Chapter 9

Case Study: Transforming Manhattan’s Financial District into a Neighborhood

Shaping Tomorrow’s Cities: Fostering Resilient and Vibrant Urban Environments

5 Minute Read

A Streetsense Case Study

Great urban neighborhoods are defined by a constellation of physical and emotional attributes. Investments in the physical environment—sidewalks with greenery and seating, pocket parks and playgrounds, pedestrian-focused signage, transit connections—help create an inviting public realm. But a great neighborhood is also a place people proudly call home, where residents feel an emotional connection to the historical context, local arts and culture and memorable brands and businesses that contribute to a sense of place.

New York’s Financial District (FiDi) is a perfect example of a business district that has evolved into a great neighborhood through a synergistic combination of attributes. Destination dining, shopping and entertainment are flourishing, along with waterfront parks and bike paths. The city’s strategic public investment complements the investments of innovative residential developers who value asset repositioning and storytelling.

Over the years, we have found that our work branding multifamily projects in the Financial District has become easier as public and private investments have ensured that residents have access to all the trappings of a true neighborhood.

The latest example of this approach—25 Water Street—comes from GFP Real Estate, Rockwood Capital and Metro Loft Management. The nation’s largest office-to-residential conversion project will transform the former 4 New York Plaza (one-time home to JPMorgan Chase) office building into more than 1,300 apartments. Renovations to the physical structure will include the addition of 10 more floors, courtyard spaces and luxury amenities. To complement this investment, CBRE joint venture partner Streetsense was engaged to develop a dynamic brand identity and marketing campaign that celebrates life within and outside the building. This is the ninth Lower Manhattan project in the Streetsense portfolio, which includes roughly 4,000 residential units within a 10-block radius.

Complex in scale, strategy and financing, the conversion of 25 Water reflects the significant impact of the COVID pandemic on Lower Manhattan real estate and the necessity of evolving old industry models in novel ways.

The genesis of FiDi’s revitalization is a story over 30 years in the making. Following the early-1990s recession that lowered the assessed value of Lower Manhattan office buildings by 28% and raised the office vacancy rate to 25%, the city of New York proposed a program of tax breaks, zoning changes and open-space and transit investments, as well as created a Business Improvement District (BID). While these plans initially languished, they were largely instituted following the Sept. 11, 2001 terrorist attacks, which resulted in billions of dollars in federal money to assist New York City’s recovery. Today, FiDi is a place that has been transformed from a central business district into a true neighborhood: The population has increased over fivefold to 66,000 residents from 13,675 since 1990, according to the Downtown Alliance.

The FiDi Playbook

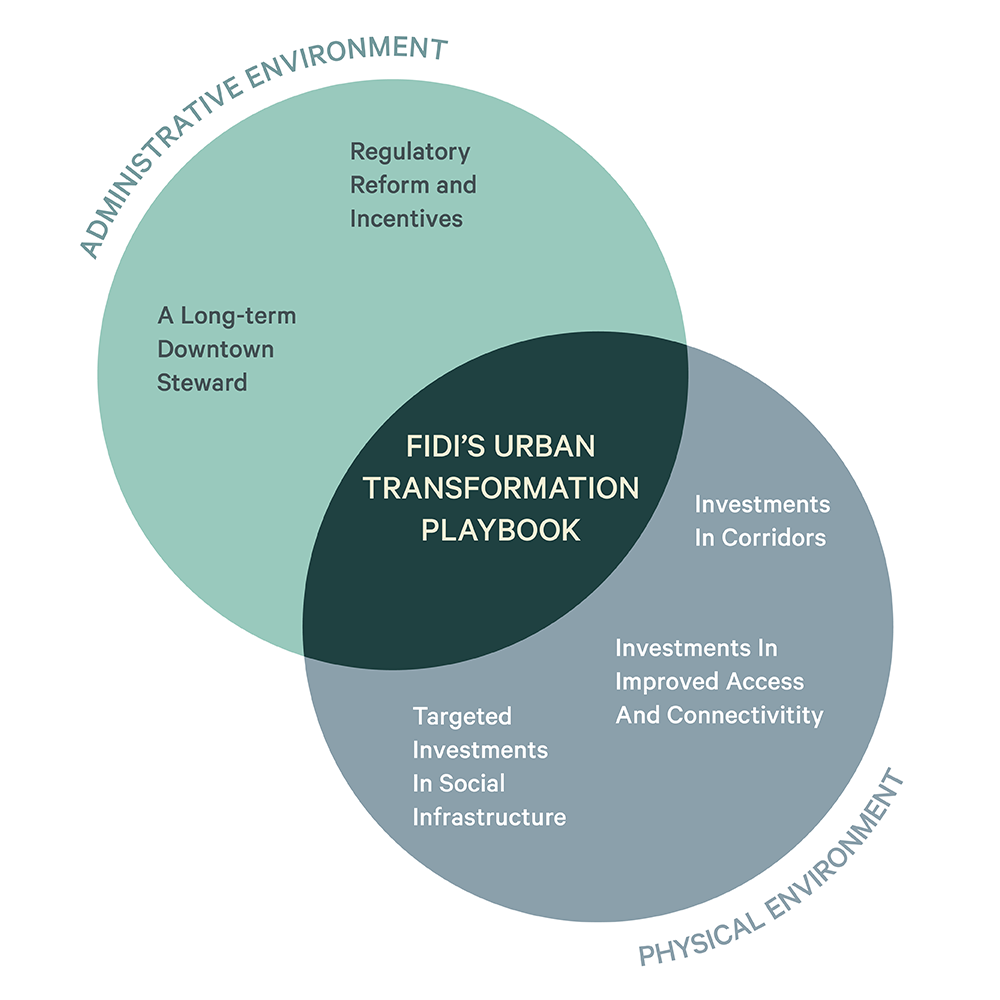

While the conditions that made this possible are unlikely to be repeated, the FiDi playbook offers valuable lessons. The five-pronged investment strategy that included regulatory reform and incentives, improved access and connectivity, significant enhancements to both public streets and recreational spaces and the establishment of a Business Improvement District now serves as an invaluable steward and champion for the district.

Regulatory Reform & Incentive

A rezoning effort in 1995 that lifted the floor-area-ratio cap and simplified conversion processes, coupled with a tax abatement program, catalyzed a significant shift in the Financial District's buildings. The program successfully incentivized property owners to convert office spaces into residential units. Over the years, 19.7 million sq. ft. were repurposed for residential use, with 76% of these conversions occurring after 2001. This not only addressed the surplus office space issue but also laid the foundation for a more balanced and diverse community.

Public Realm Investments

Investments in Improved Access & Connectivity

The transformation of the Fulton Street Transit Center played a pivotal role in enhancing downtown infrastructure. With substantial federal support, the previously dilapidated subway hub became a modern transportation nexus with retail offerings. Excellent subway access and a clean and comfortable station further solidified the area's appeal, making it easily accessible from various parts of the city.

The introduction of micro-mobility initiatives, such as the Citibike program, further complemented these improved transit options. Comprehensive waterfront bike paths surrounding FiDi and an expanded bike network seamlessly connected the district to neighboring areas, providing residents with sustainable and convenient transportation alternatives.

Finally, a robust ferry system, including a state-of-the-art terminal at Wall Street, offered improved connections to Brooklyn, Staten Island, Hoboken and Jersey City. This maritime network not only facilitated commuting but also added a scenic and efficient—not to mention tourist friendly—dimension to the district's transportation options.

Investments in Corridors

Investments along major commercial corridors like Fulton Street and Nassau Street were instrumental in redefining Lower Manhattan's urban landscape. The $37 million Fulton Corridor Revitalization Project included upgrades to both streets and storefronts. Among the improvements were new sidewalks, curbs, street furniture, lighting, greenery and pedestrian-friendly wayfinding elements, as well as upgraded storefronts and building facades.

Targeted Investments in Social Infrastructure

In the early 2010s, targeted investments in playgrounds and park renovations further revitalized key areas along the Fulton Street corridor for a growing residential community. These investments included the Pearl Street Playground, the pedestrianization of Pearl Street, the expansion of DeLury Square Park and the addition of 22,000 sq. ft. of new open space and a playground at Burling Slip, gradually transforming the district into a family-friendly environment. Titanic Memorial Park and Imagination Playground also were upgraded, contributing to the overall quality of life in the Financial District.

The redevelopment of the South Street Seaport and waterfront areas further enhanced the district's appeal. This not only revitalized historic sites but also created new opportunities for leisure and recreation along the water's edge.

Organizational Capacity

A Long-Term Downtown Steward

The Alliance for Downtown New York—one of the city’s first BIDs—was founded in 1995 to address a number of issues, including high office vacancy rates, empty storefronts and crime. Today, the BID’s $22 million budget, funded by tax assessments on buildings within the BID, goes to a mix of sanitation and security, marketing, economic development, capital improvements and advocacy. The BID continues to play a pivotal role in helping turn the district into a mixed-use residential neighborhood.

A strategic combination of regulatory reform, transportation improvements, thoughtful public space investments and organizational stewardship has played a pivotal role in transforming the Financial District from an office district into a well-connected, diverse and vibrant neighborhood with a mix of uses and users. The once purely financial hub now stands as a testament to the powerful impact that complementary public and private investments can make in downtown environments.

Related Services

- Property Type

Office

Use the world’s most comprehensive real estate services platform to find innovative solutions for your needs as a corporate occupier or office investor.

- Property Type

Multifamily

Unlock the potential of your residential real estate with expert investment, financing, valuation, due diligence, design, management and leasing strat...

- Transform Business Outcomes

Consulting

Gain comprehensive guidance on insightful, executable real estate strategies for both investors and occupiers.

- Property Type

Retail Services

With integrated solutions, unique insight, and unmatched experience, we deliver successful outcomes for retailers, restaurateurs, investors, owners, a...

- Property Type

Hotels

CBRE Hotels delivers bottom-line impact to hotel clients globally by providing advisory, capital markets, investment sales, research & valuation s...

Related Insights

-

Podcast | Future Cities

Dancing in the Street: Fried Frank's Mechanic and Werner on New York City’s revival

April 30, 2024

Fried Frank’s Jon Mechanic and Michael Werner—attorneys steeped in the in’s and out’s of New York City dealmaking—share thoughts on the office market, affordable housing, recent legislative changes and much more.

-

Podcast | Future Cities

Land of Hope and Dreams: Nashville is booming. What’s next for the Music City?

April 23, 2024

What’s attracting young people, businesses and investment capital to Nashville? Highwoods’ Alex Chambers and CBRE’s Elizabeth Goodwin explain how the Music City has created a cool culture.

-

Tampa, Florida, is one of the hottest markets, with live-work-play appeal and the U.S.’s fourth-strongest labor market, according to a recent Wall Street Journal analysis. Tampa investor/developer Darryl Shaw and CBRE’s Mike DiBlasi explain how the city has become a magnet for institutional capital, expanding employers and top talent, and what other mid-size markets can learn from it.