Viewpoint

Urban Logistics: Clear regulations crucial

August 8, 2024 15 Minute Read

Looking for a PDF of this content?

Increased regulation complicates urban logistics. The introduction of zero-emission zones leads to an increased demand for city hubs, but this is expected to be temporary. However, some municipalities have regulations that have a long-lasting impact. Understanding these regulations is important for investors and developers to determine if a development or investment is interesting. It is crucial for municipalities to ensure uniform and clear rules.

Increase in urban logistics

Logistics has been taking place in the city for years. However, in recent years, it has significantly increased and is expected to continue to do so for the foreseeable future. This is partly due to the growing trend of home delivery services and the increasing population in cities. Every day, more than 680,000 delivery vans and 53,000 trucks drive in, through, and out of Dutch cities. Urban logistics consists of various flows, with the largest group being facility management services, followed by general cargo and perishables. Therefore, urban logistics encompasses more than just last mile delivery. It is expected that urban logistics will increase by 19% by 2035.[1]

Table 1. Types of flows in urban logistics and estimation of their share (including inbound and outbound kilometers)

|

Type |

Description |

Share in urban logistics based on driven km |

|

General cargo |

Supplying stores (excluding perishables) and home delivery of items such as furniture and appliances |

28% |

|

Perishables |

Supplying supermarkets & restaurants and delivering groceries & meals to homes |

23% |

|

Express and parcel |

Delivery of packages to both businesses (B2B) and consumers (B2C) |

3% |

|

Waste |

Waste collection from businesses and consumers |

3% |

|

Facility management & services |

Supplying large institutions and delivery of services, such as plumbing |

33% |

|

Construction |

Ranging from material delivery to transportation of personnel |

10% |

Increase in regulation

The increase in all forms of urban logistics is accompanied by a rise in regulation. It is often determined where loading and unloading is allowed, there are time windows, and different municipalities have environmental zones. Starting from January 1, 2025, some municipalities will introduce zero-emission zones (see text box). There are also specific measures in certain places, such as in Utrecht where heavy trucks are banned in parts of the city center to protect the historic yard basements.

In addition to existing regulations, governments are constantly exploring measures to mitigate the disadvantages of all this logistics. For example, some municipalities are investigating how logistics can be consolidated or considering implementing a maximum loading and unloading time.

Zero-emission zones [2]

From January 1, 2025, municipalities in the Netherlands may introduce zero-emission zones. A zero-emission zone is an urban area where no polluting vans and trucks are allowed to drive. The aim is to reduce particulate matter and CO2 emissions in cities. Only vehicles without emissions are then allowed. Consider electric cars or vans that run on hydrogen. Municipalities can introduce these zero-emission zones within an environmental zone, replacing an environmental zone, but also without previously having an environmental zone. There is a transition period until 2030 for a number of vehicle categories and there are also some exemptions and waivers.

In 2024, Maastricht was the first municipality to officially take a traffic decision for a zero-emission zone as of January 1, 2025. The municipality was soon followed by Rotterdam, Eindhoven and Utrecht, among others. As it stands now, a total of 16 municipalities will introduce a zero-emission zone in early 2025 and it is expected that at least 13 more will follow in the years after.

Urban logistics becoming increasingly complex

With additional regulations, urban logistics becomes more complex, impacting businesses significantly. The mentioned time windows, for instance, create peaks in delivery moments. This is further intensified by customers often dictating delivery times that logistics service providers or suppliers must adhere to. As a result, a supplier may need to deploy additional vans to meet everyone's needs within the short time frame. Moreover, a ban on (heavy) trucks has the unintended consequence of multiple smaller transports taking place, thus increasing the number of transportation movements. Ultimately, the same amount of goods needs to enter the city. Therefore, regulation can have counterproductive effects in some cases. Hence, for municipalities, it is an ongoing quest to find the right balance and set the right goals.

City logistics and distribution centers

But whether it concerns zero-emission zones or separate bans for (often historic) city centers, it often only concerns a limited part of the city. A large part of the logistics takes place outside these areas, so the impact is limited to that part of the logistics that needs to be in these city centers. For the majority of distribution in the country and therefore also to the city, most regulations have little or no impact.

The Netherlands is a relatively small country and distribution to different cities in one route is often organized very efficiently by companies. The distribution centers involved in city logistics can be roughly divided into three types (see table 2). First of all, the large distribution centers out of town, for (inter)national or regional distribution. Consider, for example, the general cargo category, where deliveries are made once or several times a week to one or more stores in different cities. As indicated at the beginning, this category accounts for a large part of city logistics.

In addition, there are medium-sized distribution centers - often so-called 'city hubs' - at city boundaries, for transport to and from one or more cities that are close to each other. For example, for the 'Perishables' category, which also plays a large role in city logistics. Here, deliveries are made (almost) daily and sometimes even several times a day. In some cases, it can be desirable to keep a small stock in the area. Finally, there are the City Logistics centers. These are small distribution centers with a major focus on moving product, such as parcel services.

Table 2. Type of distribution centers for city logistics

|

|

Out of Town |

City Boundaries |

City Logistics |

|

Size |

10,000 sqm + |

2,000 - 10,000 sqm |

< 2,000 sqm |

|

Location |

Central in the country or region, close to highway |

Close to city and highway |

Strategic in the city |

|

Type of activity |

Focus on storage |

Balance between storage and throughput |

All about moving product |

|

Type of tenant |

Single tenant |

Both single and multi-tenant |

Both single and multi-tenant |

|

Type of transport |

Heavy goods vehicles |

Heavy goods vehicles and smaller vehicles |

Vans, LEV vehicles and/or (cargo) bicycles |

|

Terrain and access |

Large yards |

Level access |

Level access |

|

Parking spaces for employees |

Many |

Medium to many |

Limited |

|

Dock Ratio |

High |

High/Medium |

Low/None |

Which type(s) of distribution centers are best for a company can be influenced by (local) regulations, but is also strongly related to the type of user. The types of goods differ enormously between companies and therefore also what the most desirable and efficient form of transport is. Moreover, this also ensures that the requirements that a distribution center must meet - both building specifications and location - differ per company. It is important for developers and investors to gain a clear insight into this supply chain, but also for municipalities to take this into account in any new policy.

Impact of zero-emission zones on logistics, especially in the short term

The introduction of zero-emission zones will further increase the complexity of city logistics, at least in the short term. Polluting vehicles are no longer allowed to enter these zones, while many companies (particularly small and medium-sized enterprises) have not yet (completely) renewed their fleet with emission-free vehicles. Transport outside the zero-emission zones will continue with the current fleet, but for transport in and out of these zones, an additional transfer moment to emission-free transport must take place for some companies. Moreover, it is expected that the zero-emission zones in cities will be expanded in the long term. These developments will create more demand for medium-sized distribution centers at the city boundaries. The extra transshipment moment costs time, space and labor and therefore also money. Since it is unlikely that governments will step in, these are costs that will be passed on and ultimately (at least partly) end up with the consumer.

In the long term, the share of emission-free vehicles in the fleet will further increase. By 2035, 26% of vans and 18% of trucks are expected to be zero-emission.[1] Within the zero-emission zones, these percentages will be higher than this average due to the obligation. Moreover, the range of these vehicles is expected to continue to increase and therefore be greater than currently is the case. In the medium to long term, it is expected that due to this increased range, transport in the zero-emission zones will look like the current situation, only with zero-emission vehicles instead of fossil fuels.

The demand for distribution centers at city boundaries will therefore increase, especially in the short term. Although there will always be demand - just as there is now - demand will be less strong in the medium to long term. It is therefore wise for investors to take a good inventory of how great the need is in a city. At municipal level, it seems wise to make optimal use of the existing distribution centers or - where possible with limited investments - to make business premises suitable.

Long-term impact regulation

The need for more distribution centers at city boundaries may arise from other regulations. It is not inconceivable that a similar ban as in Utrecht for heavy trucks in parts of the city center to protect the yard basements will also be introduced in other municipalities that have vulnerabilities. Such as municipalities such as Amsterdam and Leiden, with many quaysides along the canals. It is also not inconceivable that more and more municipalities will introduce regulations regarding bundled delivery. In that case, it concerns the entire municipality, and demand for urban distribution from the city boundaries remains high in the long term.

Case: Utrecht

An example of a municipality where additional regulations already apply to the center is Utrecht. Due to the presence of vulnerable yard basements, heavy freight traffic is no longer permitted. In addition, the zero-emission zone will apply from 2025. And next to that, the municipality is working on reducing motorized traffic in the city, which is evident from developments such as the car-free Merwede district. It is therefore not inconceivable that in the long term there will be more regulations in order to limit logistics transport movements. This means that (bundled) distribution from the city boundaries seems to be the best solution here in the long term.

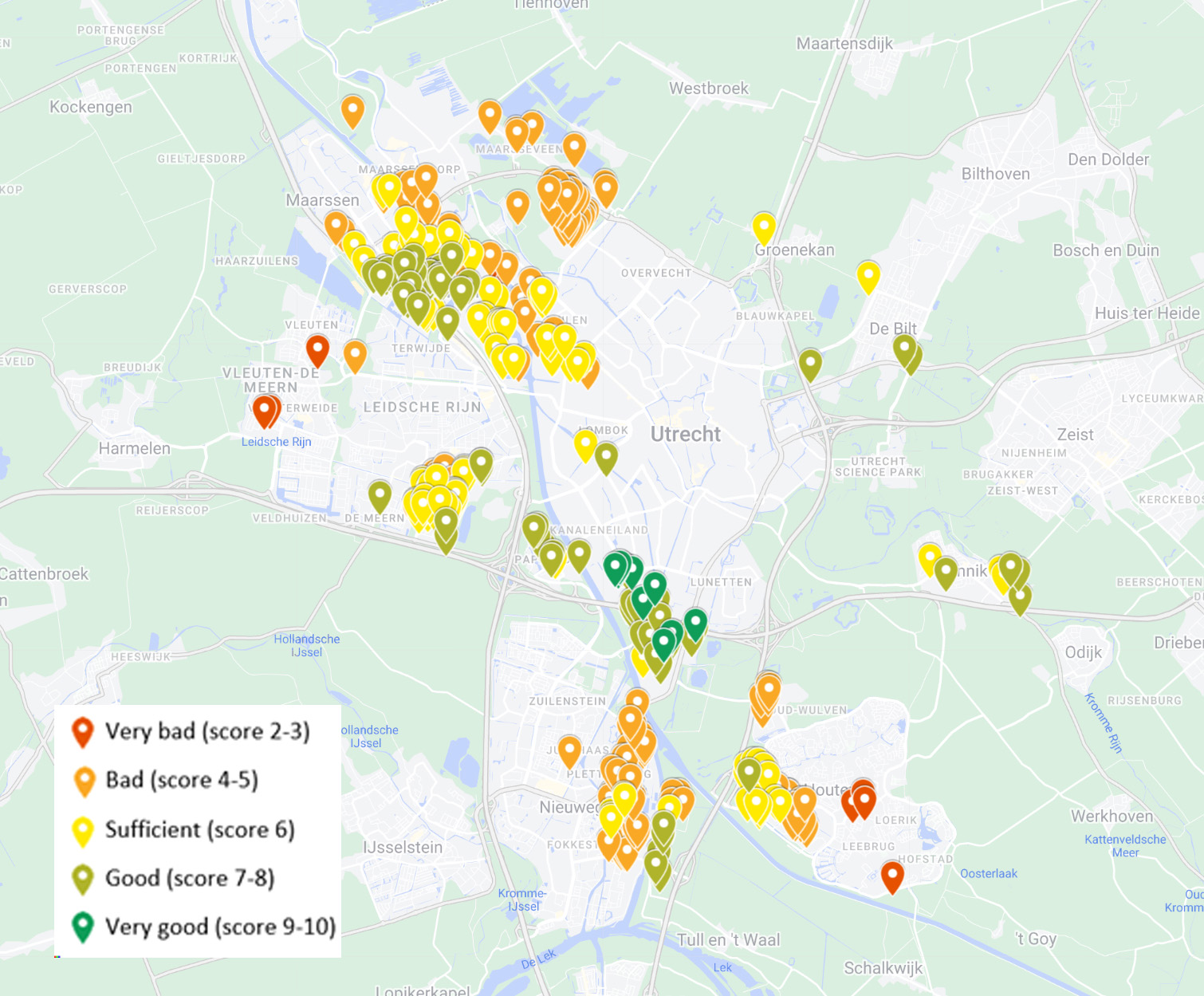

To investigate which buildings and areas are suitable for both the short and long term, an analysis was carried out based on the location of business premises with a size of 2,000 - 10,000 sqm. The distance to the nearest highway and to the center of Utrecht was taken into account. The northwestern side of Lage Weide scores well, as does Laagraven-Liesbosch on the north side of the municipality of Nieuwegein. It is therefore not without reason that companies already have so-called city hubs here, such as GLS, DHL and PostNL.

Figure 1. Scoring of business premises 2,000 - 10,000 sqm for city distribution based on location

The very good score of buildings on the retail park Woonboulevard Utrecht is striking. Although there are no distribution centers here, many buildings are allowed industrial use as well according to the zoning plan. In the event of a possible future redevelopment of this area, it could be very interesting to create a mixed use area with logistics and other functions, such as retail (as is currently the case) and, for example, residential.

Clear regulations are crucial

City logistics has increased in recent years and this increase is expected to continue in the coming years. Regulations from governments have also increased and have an impact on companies and suppliers. Some regulations only have a short-term impact, while others also have a long-term effect. For example, zero-emission zones have a major impact, but this impact will decrease in the future due to electrification of the fleet and improved range. The additional demand for transshipment points around these zones is temporary. However, in some municipalities there are or will be regulations with a long-term impact on logistics.

It is important for developers and investors to have insight into their customers' supply chain, as this influences the specifications of buildings. It is also important to know which regulations influence this. City hubs at city boundaries will always remain in demand and investments in modern city hubs are interesting if this is structural. However, if the demand is not or less structural, it is wiser to look at existing buildings that are already suitable or can be made suitable with minor investments.

It is understandable that many municipalities are still experimenting in their search for the most optimal way of logistics in the city, but it is crucial to create clarity in all regulations for companies. Uniform regulations are desirable, because differences between municipalities do not help. In addition, there are challenges that companies have no control over, such as the capacity of the electricity grid. Collaboration with municipalities is therefore essential to make developments and the transition to sustainable logistics possible.

[1] Outlook Stadslogistiek 2035, Topsector Logistiek (2024)

[2] Milieuzones in Nederland, Milieuzones in Nederland

Related insights

-

Viewpoint | Future Cities

Urban expansion and displacement of business: multi-storey construction as an answer

May 8, 2025

Land scarcity in Dutch cities requires innovative solutions like multi-storey buildings to support both residential and commercial needs. Learning from Paris's successes can help optimize urban growth while balancing business and resident demands.