Future Cities

Kansas City

2024 North America Industrial Big-Box Review & Outlook

April 29, 2024 5 Minute Read

Demographics

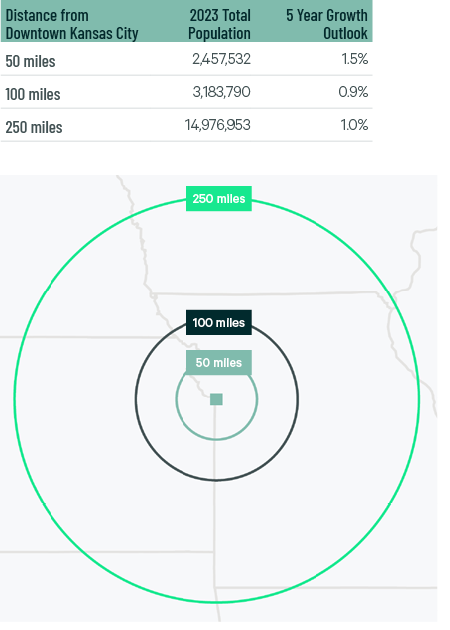

Kansas City’s biggest draw is its easy reach to a large portion of the country. More than 2.4 million people live within 50 miles of the market’s core. Close to 15 million people or 6 million households are within 250 miles.

Figure 1: Kansas City Population Analysis

The local warehouse labor force of 41,791 is expected to grow by 7.8% by 2034, according to CBRE Labor Analytics. The average wage for a non-supervisory warehouse worker is $18.29 per hour, 2.4% above the national average.

Figure 2: Kansas City Warehouse & Storage Labor Fundamentals

*Median wage (1 year experience); non-supervisory warehouse material handlers.

Location Incentives

Over the past five years, there have been over 230 economic incentives deals totaling more than $445 million for an average of $15,600 per new job in metro Kansas City, according to fDi Intelligence.

CBRE’s Location Incentives Group reports that Missouri’s top incentive program is the Missouri Works program, offering payroll rebates and discretionary income tax credits to businesses that create new jobs. For rural counties to qualify, at least two full-time jobs must be created with wages exceeding 80% of the average county wage. For non-rural counties to qualify, at least 10 full-time jobs must be created with wages exceeding 90% of the average county wage.

Another program available in Missouri is the Business Use Incentives for Large Scale Development (BUILD) program, which offers refundable tax credits to companies that create large economic development projects. To qualify, manufacturing and R&D projects must create a minimum of 100 new jobs and invest at least $15 million in capital.

A third program in Kansas City, MO is the High Performance Incentive Program (HPIP), which offers a 10% tax credit for capital investment totaling more than $1 million. To qualify, for-profit manufacturing companies must pay above-average wages and make a significant investment in employee training.

Figure 3: Kansas City Top Incentive Programs

Note: The extent, if any, of state and local incentive offerings depends on location and scope of the operation.

Logistics Driver

Kansas City’s central location gives it access to 85% of the U.S. population in two days. Numerous ground, air, water and rail transportation options make it one of North America’s most logistics-friendly industrial markets. Kansas City has five Class I rail lines intersecting the region (Kansas City Southern, Burlington Northern Santa Fe, Canadian Pacific, Norfolk Southern and Union Pacific), four of which have intermodal facilities.

Four major U.S. interstate highways (I-35, I-70, I-29 and I-49) intersect the region, which has 30% more interstate miles per capita than any other U.S. city. Kansas City also has low traffic congestion.

Kansas City International Airport is one of the U.S.’s best locations for air cargo and distribution development. It moves more air cargo than any other airport in the six-state region and added a new terminal in 2023.

Kansas City is on the Missouri River, the largest navigable inland waterway in the U.S. Port KC has over 900 feet of shoreline, which includes three load cells and docking structures for 14 barges. The port terminal has an annual capacity of 800,000 tons and provides rail and truck transfer, covered storage and product distribution.

Numerous ground, air, water and rail transportation options make it one of North America’s most logistics-friendly industrial markets.

Supply & Demand

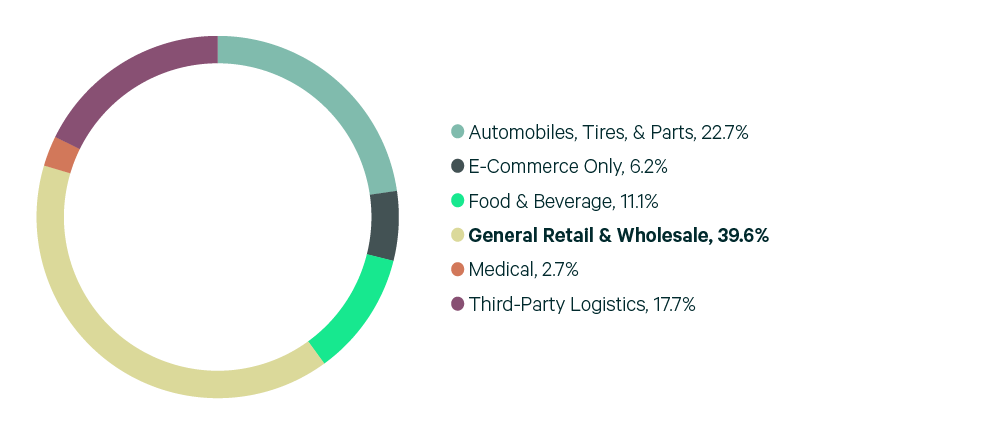

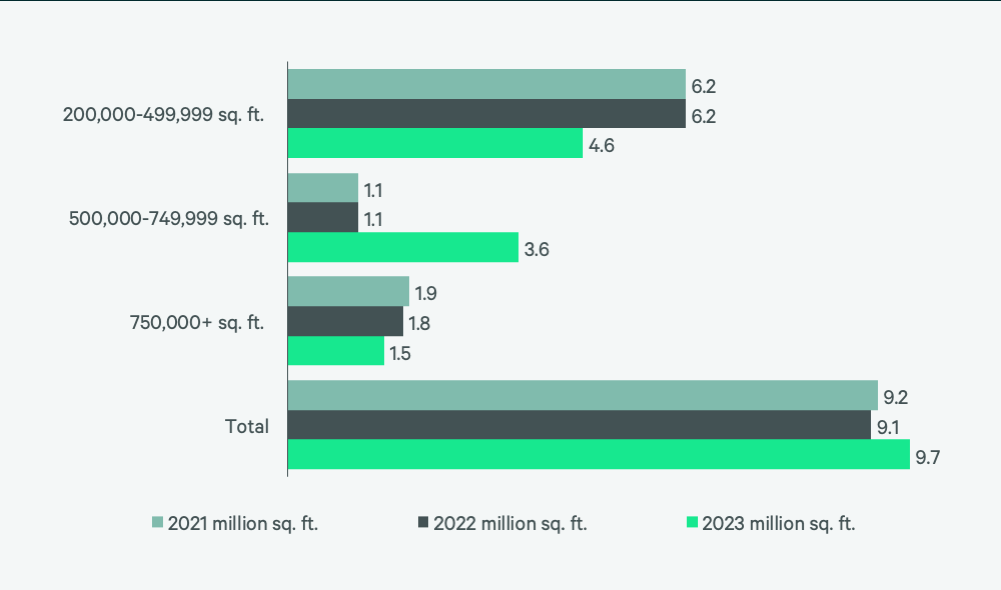

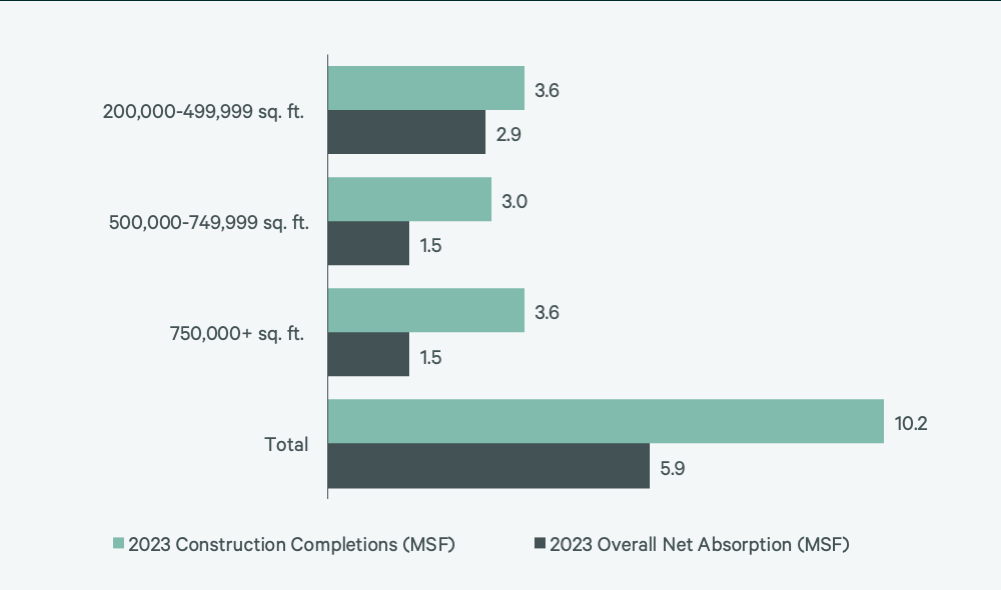

Kansas City was one of last year’s better-performing North American big-box markets due to strong regional demand for large industrial space. Transaction volume exceeded 2021’s record, reaching 9.7 million sq. ft., leading to positive net absorption of 5.9 million sq. ft. As a result, Kansas City ranked ninth in North America for growth in net absorption relative to existing inventory. General retailers & wholesalers were responsible for nearly 40% of transaction volume, attracted by Kansas City’s central location and affordable rental rates. Occupiers in the automobile sector accounted for 22.7% of total leasing.

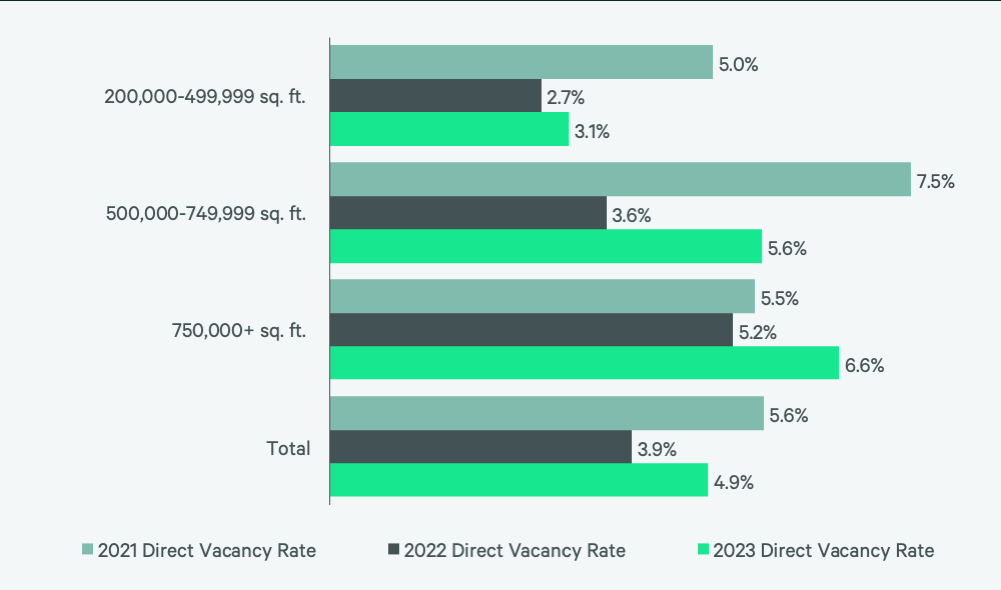

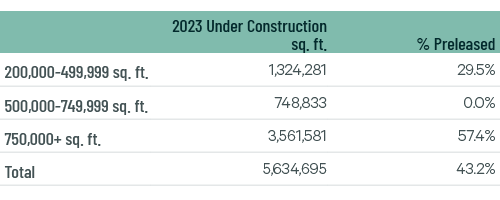

This year, Kansas City’s big-box market will continue to benefit from its central location and the expansion of manufacturing in both the U.S. and Mexico. Although vacancies slightly increased to 4.9% in 2023, they should decline again in 2024. This is because only 5.6 million sq. ft. was under construction at year-end, with 43% preleased. Few vacancies will contribute to positive rent growth for the foreseeable future, solidifying Kansas City’s position as one of the strongest big-box markets in North America.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research, 2022.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services