Future Cities

Chicago Market

2025 North America Industrial Big-Box Review & Outlook

May 22, 2024 5 Minute Read

Supply & Demand

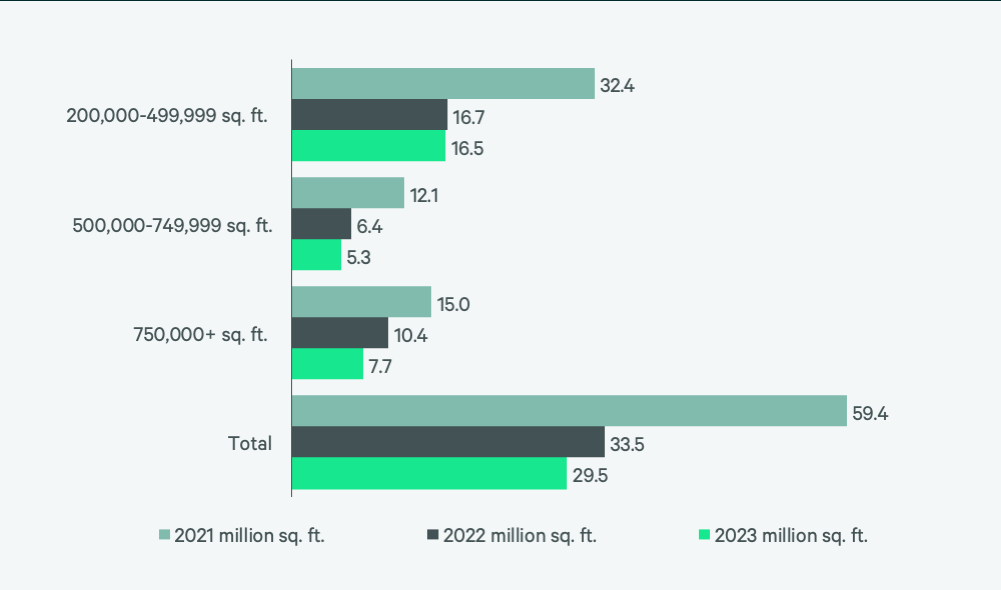

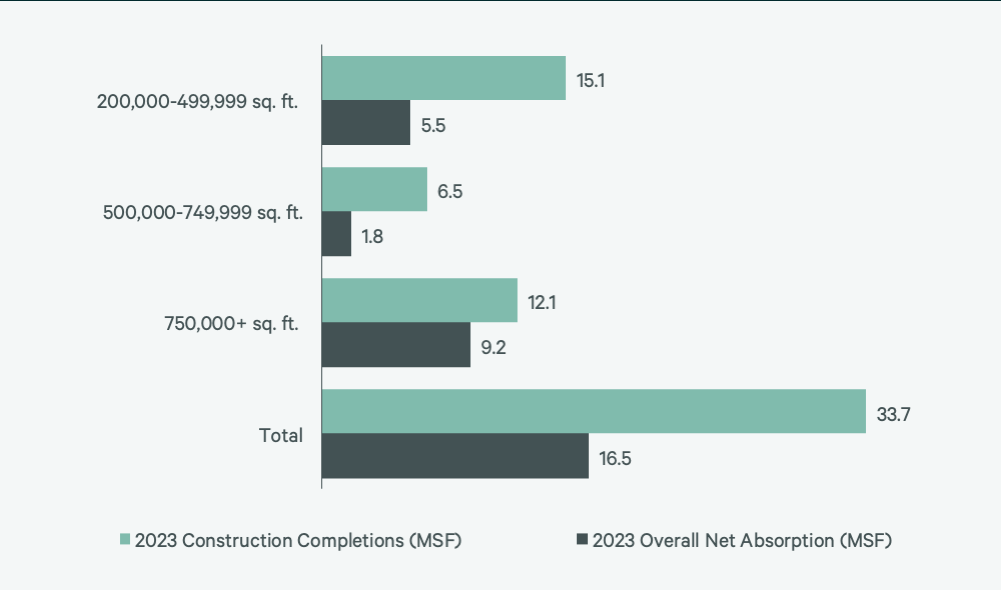

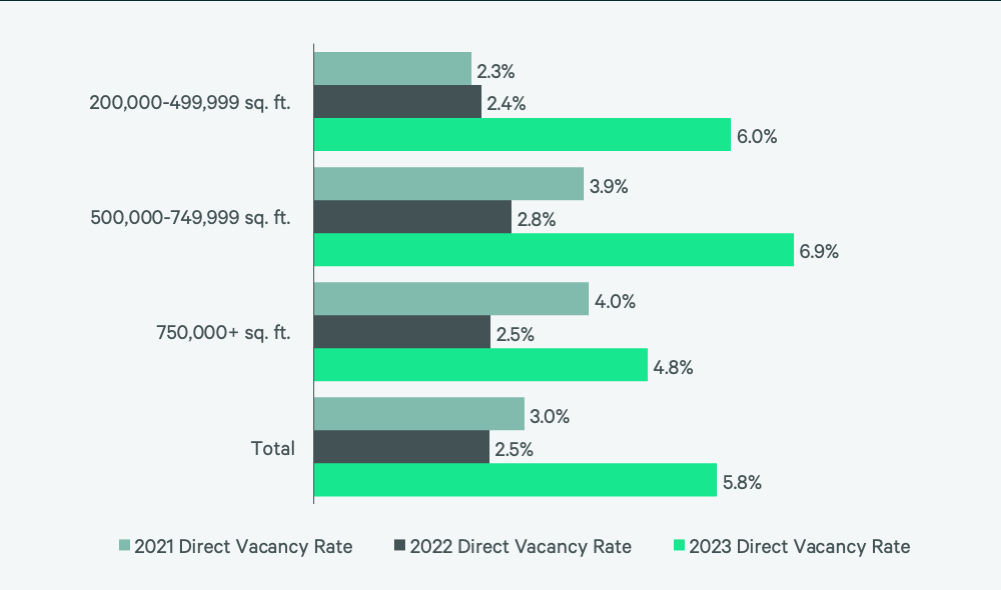

With 619 million sq. ft. of total inventory, Chicago is North America’s largest industrial big-box market. Demand did not keep pace with the previous year, with lease volume falling to 29.5 million sq. ft. Despite the decline, it was the fourth-highest in North America. Lower lease volume led to a 23% decline in positive net absorption. This decline, coupled with a record-setting 33.7 million sq. ft. of construction completions, caused vacancy rates to rise to 5.8%, more than double the 2.5% seen in 2022. Despite higher vacancies, rents increased in all major size ranges, resulting in an overall 25.2% rise for firs-year taking rents compared to 2022.

In 2023, big-box developers in Chicago struggled to initiate new projects due to difficulties in construction financing, resulting in a 53% reduction in space under construction. Nearly 50% of this space is preleased, indicating that available first-generation space will decrease this year. This reduction is expected to help stabilize vacancy rates and support continued rent growth in the coming quarters.

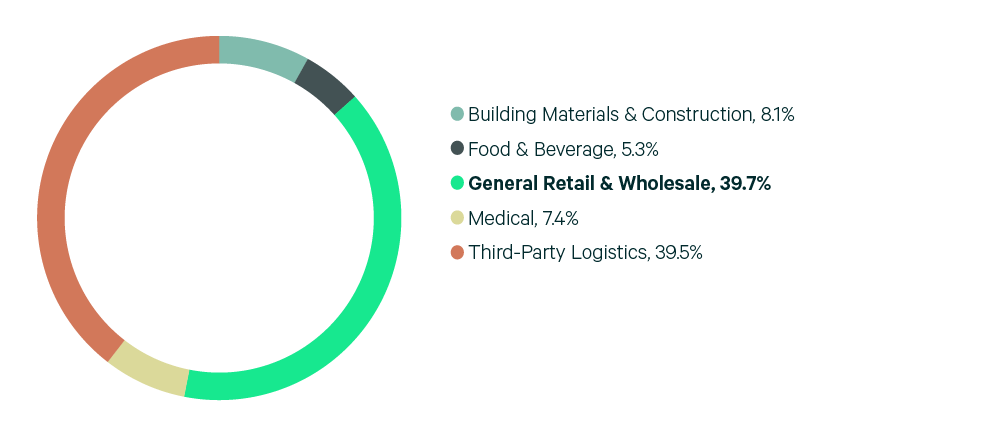

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services