Chapter 5

Evolving Space Standards

Global Occupancy Insights 2021-2022

10 Minute Read

Figure 8: During the pandemic is your client revisiting their current workplace design standards?

Source: CBRE Global Occupancy Insights Report, 2021.

Employees also want to come back into the office, but for different reasons—they are more likely to return to the office to collaborate with colleagues than to work alone. Seventy-seven percent of real estate leaders surveyed in CBRE’s Occupier Sentiment Survey reported that team collaboration is their top priority for workplaces. This helps explain why over 80% of respondents are revisiting the design of their collaboration spaces.

Figure 9: If revisiting their current workplace design guidelines, what are those changes?

Source: CBRE Global Occupancy Insights Report, 2021.

Smaller, fewer private offices

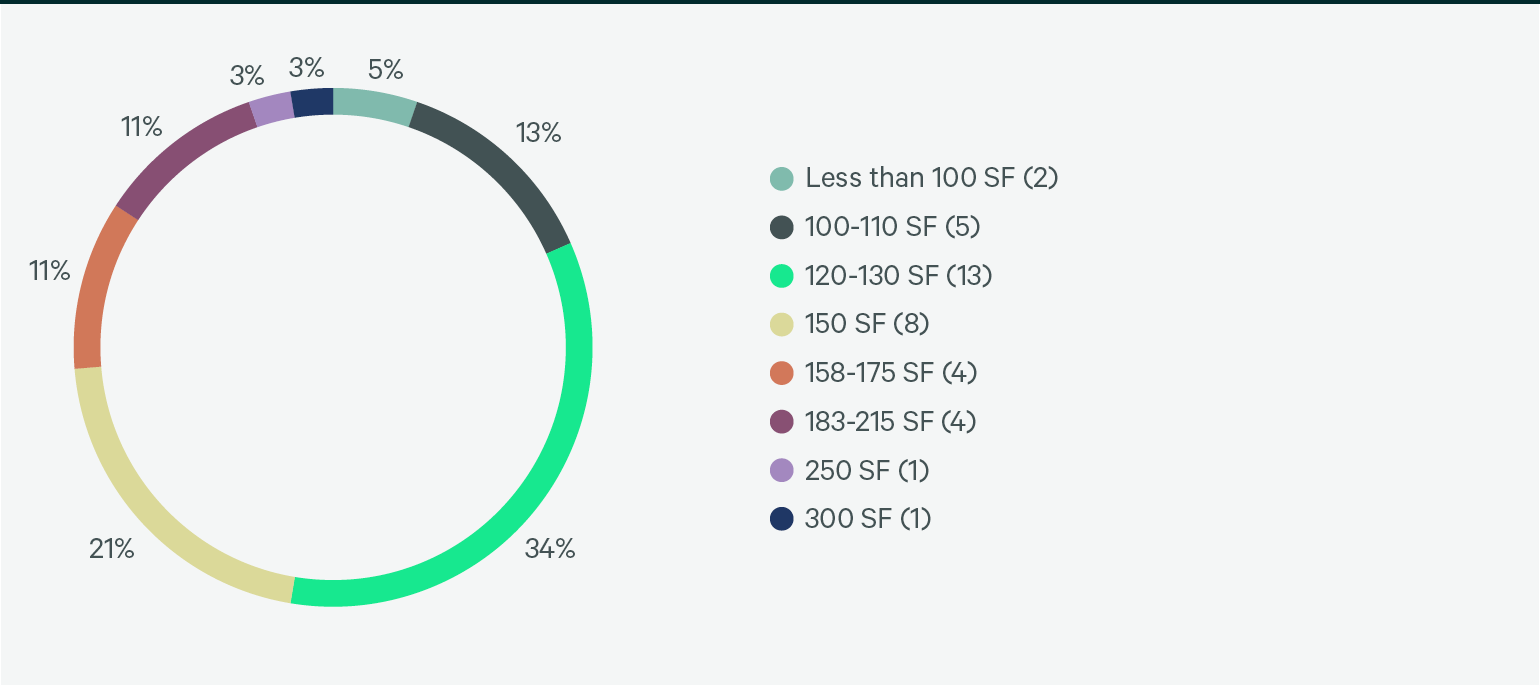

Our survey results reflect the ongoing shift away from private offices, with 25% of respondents eliminating private offices from their space standards (Figure 10). While many organizations still include private offices in their planning, the size of those offices are more compact—56% include a standard size of 100-149 sq. ft., or 9-13.9 sq. m. in their portfolio, and 13% deploy offices smaller than 100 sq. ft., or 9 sq. m.

Figure 10: Which of the following office sizes are standard in your client's portfolio?

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

It’s worth noting that while the most prevalent private office size among respondents is 120-130 sq. ft., this may not match their aspirational standard as they adjust for post-pandemic needs (Figure 11).

Figure 11: What is the most prevalent office size (by area) in your client's portfolio?

Source: CBRE Global Occupancy Insights Report, 2021.

While many organizations still include private offices in their planning, the size of those offices is more compact

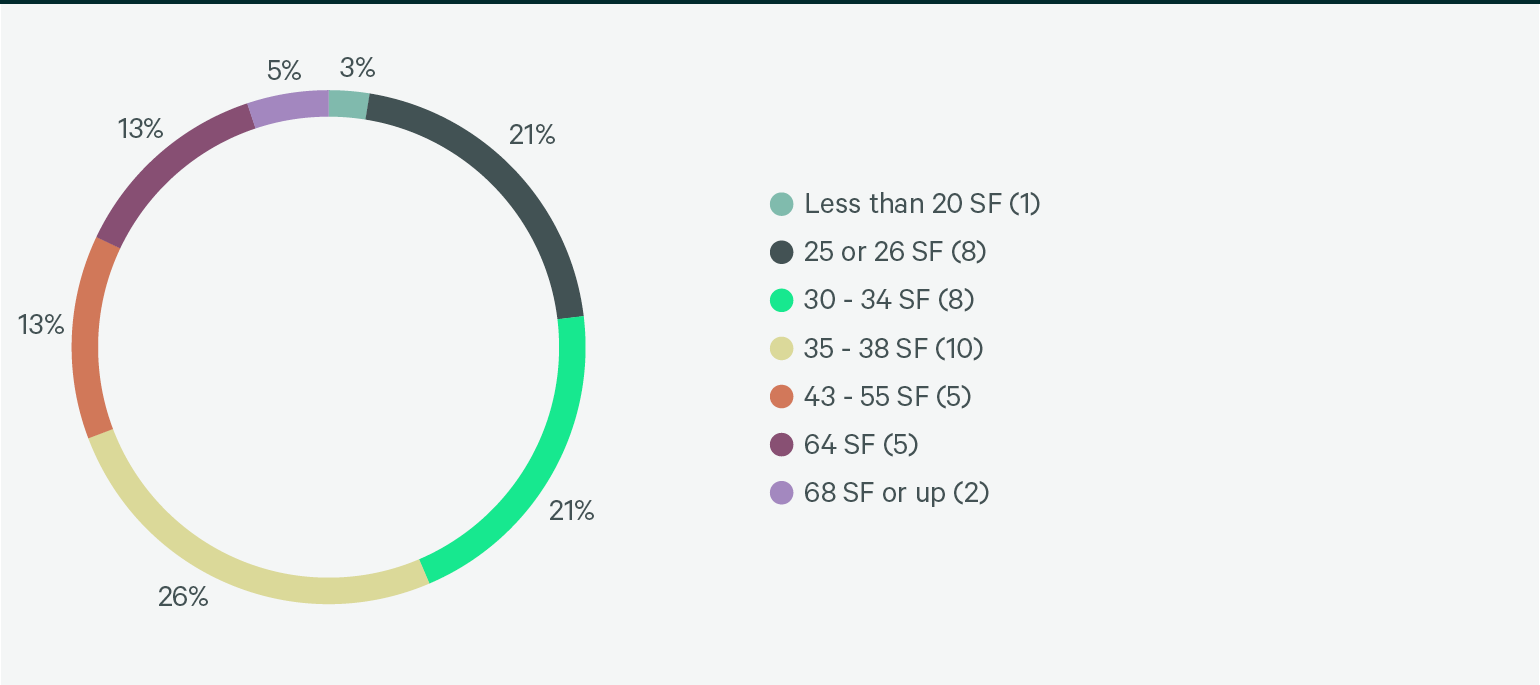

Workstations more common, likely to include standing option

Fifty-six percent of respondents include a standard workstation size of less than 35 sq. ft., or 3.3 sq. m., in their portfolio, and 48% include workstations of 35-49 sq. ft., or 3.3-46 sq. m. (Figure 12). This closely aligns with the most prevalent current size, 35 to 38 sq. ft., chosen by 26% of respondents (Figure 13).

Figure 12: Which of the following workstation sizes are standard in your client's portfolio? Select all that apply.

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

Figure 13: What is the most prevalent workstation size (by area) in your client's portfolio?

Source: CBRE Global Occupancy Insights Report, 2021.

Ninety percent of respondents offer sit/stand desks for all new build-outs or with special approval (e.g., financial and/or medical) because health and wellness are such a priority in organizations today, and occupiers are trying to address studies that show sitting too much can have adverse health consequences.

Figure 14: Does your client offer sit/stand desks?

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

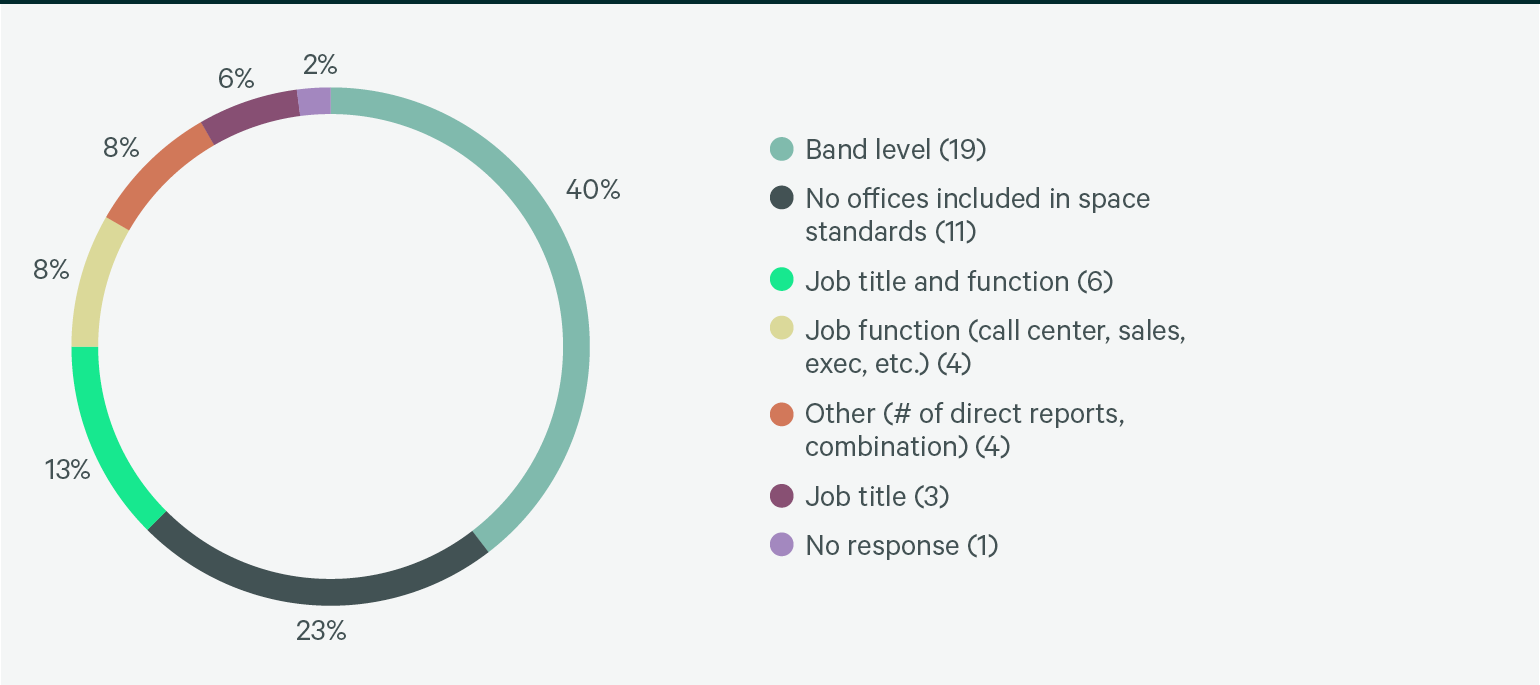

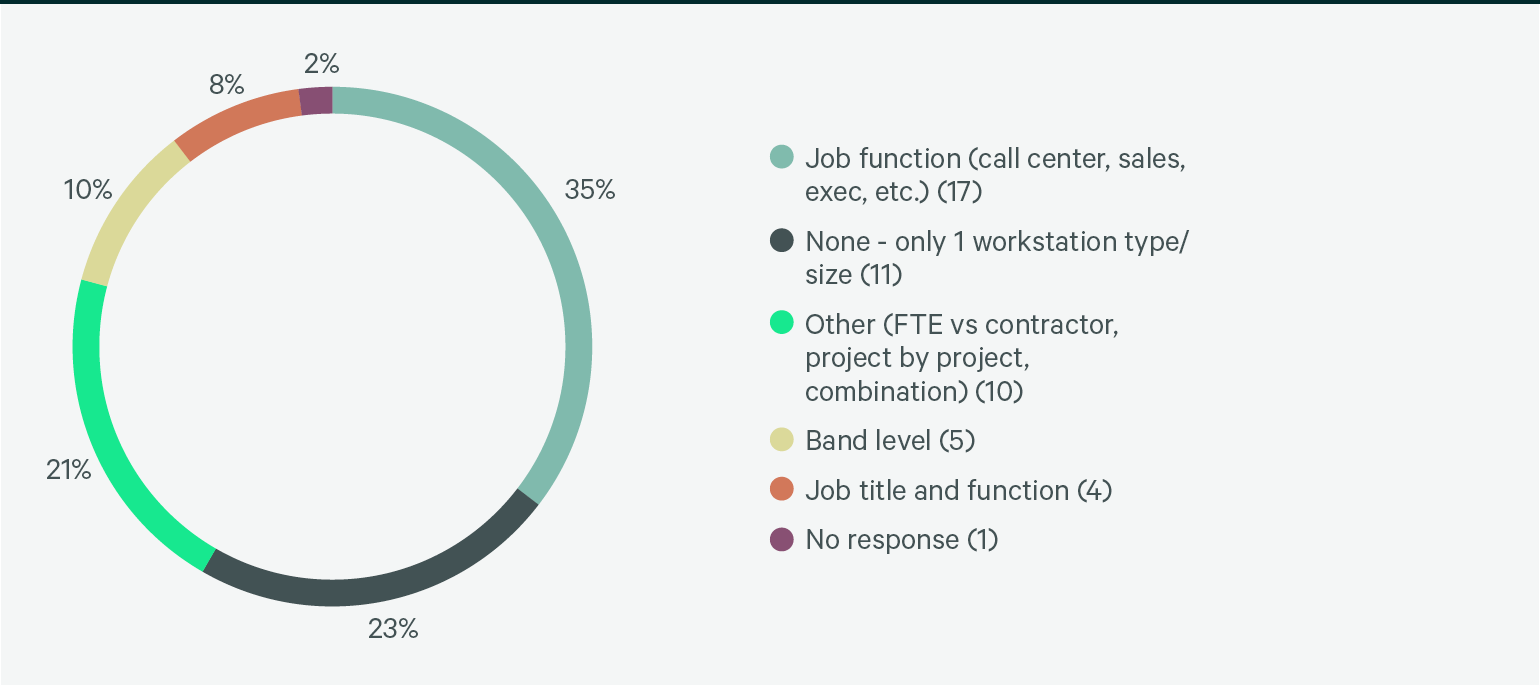

Determining space eligibility

For those that still have private offices, 40% of respondents assigned private offices based on band level (Figure 15), while 35% used job function to determine workstation size/type eligibility (Figure 16). Twenty-three percent reported that they only have one workstation size.

Figure 15: How is office eligibility determined?

Source: CBRE Global Occupancy Insights Report, 2021.

Figure 16: How is workstation type/size eligibility determined?

Source: CBRE Global Occupancy Insights Report, 2021.

Pinpointing the right amount and size of meeting spaces

For meeting rooms, 79% of those surveyed use a planning metric to determine the amount of meeting space, and 56% use a target ratio of open and/or closed collaboration seats to workspace seats (Figure 17).

Figure 17: Does your client use a planning metric to determine the amount of meeting/collaboration space? Select all that apply.

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

The standard meeting room sizes among respondents are as follows: 94% have medium sized rooms of 7-10 seats, 88% have small rooms of 5-6 seats, 85% have focus/huddle rooms of 3-4 seats and large meeting rooms of 11-16 seats, and 81% have phone rooms of 1-2 seats (Figure 18).

Figure 18: Which of the following meeting room sizes are standard in your client's portfolio?

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

Amenities crucial, especially in headquarters facilities

Amenity spaces are growing as organizations seek ways to entice employees back to the office. Figure 19 compares amenities in headquarters versus non-headquarters facilities. In addition to the more typical amenity spaces—such as collaboration spaces, food, health and wellness offerings—new amenities growing in popularity include the following:

- Walk-up technology help desks or stores (65% in headquarters facilities, 46% in satellite offices)

- Electric vehicle charging stations (44%, 35%)

- Massage/meditation/therapy rooms (40%, 25%)

- Outdoor spaces (31%, 29%) and outdoor balcony/terrace (48%, 31%)

Figure 19: Which of these specialty spaces or amenities are currently offered at your client's headquarters?

Note: Based on 48 respondents.

Source: CBRE Global Occupancy Insights Report, 2021.

Prepping for the hybrid workplace

Space standards are changing fast as occupiers revise workplace standards to achieve hybrid, flexible work accommodations within their portfolios. Unsurprisingly, more than 60% of respondents stated they are revisiting design standards.

Using CBRE’s Occupancy Management Property Benchmarking Dashboard to track space composition

The dashboard can track space composition on a building and portfolio level, breaking down the percent of space devoted to individual, collaboration, support and amenity spaces. For more information on CBRE’s Occupancy Management Subjective Survey Dashboard or to request a demo, contact the team leader from your region, listed on the Contributors page.

Future benchmarking studies will likely reveal more wide-ranging changes in design and space standards as workplace concepts evolve to meet post-pandemic needs. Employees want to come into the office for different reasons, and the design standards need to reflect these changes, which will generate more holistic, innovative designs.