Intelligent Investment

Greater Toronto Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

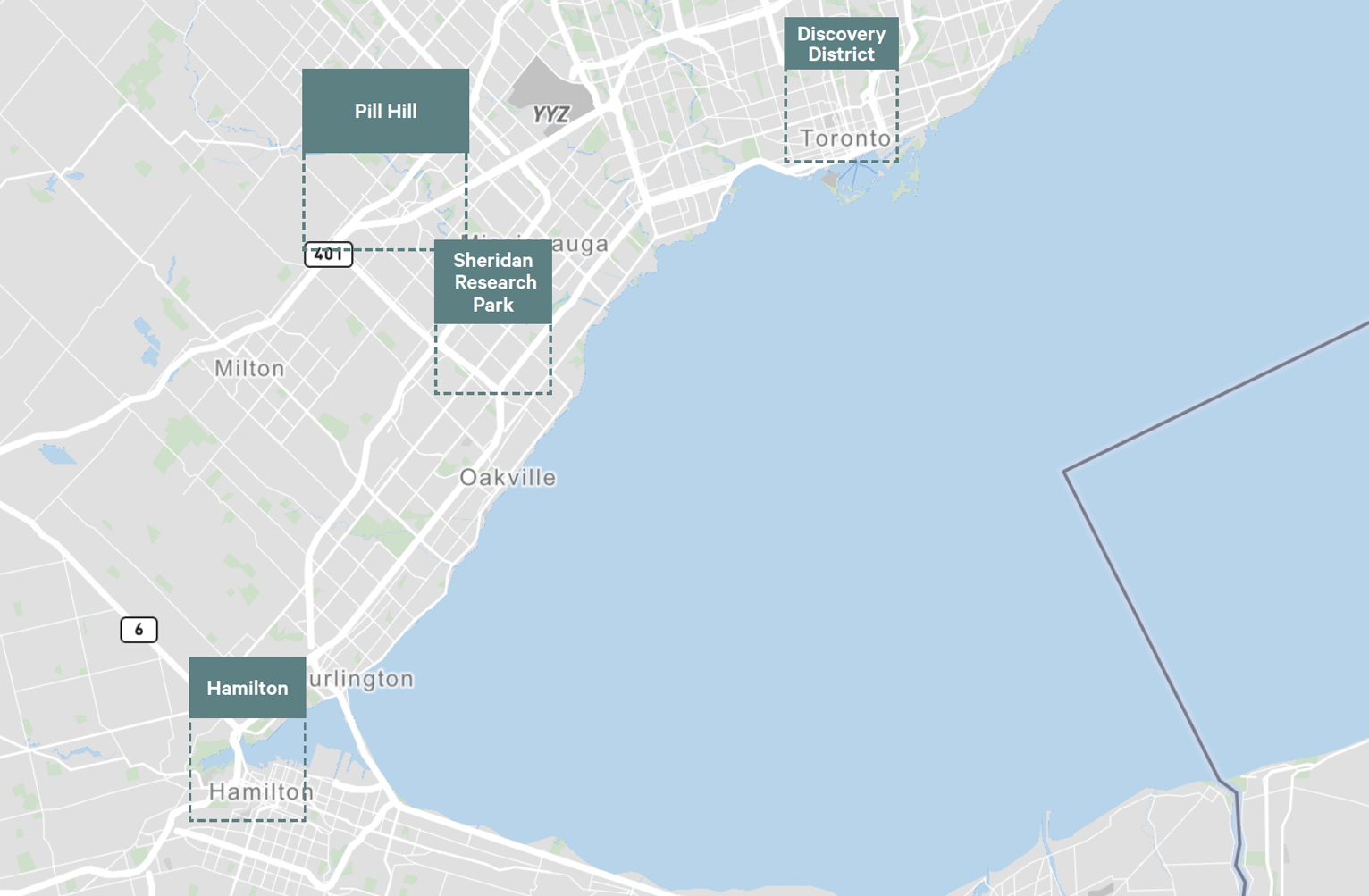

- Lab inventory in the Greater Toronto and Hamilton Area (GTHA) clusters around three research hubs: the Discovery District, in downtown Toronto; Mississauga, to the north and south of the University of Toronto Mississauga (UTM) campus; and Hamilton, around McMaster University and its innovation park.

- CBRE is currently tracking 12.4 million sq. ft. of life sciences space in the GTHA—lab and Good Manufacturing Practices (GMP)—with a current availability rate of 1.4%.

- Current demand for space in the GTHA is estimated at 850,000 sq. ft., with slightly more than half for labs and half for GMP.

- While most tenants are looking for space close to or within major research hubs, the greatest area of need is for built-out (turnkey) lab space.

- As Toronto has very little available space, either existing or under construction, the lab rental rates average $66.50 per sq. ft. net.

- While the majority of global pharma giants locate their Canadian operations in Toronto, very few tenants fill the gap between the pharma giants and early-stage startups. Toronto has become a global leader for AI development and tech talent, and this trend should help elevate the life sciences sector and attract more medium to large Canadian companies.

Submarkets

Industry Presence

Figure 1: Laboratory Inventory by City

Other municipalities include Aurora, Bowmanville, Caledon, Gormley, Pickering, Whitby and Whitchurch-Stouffville.

Source: CBRE Research, Q1 2025.

Life Sciences Venture Capital Investment Trends

Figure 2: Life Sciences Venture Capital Funding

Development Pipeline or Activity

- Currently just over 550,000 sq. ft. of development projects range from planned to recently completed and ready for tenant improvements.

Featured Projects:

- OmniaBio at McMaster Innovation Park

190 Longwood Road South, Hamilton, Ontario- Hamilton Submarket

- 114,950 sq. ft.

- Leaside Innovation Campus

156 Wicksteed Avenue, Toronto, Ontario- East York Submarket

- 89,000 Sq. Ft.

- Planned

- The Catalyst

77 Wade Avenue, Toronto, Ontario- The Junction Submarket

- 155,000 sq. ft.

- Under Construction Q2 2025

- (Source: Seeker Labs, Colliers)

- Abbott

- Amgen

- AstraZeneca

- Bayer

- Bureau Veritas

- Gilead

- Ipsen Biopharmaceuticals

- Medtronic

- Novo Nordisk

- Resilience Biotechologies

- Roche

- Sanofi

- Stryker

- David Braley Research Institute

- Hamilton Health Sciences

- Krembil Research Institute

- McMaster University

- National Research Council Canada (NRC)

- Princess Margaret Cancer Research Institute

- University Health Network

- University of Toronto

- Vector Institute

- Women’s College Research Institute