Future Cities

Savannah Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

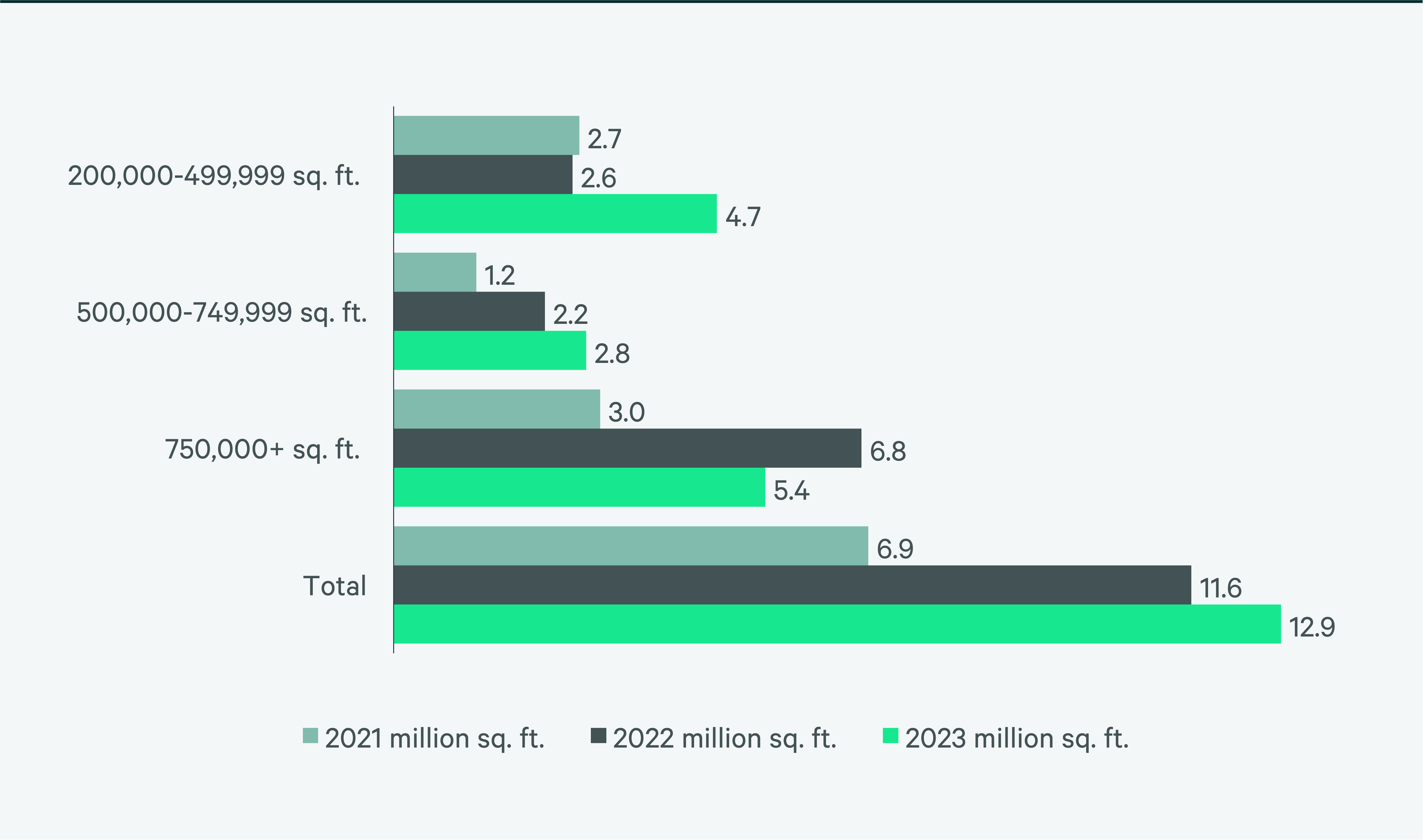

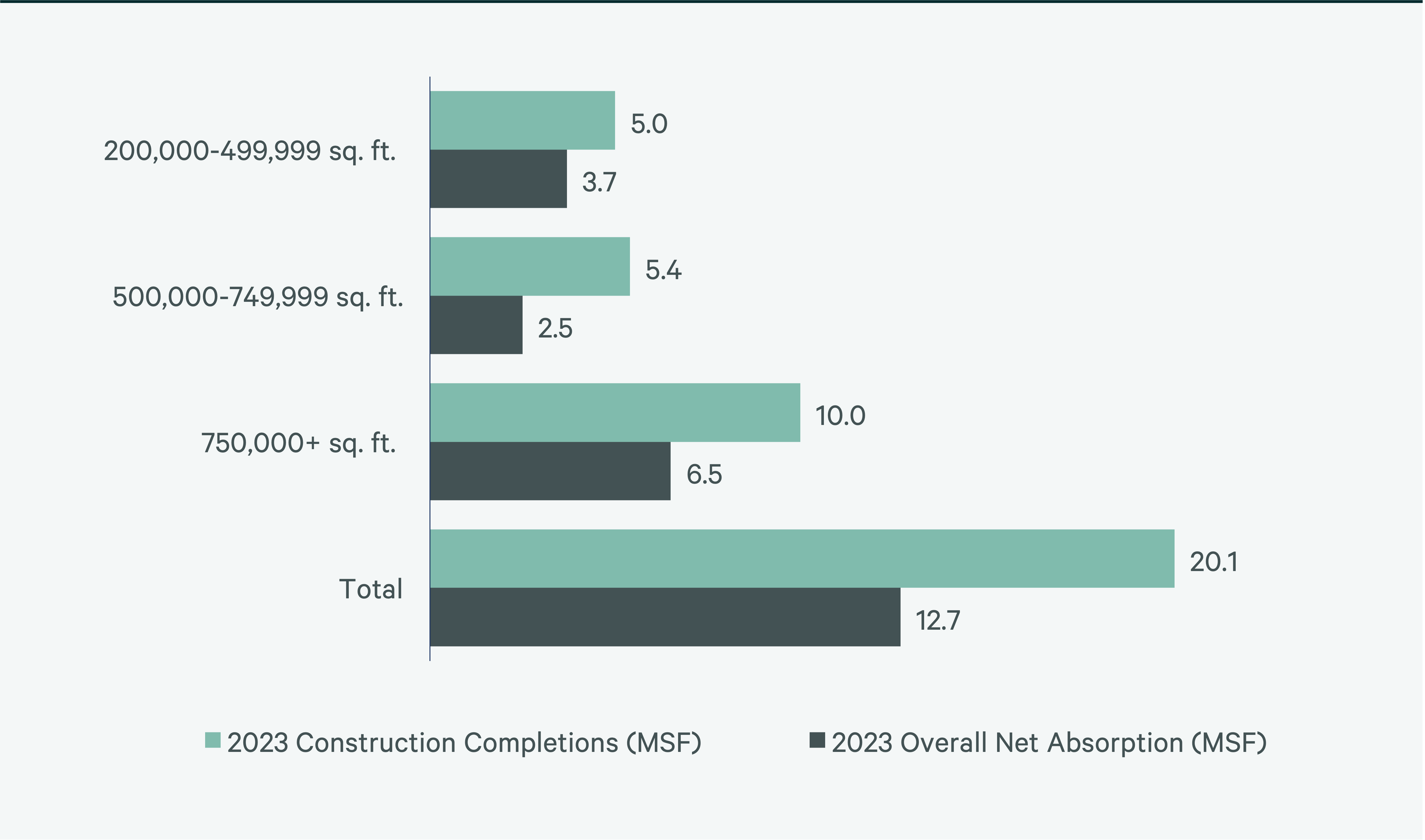

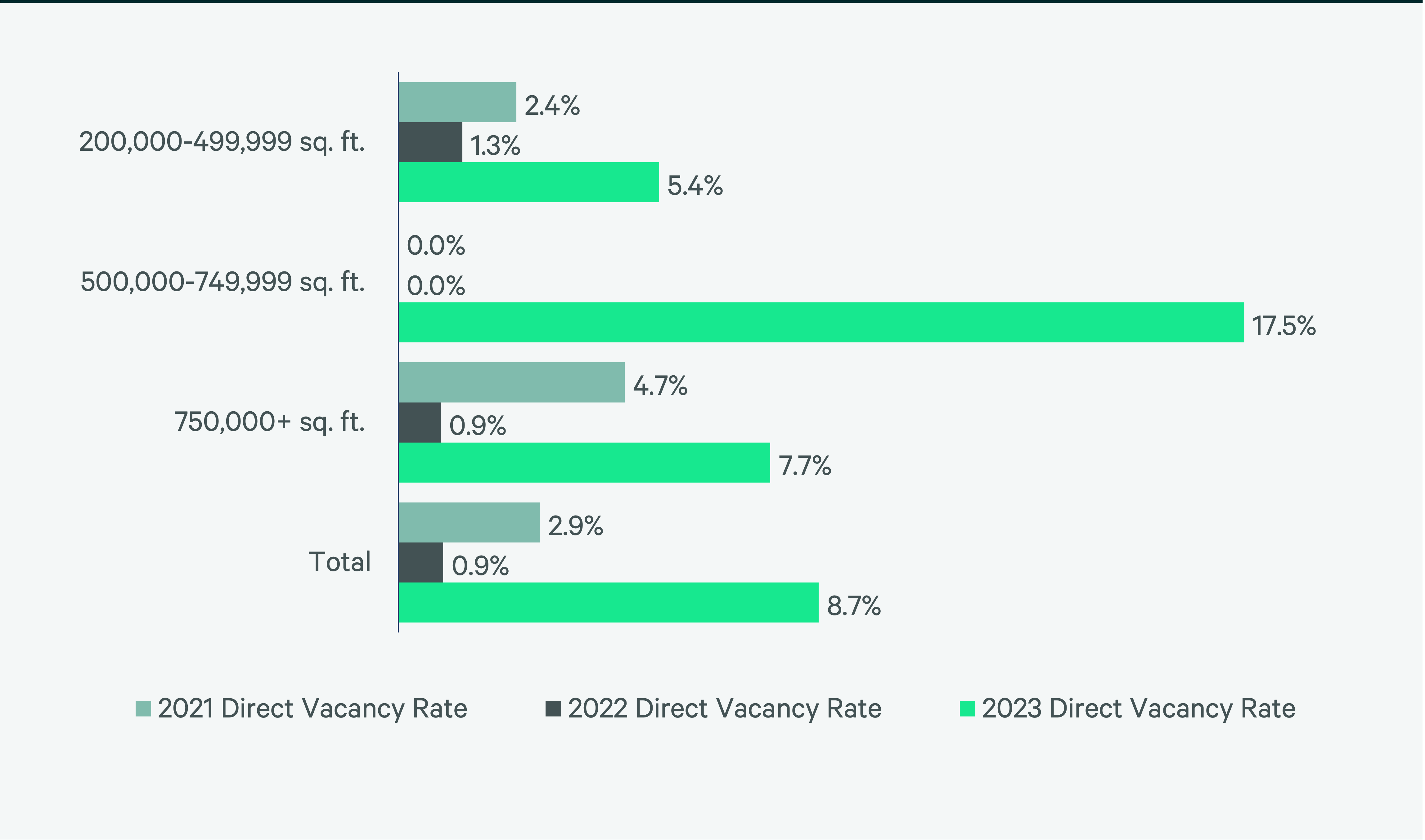

In 2023, over 20 million sq. ft. of completed construction significantly expanded the Savannah big-box market to nearly 100 million sq. ft. This surge in completions significantly increased vacancy rates from a record low 0.9% in 2022 to 8.7% in 2023. Despite this vacancy rate increase, Savannah was North America’s top big-box growth (net absorption/existing inventory) market, with a record 13 million sq. ft. of net absorption. Leasing activity was strong in 2023, with just under 13 million sq. ft. transacted, the second consecutive year leasing surpassed 10 million sq. ft. 3PLs and general retailers & wholesalers dominated leasing, collectively accounting for 80% of transaction volume.

Slightly less than 13 million sq. ft. was under construction by the end of 2023. Although this represents a nearly 50% year-over-year decrease in space under construction, it will continue to affect vacancy rates, albeit not at the 2022 rate. In 2024, expect a diverse tenant set to expand into Savannah to utilize its ports. More companies intend to diversify their source of imports in the coming quarters.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services