Evolving Workforces

The Shifting Landscape of Headquarters Relocations: Trends and Outlook

December 11, 2023 4 Minute Read

Executive Summary

This Viewpoint details top HQ relocations trends over the past five years and their implications for strategic business planning.

U.S. companies across many industries are prioritizing headquarters (HQ) relocations as part of their corporate strategies. CBRE Americas Consulting reviewed nearly 500 publicly announced HQ relocations between 2018 to 2023, ranging from start-up enterprises to Fortune 500 companies.

Key Findings:

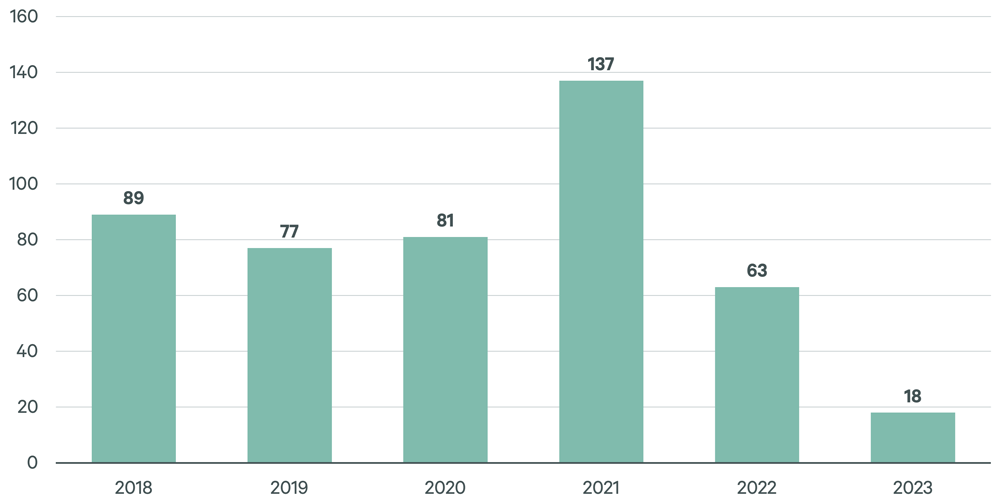

- The past five years have been an active period for HQ relocations, with 465 such moves identified since 2018. However, relocations appear to have peaked at 137 announcements in 2021 and have trended down since then.

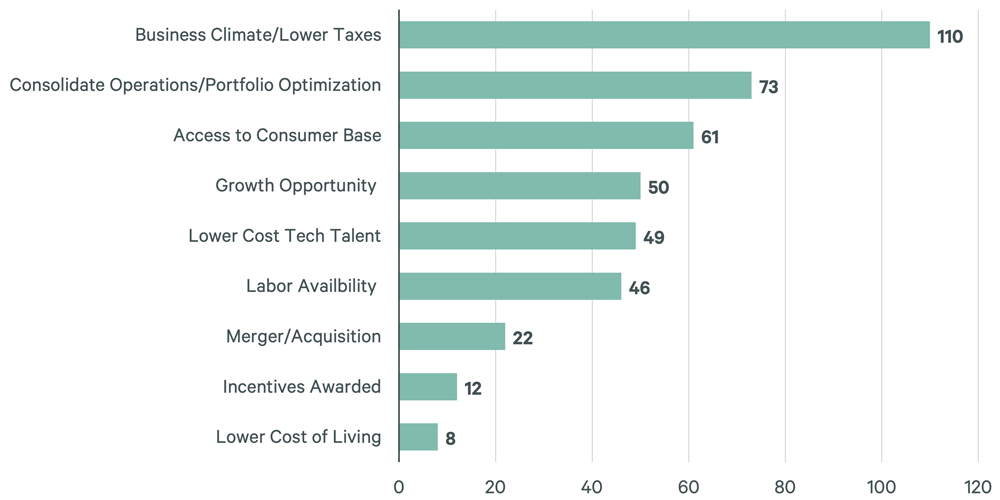

- Business climate/lower taxes is the top reason indicated for HQ relocations (24%), followed by operations consolidation/portfolio optimization (16%).

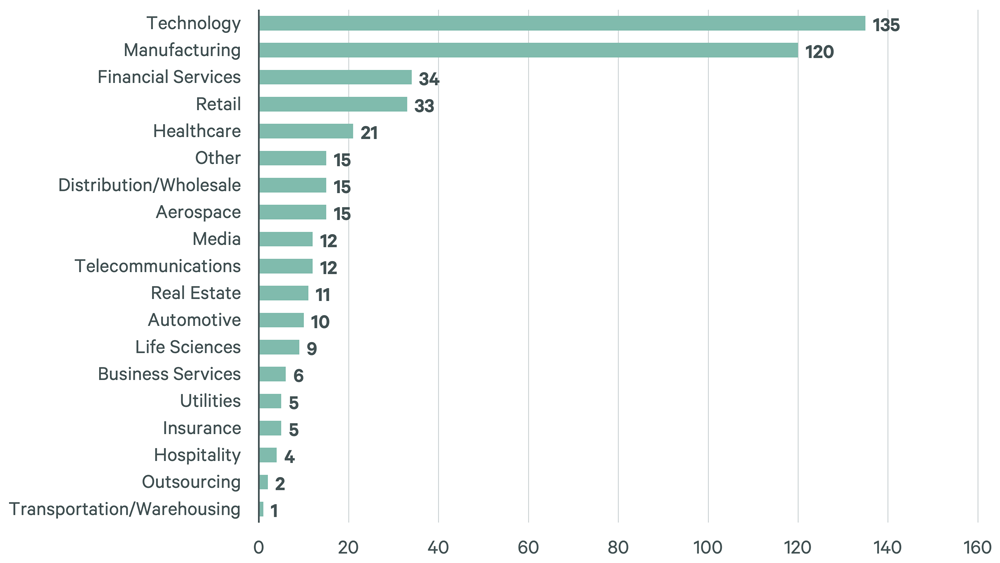

- The technology industry has seen the most HQ relocations since 2018 (135), followed by manufacturing (120). The finance industry represents the third highest (34).

- Texas has attracted the most HQ relocations (209), with 66 moving to Austin, 32 to Dallas and 25 to Houston. In contrast, the most HQs have left San Francisco/San Jose (79), Los Angeles/ Irvine (50) and New York City (21) due to top talent churn amid the high costs to both live and operate a business in these metro areas.

The most successful HQ relocations result from comprehensive workplace and location strategies that leverage qualitative and quantitative research. This includes evaluating strategies to optimize space utilization, foster productivity and support corporate culture. Additionally, financial underwriting and thorough labor market analyses can reveal cost savings, workplace transition implications, skilled talent availability, optimal commute patterns and potential government incentives available in various jurisdictions.

Trends by Reason

Our research identified the most common reasons for HQ relocations are tied directly to cost savings, most commonly a favorable business climate and low taxes, demonstrating the crucial influence of tax policy in today’s business environment. In addition, business leaders are expanding the definition of business environment to include factors beyond the tax code, including regulatory policies, crime, homelessness and other social factors, and health department policies, including vaccine requirements. Some businesses are looking to locate in cities and states that align with their core company values and corporate responsibility stances to attract the best and brightest workforce. The second most common reason was to consolidate operations/optimize the portfolio, reflecting increased corporate focus on efficiency. Seeking lower cost tech talent was another primary driver of HQ relocations, as more tech workers have migrated out of top metros since the pandemic, although the San Francisco Bay Area maintained its position as the top tech talent market. Other leading reasons include access to the consumer base, labor availability and growth expansion prospects.

Figure 1: Number of Relocations by Reason

Trends by Industry

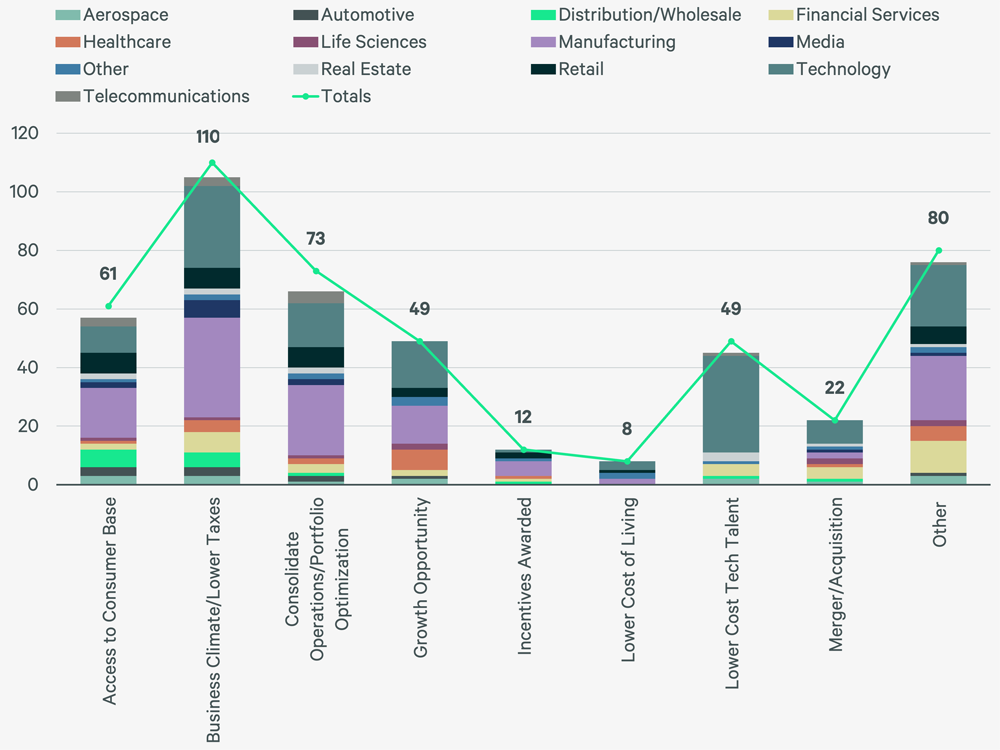

As demonstrated in Figure 1, headquarters relocations are motivated by a range of economic, financial and cultural considerations. The technology and manufacturing industries had the most relocation announcements by far, at 135 and 120, respectively. However, the reasons for these relocations varied. The most common relocation reason in the tech industry, which is more geographically nimble, was to find lower cost talent (33), closely followed by the search for a more favorable business climate/lower taxes (28). Manufacturer relocations were also motivated by a better business climate/lower taxes (34) as well as a desire to consolidate operations (24). Within retail, leading reasons for relocations included access to consumer base (7), business climate/lower taxes (7) and to consolidate operations/portfolio optimization (7). Financial services relocations were primarily driven by labor availability (9). Industries with few relocations, such as hospitality, outsourcing and transportation/warehousing, indicate immobility likely due to geographic ties to customers, among other factors.

Figure 2: Number of Relocations by Industry

Figure 3: Number of Relocations by Industry and Reason

Trends by Year

Relocation announcements surged to a total of 137 during the pandemic in 2021, following a similar pandemic-fueled uptick in residential migration. Relocation announcements fell to 63 in 2022 and just 18 through October of this year.

Several factors likely influenced this HQ relocation slowdown. Higher capital costs have likely impeded corporations’ ability to sell or sublease office assets, tying their relocation timeframes to macroeconomic conditions. It is also possible that the bulk of desired HQ relocations simply occurred during the pandemic, satiating near-term demand. Additionally, several companies have chosen to focus on workplace optimization by consolidating business lines within their existing real estate portfolios, rather than relocating. Finally, employees’ ability to sell their homes and purchase elsewhere is hampered by today’s sharply higher mortgage rates, resulting in a higher hurdle to mobility for a company’s workforce.

Figure 4: Number of Relocations by Year

Trends by Geography

Austin has become a hub for HQ relocations, with 66 new HQs in the past five years. Half (33) of the Austin-based moves were in the tech industry. Dallas, Houston, Nashville and Denver also lured many new HQs, often also technology companies. This is due to welcoming business environments and easy accessibility to talent due to lower costs of living than many major costal business hubs and lower or no state income taxes.

On the other hand, certain markets had an overall loss of HQs during this time. San Francisco/San Jose lost the most HQs, followed by Los Angeles/Irvine, New York City, San Diego and Chicago. These relocations are often catalyzed by a desire to decrease operating costs. In higher-cost cities like New York, some companies have maintained their HQ while moving specific departments to lower cost markets. Tesla embarked on a highly publicized move of its headquarters from Palo Alto, California, to Austin in 2021. Tesla CEO Elon Musk said at the time that the company would continue to expand its activities in the Bay Area but that homeownership affordability and long commutes limited how much Tesla could scale in the Bay Area.

The Texas Phenomenon

Today, 55 of the Fortune 500 companies are headquartered in Texas, the most of any state. Major firms like Oracle, HPE and Charles Schwab moved there after the pandemic began.

Austin has emerged as a global tech hub, offering cost and culture advantages. An HQ relocation from Silicon Valley to Austin typically saves 15% to 20% in tech employee wages. Austin also has a markedly lower cost of living than Silicon Valley (although not to the extent of other Texas cities). But the culture of Austin is its greatest asset and corporate real estate executives recognize it for having a strong tech ecosystem. Dealroom.co ranked Austin the U.S.’s eighth best early-stage venture capital market, 11th in their U.S. Trailblazer category, 22nd in their global science category and 25th in their global Trailblazer category. Also, the motto 'keep Austin weird' has deep local origins. A strong emphasis on work-life balance aids acquisition and retention of high-skilled talent.

Top 5 Markets That Gained HQs:

- Austin: 66

- Dallas: 32

- Houston: 25

- Nashville: 21

- Denver: 11

Top 5 Markets That Lost HQs:

- San Francisco / San Jose: 79

- Los Angeles / Irvine: 50

- New York City: 21

- San Diego: 11

- Chicago: 10

Outlook

Company leaders should inform their strategic HQ planning by addressing these questions that reflect changes in job functions, work models, talent migration and geography considerations. A seasoned real estate advisor can be a critical partner when considering these questions, helping to unlock insights that optimize both business operations and company culture in any corporate HQ relocation.

- Which business groups should remain, shift or relocate from the HQ?

- What is the role of our HQ now and in the future, given a hybrid work environment?

- How does my company’s organizational model and operations policies support distribution of business groups?

- What are the biggest business priorities (such as culture, costs and/or access to talent) that will influence our company’s strategic planning?

- How do we prioritize lower cost markets (labor and real estate costs) with minimal talent quality trade-offs?

- How do we measure demand for labor and understand the competition in potential HQ markets?

- How large should our future HQ be?

- How does our headquarters strategy fit with the rest of our company’s real estate locations?

- In alignment with business strategy, what skill sets will our company need in the future?

- What is our desired go-forward ownership structure for our real estate holdings?

- What’s the required investment to stay and reinvigorate our current headquarters, and what would be the net cost of a move?

- What is the anticipated payback period for my company’s HQ relocation investment?

Related Insights

-

Viewpoint | Future Cities

The Shifting Landscape of Headquarters Relocations: 2025 Update

May 7, 2025

The transfer of business headquarters (HQs) continues to be a significant focus in the dynamic landscape of corporate strategy.

-

Local Response | Future Cities

Headquarters Relocation Is an Opportunity to Reshape Employee Behaviors

April 1, 2024

A company’s decision to relocate its headquarters, whether locally or nationally, goes beyond just changing its physical location.

-

Local Response | Future Cities

The Shifting Landscape of Headquarters: Change Among the Fortune 500

March 12, 2024

Following our December 2023 analysis of headquarters relocation trends over the past five years, CBRE initiated a study of HQ trends over the same period within the Fortune 500.

-

Brief | Creating Resilience

Three Office Occupancy Trends That Are Impacting Portfolio Strategy

September 1, 2023

CBRE’s 2023 Workplace & Occupancy Benchmarking Program has identified three trends across Occupancy Management clients.

Related Services

- Consulting

Labor Analytics

Make better location decisions with a holistic approach that weighs factors like labor costs and availability, supply chain logistics, and incentives.

- Plan, Lease, Occupy

Portfolio Strategy

Generate cost savings and maximize revenue potential through strategic adjustments to support your operational objectives and needs.

- Transform Business Outcomes

Consulting

Gain comprehensive guidance on insightful, executable real estate strategies for both investors and occupiers.

- Plan, Lease & Occupy

Workplace Consulting

Build resilience, attract and retain talent, and foster connection and collaboration in your workplace.