Future Cities

Kansas City Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

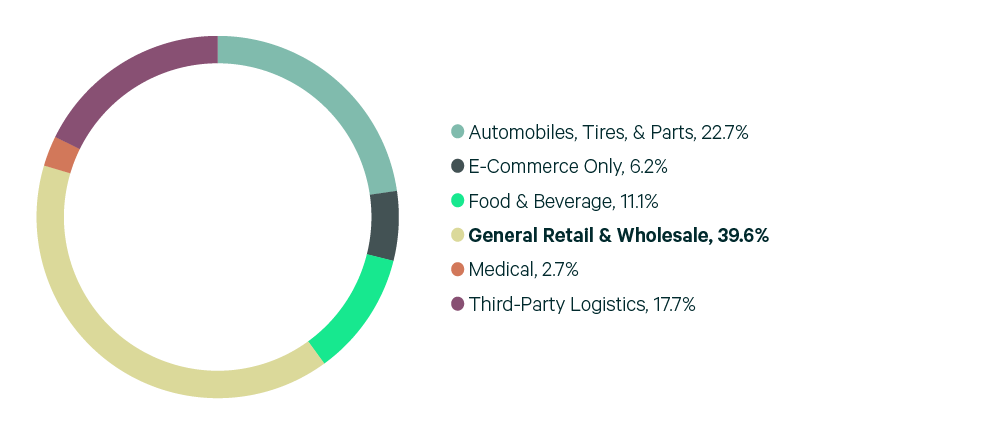

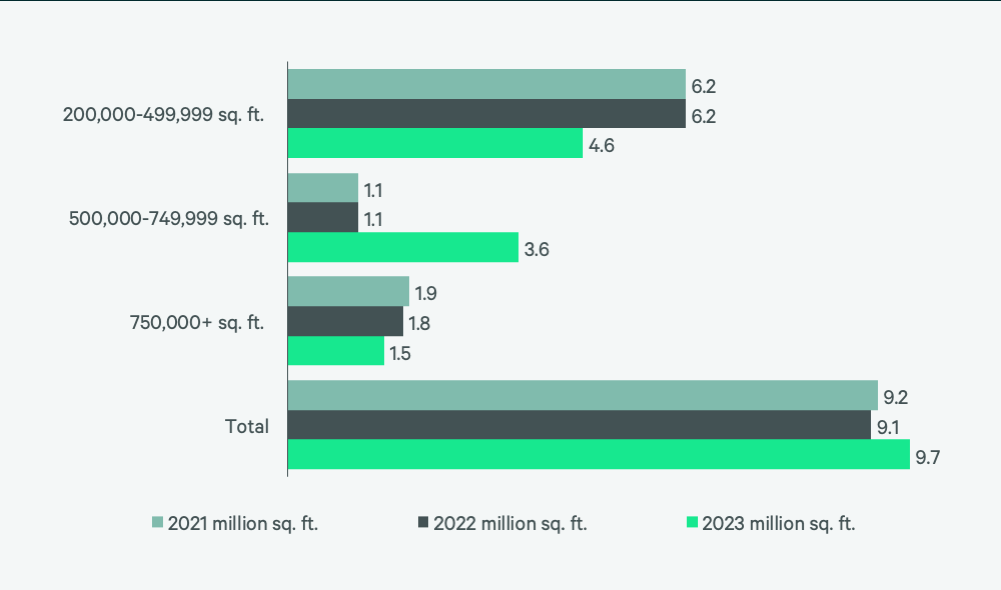

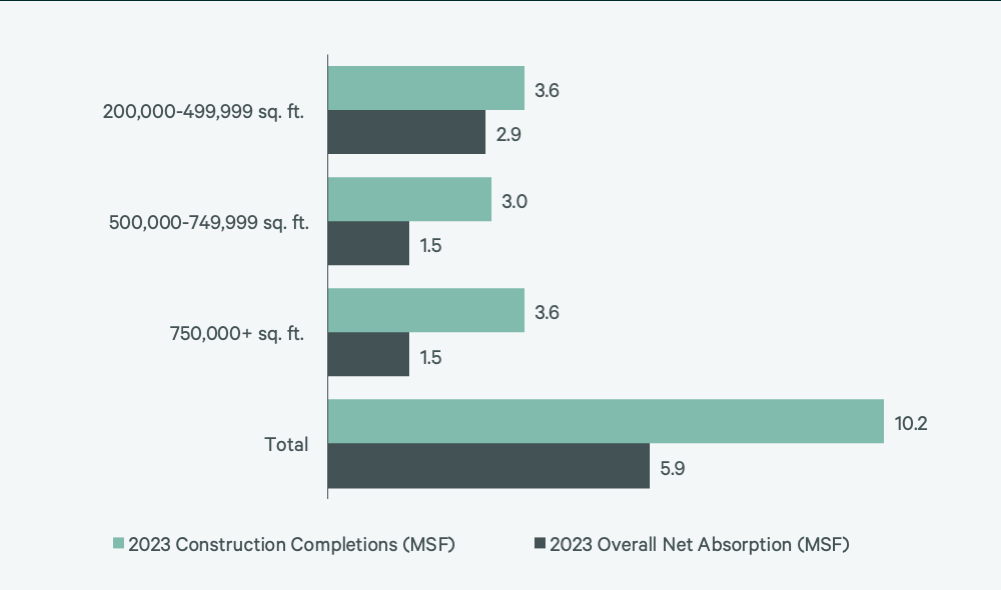

Kansas City was one of last year’s better-performing North American big-box markets due to strong regional demand for large industrial space. Transaction volume exceeded 2021’s record, reaching 9.7 million sq. ft., leading to positive net absorption of 5.9 million sq. ft. As a result, Kansas City ranked ninth in North America for growth in net absorption relative to existing inventory. General retailers & wholesalers were responsible for nearly 40% of transaction volume, attracted by Kansas City’s central location and affordable rental rates. Occupiers in the automobile sector accounted for 22.7% of total leasing.

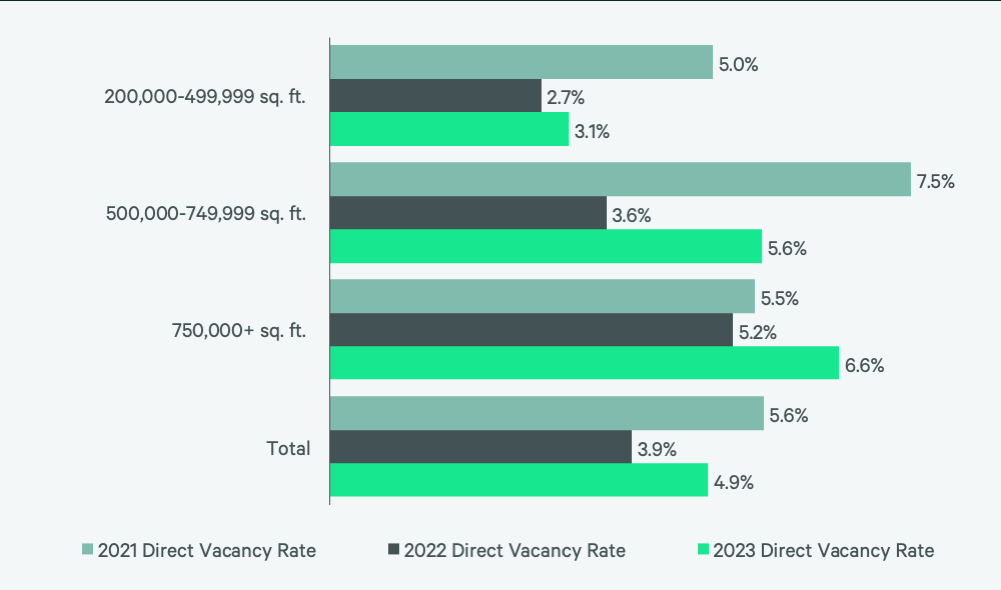

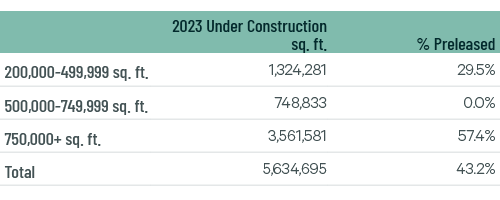

This year, Kansas City’s big-box market will continue to benefit from its central location and the expansion of manufacturing in both the U.S. and Mexico. Although vacancies slightly increased to 4.9% in 2023, they should decline again in 2024. This is because only 5.6 million sq. ft. was under construction at year-end, with 43% preleased. Few vacancies will contribute to positive rent growth for the foreseeable future, solidifying Kansas City’s position as one of the strongest big-box markets in North America.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research, 2022.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services