Intelligent Investment

Boston-Cambridge Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The Boston-Cambridge life sciences cluster, reflecting the Greater Boston metropolitan area, is the premier location for the life sciences industry on the U.S. East Coast, if not the entire world. Some 130,000 work in the local industry, with nearly 52,000 in life sciences research and development (R&D) roles.

- The largest inventory of life sciences lab/R&D space exists in Boston-Cambridge, encompassing just under 56 million sq. ft. Another 3.9 million sq. ft. is under construction. Supply of space is outpacing demand as of the end of 2024, causing the region’s lab/R&D vacancy rate to reach its highest level in years.

- Boston-Cambridge life sciences companies secured $55.9 billion of venture capital funding between 2019-2024, more than anywhere else in the world.

- Supporting a dynamic life sciences ecosystem are world-renowned universities (Harvard, MIT, Boston University and Tufts, among others), leading health care institutions (Massachusetts General, Brigham and Women’s, Beth Israel Deaconess and Boston Children’s) and two of the nation’s most prestigious biomedical research institutes (Whitehead and Broad).

- The National Institutes of Health (NIH) allocated almost $3.1 billion in FY 2024 to organizations in Boston-Cambridge for healthcare and life sciences initiatives, the second-highest in the U.S. metropolitan areas.

Submarkets

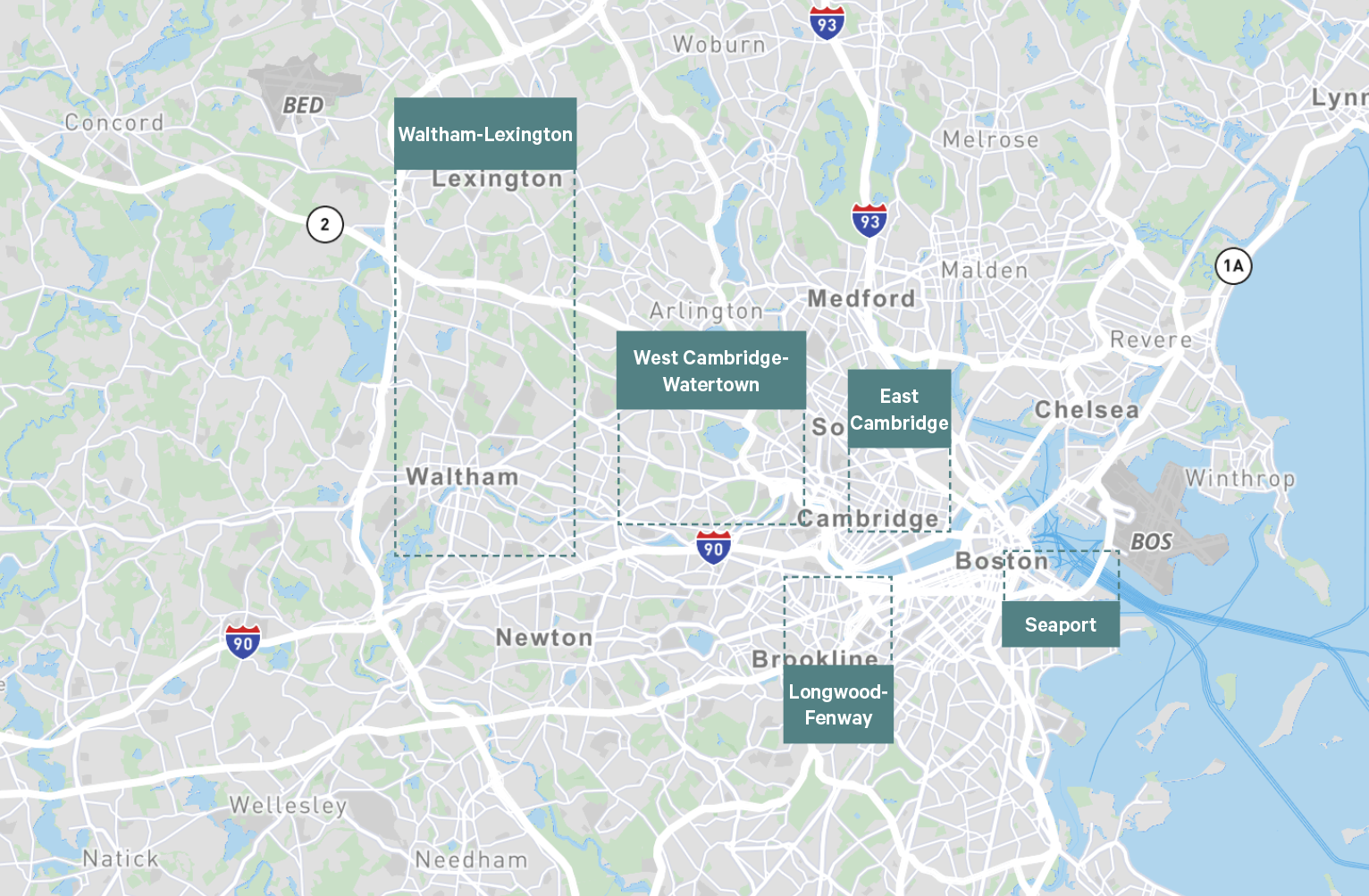

Due to its enormous size, the Boston-Cambridge market includes an abundance of submarkets and micro markets. The map shows some of the more significant clusters.

- In Boston, the Seaport has emerged as the premier destination for life sciences, but Fenway and Longwood are also vital submarkets.

- In East Cambridge, Kendall Square could be the most important submarket for life sciences in the world and has traditionally been the center of the local life sciences industry.

- West Cambridge and Watertown have grown to be key destinations for the industry, offering lower costs than Kendall Square but also a convenient location.

- The suburban market has the largest industry presence in Waltham and Lexington.

Industry Presence

- Roughly 130,000 people work in the region’s life sciences industry, comprising 5.4% of total employment in the Boston-Cambridge market, a far higher density than the U.S. average of 1.4%.

- Boston-Cambridge life sciences has more than 52,000 people in life sciences R&D roles, the nation’s largest number and strongest density.

- Boston-Cambridge life sciences companies secured almost $7.3 billion of venture capital funding in 2024, the second-largest amount across global markets.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

- Abbvie

- Alnylam Pharmaceuticals

- Amgen

- Bristol Myers Squibb

- Eli Lilly

- GSK

- Merck

- Moderna

- Novartis

- Novo Nordisk

- Pfizer

- Sanofi

- Takeda

- Vertex Pharmaceuticals

- Boston Children’s Hospital

- Boston University

- Brigham and Women’s Hospital

- Broad Institute

- Dana Farber Cancer Institute

- Harvard University

- Massachusetts General Hospital

- Massachusetts Institute of Technology

- The Ragon Institute

- Tufts University