Creating Resilience

Portfolio Optimization in Large-Cap Corporations

December 5, 2023 5 Minute Read

Introduction

Corporations and their real estate departments had to overcome tremendous adversity throughout the pandemic, and now are returning to the office in a hybrid work style which appears here to stay.

Corporate Real Estate (CRE) departments are now faced with their next challenge—portfolio optimization to account for new work styles. And C-suite leaders expect effective optimization at a time when demand for office space in many markets is quite low. While this makes it challenging to shed surplus space, occupiers can take advantage of leverage in negotiations for both new leases and renewals.

As CRE leaders prepare their strategies for portfolio optimization, a question often arises: “What are my peers doing?”

To explore this topic, CBRE Institute completed one-on-one interviews with 60 executives who lead the CRE functions for many of the world’s largest corporations. Together, these leaders are responsible for 785 million square feet and 4.3 million employees, across the sectors of Technology, Media & Telecommunications; Financial & Professional Services; Industrial & Logistics; Life Sciences and Energy.

Interview questions included such topics as:

- What are office utilization rates today? Is this steady state?

- What percentage of the office portfolio is targeted for optimization? How long will this take?

- What is the vision state of hybrid work?

- What are the deciding factors in renewing versus exiting a lease?

Given the specific study demographics focused on large-cap corporations, CBRE Institute is able to better analyze the nuanced strategies and tactics unique to companies who have a significant number of employees and large office portfolios, versus those of small- and mid-cap firms.

Research Highlights

CBRE Institute’s interviews confirm that portfolio optimization is well underway in nearly every large corporation, despite continuing uncertainty.

And CRE executives are facing tough optimization decisions when utilization is not yet at a target state—which impacts the amount of office space needed as well as the duration of planned optimization efforts. That said, a common theme from all interviews is a desire for a more efficient portfolio with an enhanced employee and client experience.

Key highlights of CBRE Institute’s findings are provided below.

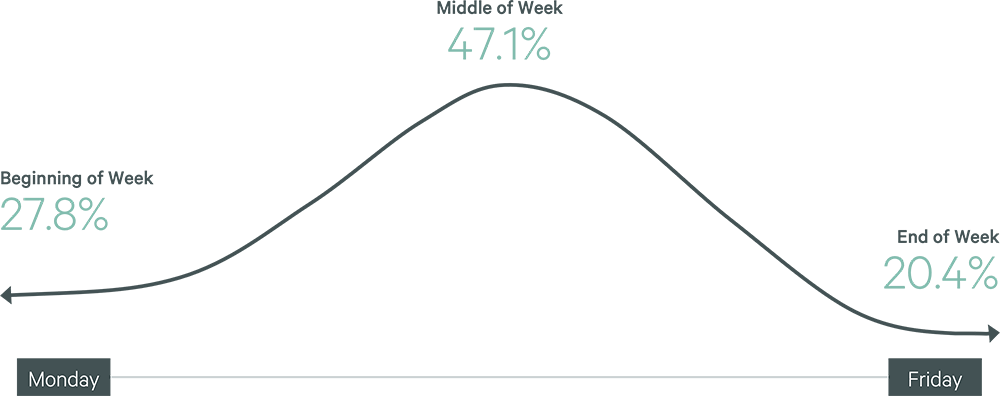

Current Utilization Rates by Day of Week

Office utilization* within large corporations currently resembles a bell curve—with occupancy levels peaking midweek at 47%.

Figure 1: On average, what is the daily utilization rate in major offices?

*Utilization rate is defined as the number of people using the space divided by the capacity of the space.

Source: CBRE Institute, 2023.

Steady State

The majority of large corporations believe there is room for improvement in office utilization, with 57% of CRE leaders noting their utilization is not yet at steady state.

Figure 2: Has your client accepted these office utilization rates as steady state?

Source: CBRE Institute, 2023.

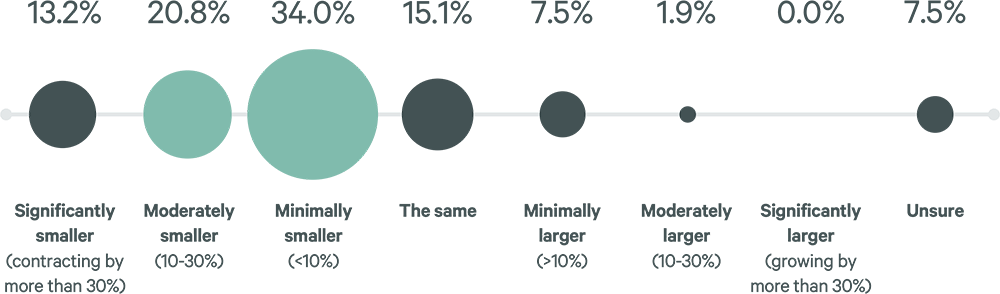

Optimization Goals

More than a third of major corporations (34%) are anticipating shedding up to 10% of their office space over the next three years. Another 20% have targets to shed up to 30% of their office portfolios. Given the average portfolio size in this study is 13 million square feet, these reductions equate to a substantial amount of space.

Figure 3: How will the office portfolio shift in the next three years (assuming only organic movement)?

Source: CBRE Institute, 2023.

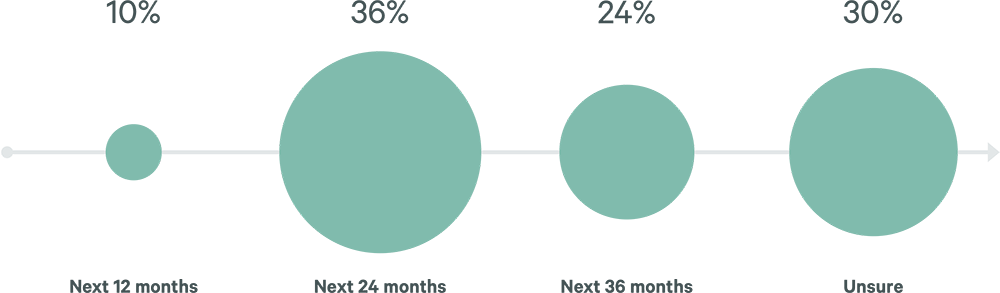

Timing of Optimization Efforts

Given the combination of large targets and state of the market, a tremendous amount of uncertainty remains about the amount of time needed to complete these portfolio optimization efforts.

Figure 4: If the portfolio is contracting, when is sentiment toward downsizing expected to cease?

Source: CBRE Institute, 2023.

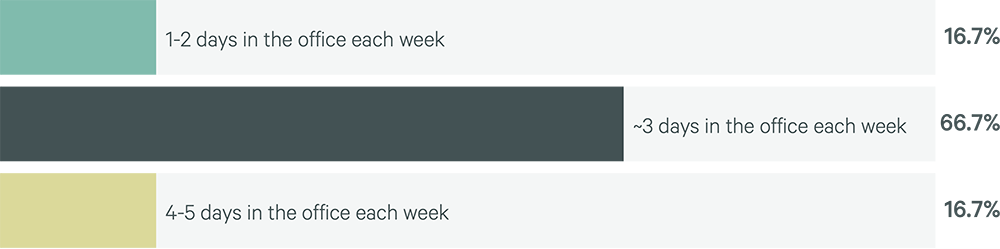

Vision State of Hybrid Work

Two-thirds of large-cap corporations in our study believe that approximately three days a week in the office is the vision state for the future of work.

Figure 5: What is your client’s vision state for office employees’ time in the workplace?

Source: CBRE Institute, 2023.

“Should I Stay or Should I Go Now?”

The #1 reason large-cap companies are renewing their office leases is due to the capital outlays required to relocate. This is followed by a landlord’s willingness to renegotiate lease terms (i.e., rental rates).

When making optimization decisions, large-caps corporations agree that the end goal is less space, but with an upgraded experience for employees and clients.

Stay

Q. What are the top three factors driving the decision to renew a lease?

- Capital cost associated with moving

- Current landlord willing to renegotiate lease terms (i.e., rental rates)

- The current market/submarket suits our employee base

Go

Q. What are the top three factors driving the decision to NOT renew a lease?

- Want to downsize amount of space but upgrade experience

- Want better lease terms/rental rates

- TIED

Want to move to a building with better amenities and services

Want to build the next generation workplace

Conclusion

C-suites and CRE leaders have decided that they can no longer wait for steady state of the future of work to unfold—optimization efforts are now fully under way.

But it’s not going to be easy. Transformational initiatives like portfolio optimization take a tremendous amount of planning, analysis (with relevant data), strategy and execution. It’s hard enough to shed surplus space in a buoyant market, but today’s challenges are exacerbated by the perfect storm of high vacancies, low demand and the fact that most large corporations are also trying to reduce their portfolios. Yet it can also be an opportune time to take advantage of the leverage occupiers currently enjoy in lease negotiations.

With challenges likely ahead, conceptualizing and sharing enterprise-aligned strategies can motivate the CRE delivery team and continue to elevate CRE’s position with the C-suite:

- Optimization has the ability to make a marked difference on occupancy costs, helping overall company profitability.

- Less space, combined with greener leases, can aid in achieving the corporation’s carbon-reduction commitments.

- Enhanced workplace experience can benefit culture, innovation and employee engagement.

Ultimately, achieving portfolio optimization during this pivotal time can further CRE’s position as a contributor to overall company success.

Additional Resources

CBRE contractual clients have access to CBRE Institute’s breadth of research, including more in-depth study results by industry sector. For additional information, please reach out to your CBRE point of contact.

CBRE Institute Leadership

Related Insights

Related Services

- Transform Business Outcomes

Real Estate Outsourcing Services

Guide transformational outcomes to create tangible value across your portfolio.

Leverage occupancy data to empower, anticipate and unlock opportunities within your portfolio.

We look beyond the traditional scope of transactions, incorporating insight from experts across our business to ensure maximum value.

- Design & Build

Project & Program Management

Deliver projects seamlessly with an integrated team that manages everything from schedules and budgets to the entire construction process.

Optimize your workplace performance and ensure success with superior facilities management and maintenance services.