Intelligent Investment

New Jersey Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The New Jersey life sciences cluster is one of the nation’s most mature, with deep, historical presence of the pharmaceutical industry. Almost 83,000 people work in the local industry, the fourth-largest workforce in the U.S.

- New Jersey has 18.9 million sq. ft. of life sciences lab/research and development (R&D) space, making it the fourth-largest market in the U.S. Another 1.1 million sq. ft. is under construction.

- Between 2019-2024, greater New York City/New Jersey metropolitan area life sciences companies secured roughly $12.5 billion of venture capital funding—the fifth-largest amount in the world.

- World-renowned universities (Princeton University, Rutgers University, among others) support its life sciences ecosystem, but strong depth of talent is what sets New Jersey apart.

- The National Institutes of Health (NIH) allocated almost $3.2 billion—the highest amount in the U.S.—in FY 2024 to organizations in the greater New York/New Jersey metropolitan area for healthcare and life sciences initiatives.

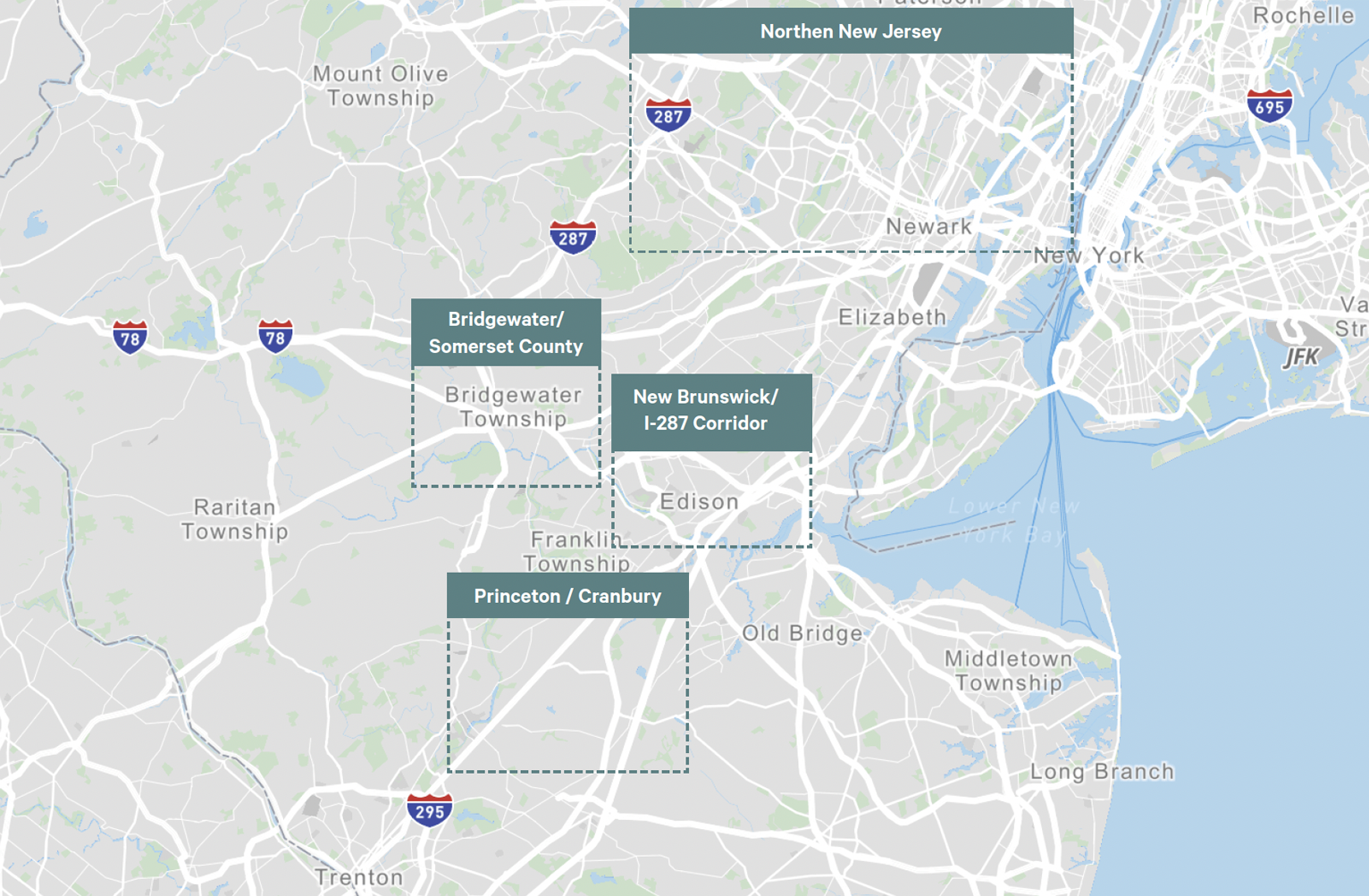

Submarkets

Industry Presence

- Almost 83,000 people work in New Jersey’s life sciences industry, the fourth-largest workforce in the U.S., comprising 3.0% of New Jersey’s total employment, more than double the industry’s U.S. concentration (1.4%).

- In the larger New York City/New Jersey metropolitan area, more than 43,000 people work in life sciences R&D roles, the second-largest research workforce in the nation.

- Greater New York City/New Jersey metropolitan life sciences companies secured almost $2 billion of venture capital funding last year.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

Key Trends/Big News

- Leasing fell by 33% quarter-over-quarter in Q4 2024 to 85,000 sq. ft.

- The vacancy rate fell by 40 basis points quarter-over-quarter to 11.3%.

- Absorption of 92,000 sq. ft. in Q4 brought the annual total to 231,000 sq. ft.

- Tenant requirements remained flat quarter-over-quarter at nine tenants in the markets.

- AstraZeneca

- Abbvie

- Bristol Myers Squibb

- Genmab

- Johnson & Johnson

- Merck

- Novo Nordisk

- Novartis

- Pfizer

- Roche Molecular Systems

- New Jersey Institute of Technology (NJIT)

- Princeton University

- Rutgers University

- Stevens Institute of Technology