Affordable Housing

With a dedicated team of professionals, we provide investment sales, debt and structured finance, and investment banking services for owners and investors in affordable housing.

Learn More About Our Team

See why we are the leader in the affordable housing space.

Download Capabilities-

$1.42B

Investment properties listed

and on the market -

$1.28B

Financing closed in 2024

-

$49.1B

Closed transaction volume all-time

Unsurpassed National Track Record

Multifamily Insights

-

Underwriting assumptions for core multifamily assets improved in Q1, while those for value-add assets slightly weakened. Buyer and seller sentiment improved for both core and value-add assets.

-

Renter demand outpaced new deliveries in Q4, lowering the overall multifamily vacancy rate to 4.9%—slightly below its long-run average of 5.0%.

-

Brief | Intelligent Investment

Multifamily Underwriting Assumptions Mostly Unchanged in Q4

January 23, 2025

Underwriting assumptions for both core and value-add multifamily assets were mostly unchanged in Q4.

-

James Millon, President U.S. Debt and Structured Finance, joins the capital markets conversation to talk about his view on markets in 2025.

-

With continued solid fundamentals, multifamily is the most preferred asset class for commercial real estate investors in 2025.

-

Article | Intelligent Investment

Resilience and Opportunity: The Future of Affordable Housing Investment

November 18, 2024

In this episode of Capital Markets Conversations, Armand Tiberio, Vice Chairman of the CBRE Affordable Housing team, discusses the current state of the affordable housing market and where the best opportunities are in 2025.

-

The overall multifamily vacancy rate fell to 5.3% in Q3 as demand outpaced new deliveries.

-

Brief | Intelligent Investment

Core and Value-Add Multifamily Metrics Improve in Q3

October 28, 2024

CBRE Research is pleased to announce the expansion of its quarterly Multifamily Underwriting Survey in Q3.

Investor Preferences

Interested in affordable housing? Let us know more about what you are looking for.

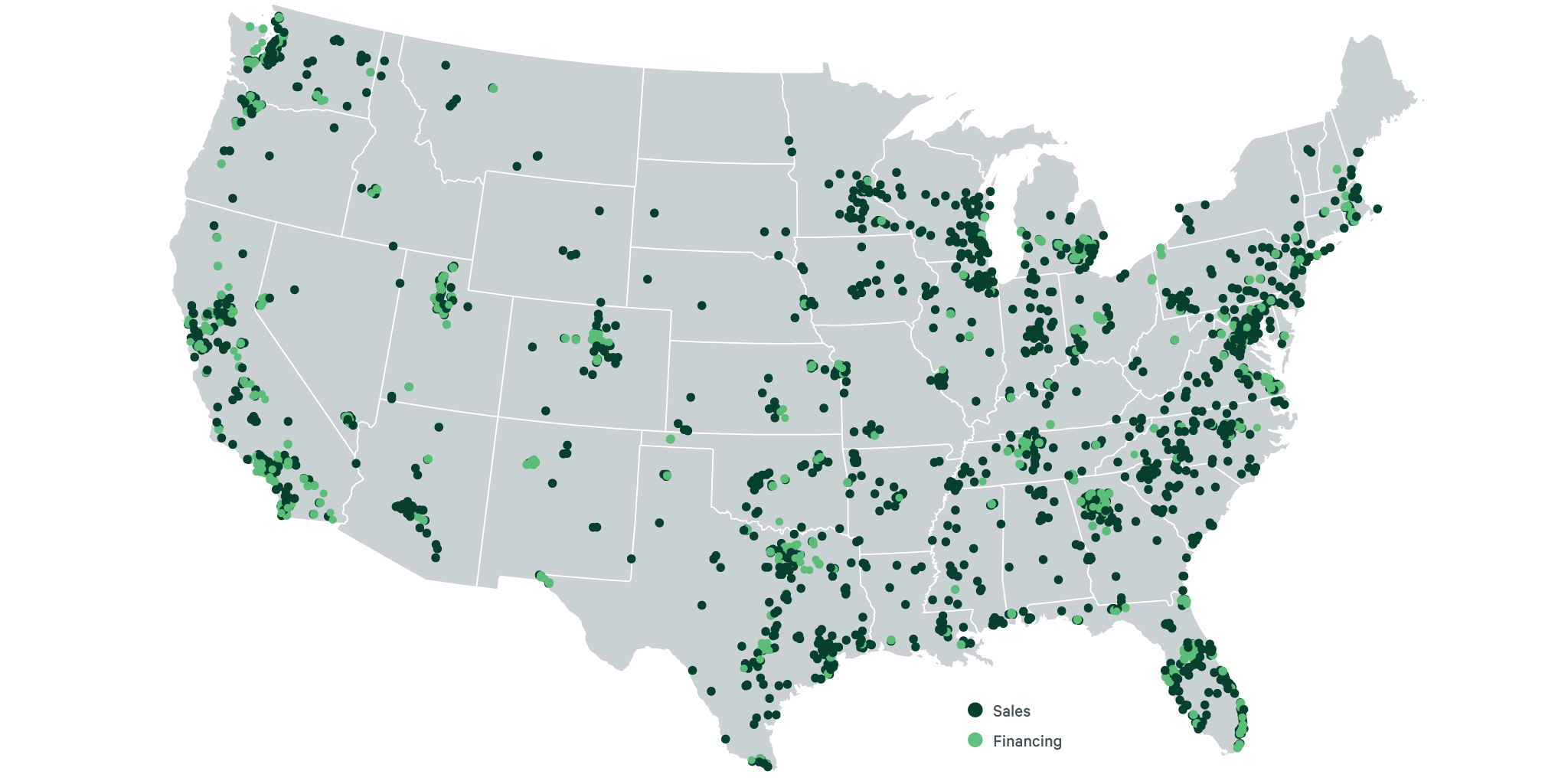

Our platform size and transactional experience with LIHTC and Section 8/HAP contract properties has provided us with a comprehensive database of more than 40,000 affordable properties nationwide—giving us insights into almost every market in the country. To support our client efforts, we partner with CBRE offices nationwide to provide unparalleled access to local information anywhere that you own an affordable asset. Our passion and commitment to building trusted client relationships is at the core of our business.

-

$27.3B

Closed Sales Volume All-Time

-

$1.7B

Property Value Currently on the Market

-

1.88M+

Units Valued Nationwide

View Our Listings

Our Investment Properties team represents buyers and sellers of all sizes and property types, from large portfolios to single-asset sales.

Our expertise and ability to handle transactions of all sizes has allowed us to support many sellers who are interested in selling their entire portfolios, as well as those buyers or owners who are looking to finance several properties at the same time. In addition, our lending team has been at the forefront of educating institutional buyers on the nuances of affordable housing financing allowing new capital to flow into the industry.

- Affordable Housing Preservation

- Credit Facility

- Healthy Housing Rewards – Enhanced Resident Services

- Healthy Housing Rewards – Healthy Design

- MBS as Tax-Exempt Collateral (MTEB)

- Unfunded Forward Commitment

- Workforce Housing: Sponsor-Initiated Affordability

- Structured Adjustable Rate Mortgage Loans (SARM Loans)

-

$15.1B

Closed Financing since 2016

-

1,130+

Properties Financed

-

$1.28B

Closed Financing in 2024

CBRE Affordable Housing does a great job putting all the pieces together for a successful closing. A major advantage is their expertise in affordable housing, which produces competitive terms on each deal.

Our Investment Banking team was created to leverage our deep understanding of affordable housing and industry relationships to bring a full range of investment banking services to our clients. Understanding drivers of value in affordable housing and our client’s business objectives, our team works with institutional capital partners to add value to every transaction.

In partnership with the global CBRE Investment Banking team, we offer:

- M&A

- Capital raising – recapitalization, acquisition and growth capital

- Buy-side advisory services

- Business analysis and planning

As part of our integrated affordable housing platform, our Investment Banking team brings together asset valuation, debt financing expertise and market transaction knowledge with institutional capital providers in the market.

-

$6.7B

Transaction and Equity Volume Closed

-

$19.0B

Real Estate Value Closed

Learn About Our Investment Banking Services

Our Investment Banking team provides time-efficient, strategic and innovative solutions for affordable housing operators and investors.

Our team has industry leading experience in the Affordable Housing space, providing non-profits with the insights that you need to maximize the management of your portfolio. We provide in-depth market and local knowledge that helps non-profit leaders to make well-informed decisions. Our portfolio management solutions include:

- Financing solutions

- Land acquisition

- Out-of-the-box thinking for acquiring new affordable units

- Portfolio and property valuation

- Property sales and ownership restructures

Quick Guide Refinancing Next Steps

Unmatched expertise and innovative solutions for financing

Our financing team works closely with non-profit clients to meet their financing needs. We strive to be our client's financing partner, analyzing alternative financing scenarios and suggesting creative deal structures to achieve your organization's goals, whether that is closing an acquisition, refinance, or construction loan.

Solutions include:

- Bond structuring and financing

- Fannie Mae and Freddie Mac lending programs

- Construction loans

- FHA Expertise

- New construction and resyndication debt structuring

Creative solutions and proven outcomes for portfolio management

A strategic review and asset-level valuation is the first step to portfolio-level analysis. Following completion of a property valuation, CBRE's unmatched volume in underwriting provides highly accurate peer-group data points to help identify opportunities for improvement. A strategic recommendation will then be provided to drive client decision-making for the eventual execution of operational goals that may include acquisitions, dispositions, or retaining assets and implementing post-analysis operational changes.

Real Solutions for Non-Profits

Creative financing utilizing recycled bonds allows non-profit to turn an assisted living facility into affordable housing.

LA-based non-profit secures low interest rate through a Fannie Mae M.TEB loan utilizing 501(c)(3) bonds.

CBRE partners with Housing Authority to finance 459 units of permanent supportive housing in LA using CA’s Homekey program.

CBRE partners with Seattle non-profit to meet their mission goals by finding a buyer dedicated to keeping the property affordable.

Why Choose CBRE?

-

Trust Our

ExpertiseCBRE has more expertise in the Affordable Housing industry than any other commercial real estate firm nationwide. The power of our experience and the strength of our track record provides us with the expertise to craft solutions for any need. Our unmatched database of sales and expense comps allow us to guide our clients to well-informed decision backed by hyper-relevant data.

-

Maximize Your Portfolio

CBRE works with you to come up with the best solutions for your unique portfolio. Whether that be financing options, management optimization, or valuations and dispositions – we have an answer to your tough portfolio questions.

-

Meet Your

GoalsWe work with you to achieve the goals for your organization – ensuring that you are meeting your mission and the expectations of your board. We know that all non-profits are different and we strive to achieve your unique best outcomes.

Non-Profit Contacts

Leadership

Investment Properties

Debt & Structured Finance

Micah Springston

LP - Vice President