Future Cities

More Office Conversions Underway to Revitalize Downtowns

April 11, 2024 2 Minute Read

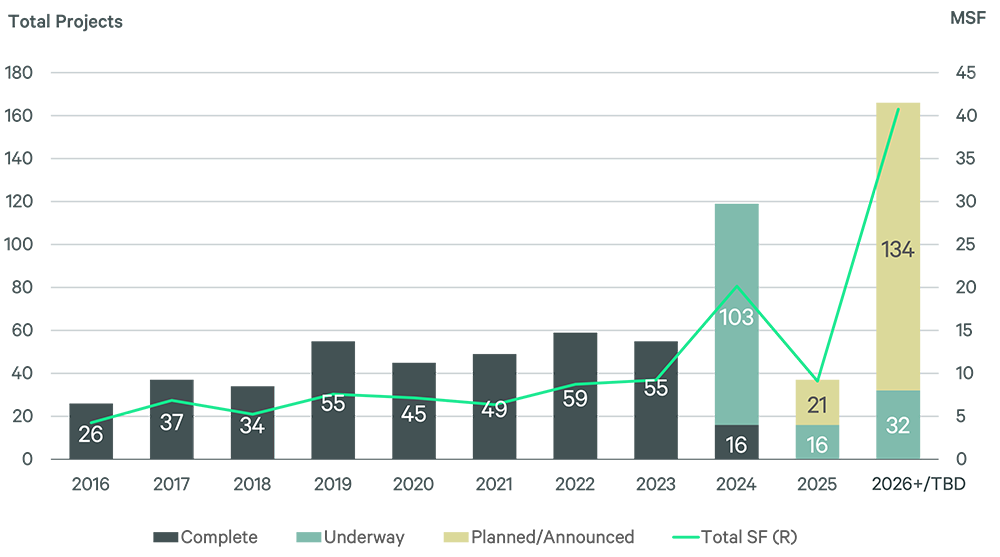

There has been a notable increase in office-conversion projects over the past six months, as urban office districts undergo a much-needed transformation. Nearly 70 million sq. ft. of office space or 1.7% of total U.S. supply was undergoing conversion to other uses in Q1 2024, up from 60 million sq. ft. or 1.4% of total supply in Q3 2023.

Office-conversion completions are expected to more than double this year over last. And with hundreds more of these projects in the pipeline, many urban office centers are slowly being transformed into more vibrant, commercially diverse districts.

Approximately 120 office-conversion projects nationwide—one-third of them to multifamily—are expected to be completed this year, compared with an annual average of 45 between 2016 and 2023. This pipeline indicates higher-than-average conversion completions over the next several years.

Figure 1: Office Conversions by Construction Status & Estimated Year of Completion

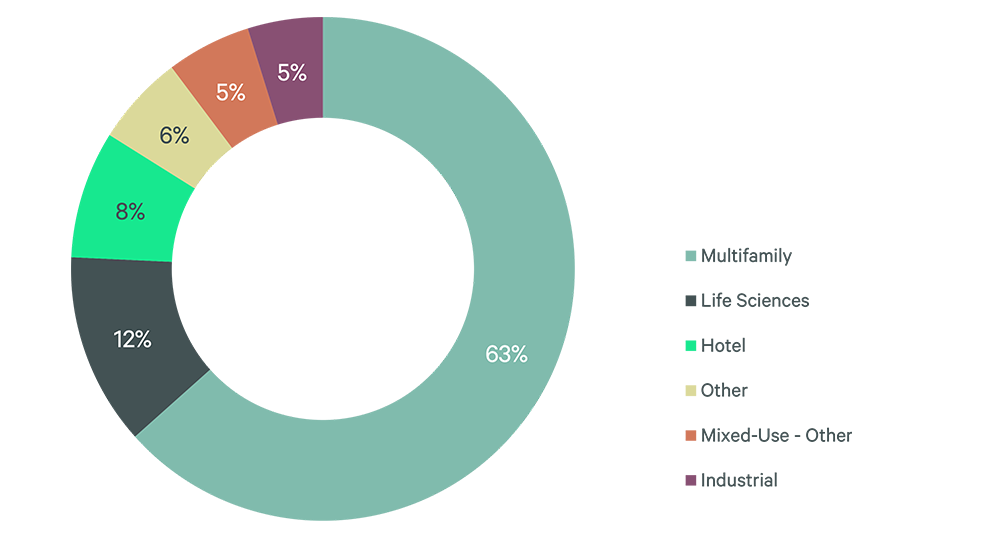

Office-to-multifamily conversions, including mixed-use residential, account for 63% of the office space currently undergoing or planned for conversion. Since 2016, 133 office-to-multifamily conversions created more than 22,000 apartments. The 169 underway or planned projects are estimated to produce another 31,000 apartments over the next several years. Nevertheless, this additional supply represents less than a half-percent of total U.S. apartment inventory and will do little to alleviate the broader U.S. housing shortage.

Figure 2: Underway/Planned Office Conversions by New Property Type

*"Other" includes retail, senior and student housing, schools and data centers.

**Multifamily and Hotel include mixed-use projects anchored by the respective property type. "Mixed-Use - Other" includes projects without multifamily or hotel components.

Markets with a lot of older office buildings have the most office conversions planned or underway. Cleveland has the highest percentage of its total office inventory (11%) undergoing or planned for conversion, while Houston has the most total square footage at 6.2 million. Eight of the top 10 markets for conversion activity had an office vacancy rate above the 18.6% U.S. average as of Q4 2023.

Downtown Cleveland is a notable example of an office-dense urban market that has benefited from converting outdated and largely vacant office buildings into apartments and hotels. Since 2016, more than 3.5 million sq. ft. of downtown Cleveland office space has been converted to other uses, resulting in an 18% reduction in its total office inventory and reducing its vacancy rate to 17.3% from 19.7%.

Figure 3: Top 10 Markets for Planned/Underway Conversions as Percentage of Total Office Inventory

*Markets with office vacancy rate greater than U.S. average as of Q4 2023.

Source: CBRE Research, Q1 2024.

Although converting mostly vacant office buildings to more marketable uses such as housing appears to be a simple solution, the high cost of such projects is often prohibitive. Conversion costs generally range between $250 and $650 per square foot, depending on the complexity of the project. High interest rates are an additional challenge, although CBRE expects rates will begin to fall later this year.

Many state and local governments are considering subsidizing conversion projects, as well as easing zoning restrictions and speeding up the approvals process. This type of public support is a welcome incentive to reinvent America’s downtowns.

Explore U.S. Office Conversion Projects

Related Service

- Property Type

Office

Use the world’s most comprehensive real estate services platform to find innovative solutions for your needs as a corporate occupier or office investor.