Future Cities

Baltimore Market

2025 North America Industrial Big-Box Review & Outlook

May 22, 2024 5 Minute Read

Supply & Demand

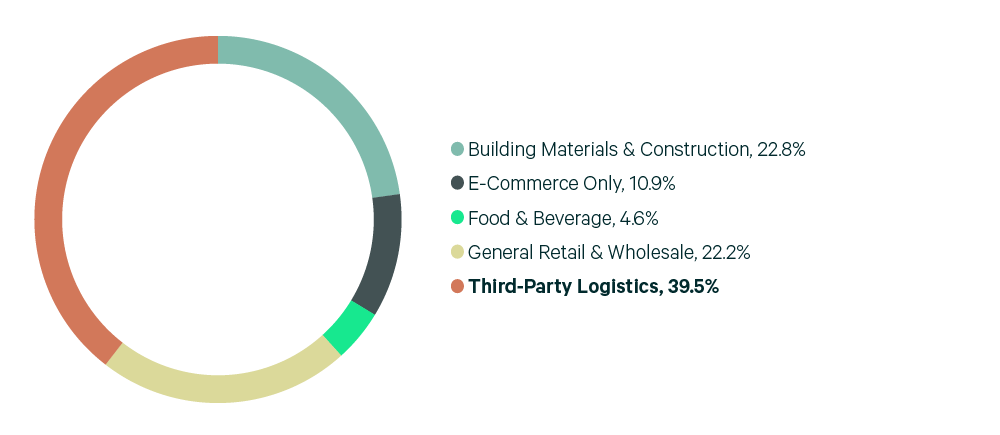

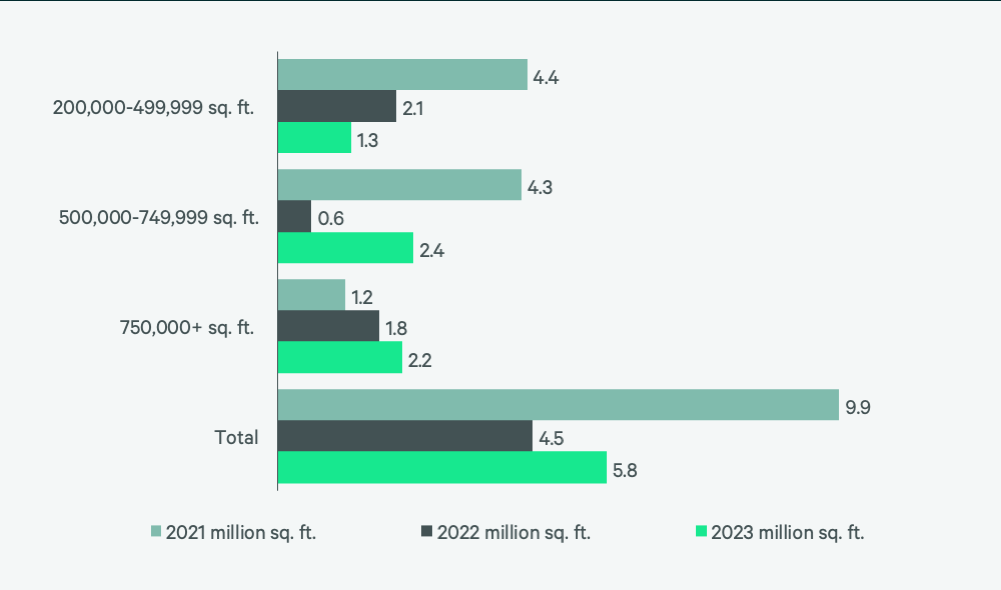

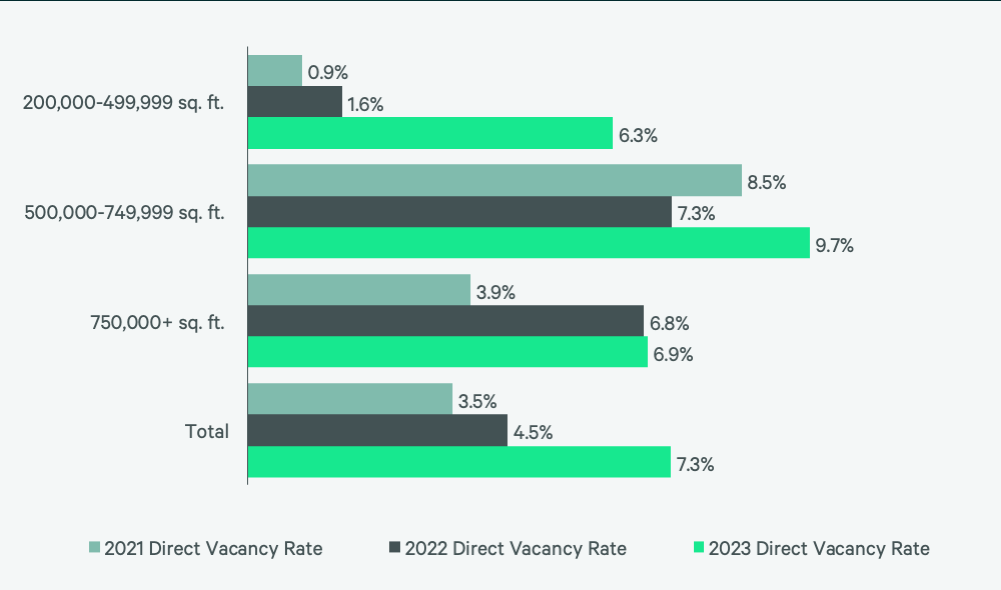

Despite only 87 million sq. ft of existing industrial big-box inventory, Baltimore is garnering significant interest from big-box occupiers because of its central location and nearby port. Baltimore’s 2023 leasing volume was 5.8 million sq. ft., a nearly 30% year-over-year increase. It is one of the few markets in this report to have a year-over-year increase in leasing activity. Despite this, a decline in positive net absorption and 3.3 million sq. ft. of construction completions drove up the vacancy rate to 7.3%, significantly higher than 2022’s 4.5% rate. 3PLs were the most active occupier in 2023, accounting for 39.5% of leasing activity. However, the building materials, general retail & wholesale, and e-commerce sectors each also accounted for more than 10% of the total transaction volume.

Baltimore’s vacancy rate should stabilize in H1 2024, given that only 2.1 million sq. ft. is under construction, and decline year-over-year by this year’s end. Leasing activity is expected to increase throughout this year as occupiers, buoyed by solid retail sales and economic stability, expand into Baltimore to leverage its central location and other logistics advantages.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services