Future Cities

Dallas-Ft. Worth Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

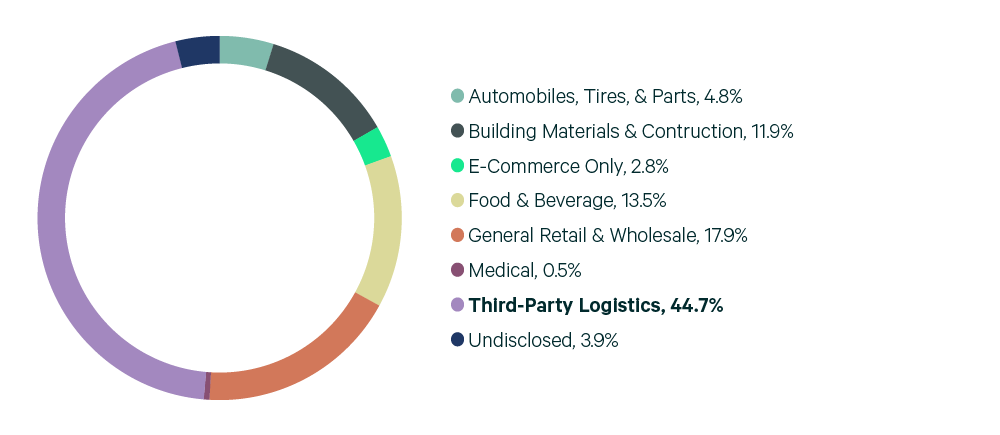

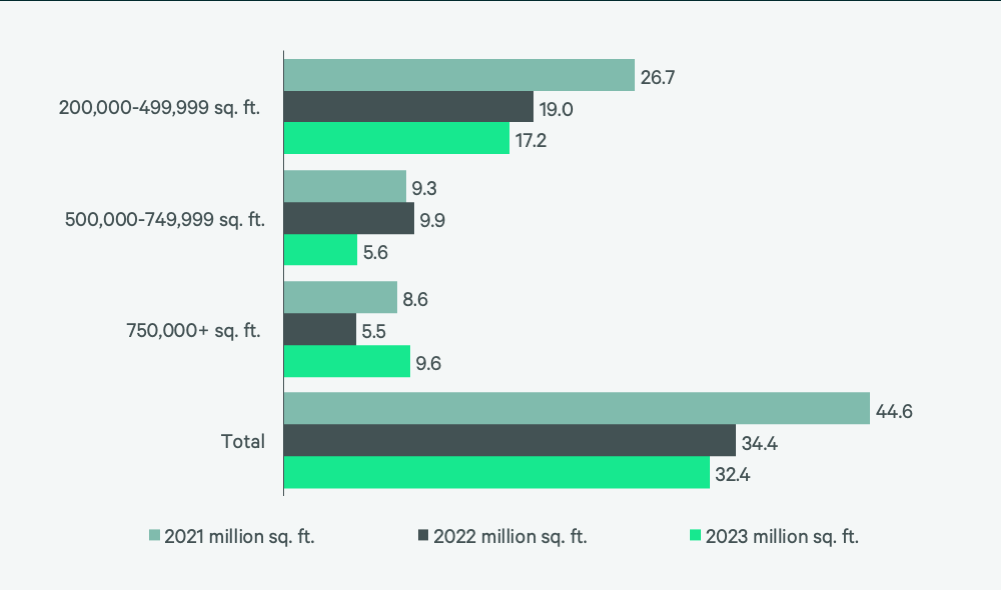

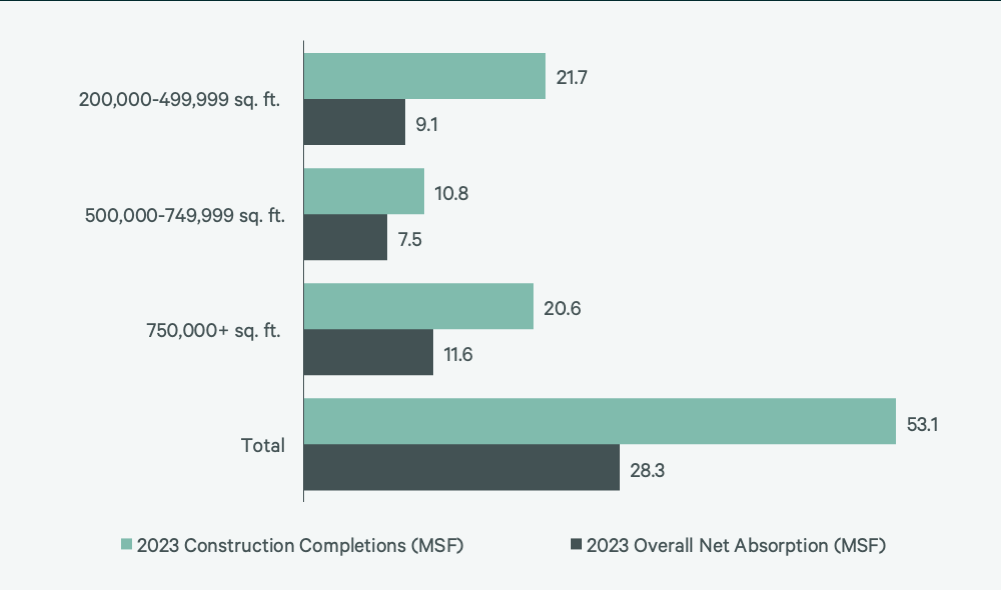

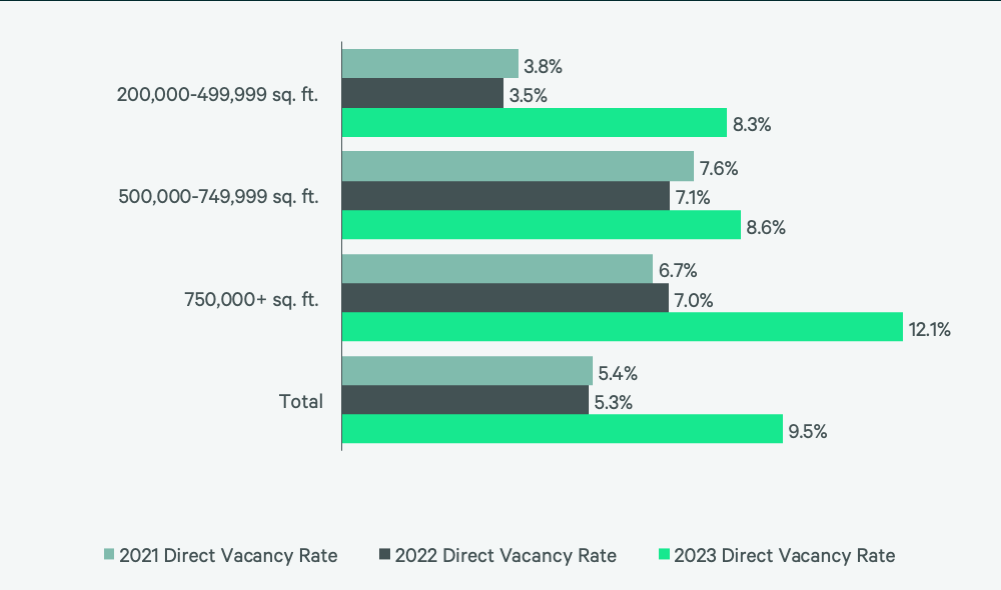

With 516.2 million sq. ft. of total inventory, Dallas-Ft. Worth is the third-largest big-box market in North America. Occupiers continue to move in and expand: a total of 32.4 million sq. ft. was leased, only slightly less than 2022’s 34.5 million sq. ft. This was the second most big-box leasing in North America. 3PLs accounted for 44.7% of lease transactions, by far the most of any occupier type. Despite robust leasing and nearly 30 million sq. ft. of positive net absorption, vacancy rates nearly doubled to 9.5% due to a record 53.1 million sq. ft. of completed construction, the most in North America.

Only 25.6 million sq. ft. was under construction at year-end with 22% preleased. This reduced development should help stabilize vacancy rates, but a significant vacancy reduction will require an increase in new leasing. The current stability in vacancies is expected to help maintain market rents at current record highs for the foreseeable future.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services