Future Cities

Montreal Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

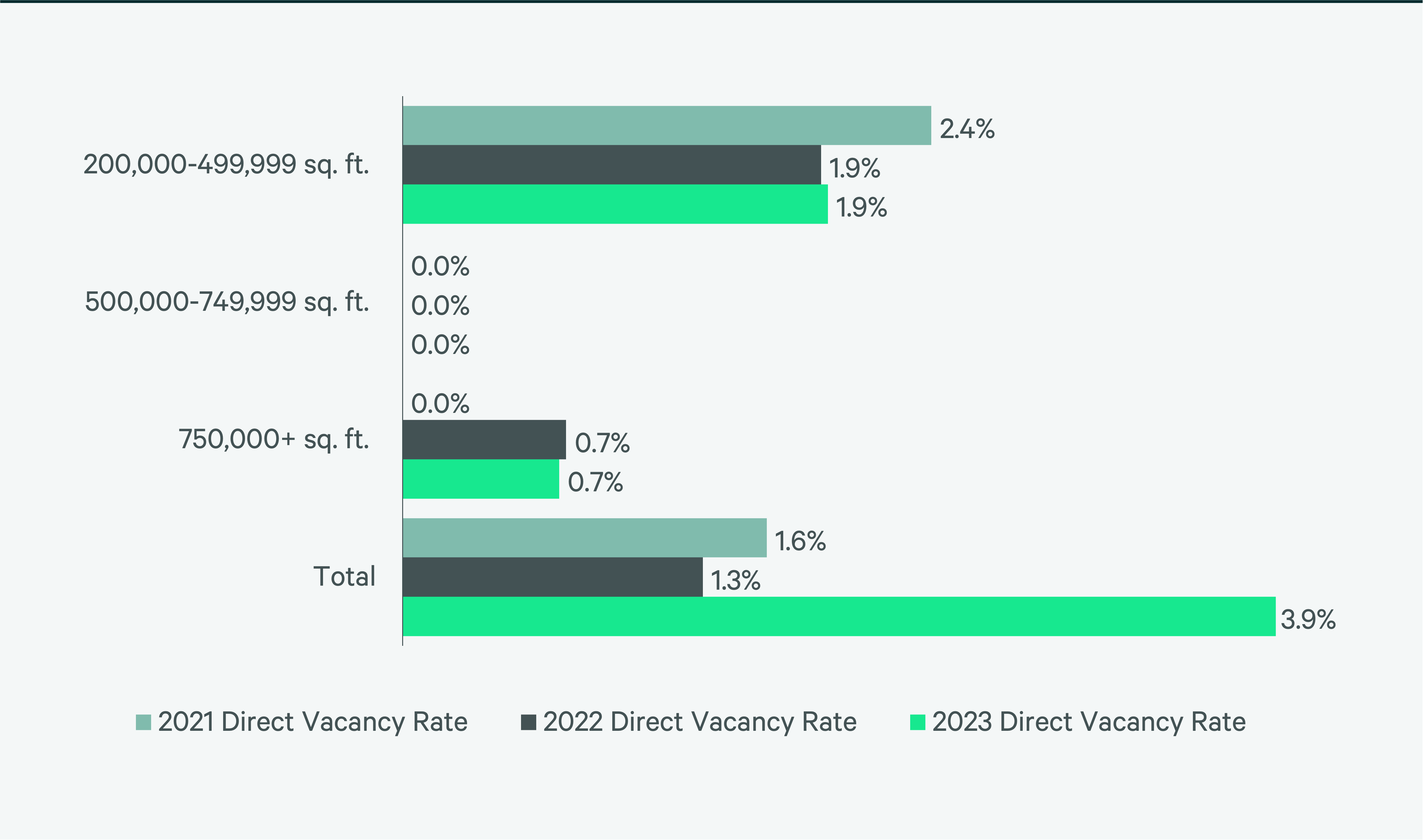

With 80.1 million sq. ft. of total inventory, Montreal is Canada’s second-largest big-box market. Like Toronto, the market is land-constrained and has a vacancy rate of 3.9%, the fifth-lowest of any market in this report. Lease transaction volume was light in 2023, as only a few big-box operators signed deals. The decrease in leasing reduced net absorption to just 370,656 sq. ft. The small of product that was leased garnered much higher rents than the previous year at $16.52 CAD per square foot/per year, 16.8% higher than 2022.

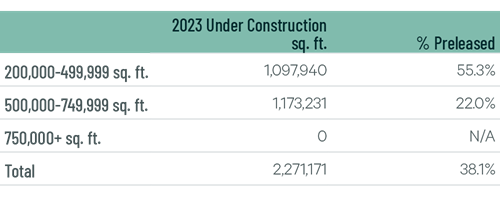

Occupiers focused on supply chain resiliency will help bolster demand this year. With only 2.3 million sq. ft. under construction, vacancy rates will stay under 4% this year, further pressuring taking rents in the upcoming quarters.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

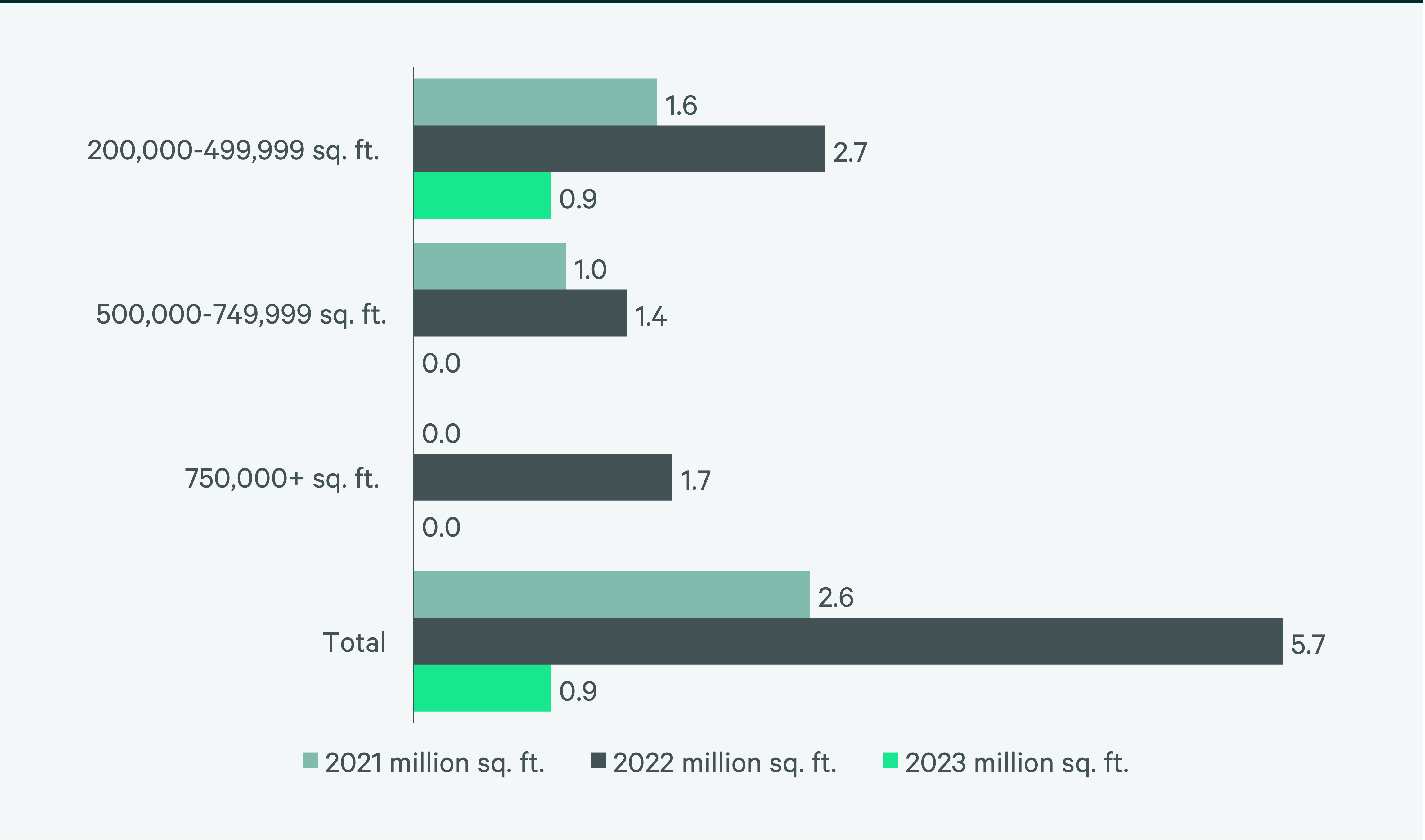

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

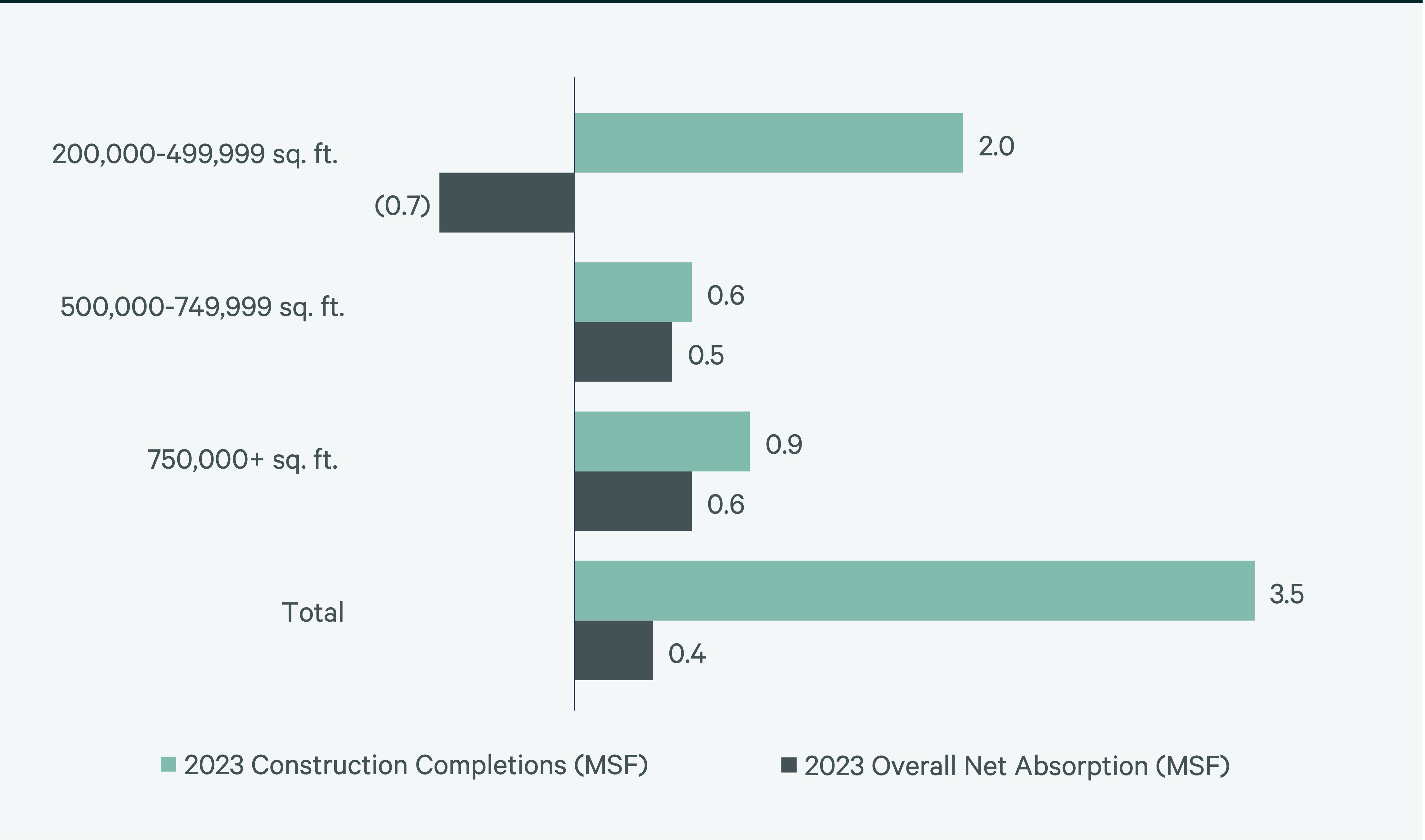

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services