space and occupancy data tied to floor plans.

IWMS refers to integrated workplace management systems and includes capabilities beyond managing space and occupancy data using floor plans like real estate portfolio management, infrastructure, work order systems, lease administration and project management.

Many CAFM systems have added functionality over time to be more appropriately classified IWMS, so these terms have become increasingly synonymous.

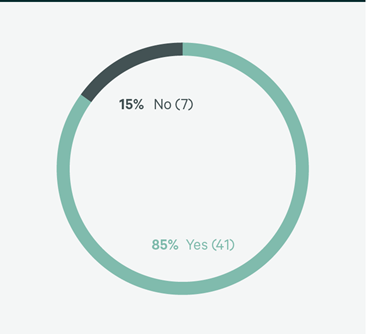

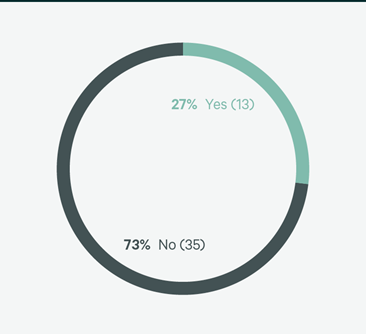

The use of reservation systems for both collaboration spaces and workspaces are also on the rise. Eighty-five percent of respondents use a reservation system for meeting rooms (Figure 28) and 27% use them to reserve workspaces (Figure 29). The adoption of these reservation tools will continue to rise as the deployment of mobile programs increases.

Figure 28: Does your client use a room

reservation booking system for

meeting rooms?

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

Figure 29: Does your client use a room/desk

reservation booking system for mobile

seats, neighborhoods or offices?

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

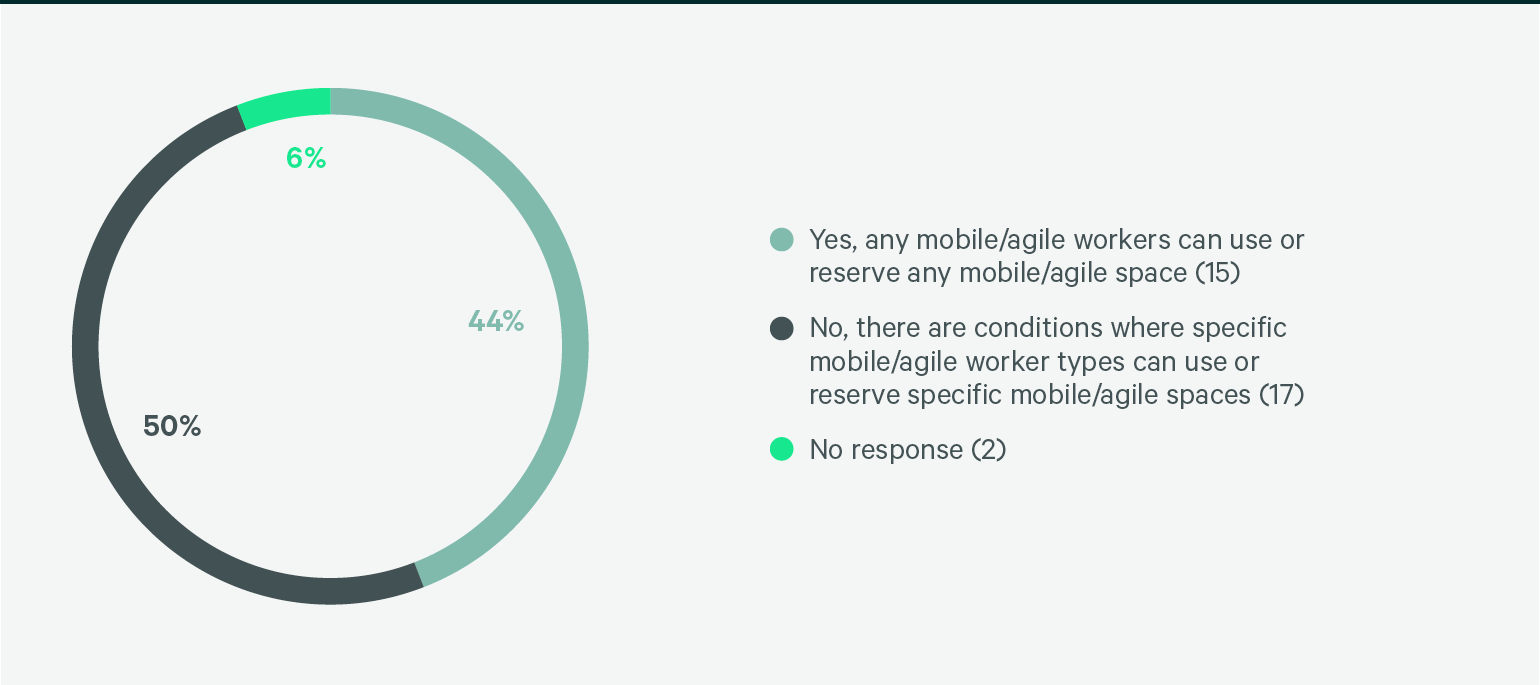

Forty-four percent of respondents allow hybrid employees to reserve any kind of mobile/agile space without conditions, while half put some conditions in place for space reservations, such as senior executives being allowed greater access to more workspace types than other employees (Figure 30).

Figure 30: Are mobile/agile workers allowed to use or reserve any mobile/agile space?

Note: Based on 34 responses with mobile/agile program.

Source: CBRE Global Occupancy Insights Report, 2021.

Furnishing workspaces

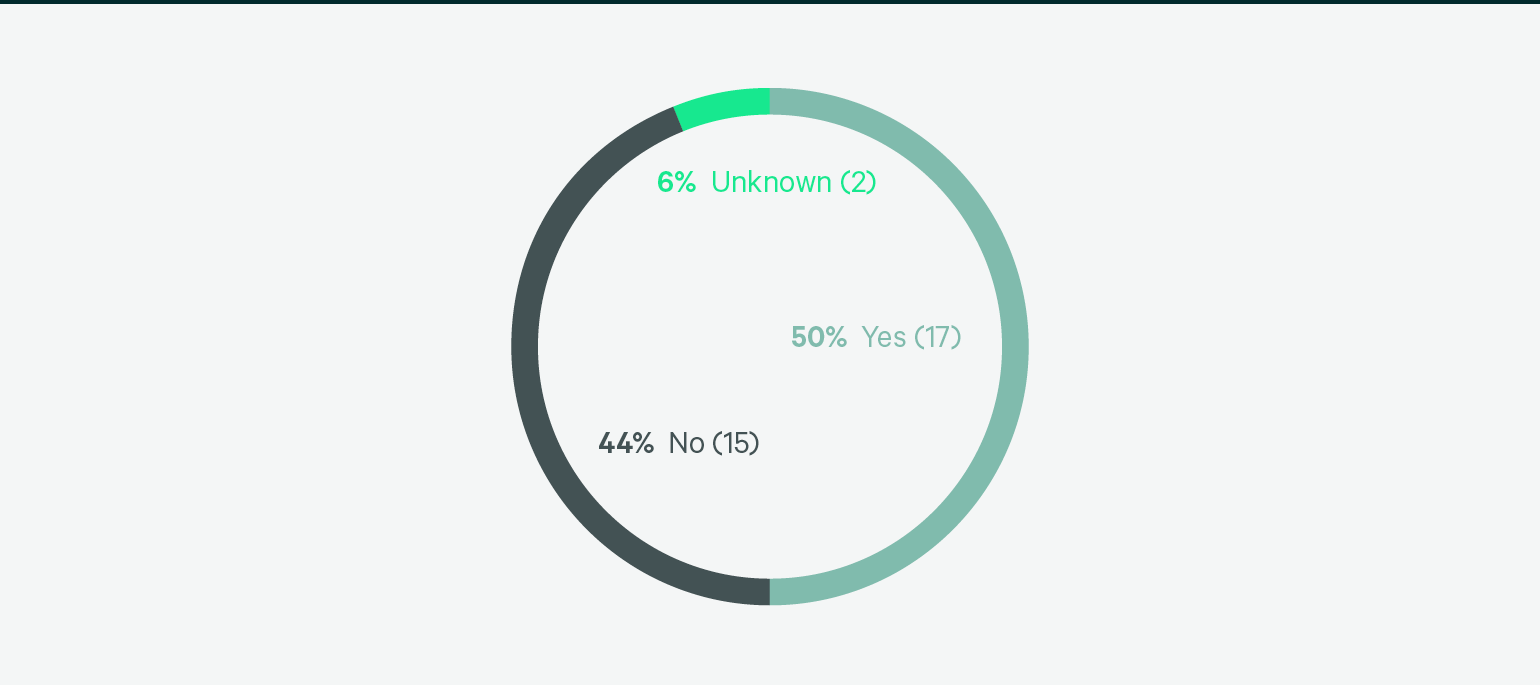

Respondents are almost evenly split on whether they provide different furniture standards for mobile/agile areas versus assigned seating: 50% do, 44% do not (Figure 31). If mobile areas use different furniture standards, it may become more difficult to manage as occupancy changes, which affects how flexible a space can be.

Figure 31: Is the furniture standard different for mobile/agile space?

Note: Based on 34 responses with mobile/agile program.

Source: CBRE Global Occupancy Insights Report, 2021.

Respondents are almost evenly split on whether they provide different furniture standards for mobile/agile areas versus assigned seating.

Respondents are almost evenly split on whether they provide different furniture standards for mobile/agile areas versus assigned seating.

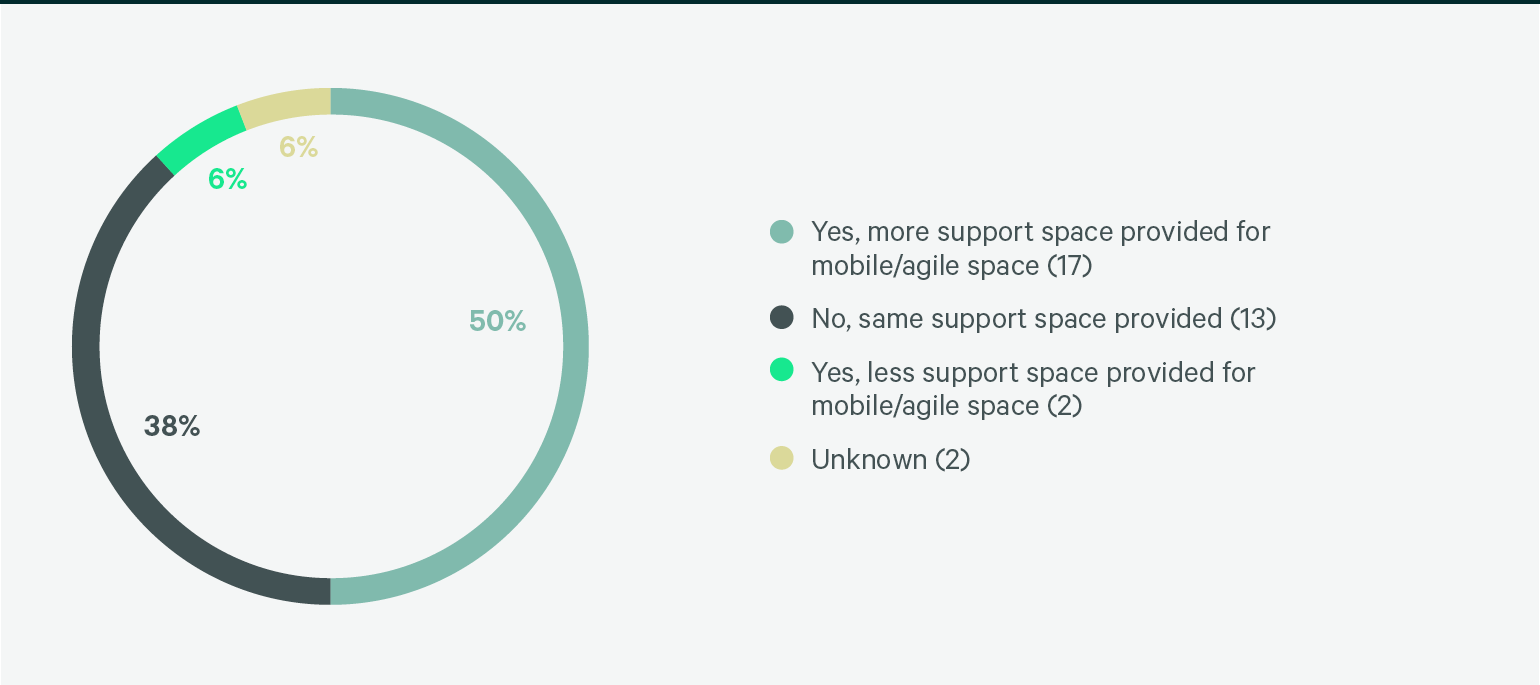

Half report they plan for more support space for the mobile/agile environment, and 38% use the same planning ratios for support space whether its assigned/dedicated or mobile/agile.

Figure 32: Does the ratio of support space differ for mobile/agile space vs. traditional office environment (assigned 1:1)?

Note: Based on 34 responses with mobile/agile program.

Source: CBRE Global Occupancy Insights Report, 2021.

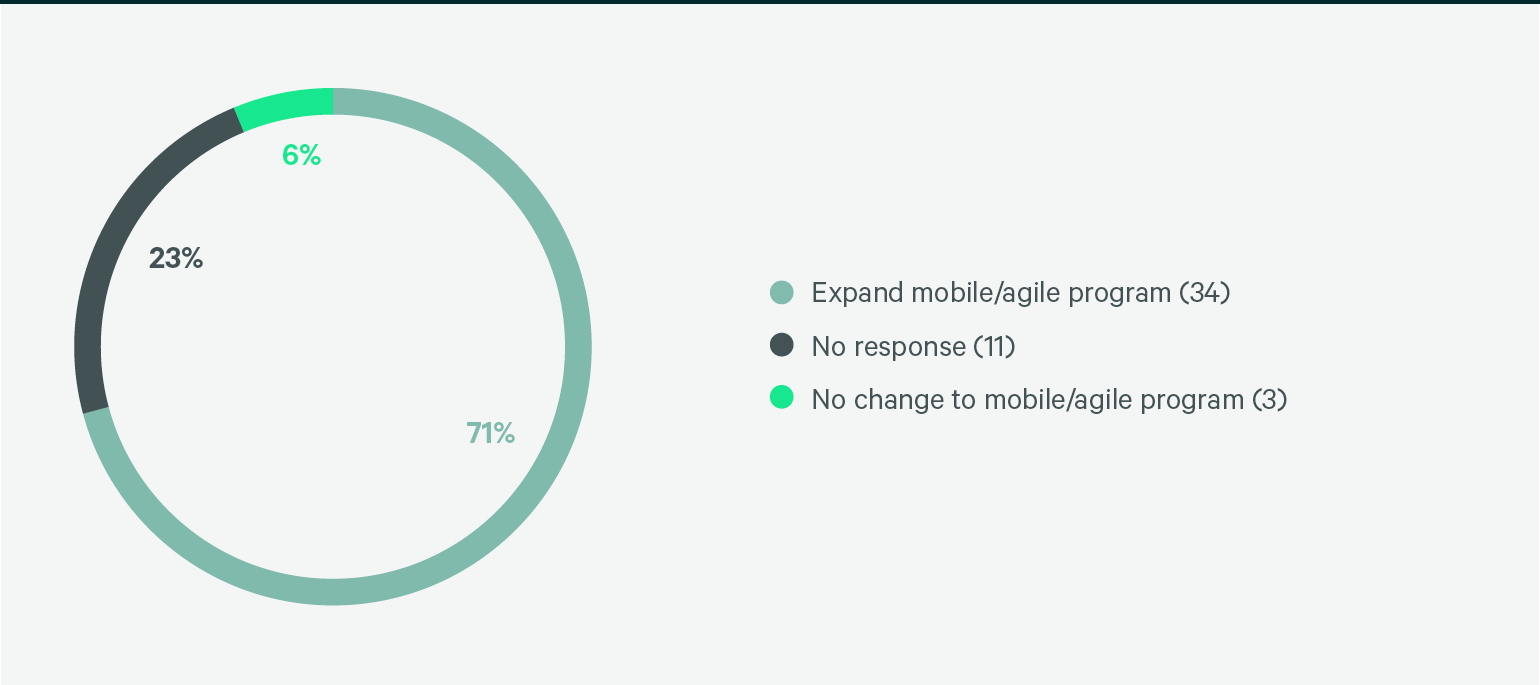

Lastly, and probably most revealing, is that over the next three years, 71% of respondents report that they plan to expand their mobile/agile program, while no respondents are planning to reduce them.

Figure 33: Over the next 3 years, what is your client's plan for its mobility/agile program?

Source: CBRE Global Occupancy Insights Report, 2021.

Mobility programs key to workplace success and reducing space needs

Working from home became standard practice during the pandemic, and mobility programs proved to be vital for organizations to maintain business operations.

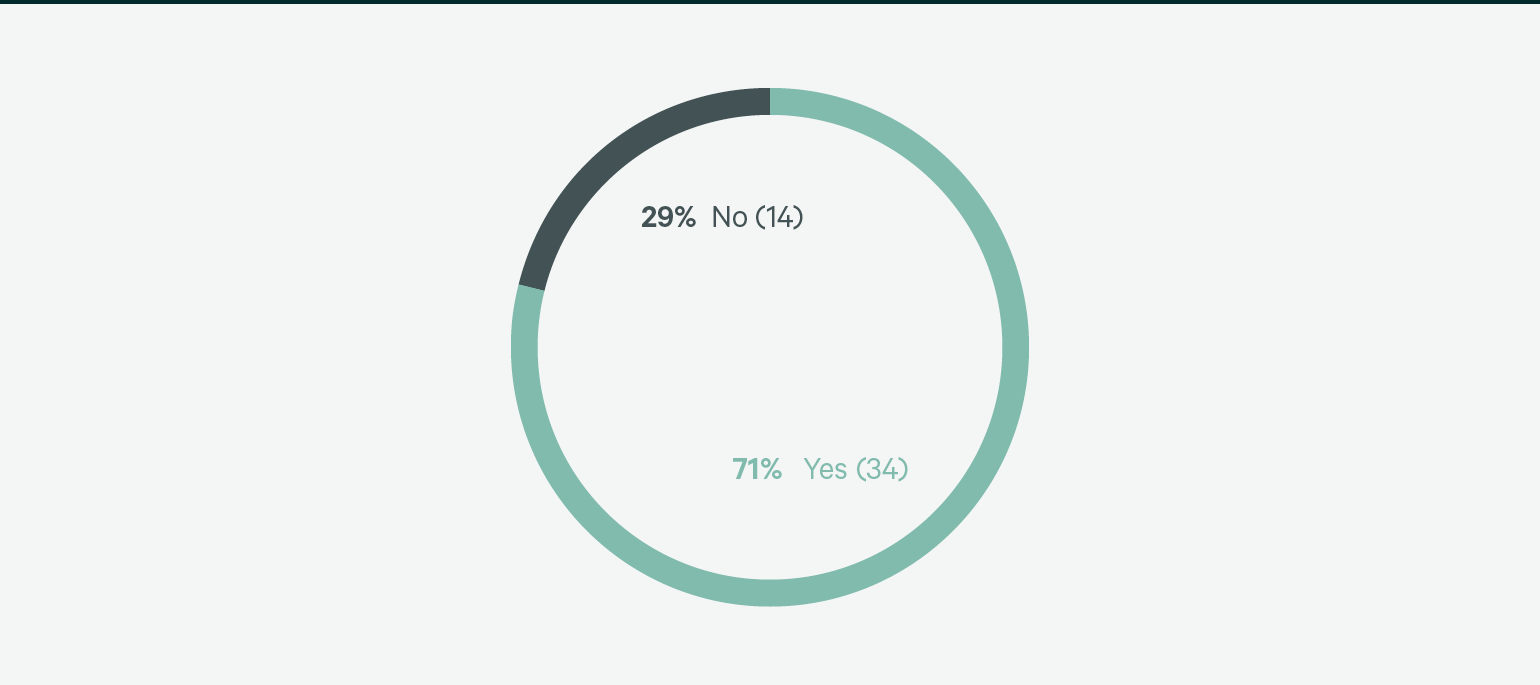

Unsurprisingly, 71% of respondents state they have mobility/agile work programs, a material change in how companies conduct business (Figure 20).

Figure 20: Does your client have a mobile/agile program?

Note: Based on 48 respondents.