Intelligent Investment

Chicago Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The Chicago life sciences cluster is the largest in the U.S. Midwest region. Almost 59,000 people work in the local industry, with over 13,000 in life sciences research and development (R&D) roles.

- Chicago has over two million sq. ft. of multi-tenanted life sciences lab/R&D space, as well as a significant amount of owner-occupied space due to the pharmaceutical industry’s deep, historical presence.

- Chicago life sciences companies have garnered almost $1.9 billion in venture capital investment between 2019-2024. Between 2023-2024, venture funding jumped 55%.

- Catalytic institutions such as Portal Innovations, UChicago Science Incubator and the Chan Zuckerberg Biohub Chicago are spurring new scientific discoveries and startups that will expand the ecosystem.

- The growth of the city as a global quantum science hub will further accelerate Chicago’s life sciences innovation.

- The ecosystem is also supported by world-renowned universities (Northwestern University, the University of Chicago, Illinois Tech, among others) and leading health care institutions (Northwestern Memorial Hospital, Rush University Medical Center, University of Chicago Medical Center, Lurie Children’s Hospital, etc.).

- More than $1.1 billion in FY 2024 had been allocated from the National Institutes of Health (NIH) to organizations in Chicago for healthcare and life sciences initiatives.

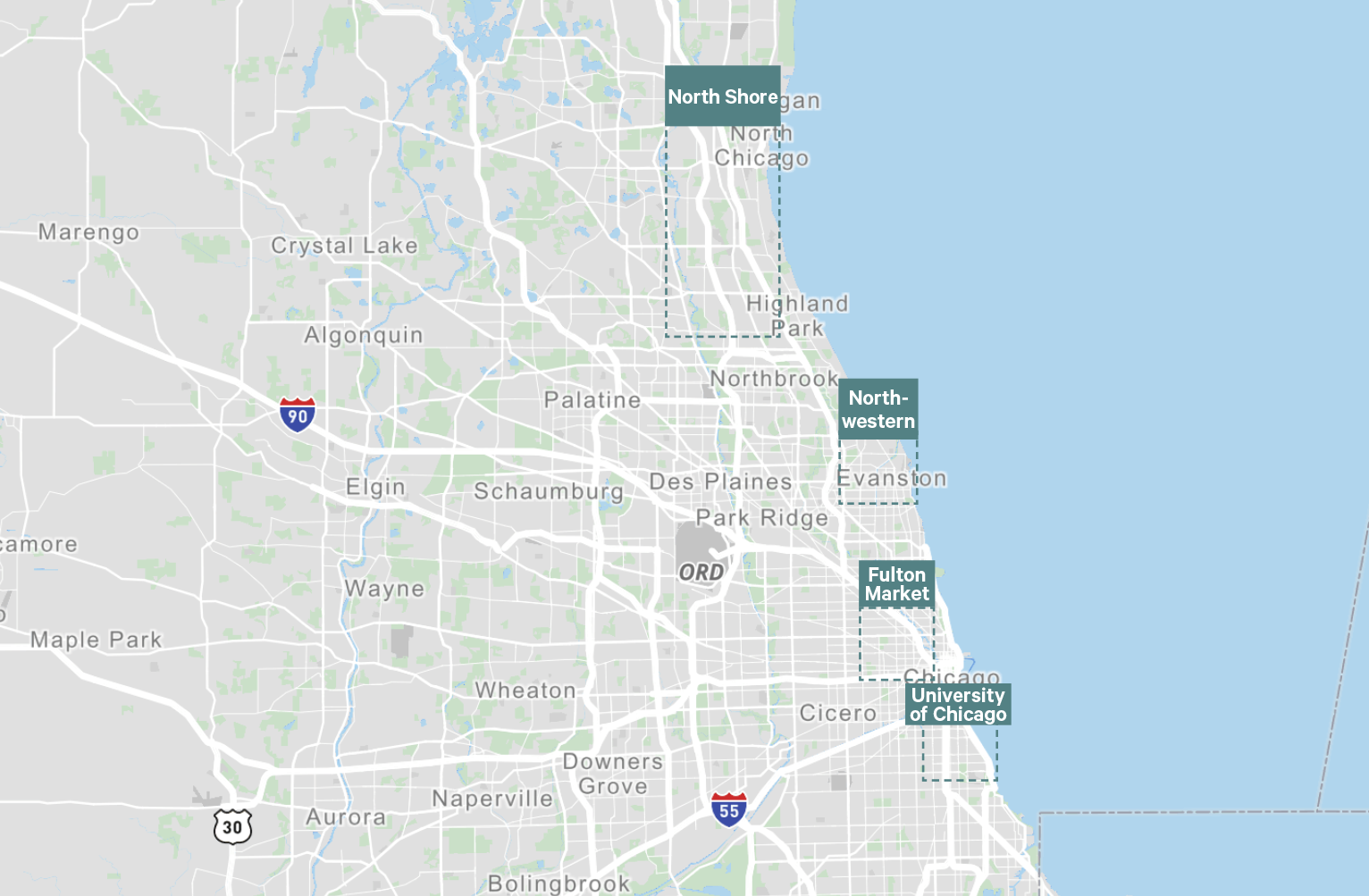

Submarkets

Industry Presence

- The nearly 59,000 people working in the region’s life sciences industry is the nation’s sixth-largest workforce.

- Roughly $350 million of venture capital funding was invested in Chicago life sciences companies in 2024, a 55% increase from 2023’s $206 million.

- Several new science incubators are dramatically increasing Chicago’s capacity to build successful life sciences companies. Portal Innovations, for example, has 50 member companies in Chicago (75 nationwide) after launching just four years ago.

- PsiQuantum and IBM will anchor the new $2 billion Illinois Quantum and Microelectronics Park. PsiQuantum’s U.S.-based, utility-scale, fault-tolerant quantum computer and IBM’s National Quantum Algorithm Center will unlock new life sciences discoveries and attract industry companies.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

By early 2025, the metro Chicago market had added 1.5 million sq. ft. of new Class A lab inventory since 2020, representing a nearly 150% increase in multi-tenanted lab inventory from pre-COVID to post-COVID. These include new buildings in the city’s hottest downtown submarket; across from Northwestern University’s campus; and in collaboration with the University of Chicago.

Figure 3: Lab/R&D Space Under Construction

Key Trends/Big News

- Leasing activity ticked up in Q4, as a new Class A lab building was delivered next to Northwestern’s campus.

- Chicago continues to attract early-stage life science ventures with new speculatively built lab suites.

- IBM announced its first location for next-generation quantum computing at Hyde Park Labs, which will deliver Q1 2025.

Featured Projects

- Fulton Labs

- This 725,000 sq. ft. R&D lab campus is located in the heart of one of the fastest growing submarkets in the nation. The campus is home to some of Chicago’s most exciting life sciences companies and organizations, including Portal Innovations, Chan Zuckerberg Biohub, Xeris Biopharma, Vanqua Bio, Illinois Tech and more than 50 startups based out of Portal Innovations. Additional phases are contemplated in the Fulton Park Campus. The campus also includes a newly developed luxury apartment building and public park for the ultimate live-work-play environment.

- Evanston Labs

- This brand new 177,000 sq. ft. building, located across from Northwestern University’s campus on Chicago’s north shore, delivered in 2024 40% preleased. Tenants include Cour Pharmaceuticals, which recently raised a $105 million series A round backed by BMS, Northwestern University and Cyclopure.

- Hyde Park Labs

- This 300,000 sq. ft. lab building is driven by the University of Chicago’s world-class life sciences, quantum and deep tech research. The University of Chicago will occupy approximately 55,000 sq. ft. including a 22,000 sq. ft. Science Incubator for startups. This building delivered in Q1 2025.

- Abbott

- Abbvie

- Amgen

- Astellas

- Baxter

- Bristol Myers Squibb

- Chan Zuckerberg Biohub Chicago

- Charles River Laboratories CRADL

- Cour Pharmaceuticals

- Endotronix

- Fresenius Kabi

- GE HealthCare

- Novartis

- Pfizer

- Portal Innovations

- Seimens

- Sysmex

- Takeda

- Tempus

- Vetter Pharma

- Xeris Biopharma

- Illinois Institute of Technology

- Lurie Children’s Hospital

- National Labs: Fermilab & Argonne National Laboratory

- Northwestern Memorial Hospital

- Northwestern University

- Rush University Medical Center

- The University of Chicago

- UChicago Medicine Comprehensive Cancer Center

- University of Chicago Medical Center

- University of Illinois at Chicago