Intelligent Investment

Washington, DC-Baltimore Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The life sciences cluster stretching across the Washington, D.C.-Baltimore region is one of the most important in the U.S., bolstered by the presence of federal government agencies and world-renown universities.

- More than 75,000 work in the Washington, D.C.-Baltimore life sciences industry with nearly 35,000 in life sciences research and development (R&D) roles.

- The Washington, D.C.-Baltimore region has 14.3 million sq. ft. of life sciences lab/R&D space, with 65,000 sq. ft. under construction.

- Between 2019-2024, Washington, D.C.-Baltimore life sciences companies secured almost $5.4 billion in life sciences venture capital funding investment, the 11th-highest amount in the world.

- Supporting a dynamic life sciences ecosystem are world-renowned universities (Johns Hopkins University, University of Maryland, Georgetown University, among others), leading healthcare institutions (George Washington University Hospital, National Children’s) and government research institutes and agencies (National Institutes of Health, FDA).

- The National Institutes of Health (NIH) allocated more than $1.7 billion to organizations in the Washington, D.C.-Baltimore region in FY 2024 for healthcare and life sciences initiatives, the fourth-highest amount in the U.S.

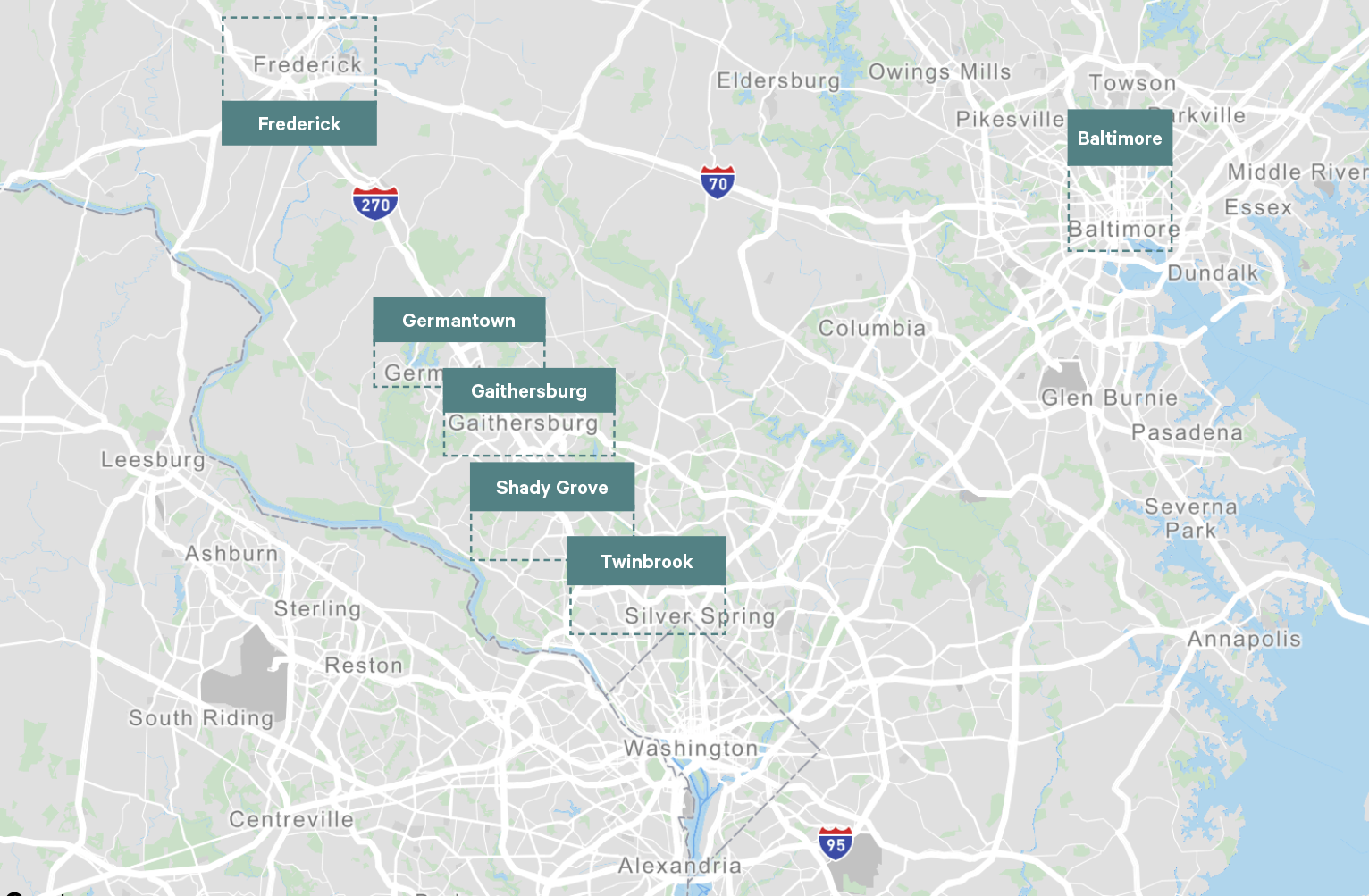

Submarkets

Industry Presence

- More than 75,000 people work in Washington, D.C.-Baltimore’s life sciences industry, comprising 2.1% of total employment in the region, exceeding the 1.4% figure for the U.S.

- The Washington, D.C.-Baltimore life sciences cluster has nearly 35,000 people employed in life sciences R&D roles, the nation’s fourth-largest number of these researchers.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

Key Trends/Big News

- Net absorption fell significantly compared with post-pandemic averages but remained positive for the 16th consecutive quarter.

- Supply has stabilized with the under-construction pipeline largely delivered and future construction starts stagnant.

Featured Project

- 9820 Darnestown Road

- ARE Developer/Owner

- 250,000-sq.-ft. build-to-suit for Millipore Sigma

- Delivered Q4 2024

- AstraZeneca

- BioNTech

- Emergent BioSolutions

- GSK

- Kite Pharmaceuticals

- Millipore Sigma

- ThermoFisher Scientific

- United Therapeutics

- US Pharmacopeia

- Georgetown University

- George Washington University

- Johns Hopkins University

- National Children’s

- University of Maryland