Future Cities

Mexico City Market

2025 North America Industrial Big-Box Review & Outlook

April 16, 2025 5 Minute Read

Supply & Demand

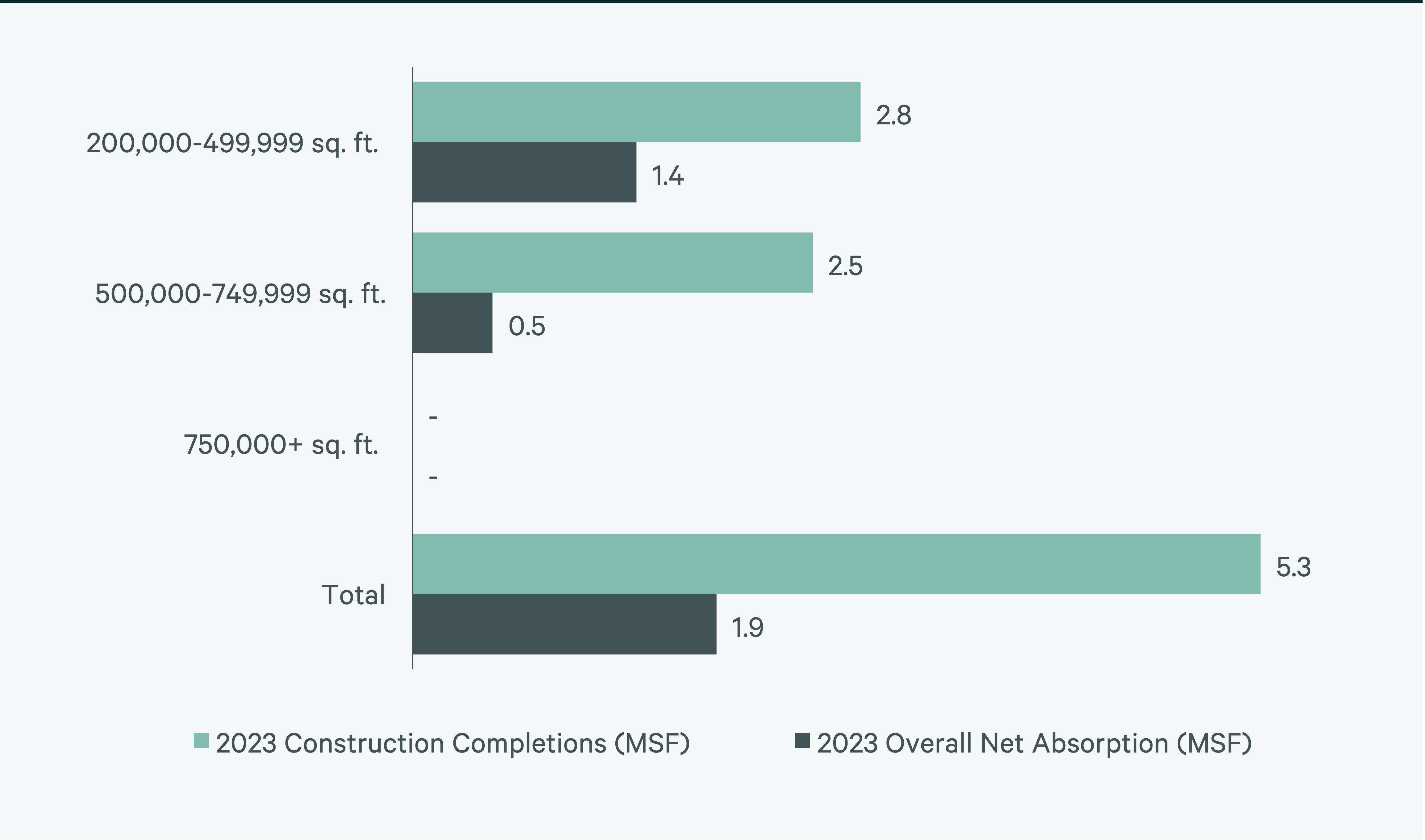

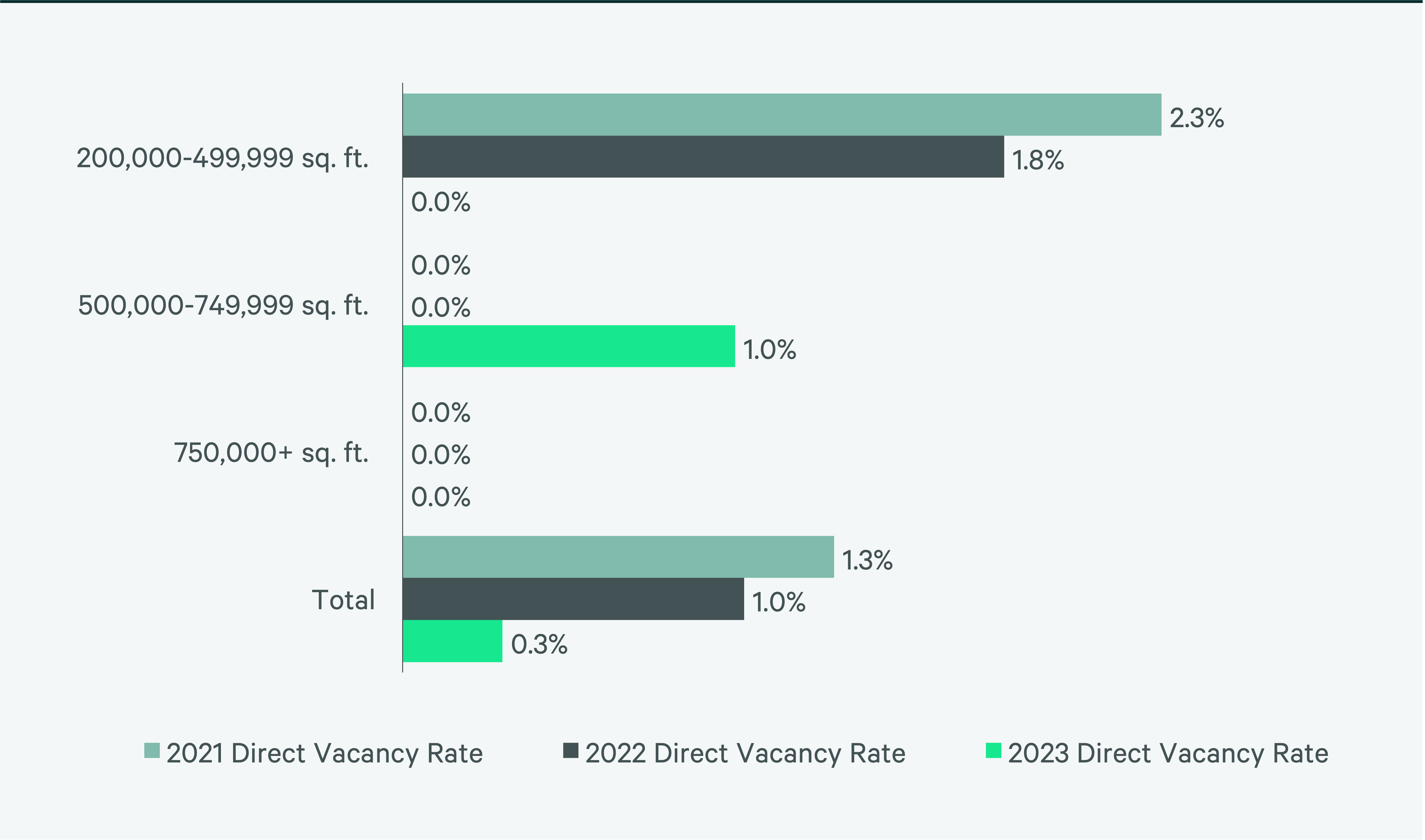

With 68 million sq. ft. of total inventory, Mexico City is Mexico’s largest big-box market. Strong demand lowered the direct vacancy rate to 0.3% in 2023, from 1% in 2022, the lowest in North America. Transaction volume totaled 8.5 million sq. ft., slightly lower than the previous year’s 8.9 million sq. ft. Strong leasing led to another year of positive net absorption, at 1.9 million sq. ft. Food & beverage companies leased by far the most space in 2023, at 54.6% of the total volume. Companies expanded to serve the significant population in and around Mexico City.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

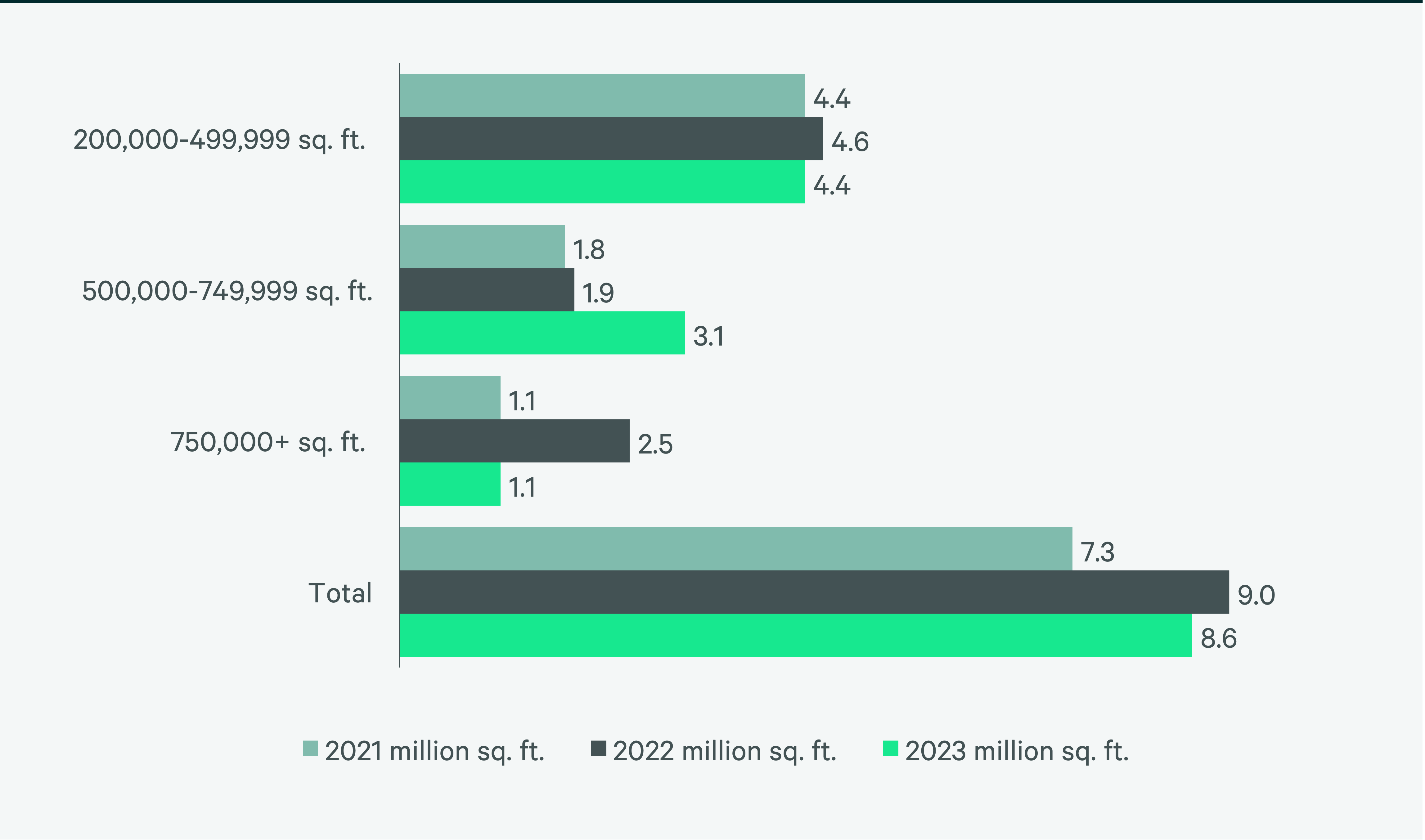

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services