Chapter 3

Employment Trends & Outlook

2024 U.S. Life Sciences Outlook

5 Minute Read

Looking for a PDF of this content?

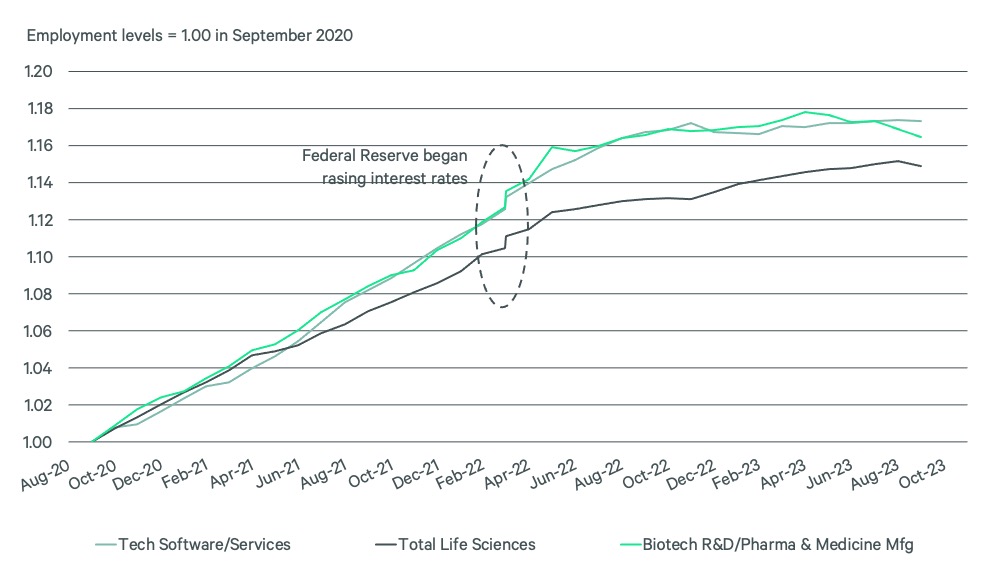

Life sciences job growth has slowed to an average of 2,921 per month since July 2022 from more than 10,000 per month in 2021. This slowdown is even more pronounced in the Biotechnology R&D and Pharmaceutical & Medicine Manufacturers sectors (Figure 15), which have been a key source of demand for top-tier lab/R&D space in the U.S. over the past few years.

Figure 15: U.S. Employment by Industry

Despite total life sciences employment continuing to grow, the number of life sciences companies announcing layoffs remains relatively high, although down from earlier in 2023.

While anecdotal evidence and employment data suggest that some of those laid off have been rehired, layoffs picked up again in November 2023.

Figure 16: Number of Life Sciences Companies Announcing Layoffs

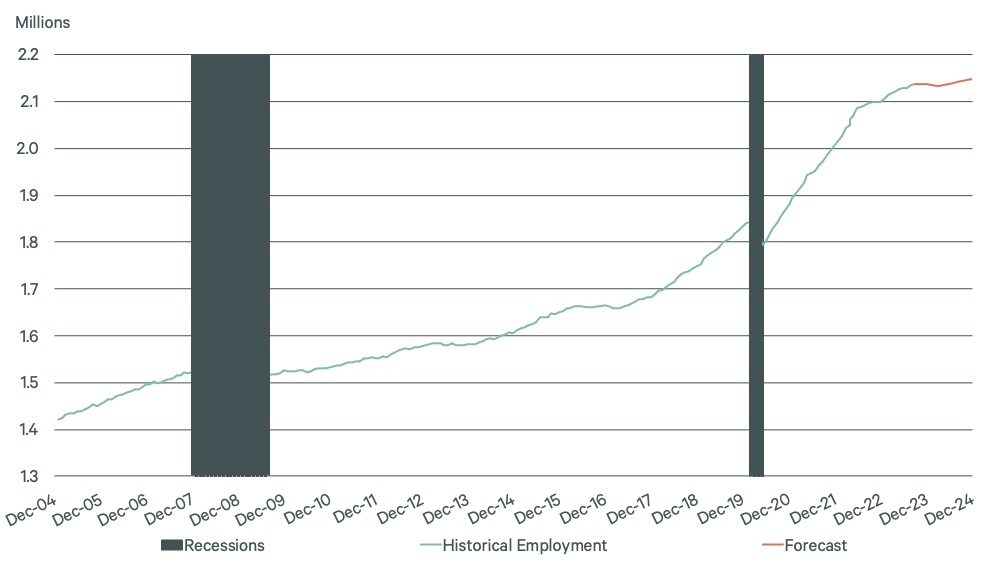

A limited amount of life sciences job losses is expected amid an economic slowdown in 2024 (Figure 17). A modest 0.2% drop in life sciences employment in the first half of 2024, followed by mild growth in the second half, should ultimately result in higher life sciences employment at the end of 2024 than in 2023. By comparison, total life sciences employment during the Global Financial Crisis fell by 6.3% and took three years to recover.

Figure 17: Total U.S. Life Sciences Employment Forecast

Related Services

- Property Type

Life Sciences

We provide the life sciences industry solutions that maximize facility and investment performance across labs, manufacturing space and critical enviro...

Related Insights

-

Life sciences employment growth has slowed to 1.4% since January—slightly above the 1.0% increase in total U.S. nonfarm payrolls.