Future Cities

Memphis Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

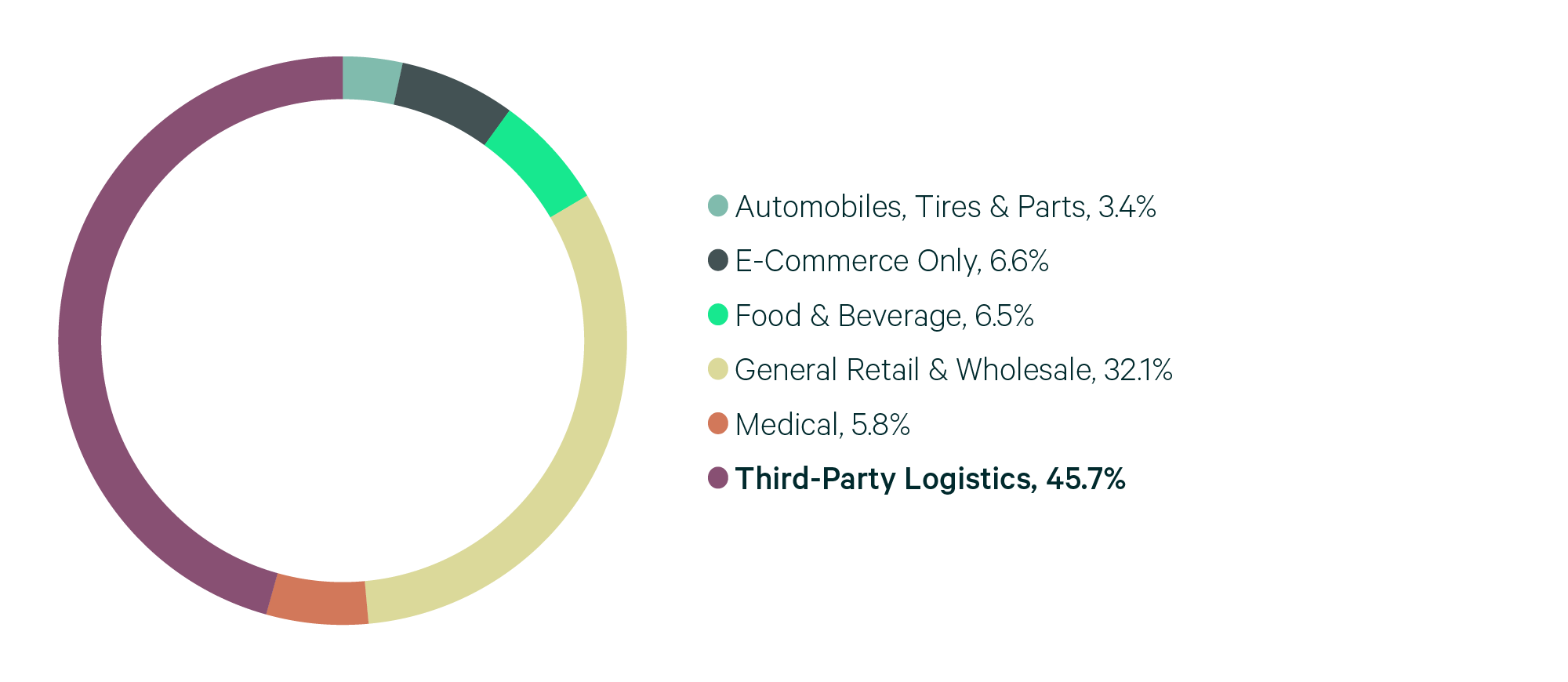

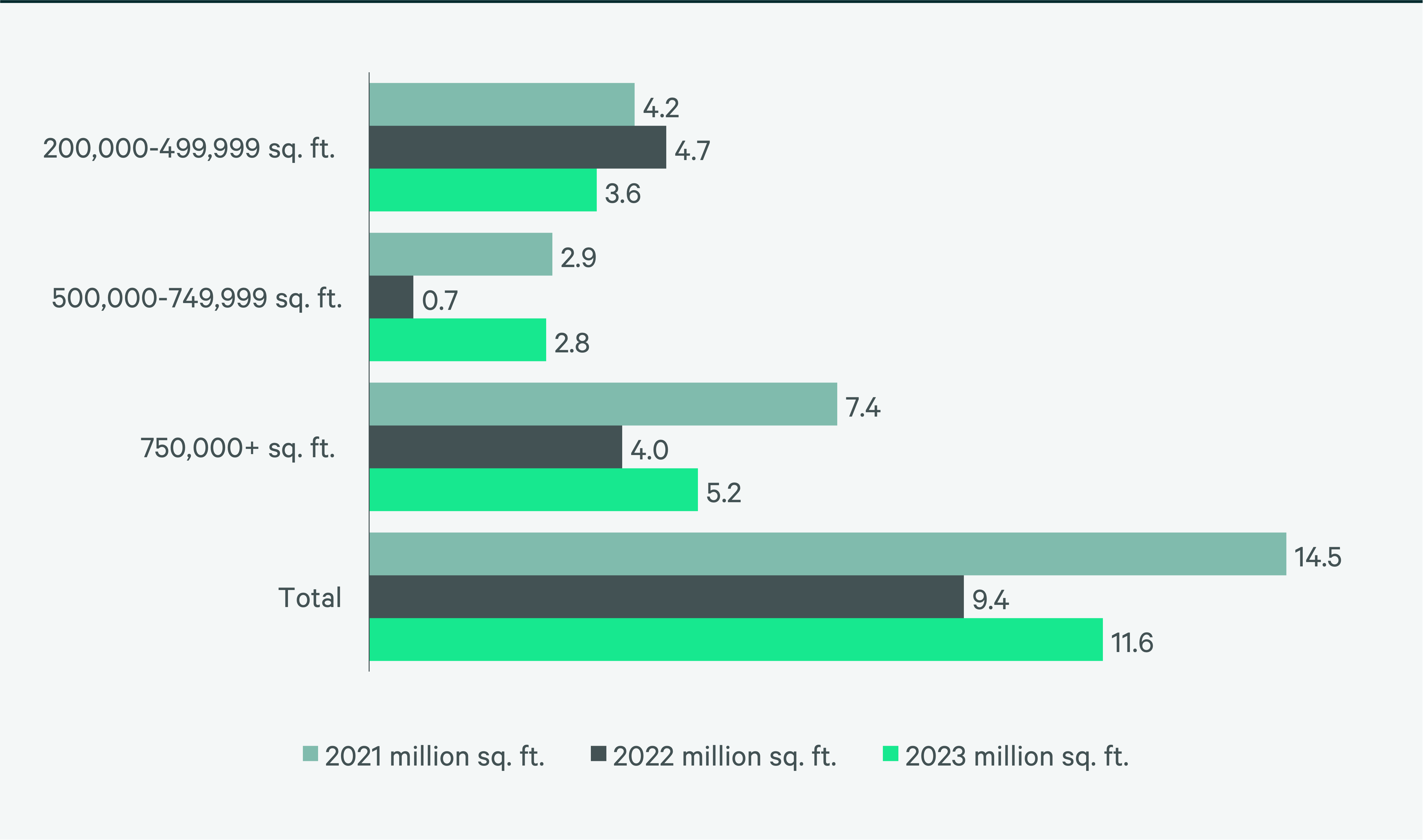

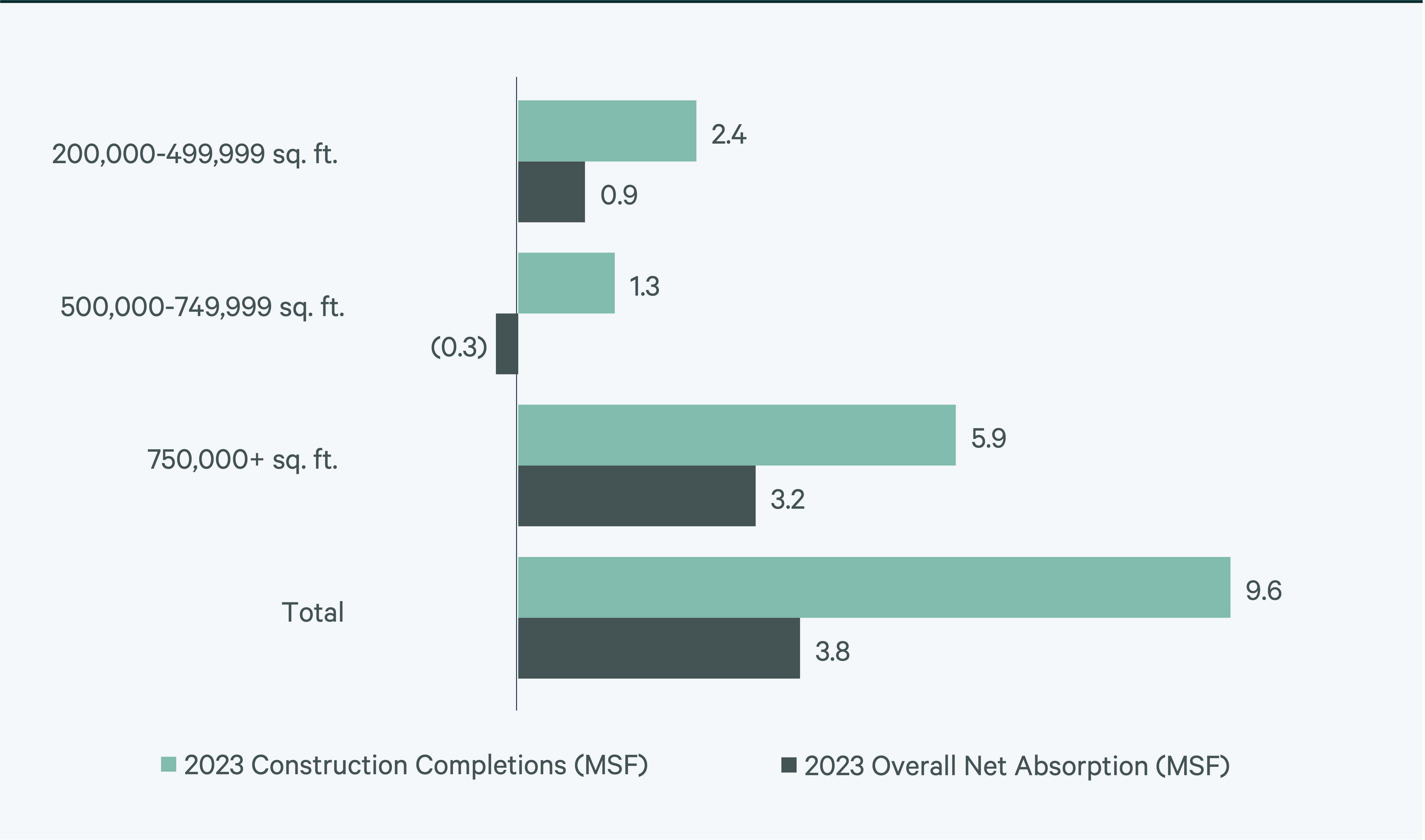

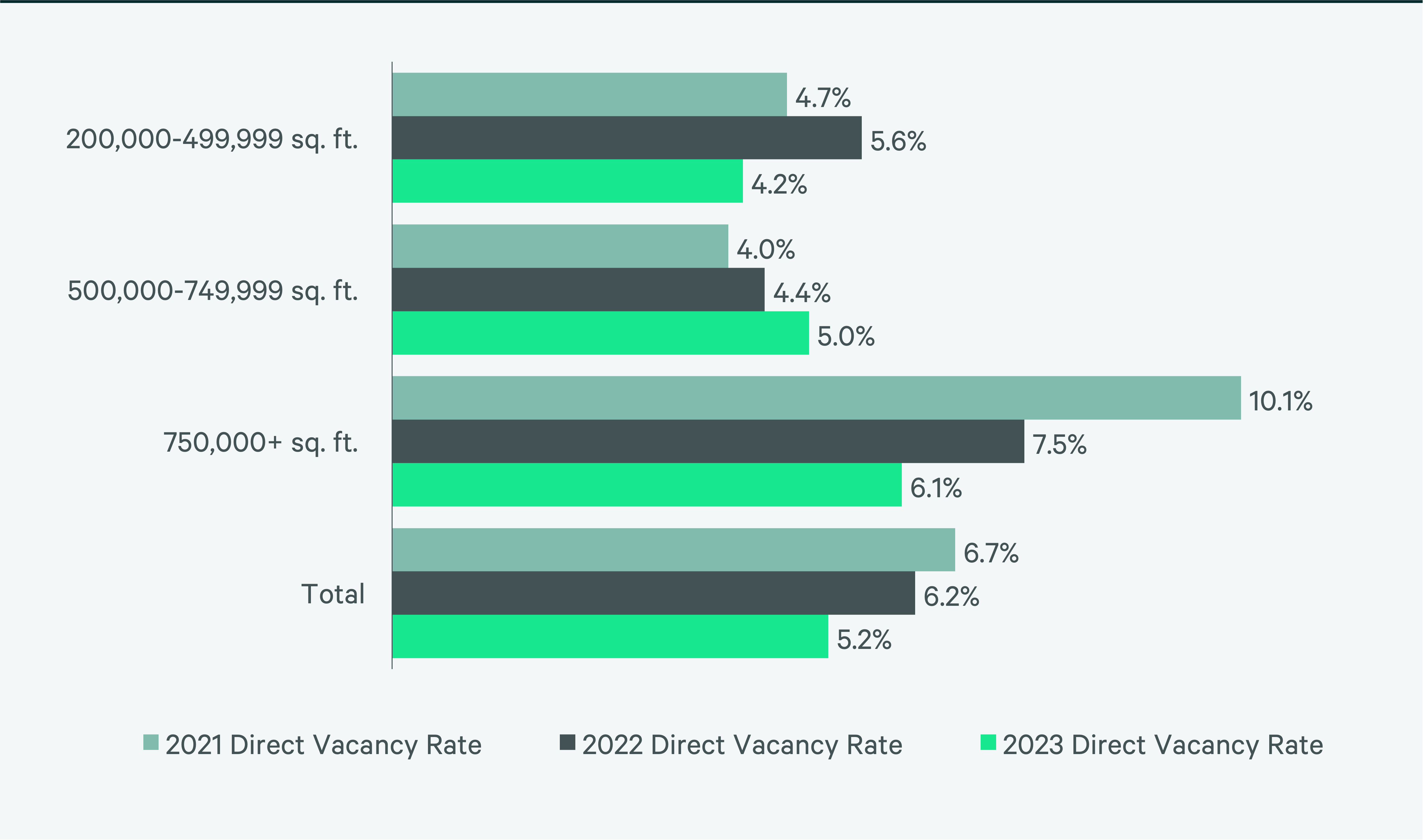

Memphis demonstrated strong big-box industrial fundamentals in 2023, with an increase in leasing transactions and a decrease in vacancy rates compared to 2022. Over 11.6 million sq ft. were leased in 2023, more than half of these leases for spaces of 750,000 sq. ft. or larger. Robust leasing lowered the vacancy rate to 5.2% despite 9.6 million sq. ft. of new construction. 3PLs and general retail & wholesale occupiers dominated the leasing, accounting for 45.7% and 32.1% of lease volume, respectively. Despite this, Memphis remains one of the most economical big- box markets in the U.S. with rents actually decreasing 4.1% compared to 2022.

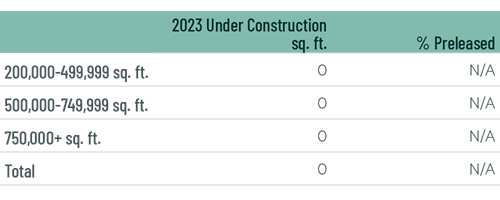

The decline in construction starts has significantly impacted Memphis, with no projects over 200,000 sq. ft. under construction as of year-end 2023. The lack of new supply is expected to continue pushing vacancy rates downward for the foreseeable future and should enable landlords to charge higher rents this year.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services