Chapter 1

Life Sciences Innovation & Expansion

2024 U.S. Life Sciences Outlook

5 Minute Read

Looking for a PDF of this content?

Various drivers of life sciences industry expansion appear well entrenched, acting as a stabilizing force in the near term and a catalyst for long-term growth.

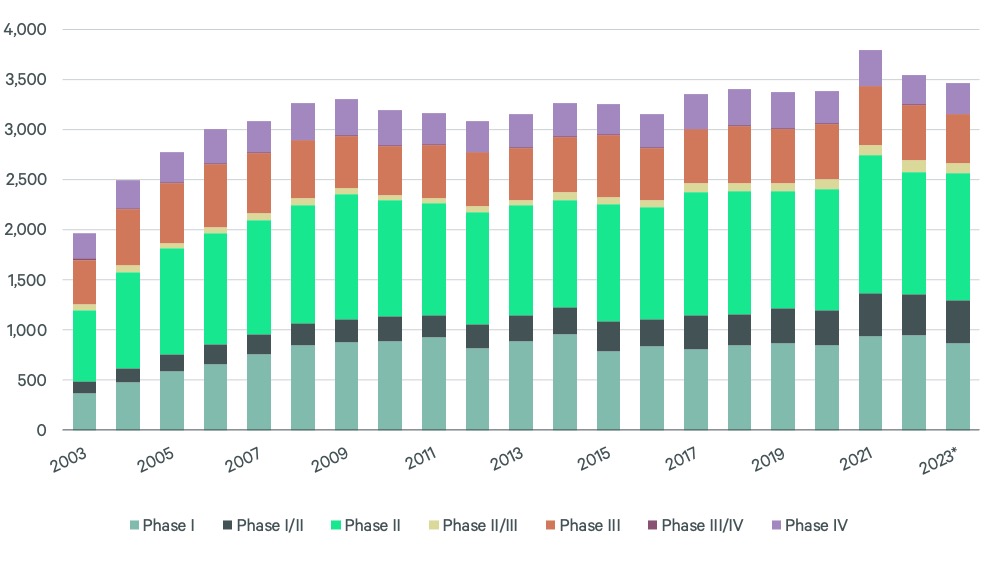

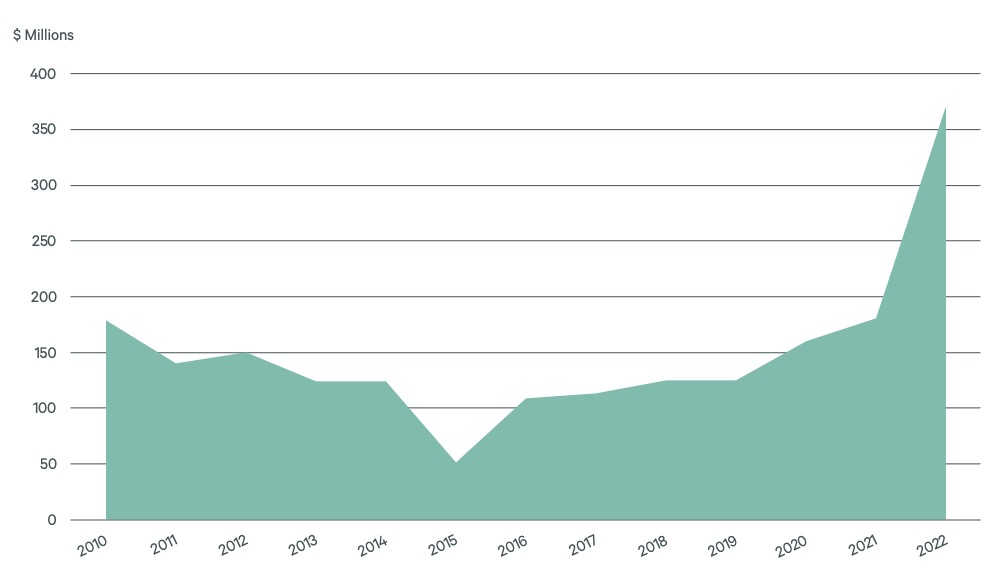

The number of drug clinical trials in the U.S. has stabilized to more normal levels since a surge in 2021 but remains elevated (Figure 1). Furthermore, the current share of trials in Phase 1 or 2 stages (71.4%) is at its highest in over two decades, potentially leading to above-average growth of drug approvals and company formations.

Figure 1: U.S. Clinical Trials of Drugs

Note: Interventional trials planned, completed or ongoing. Excludes device, surgical, diagnostic and behavioral studies.

Source: GlobalData, Q4 2023.

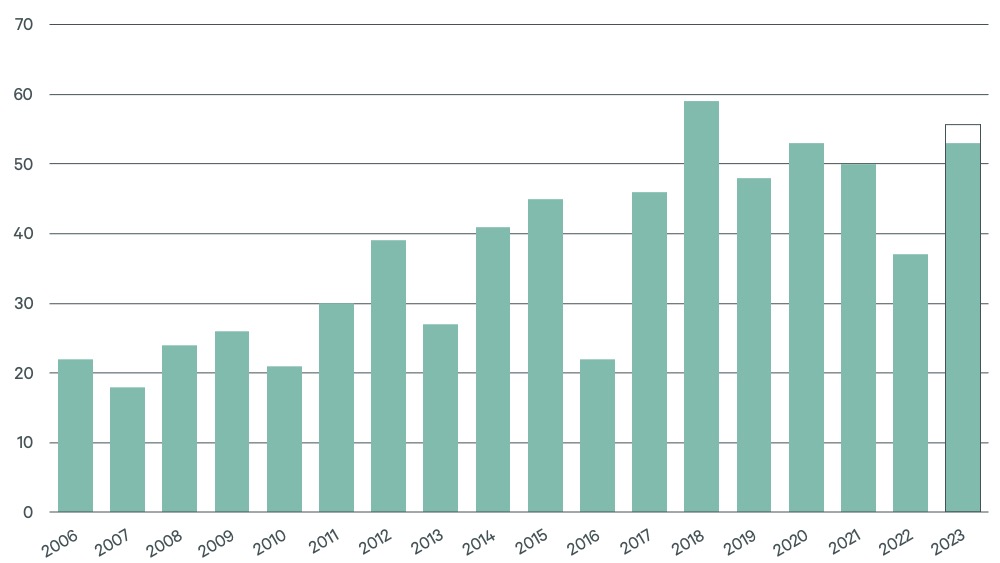

2023 is on track to be one of the top three years for novel drug approvals by the U.S. Food & Drug Administration (FDA). While the uptick likely reflects some of the backlog the FDA has been clearing since the pandemic, it also underscores a high degree of industry innovation.

Figure 2: FDA Novel Drug Approvals

Source: U.S. Food & Drug Administration, CBRE Research, Q4 2023.

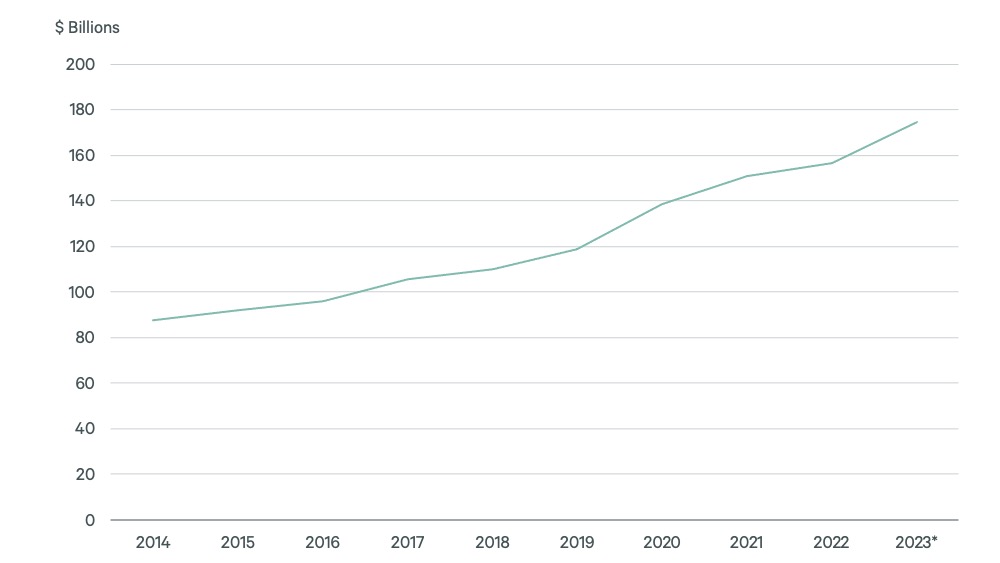

Despite a decline in venture capital funding and IPO activity, the amount of R&D spending by public companies continues to rise (Figure 3).

Even in the peak year of 2021 for venture capital funding, public life sciences company R&D expenditures of $151 billion were roughly triple the amount of venture capital and IPOs in the U.S.

In many respects, R&D spending reflects the much more favorable conditions for large-cap life sciences companies in today’s business environment that will underpin growth of the industry.

Figure 3: Public Life Sciences Company R&D Expenditures

Source: S&P CapitalIQ, Q4 2023.

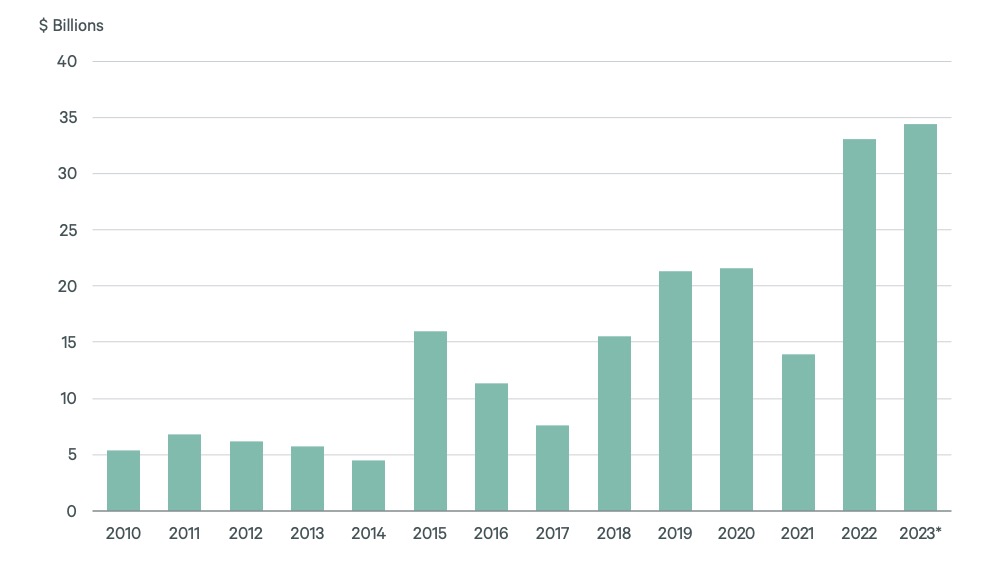

The more favorable financial status of large-cap life sciences companies has enabled them to commit to record-setting partnership deals and licensing activity.

There has been a surge in partnering deals since the decline in equity markets and venture capital funding, as less-capitalized companies became more agreeable to deals with stronger partners.

In some of these partnerships, efficiencies and risk reduction can help advance certain scientific work that might otherwise be curtailed. Despite some successful outcomes, other companies are cutting their research pipelines and trials to operate in a less-favorable economic environment.

Figure 4: Life Sciences Industry Partnering Deal Value

Source: GlobalData, Q4 2023.

Although a smaller source of life sciences funding, philanthropic grants are growing (Figure 5). One of the most notable new sources of philanthropic funding is the Chan-Zuckerberg Initiative, which provides funding to life sciences ventures and has established the Chan-Zuckerberg Biohub Network in San Francisco, Chicago and New York City.

Figure 5: Philanthropic Grants for Life Sciences

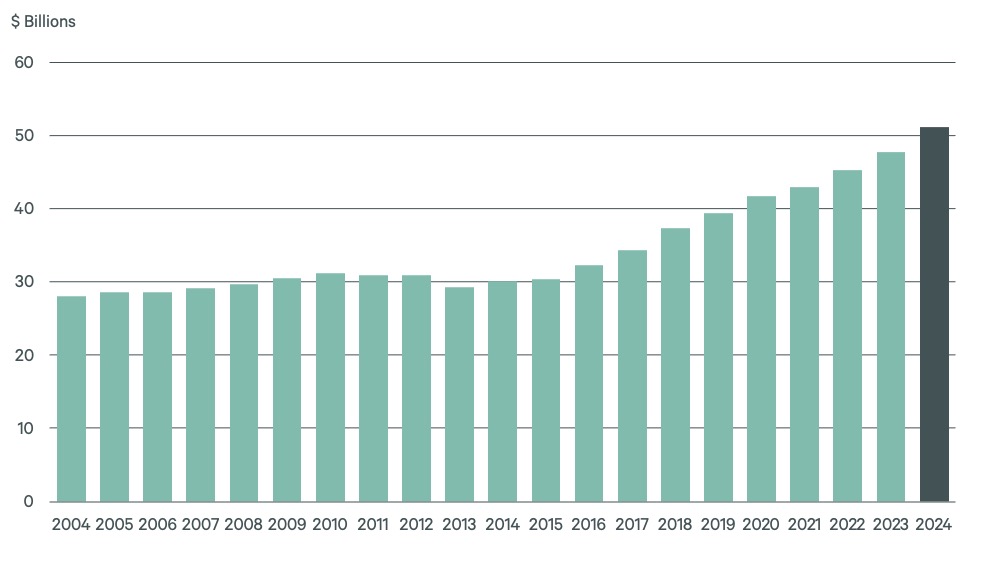

Annual funding from the National Institutes of Health (NIH) has continued to grow since 2016. A requested 7.2% increase in NIH appropriations for fiscal year 2024 would be the second largest since 2003.

Figure 6: Funding Appropriations for National Institutes of Health

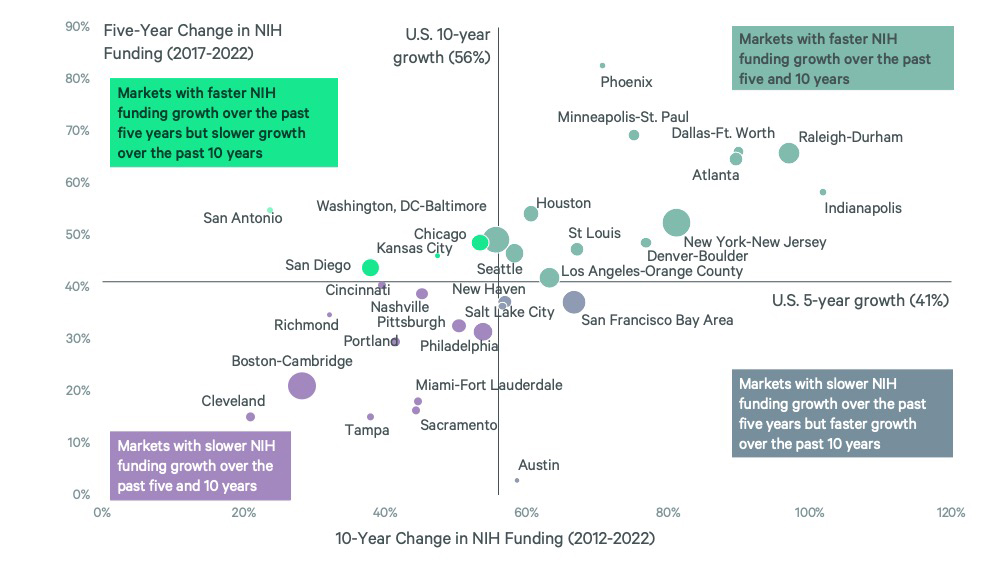

Markets with the biggest increases in NIH funding over the past five and 10 years include Raleigh-Durham, Dallas-Fort Worth, Atlanta, Phoenix, Minneapolis-St. Paul and Indianapolis (Figure 7). The large markets of New York-New Jersey, Washington, D.C.-Baltimore and Los Angeles-Orange County also grew at an above-average pace, while the premier life sciences markets of Boston-Cambridge, the San Francisco Bay Area and San Diego had more moderate growth in NIH funding over the past decade.

Figure 7: NIH Funding Growth for Major U.S. Markets

Source: National Institutes of Health, CBRE Research, Q4 2023.

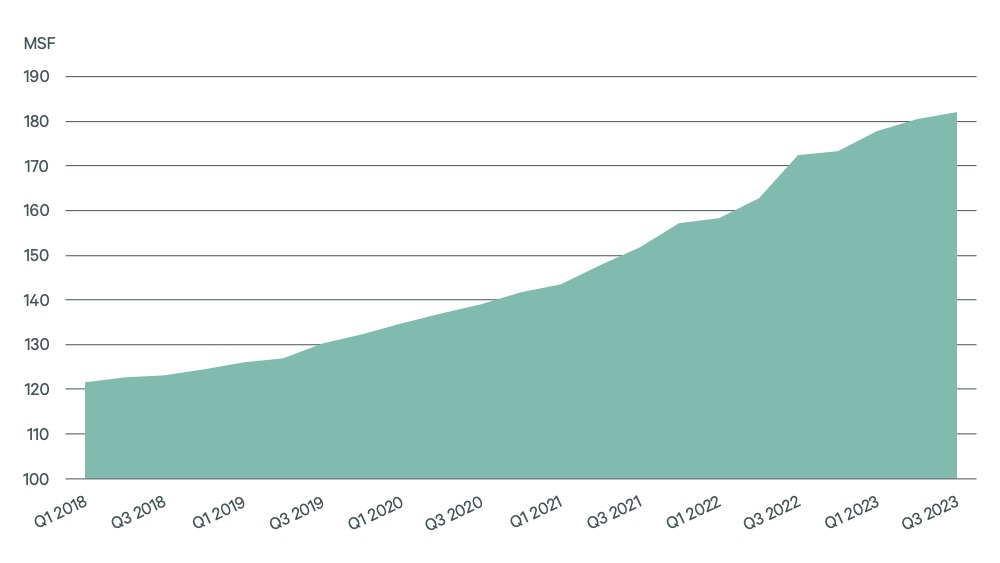

Ongoing scientific discovery, supported by major sources of private and public capital, continues to fuel increased demand for lab/R&D space. To meet this demand, total inventory of lab/R&D space in nine major markets has grown by 48% or roughly 59 million sq. ft. over the past five years. Construction deliveries of several million more sq. ft. are expected in 2024.

Figure 8: Total Lab/R&D Space in Nine Major Markets*

Source: CBRE Research, Q4 2023.

To meet demand, lab/R&D space in nine major markets has grown by 48% or roughly 59 million sq. ft. over the past five years.

Related Services

- Property Type

Life Sciences

We provide the life sciences industry solutions that maximize facility and investment performance across labs, manufacturing space and critical enviro...

Related Insights

-

Life sciences employment growth has slowed to 1.4% since January—slightly above the 1.0% increase in total U.S. nonfarm payrolls.