Viewpoint

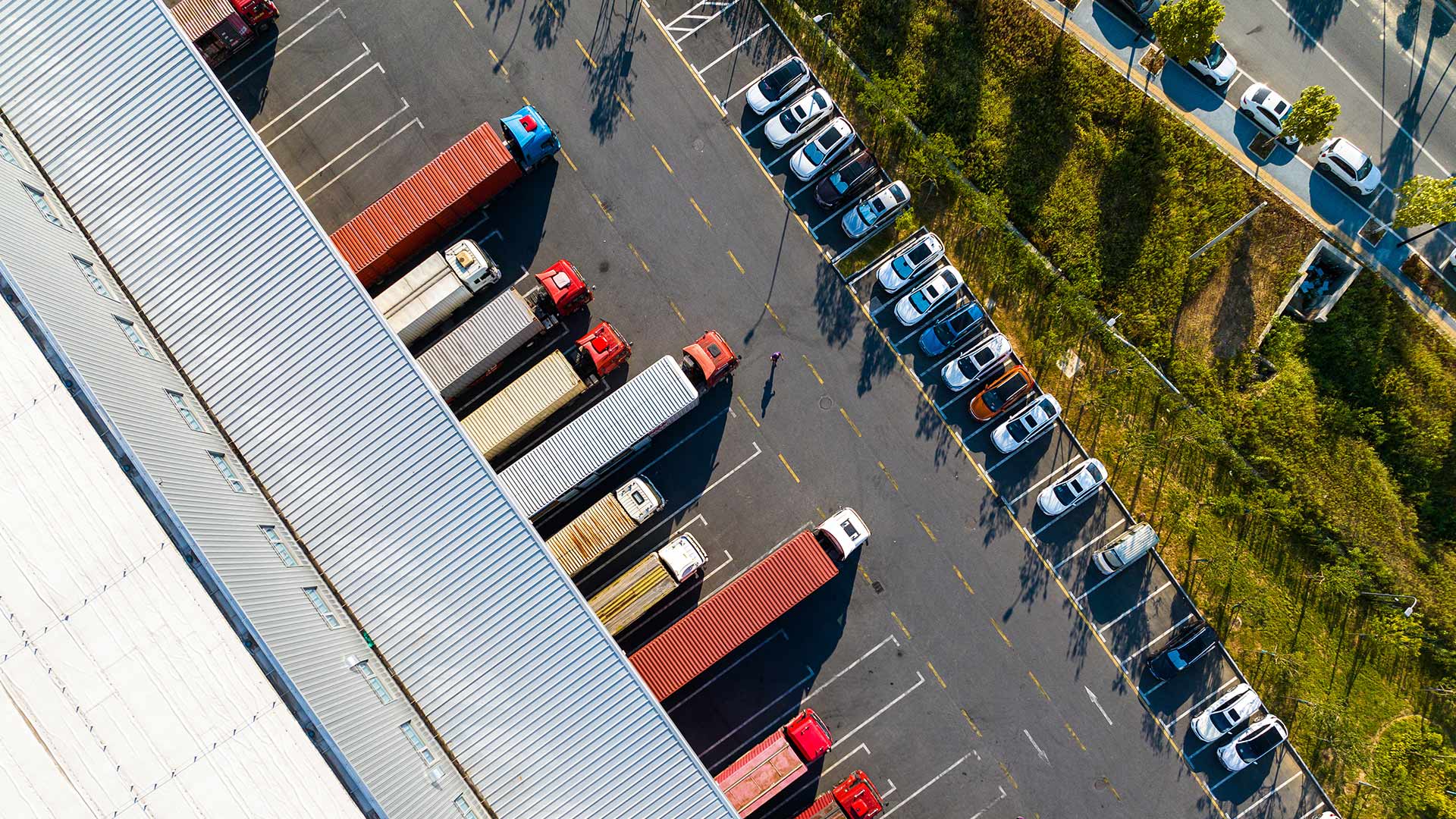

Logistics real estate: recovery expected on the occupier market

October 23, 2024 5 Minute Read

The dynamics on the logistics occupier market have decreased significantly in recent quarters, causing vacancy to rise to the highest level in almost 10 years. However, recovery is expected next year. Investors therefore continue to have confidence in the logistics market, which is also reflected in the investment volume that has increased compared to last year.

Logistics vacancy increased

After the record years of logistics take-up that followed the COVID-19 pandemic in 2021 and 2022, there is currently a clear decline in take-up. Some of the companies that have expanded significantly in recent years now have more space than necessary due to the economic setback. Other companies take a step back and are waiting to invest in expansion. As a result, take-up in the first three quarters of 2024 was around 1 million sqm, the lowest level in ten years.

This also means that the vacancy rate has increased and reached its highest level since 2015. After a historically low vacancy rate of just over 1% in 2022, it has now increased to an average of over 3.5%. Although this is only a fraction higher than the previous peaks in 2018 and 2020, there has been a clear increase in recent quarters.

Regional differences

Nationally, take-up is decreasing and vacancy is increasing. However, there are both sectoral and regional differences. Sectors that are taking up relatively less space compared to previous years are 3PLs, the e-commerce sector - which saw a large take-up in 2022 - and the food sector. In contrast, within the consumer products and (non-food) retail sectors, there are companies that have signed for large floor areas, such as Foot Locker and Rituals. Because the overall take-up is relatively low, these sectors now stand out.

There are also regional differences, with a renewed focus on the traditional logistics hotspots, which leads to polarization in vacancy. In particular, due to the low vacancy rate in these hotspots in recent years, more has been developed and rented outside these hotspots. This has led to the same amount of take-up outside the logistics hotspots as in the hotspots in 2023. But in 2024, a turnaround has been visible so far. The increase in the overall vacancy rate has led to more availability in the logistics hotspots; an opportunity that several companies have seized. As a result, there is relatively more take-up in the logistics hotspots again, which has increased the differences in vacancy between the regions. In Venlo-Venray and Tilburg-Waalwijk, for example, the vacancy rate is still extremely low at around 1.5%. On the other hand, in regions such as Twente, Rivierenland and Arnhem, the vacancy rate is considerably higher with percentages above 5%.

Core investors active again

A recovery is expected on the logistics market. According to recent figures from the Central Planning Bureau (CPB), the economy will grow by a modest 0.6% this year, but growth of 1.5% is expected for 2025[1]. Previous research by CBRE among logistics users has shown that there is only a limited need for expansion this year, but that no less than 58% expects to expand again next year onwards. In the Netherlands, CBRE now sees that significantly more viewings and rental proposals are being made in the third quarter than at the beginning of 2024.

Investors therefore continue to have confidence in the logistics market. This was already evident from the CBRE research among investors earlier this year, in which most (34%) indicated that they had a preference for investing in logistics; an increase compared to last year when 'only' 23% indicated that they preferred logistics. This is confirmed by the investment volume of the first three quarters, which was 21% higher than the same period in 2023.

Regional differences are also visible in logistics investments. In 2023, almost 60% of the investment volume consisted of transactions outside the logistics hotspots. Now that vacancy in these regions is increasing and the majority of take-up is taking place in the traditional hotspots again, it is also visible that investors are moving along. In 2024, 74% of the investment volume has been invested in these traditional hotspots so far. Core investors, who were less active the past year, are back in the market again. With the expected recovery in the logistics user market and an expected fall in policy rates in the long term, they see an opportunity to strike.

[1] CPB (September 2024) Macro Economische Verkenning 2025