Intelligent Investment

New York City Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The New York City life sciences cluster has demonstrated significant growth and momentum over the last several years. Almost 59,000 people work in the industry in New York City proper and its adjacent counties.

- New York City has approximately 2.9 million sq. ft. of life sciences lab/research and development (R&D) space, with another 200,000 sq. ft. under construction.

- Between 2019-2024, the greater New York City/New Jersey metropolitan area life sciences companies secured roughly $12.5 billion of venture capital funding—the fifth-largest amount in the world—73% of which was invested in New York City companies.

- Supporting its life sciences ecosystem are world-renowned universities (Columbia University, New York University, among others), leading health care institutions (Mount Sinai, New York Presbyterian, Weill Cornell, etc.) and prestigious research institutes (New York Genome Center).

- The National Institutes of Health (NIH) allocated almost $3.2 billion in FY 2024—the highest in the U.S.—to organizations in the greater New York metropolitan area for healthcare and life sciences initiatives.

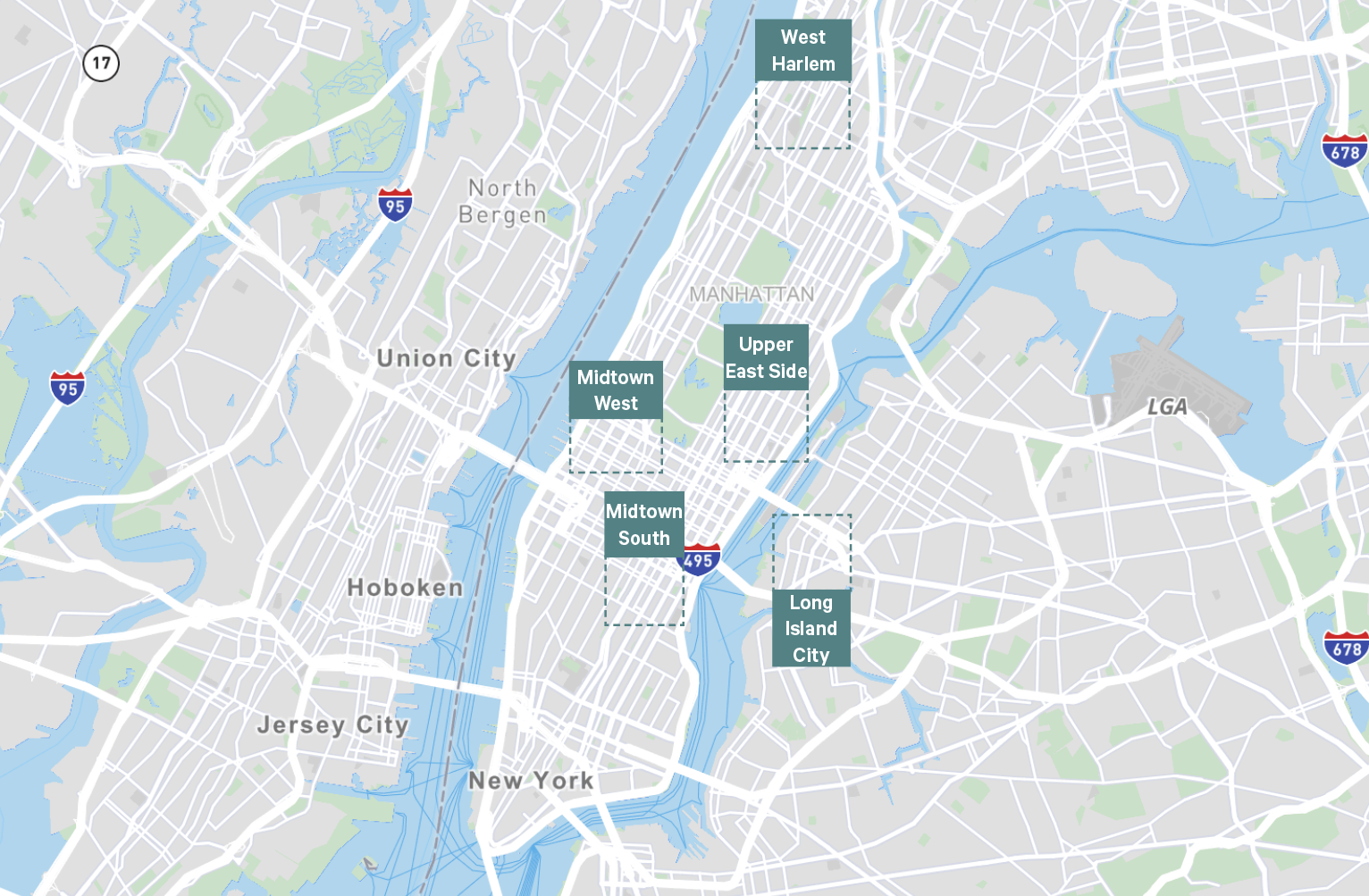

Submarkets

Industry Presence

- Roughly 59,000 people work in the New York City region’s life sciences industry (excluding New Jersey), the seventh-largest workforce in the U.S.

- In the greater New York City/New Jersey metropolitan area, more than 43,000 people work in life sciences R&D roles, the second-largest workforce in the nation.

- New York City life sciences companies secured almost $1.8 billion of venture capital funding last year, more than double 2023’s investment activity.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

Key Trends/Big News

- Smaller users increased their leasing activity in Q4, a trend that is expected to continue in 2025.

- Compared with previous years, lab demand is increasingly focused on smaller and cost-effective space.

- Academic and medical institutions continue to have interest in the NYC lab market, but demand and leasing activity remain slow.

- Chan Zuckerberg BioHub

- Eikon Therapeutics

- Graviton Bioscience

- Albert Einstein Medical Center

- Columbia University

- Icahn School of Medicine at Mount Sinai

- Memorial Sloan Kettering Cancer Center

- New York University

- Rockefeller University

- Weill Cornell