Future Cities

Louisville Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

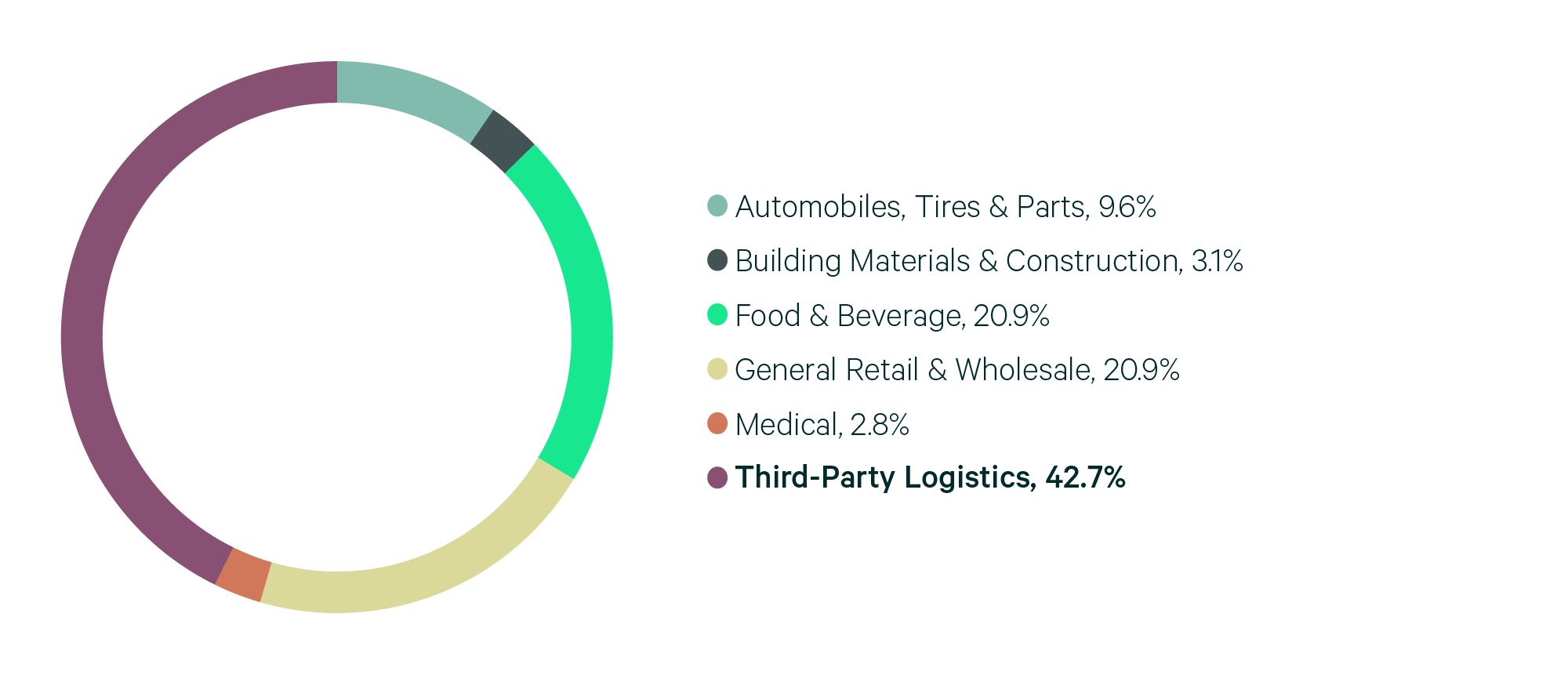

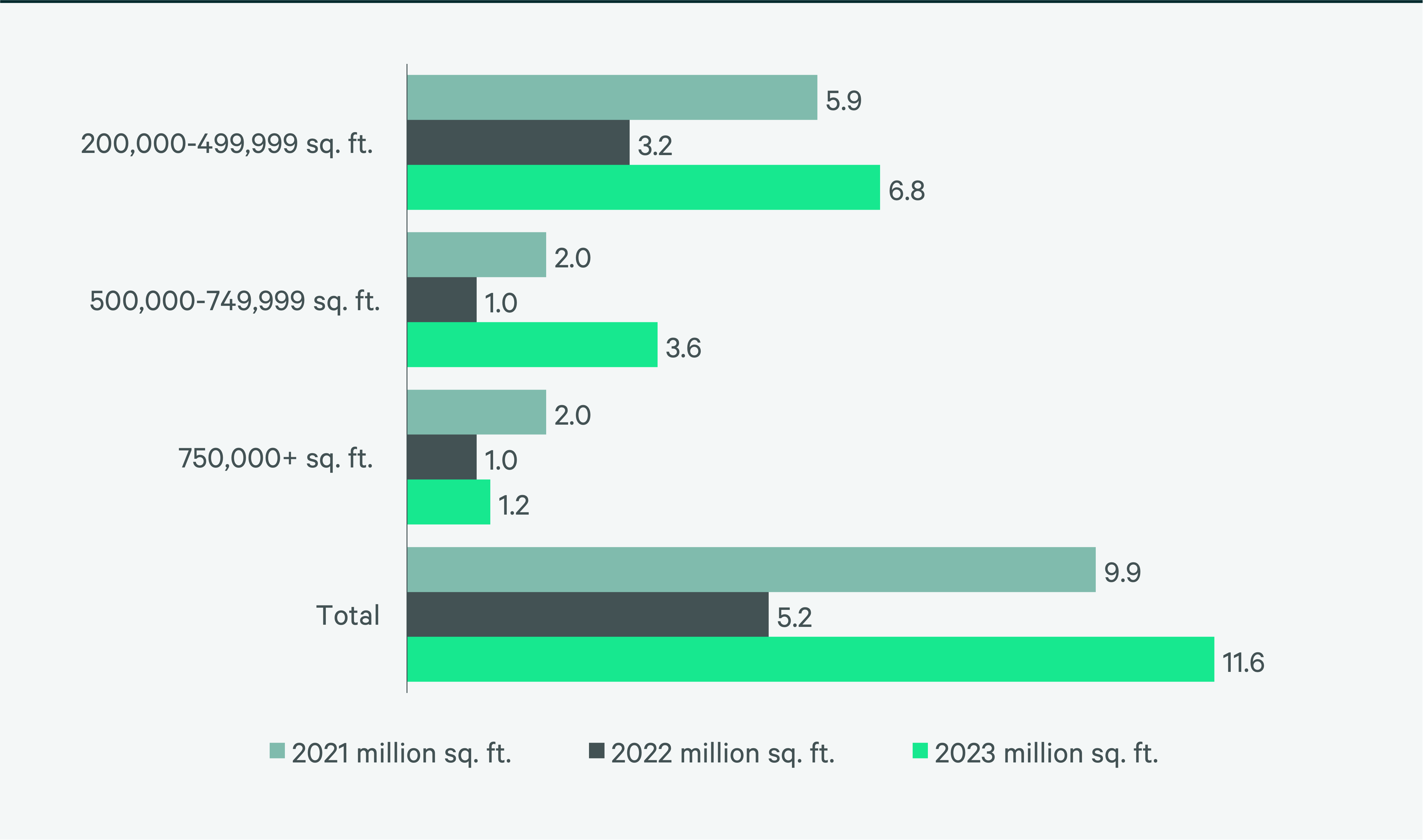

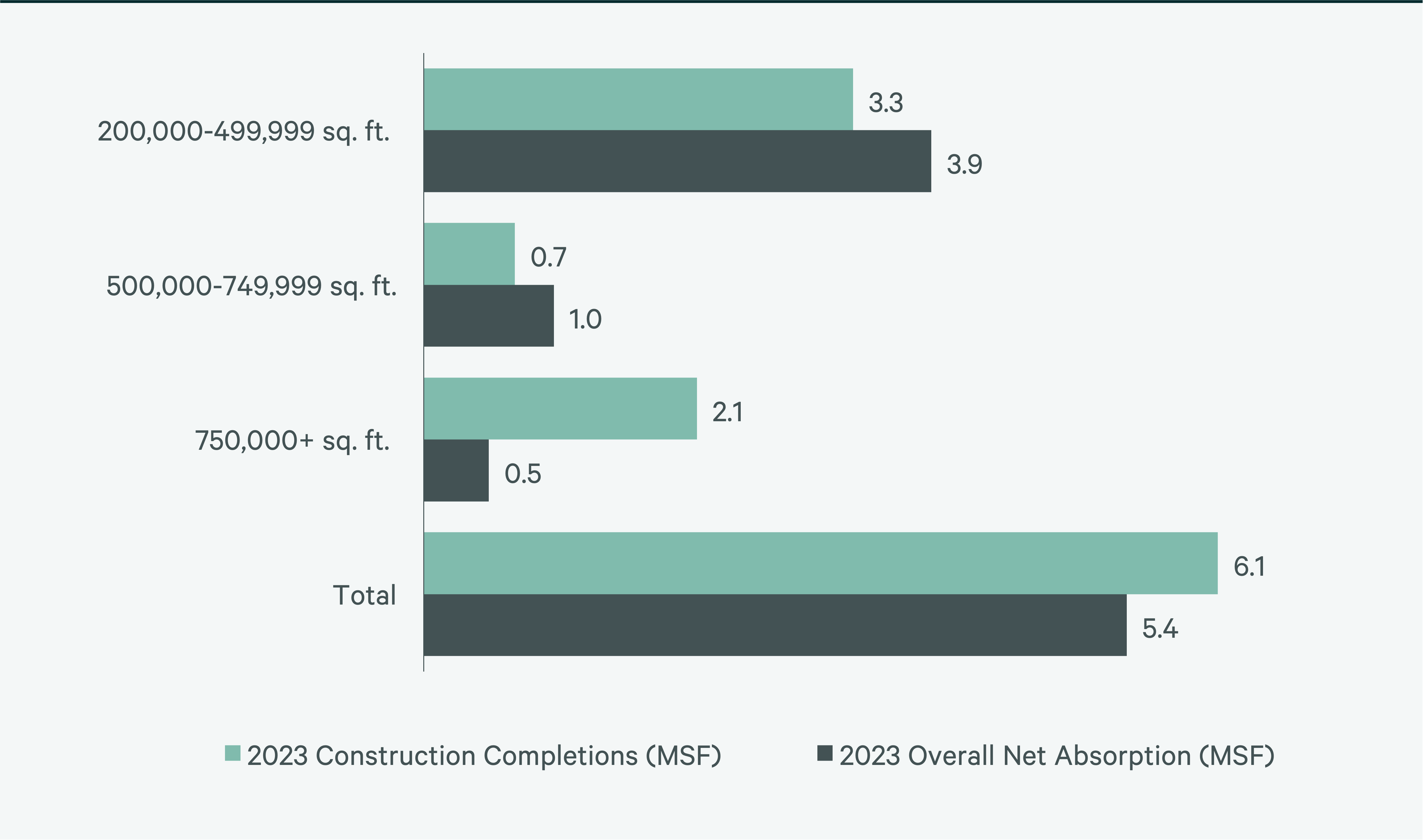

Louisville’s central location is attracting new occupiers, leading to robust demand and new development. Louisville’s transaction volume reached a record 11.5 million sq. ft. in 2023, the 10th-highest for a market in this report, from 5.2 million sq. ft. in 2022, Strong leasing activity resulted in positive net absorption of 5.4 million sq. ft., making Louisville the seventh-top growth (net absorption/existing inventory) market in this report. 3PLs dominated leasing, followed by food & beverage and general retail & wholesale, each of which accounted for 21% of transaction volume.

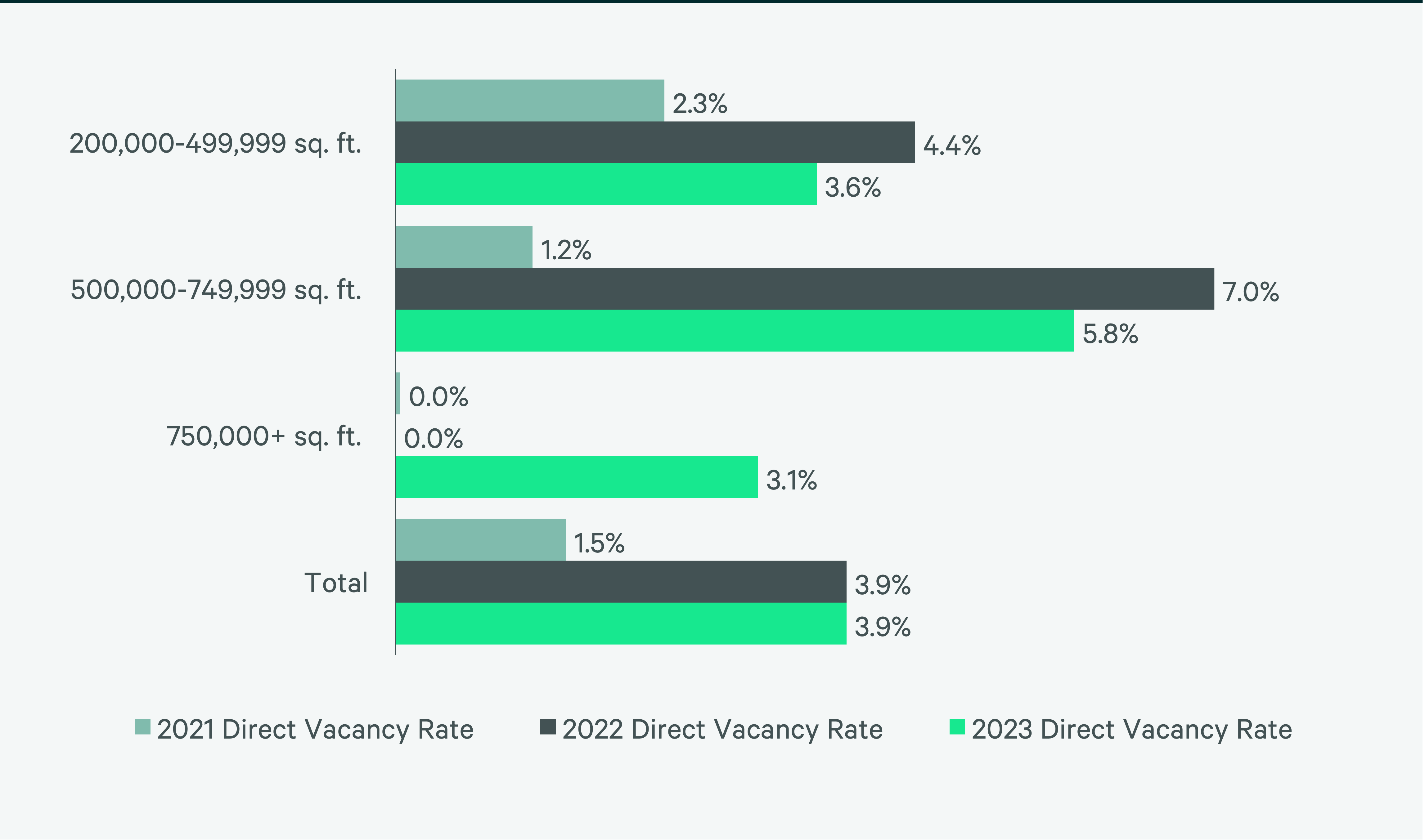

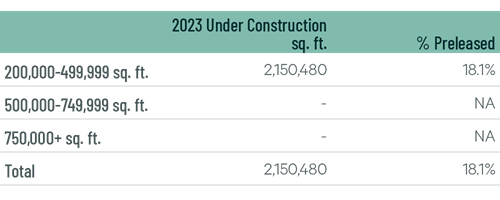

Louisville was one of the few markets in this report that did not experience an increases in vacancy rates, ending the year at 3.9%. Challenges in securing construction financing led to a decline in space under construction, to 2.2 million sq. ft. by year-end. As a result, Louisville is one of the most undersupplied big-box markets in North America. The lack of new supply will likely reduce vacancy rates and continue to exert upward pressure on rents this year.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services