Future Cities

Houston Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

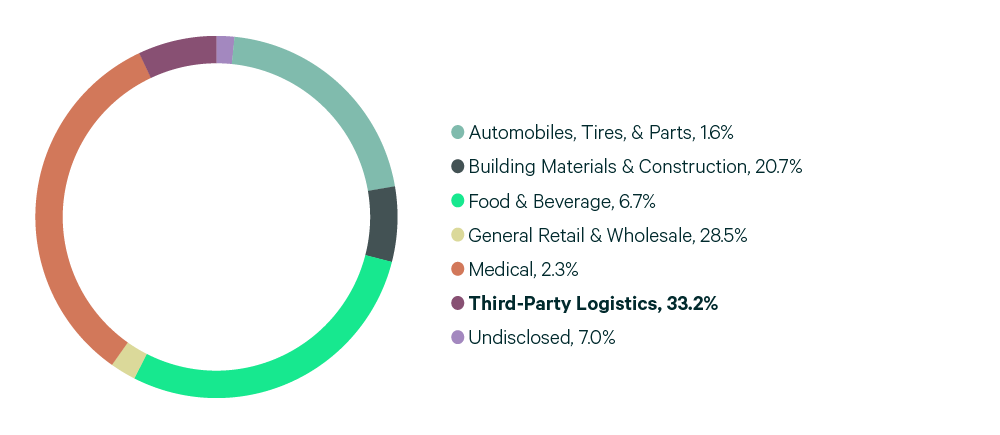

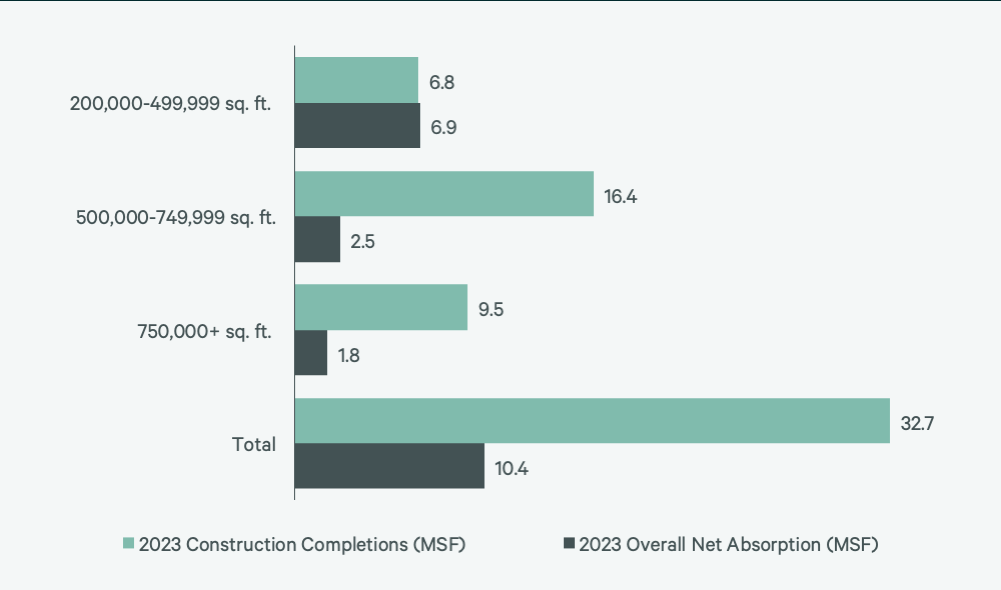

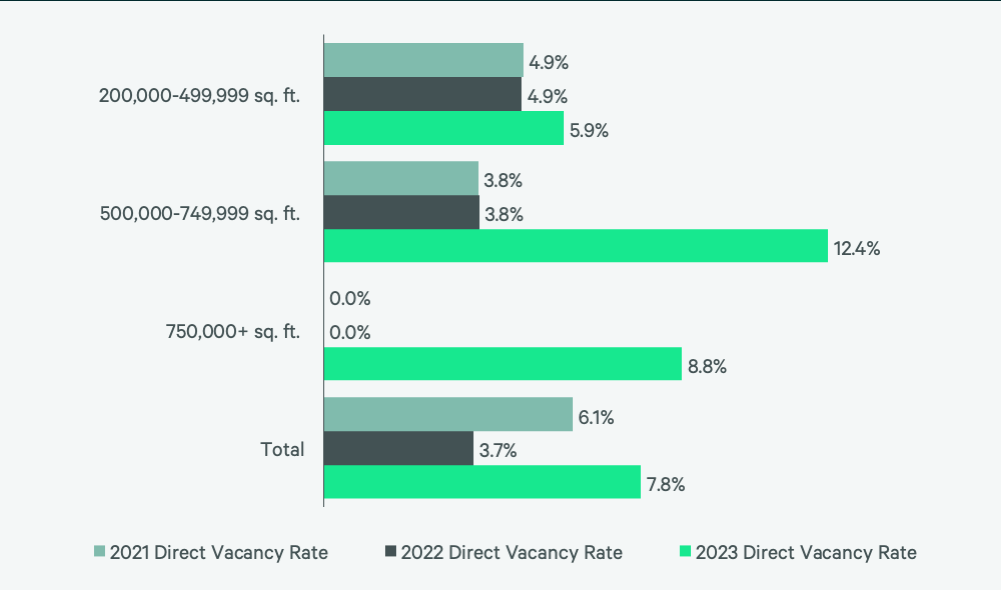

Houston remains one of North America’s top growth markets despite a decline in leasing . Lease transaction volume decreased by 46% from 2022’s record pace to 10.4 million sq. ft. Despite this decrease, Houston was North America’s third growth market (net absorption/existing inventory) with 13.6 million sq. ft. absorbed. However, new supply outpaced demand as a record 32.7 million sq. ft. of construction was completed, raising the vacancy rate to 7.8%. A diverse set of occupiers leased space in 2023, led by 3PLs at 33.2% of total volume, followed by general retail & wholesale at 28.5%, and building materials & construction at 20.7%.

By the end of 2023, only 10.4 million sq. ft. of space was under construction, a 63% year-over-year decline, with nearly half preleased. Transaction volume should increase this year as improved economic clarity attracts more tenants into Houston that want to leverage its growing population and numerous logistics drivers. The combination of increased demand and significantly decreased supply is expected to lower vacancy rates by the end of this year.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services