Intelligent Investment

Raleigh-Durham Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The Raleigh-Durham life sciences cluster is one of the most important in the U.S., with a strong, historical presence of the pharmaceutical industry and massive, new investments in biomanufacturing facilities. More than 40,000 work in the local industry, with over 13,000 employed in life sciences research and development (R&D) roles.

- Raleigh-Durham has roughly 9.5 million sq. ft. of leasable life sciences lab/R&D space, as well as another 1.6 million sq. ft. of owner-occupied space.

- Between 2019-2024, Raleigh-Durham life sciences companies secured almost $4.4 billion in life sciences venture capital funding, the 13th-highest amount in the world.

- Supporting a dynamic life sciences ecosystem are world-renowned universities (Duke University, University of North Carolina, North Carolina State University, among others) and the Research Triangle Institute.

- In FY 2024, the National Institutes of Health (NIH) allocated almost $1.6 billion—the fifth-highest amount in the U.S.—to organizations in Raleigh-Durham for healthcare and life sciences initiatives.

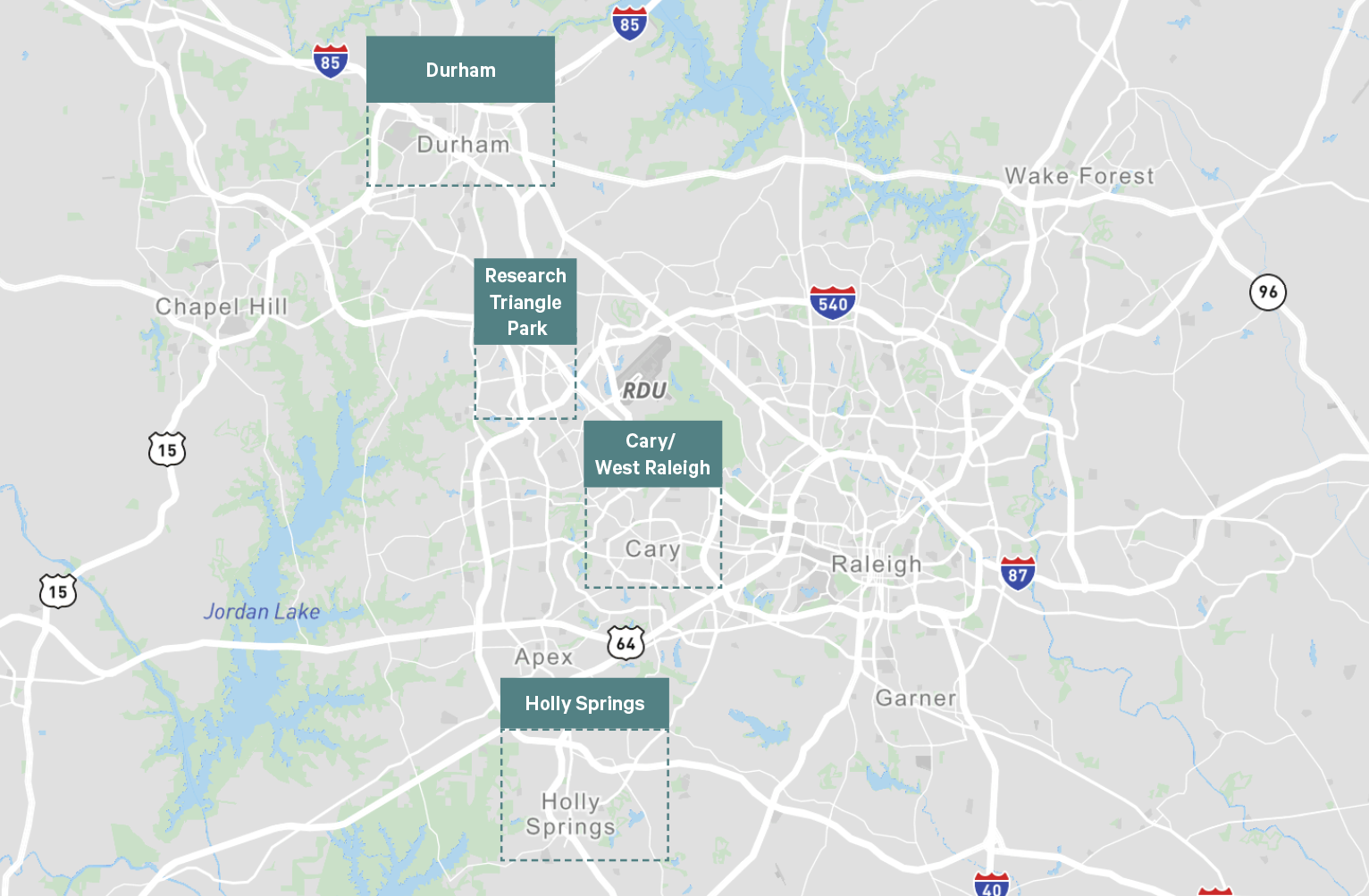

Submarkets

Industry Presence

- More than 40,000 people work in the region’s life sciences industry, comprising 4.5% of Raleigh-Durham’s total employment, a far higher density than the U.S. average of 1.4%.

- The Raleigh-Durham life sciences cluster employs more than 13,000 people in life sciences R&D roles, the nation’s 10th-largest number of these researchers.

- Raleigh-Durham life sciences companies secured more than $772 million of venture capital funding last year, the eighth-largest amount across global markets.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

- Amgen

- AstraZeneca

- Biogen

- Diosynth Biotechnologies

- Eli Lilly

- FujiFilm

- Gilead

- GSK

- Merck

- Novartis

- Novo Nordisk

- Pfizer

- Syngenta

- ThermoFisher Scientific

- United Therapeutics

- Duke University

- North Carolina State University

- Research Triangle Institute

- University of North Carolina