Future Cities

The Shifting Landscape of Headquarters: Change Among the Fortune 500

March 12, 2024 3 Minute Read

Executive Summary

Following our December 2023 analysis of headquarters relocation trends over the past six years, CBRE initiated a study of HQ trends over the same period within the Fortune 500. CBRE Americas Consulting reviewed publicly announced relocations in press releases, company websites, Associated Press newswires and market-specific real estate news for Fortune 500 companies.

Key Findings:

- Between 2018 and 2023, 30% of Fortune 500 firms took some major action regarding their physical HQ space, ranging from a full geographic relocation to sizable reinvestments in their existing space.

- 35 Fortune 500 firms relocated their HQs outside of their existing metropolitan statistical area (MSA). Sunbelt states such as Texas, Florida and Georgia received the most net gains in Fortune 500 firms, while California, New York, New Jersey and Illinois had the greatest net losses.

- 117 Fortune 500 firms made some sizable HQ change within their existing market. Some (70) moved to a new submarket within their existing metro, while others carried out large reinvestments or sale-leasebacks of their existing buildings.

- Total HQ relocations within the United States peaked in 2021 while Fortune 500 relocations alone peaked a year later in 2022. Total actions from Fortune 500 firms (with many being within their existing MSA) peaked last year in 2023.

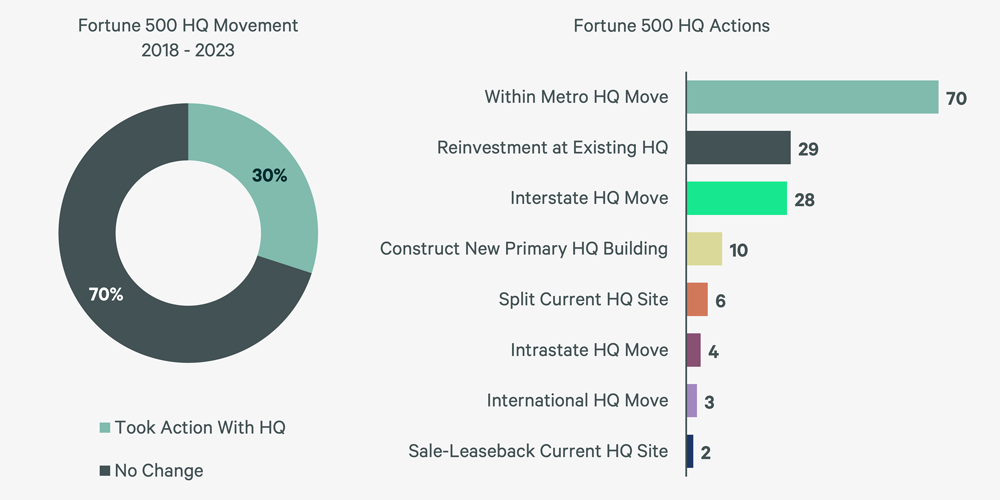

Figure 1: Fortune 500 Firms Who Took Action on HQ, 2018-2023

Between 2018 and 2023, 30% of Fortune 500 firms took major action on their physical HQ. A major action refers to a significant reinvestment, new build or relocation of their physical headquarters. In total, 149 companies took 152 actions (three companies made two major HQ changes in the six-year period). Within those 149 firms, the top actions included moving their HQs within their metro area (70), followed by making major reinvestments to their existing HQ (29). Thirty-two firms moved their HQ either across state lines (28) or within their existing state (4). Three brought their HQ to the United States from an international site.

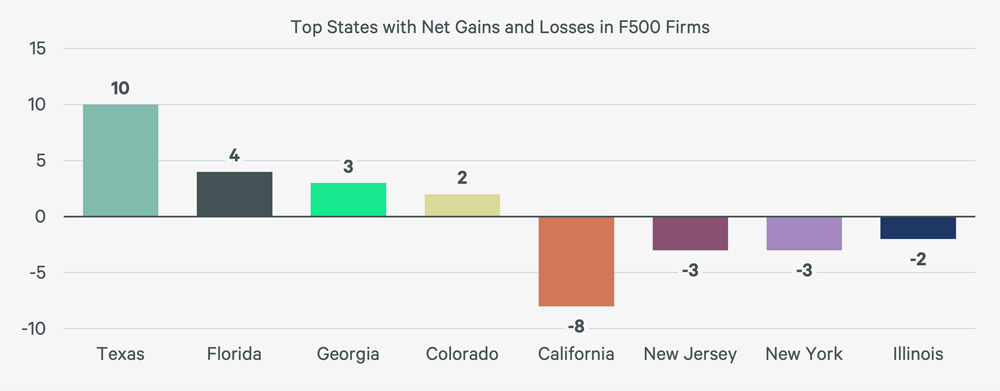

Figure 2: Net Gains and Losses of Fortune 500 HQs by State

From 2018 to 2023, 28 Fortune 500 companies opted to move their headquarters out of state. Notably, Sunbelt states had the largest net gains of Fortune 500 firms, led by Texas with +10 and followed by Florida (+4) and Georgia (+3). California experienced a net loss of eight F500 firms in the past six years, with seven of California’s eight losses going to Texas.

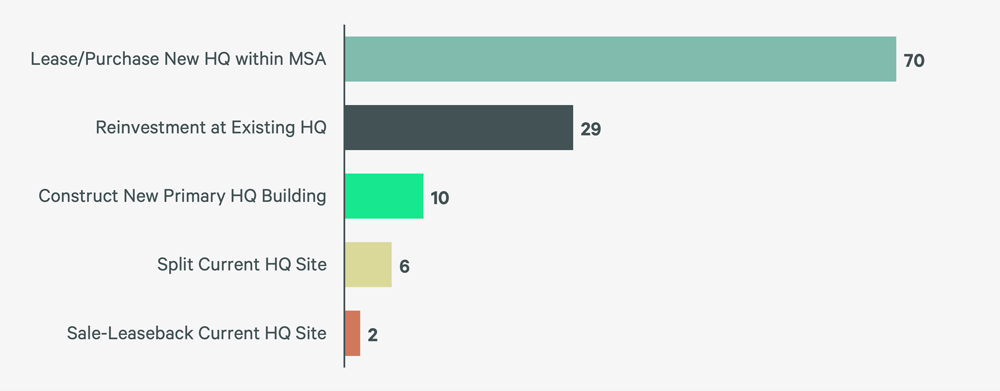

Figure 3: Fortune 500 Facility Adjustments Within Existing Metro

For the Fortune 500 firms that did not relocate out of their existing HQ MSA, 117 made a significant change to their HQ. Many of these changes were in response to the evolving nature of the office, the rise of hybrid work and the continued competition for talent. Seventy firms acquired a new site within their existing MSA, with many downsizing or changing their location to an adjacent submarket. Twenty-nine firms reinvested into their existing HQ site. Reinvestments included large renovations to modernize space, spending from $25 million to $500 million. Other reinvestments included space expansions of at least 100,000 sq. ft. at their current HQ site. The remainder of Fortune 500 firms that acted within their existing MSA either constructed brand-new HQ physical space (10), split up their HQ site (6), or completed sale-leasebacks of their HQ (2).

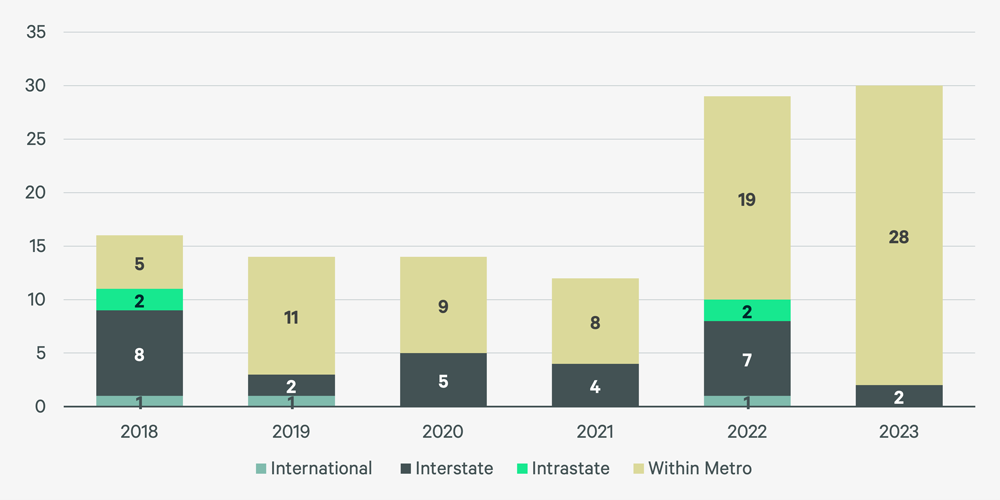

Figure 4: Fortune 500 HQ Moves Over Time

From 2018 to 2023, 115 (23%) Fortune 500 companies moved their physical headquarters from their existing site. Fortune 500 HQ relocation activity (moving out of state or from an international destination, leaving the current MSA) reached its peak in 2022 , a year later than the peak among all corporate relocations recorded in our earlier study. The later peak among the Fortune 500 is likely due to their substantial size, which necessitates complex decision-making and operational considerations. Overall, 2023 was the peak for all Fortune 500 HQ movements (changing addresses, without leaving the current MSA) with many of the year’s moves occurring within their current metro area. The decision to remain within their current metro can likely be attributed to the desire to maintain proximity to existing business networks and talent pools. Many companies strategically positioned their move as an opportunity to upgrade into higher-quality space, optimize their real estate footprint to account for hybrid work or expand their footprint to accommodate growth.

Outlook

Over the past six years, significant real estate changes have occurred among Fortune 500 HQs. Continued movements among these large employers will play out in the coming years as firms continue to evaluate the purpose of physical office space, understand the best location in relation to skilled talent and leverage the role of the workplace to promote company culture and values.

Related Insights

-

Viewpoint | Future Cities

The Shifting Landscape of Headquarters Relocations: 2025 Update

May 7, 2025

The transfer of business headquarters (HQs) continues to be a significant focus in the dynamic landscape of corporate strategy.

-

Local Response | Future Cities

Headquarters Relocation Is an Opportunity to Reshape Employee Behaviors

April 1, 2024

A company’s decision to relocate its headquarters, whether locally or nationally, goes beyond just changing its physical location.

-

Viewpoint | Evolving Workforces

The Shifting Landscape of Headquarters Relocations: Trends and Outlook

December 11, 2023

U.S. companies across many industries are increasingly prioritizing headquarters (HQ) relocations as part of their corporate strategies.

Related Services

- Transform Business Outcomes

Consulting

Gain comprehensive guidance on insightful, executable real estate strategies for both investors and occupiers.

Contacts

Cliff Bell

ClientStrategyConslt Director

Victoria Patronis

Client Consulting Manager | Americas Consulting