Future Cities

Central Valley, California Market

2025 North America Industrial Big-Box Review & Outlook

May 22, 2024 5 Minute Read

Supply & Demand

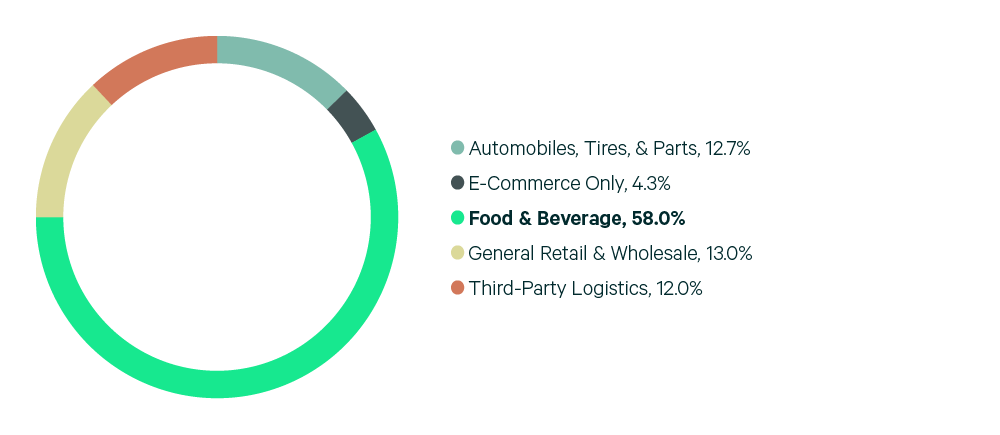

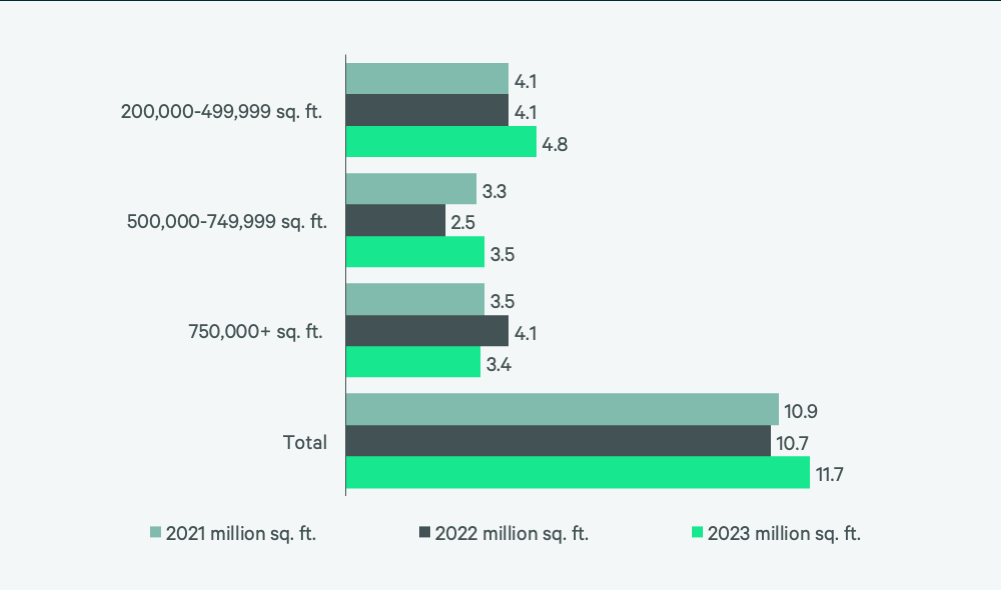

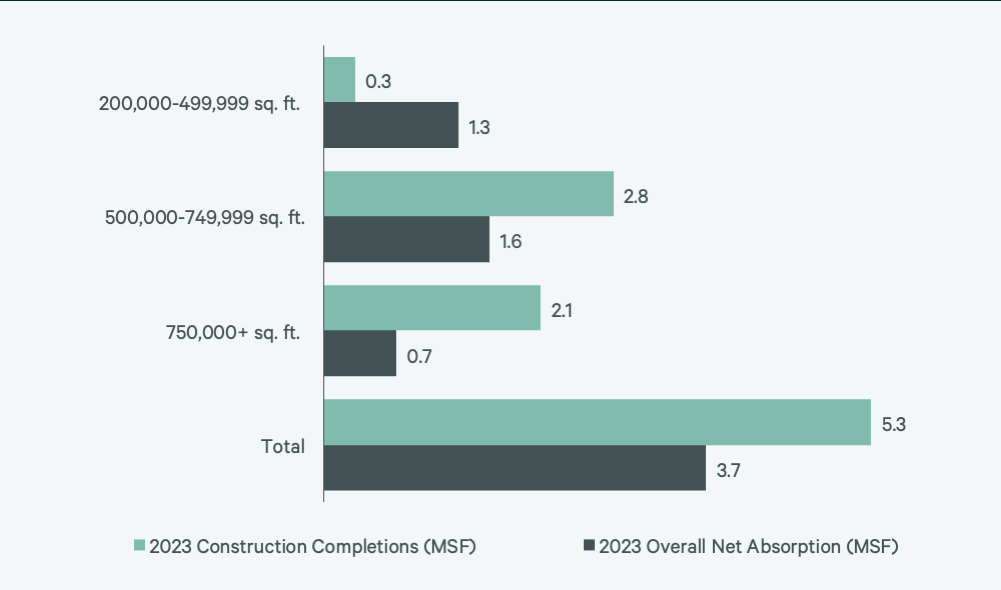

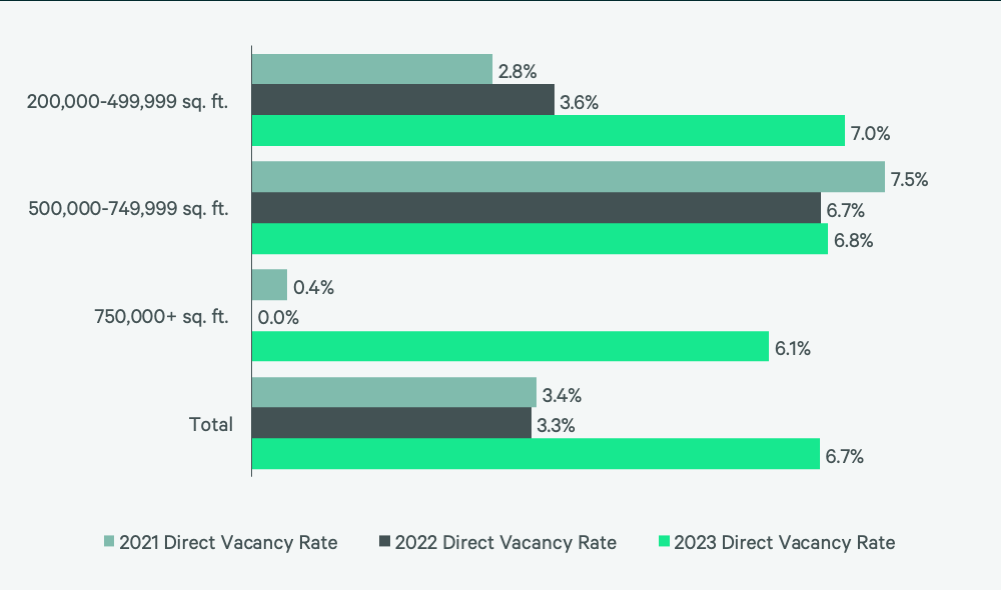

Central Valley remained one of North America’s better performing big-box markets due to its central location in California and affordable rental rates. Transaction volume totaled 11.7 million sq. ft. in 2023, making it one of the few markets in this report that had a year-over-year increase in lease volume, with demand evenly distributed throughout different size ranges. Despite more leasing, net absorption decreased to 3.7 million sq. ft. This decline, along with 5.3 million sq. ft. of construction completions, pushed up vacancy rates to 6.7%, about double last year’s 3.3%. Demand was dominated by the food & beverage sector, which accounted for 58% of total transaction volume. First-year taking rents increased by 11.4% to $7.84 per sq. ft., which remains the lowest taking rent of any California market.

There was a significant decrease in construction projects due to macroeconomic challenges in construction financing. By year-end 2023, only 3.9 million sq. ft. was under construction, with 43% of it preleased. The low levels of available under construction space will help stabilize vacancy rates and could lead to vacancy reductions by H2 2024. Lower vacancies will keep rental rates rising in the coming quarters.

Figure 4: Share of 2023 Leasing by Occupier Type

Source: CBRE Research.

Figure 5: Lease Transaction Volume by Size Range

Source: CBRE Research.

Figure 6: 2023 Construction Completions vs. Overall Net Absorption by Size Range

Figure 7: Direct Vacancy Rate by Size Range

Figure 8: Under Construction & Percentage Preleased

Figure 9: First Year Taking Rents (psf/yr)

Source: CBRE Research.

Explore Big-Box Insights by Market

Industrial & Logistics Research

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services