Future Cities

Southern New Jersey/Eastern Pennsylvania Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

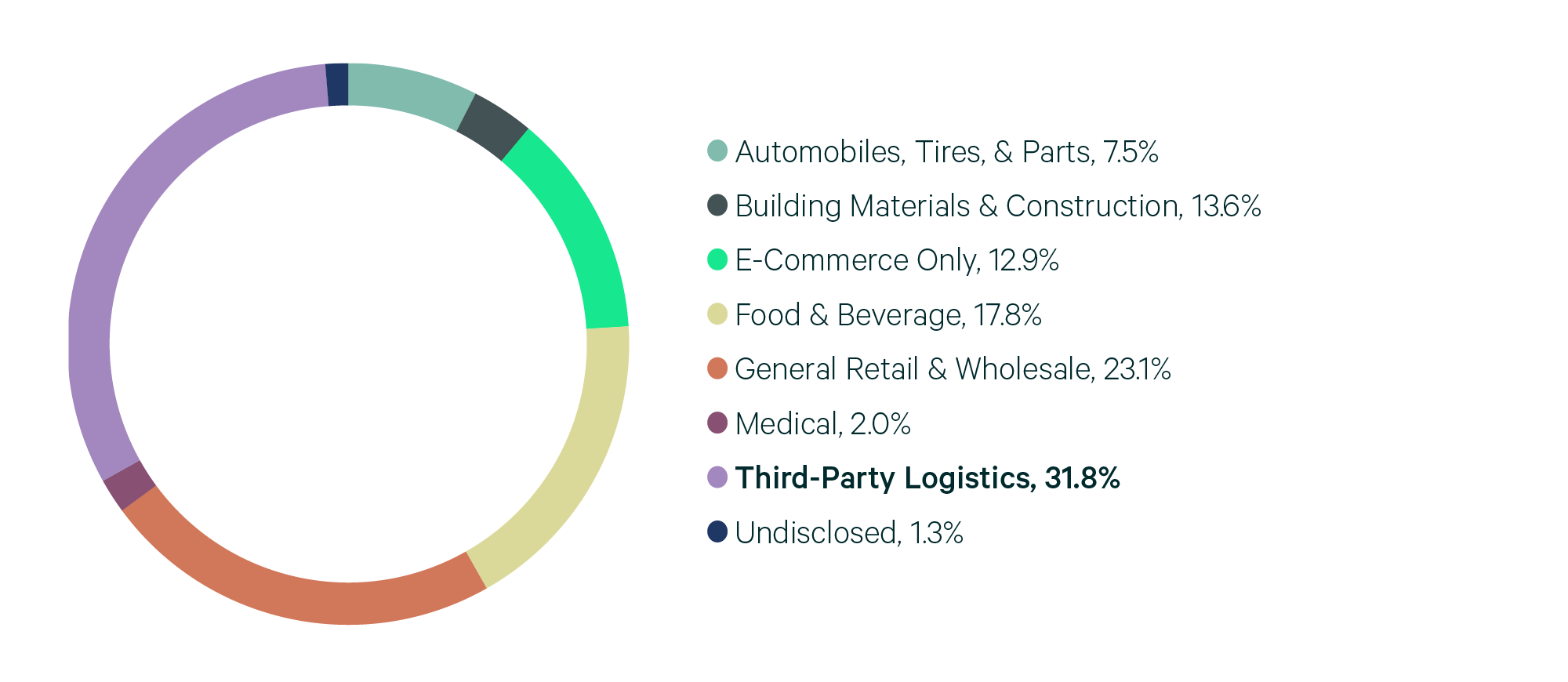

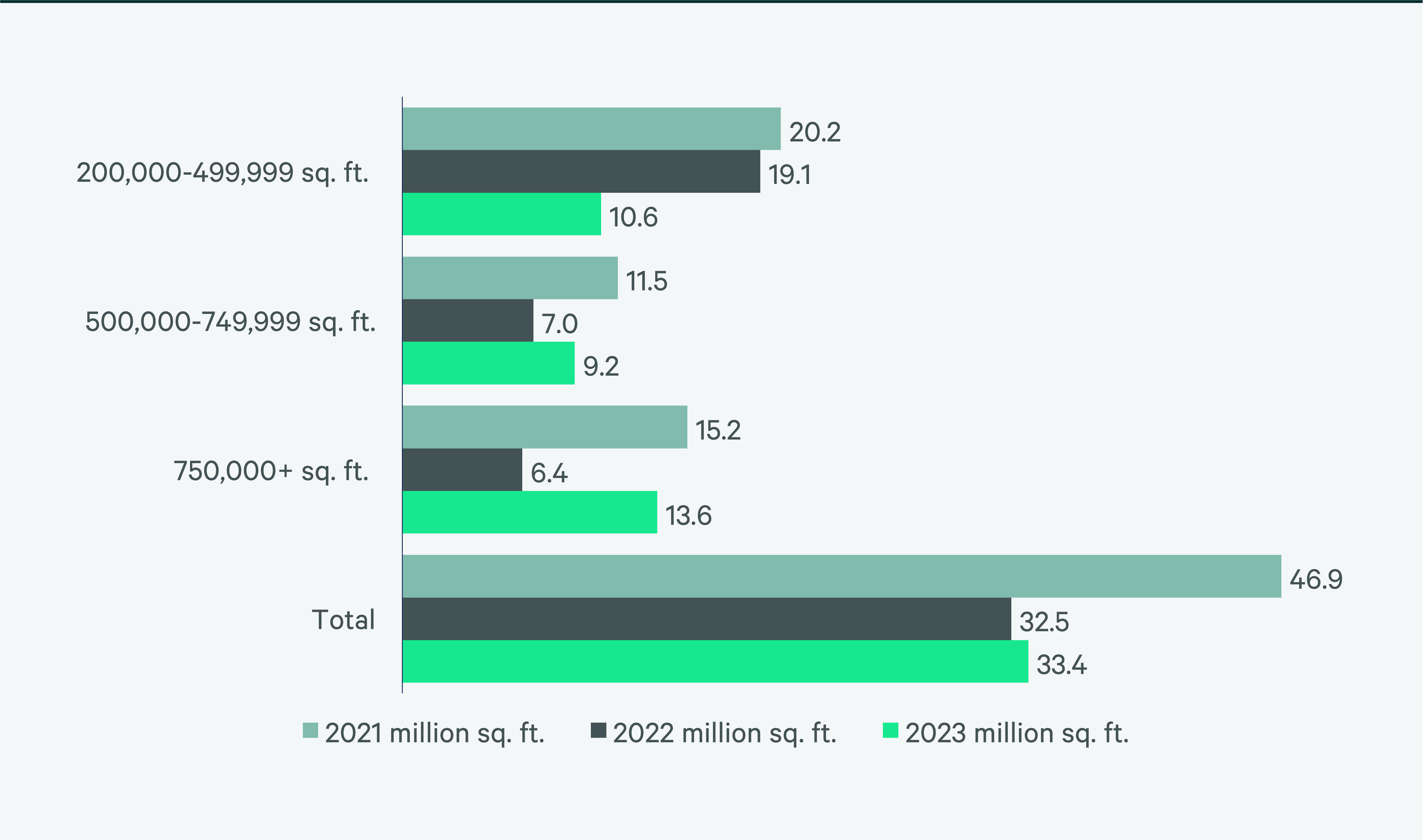

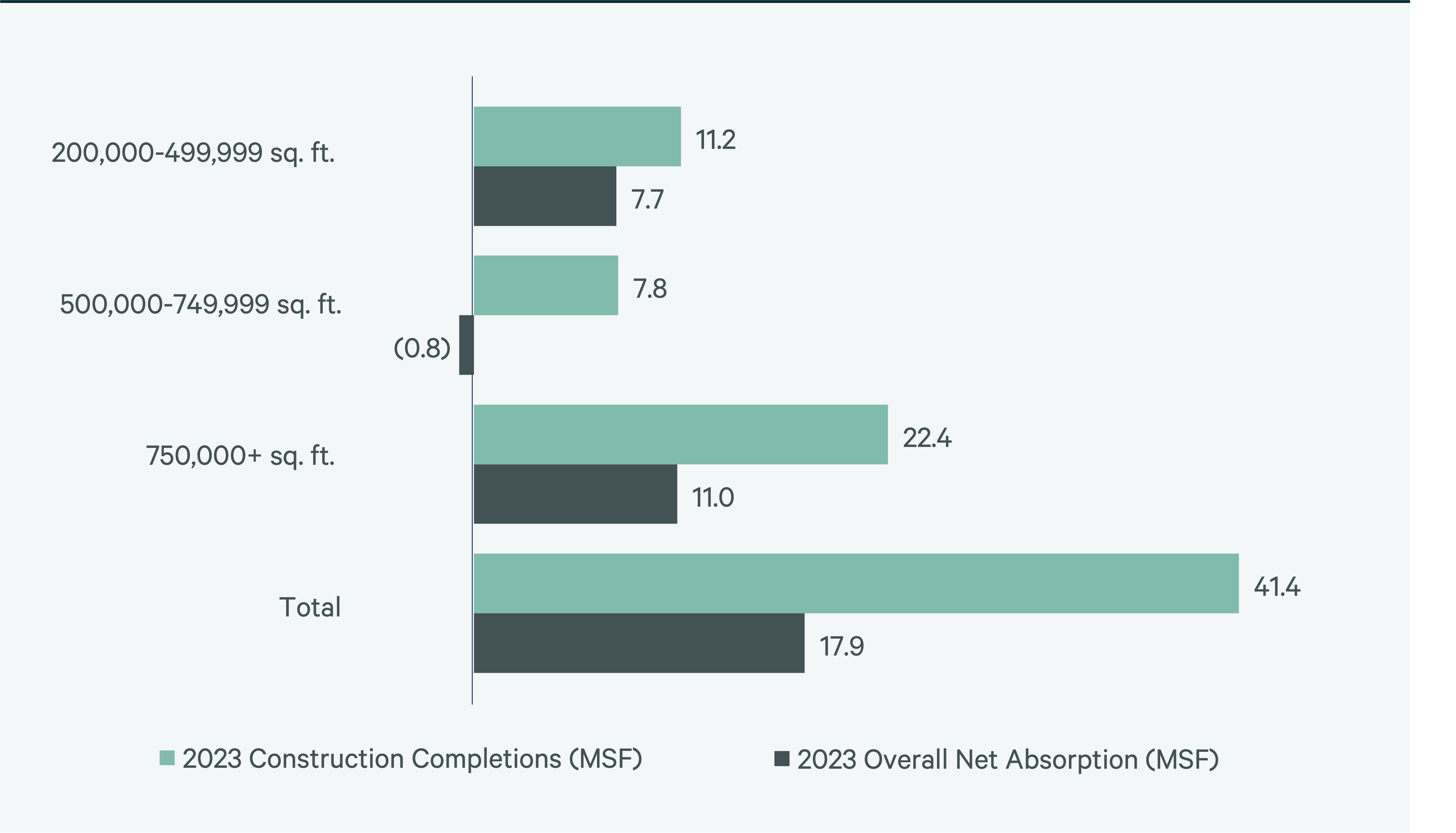

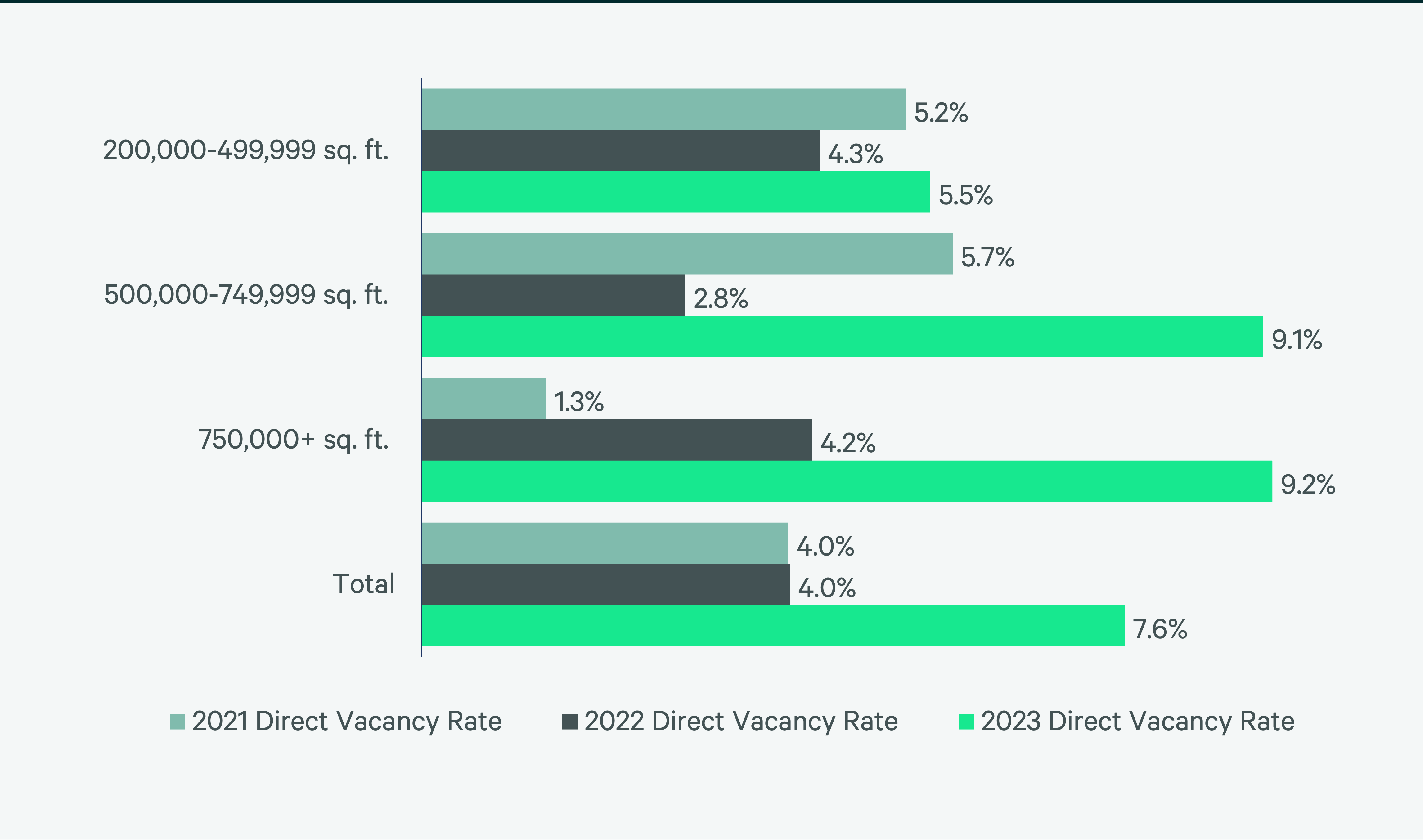

Southern New Jersey/Eastern Pennsylvania is the second-largest big-box market in North America, with 560 million sq. ft. of total inventory. Just over 33.4 million sq. ft. leased in 2023, including more than 13.6 million sq. ft. in transactions over 750,000 sq. ft., the highest in North America. Total big-box leasing increased 2.6% year-over-year, and leasing of spaces 750,000 sq. ft. and larger doubled year-over-year. Despite robust leasing activity, net absorption declined to 18 million sq. ft. This decline, combined with 41.4 million sq. ft. of completed construction, raised the vacancy rate from 4% in 2022 to 7.6%. A diverse set of occupiers leased big-box space in 2023, led by 3PLs transacting 31.8% of space. This market had the highest percentage of e-commerce-only occupiers in this report, accounting for 12.9% of total volume.

The market’s abundant logistics drivers and large surrounding population will continue to make it the most in-demand big-box region in the Northeast. At the end of the year, only 10.1 million sq. ft. of big-box space was under construction. This is expected to lead to reductions in vacancy and continued rent growth for big-box facilities in 2024.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services