Future Cities

Northern/Central New Jersey Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

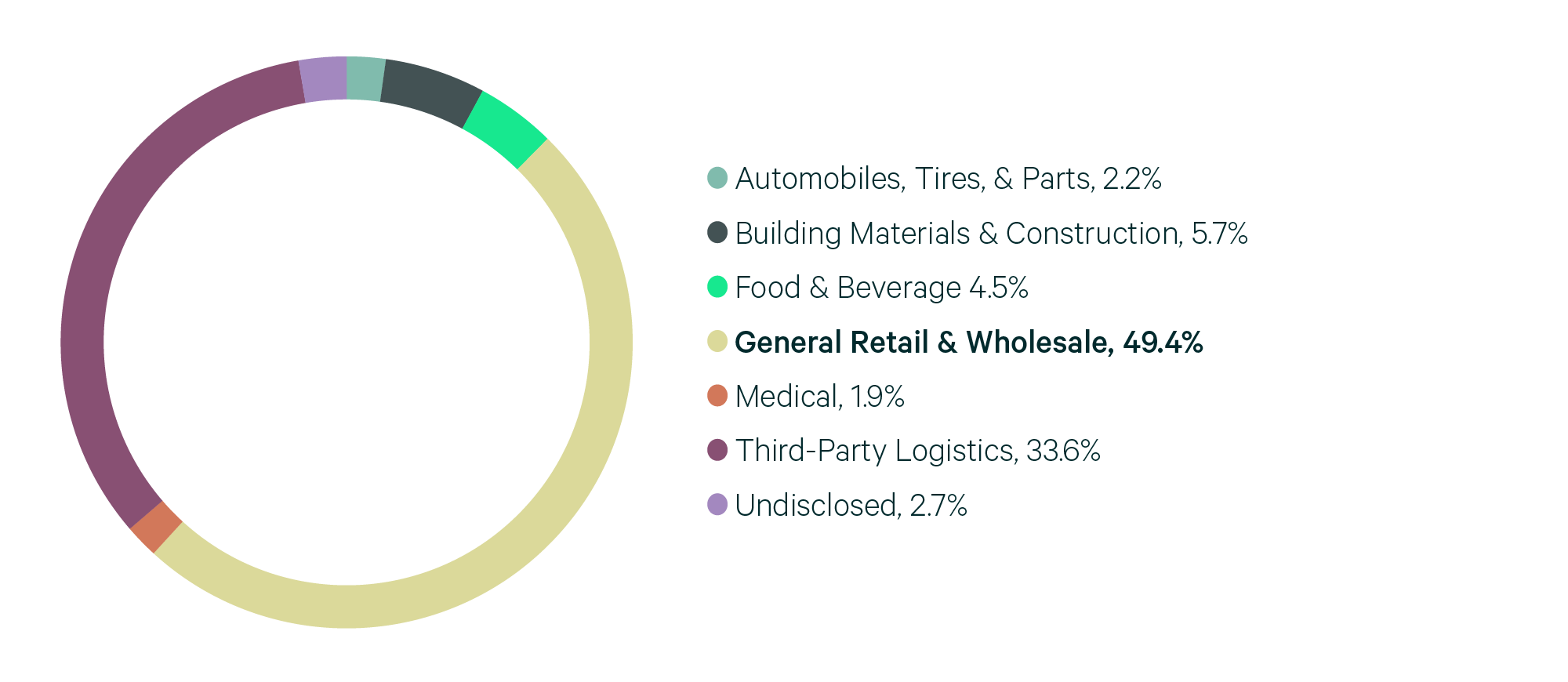

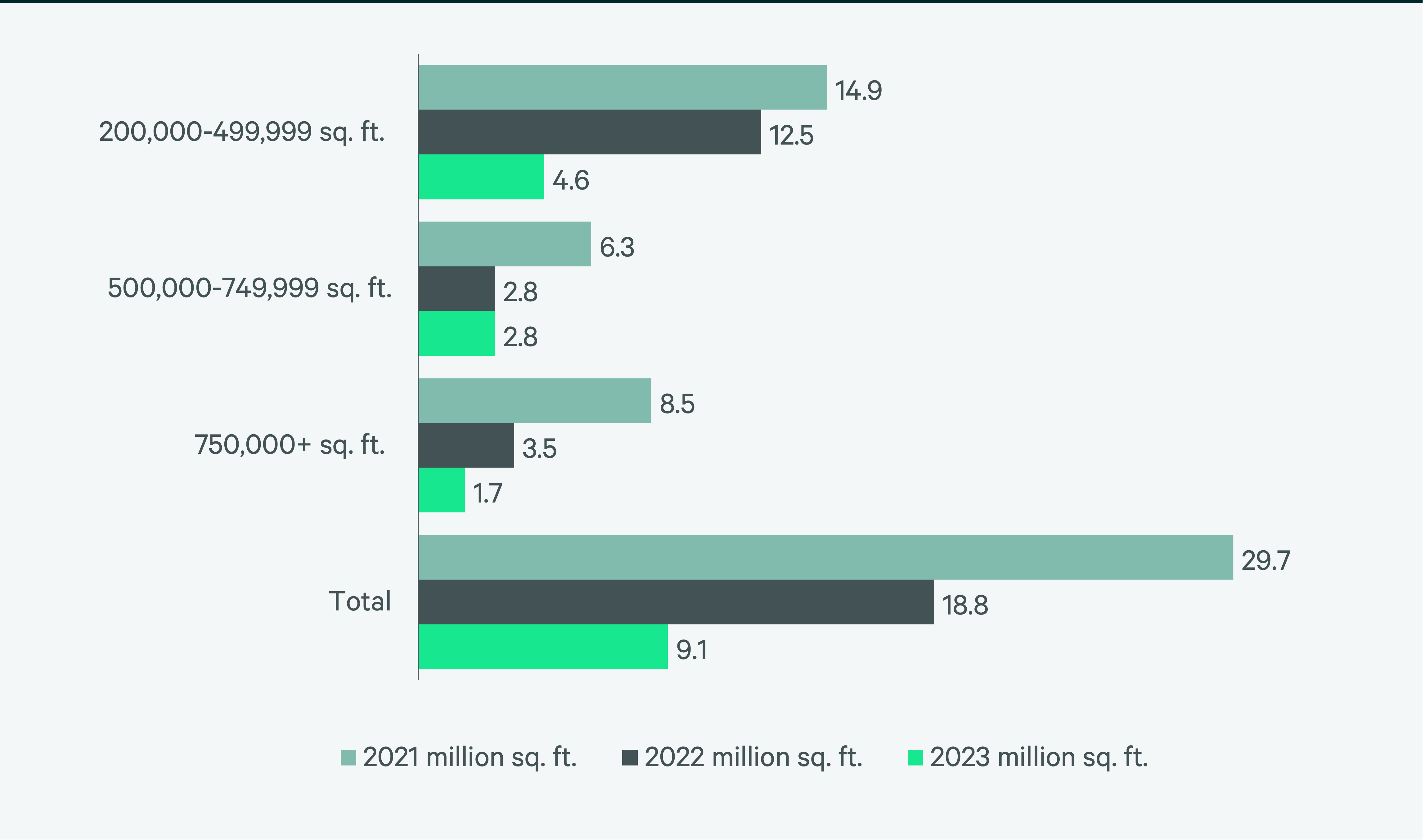

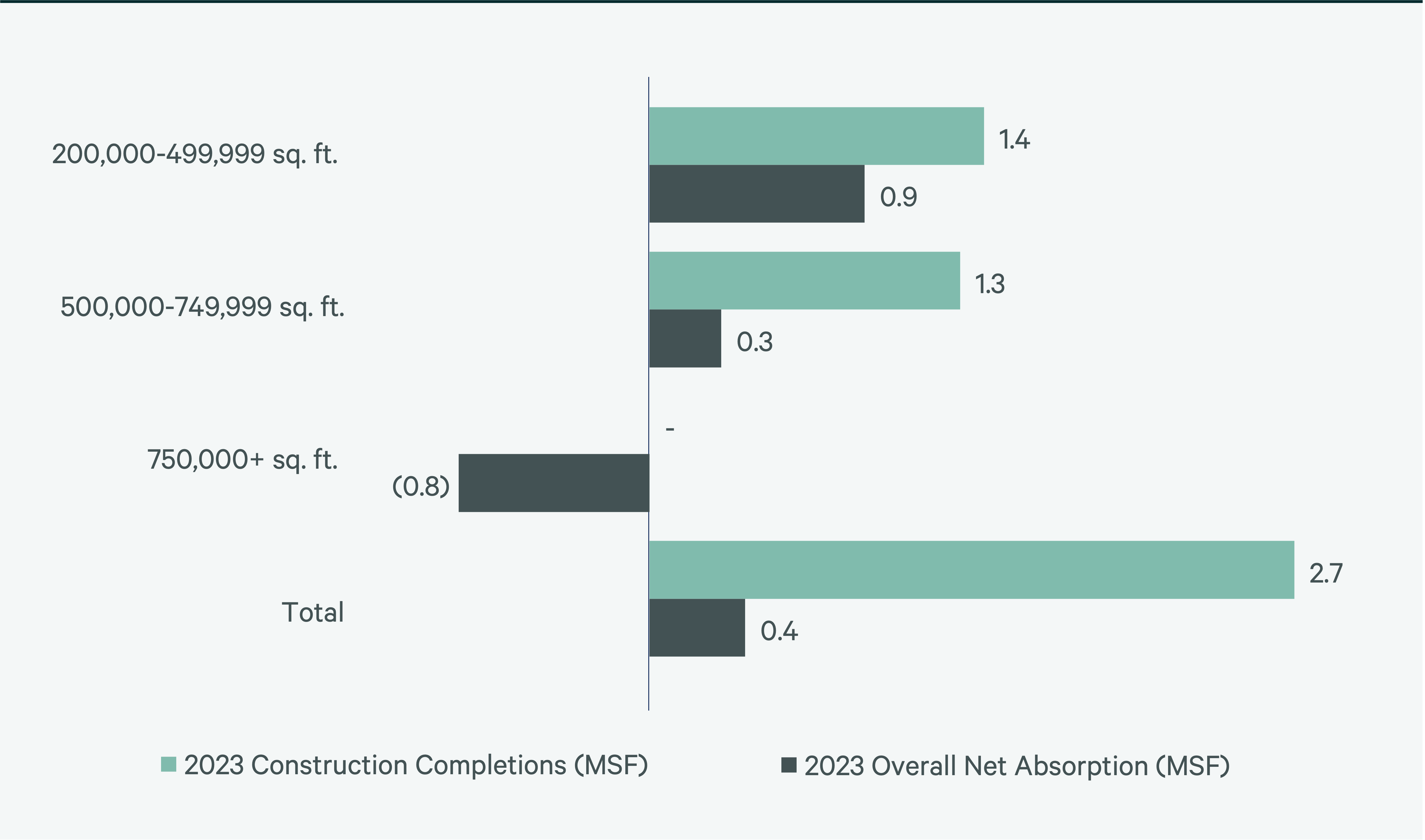

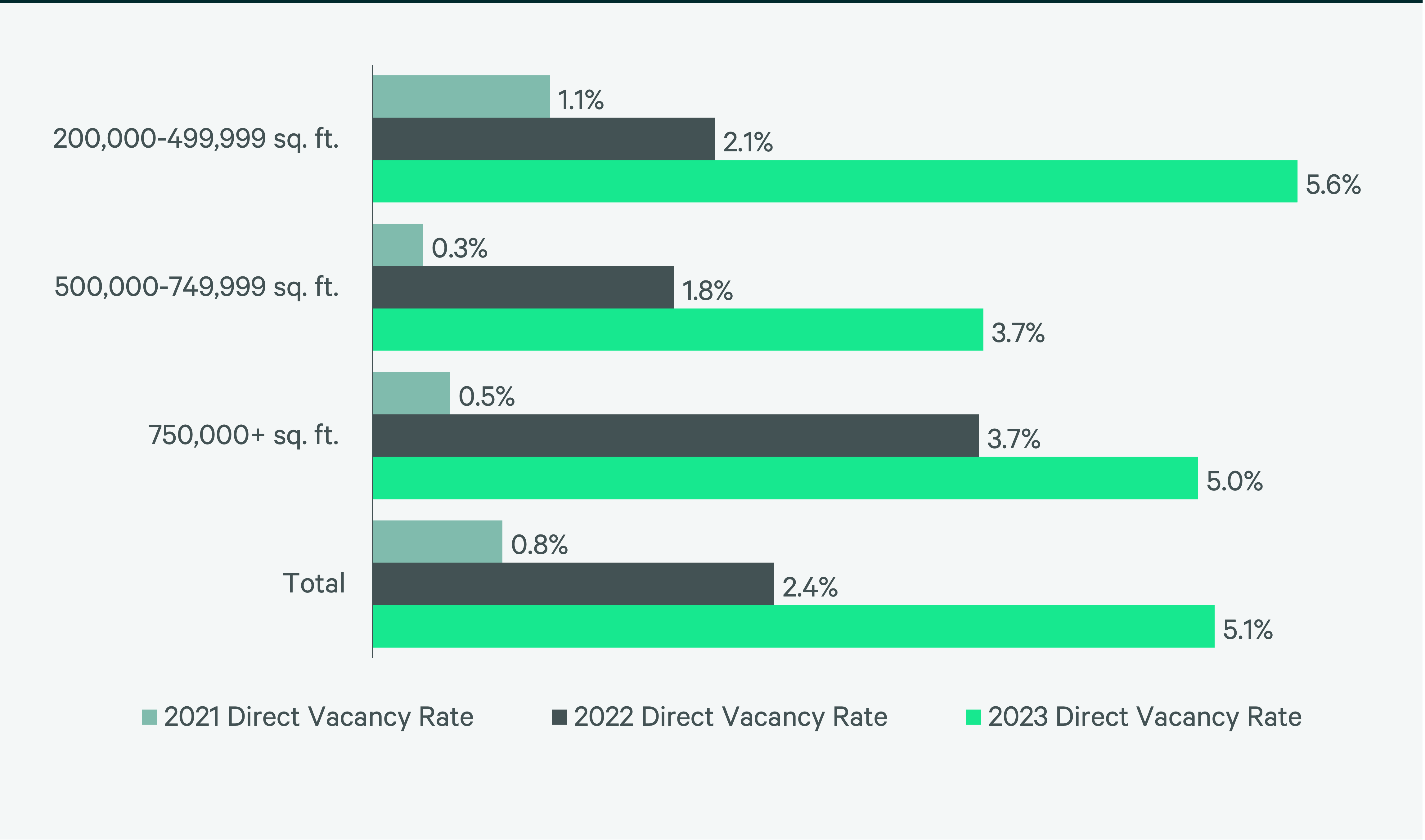

Northern/Central New Jersey is the sixth-largest North American industrial market, with 370 million sq. ft. of total inventory. There was 9.2 million sq. ft. of lease transactions in 2023, around half of 2022’s volume. The vacancy rate increased to 5.1% in 2023, more than double 2022’s 2.4% rate, due to a mix of less leasing, more move-outs and 11.6 million sq. ft. of construction completions. Higher vacancies also stabilized taking rents, which finished the year at $15.09 psf/yr, slightly higher than 2022’s $14.99 psf/yr. General retailers & wholesalers seeking to shore up inventories near the largest population concentration in the U.S. were the most active occupiers, accounting for 49.4% of lease volume.

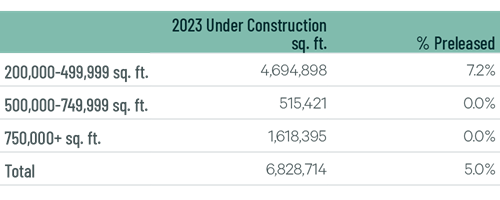

With only 6.8 million sq. ft. of space under construction, big-box completions should return to pre-pandemic levels, leading to vacancy rate stabilization this year. Lease transaction volume should improve as economic clarity and continued solid retail sales lead occupiers to restart expansion plans. They will seek to service the highest population concentration in the U.S.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services