Creating Resilience

Reports of Street Retail’s Demise Are Greatly Exaggerated

May 13, 2024 4 Minute Read

While some retailers are showing a greater preference for suburban locations, most have not abandoned their urban retail storefronts as some observers had predicted. And although some downtown shopping districts have been hampered by increased crime and sluggish office attendance, many others have recovered to a healthy state.

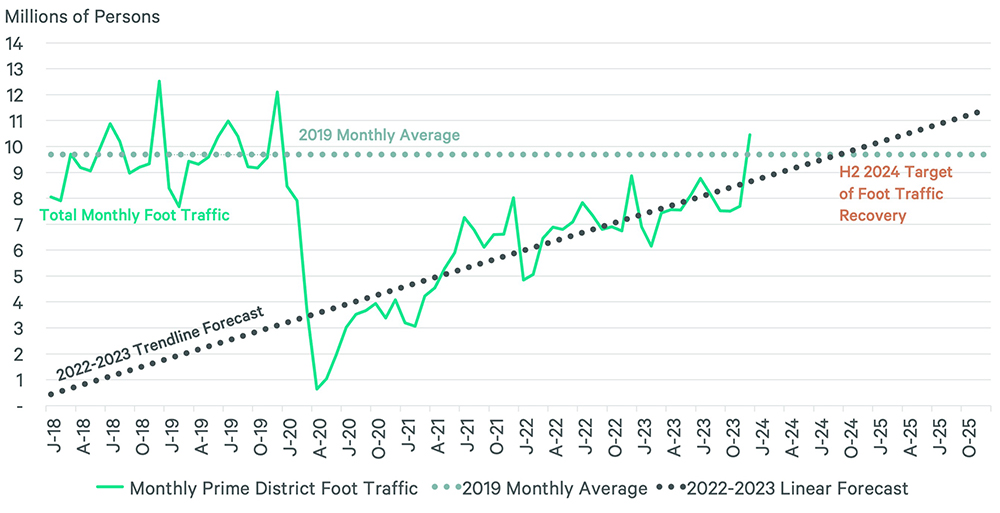

Although the pandemic had a profound impact on prime retail districts, a strong recovery has been underway over the past several years. Average monthly foot traffic last year in 10 prime retail districts tracked by CBRE had recovered to 81% of pre-pandemic 2019 levels. Traffic is expected to fully recover by Q3 2024 and could potentially surpass previous levels by the end of 2025.

Although foot traffic has not yet been fully restored, many retailers are reporting sales surpassing pre-pandemic levels. This trend suggests alignment with the Pareto Principle, which if applied to retail suggests that 80% of sales come from 20% of consumers. High-end retailers are catering to their best customers by expanding loyalty programs and establishing private clubs.

Figure 1: High-Street Foot Traffic by Month

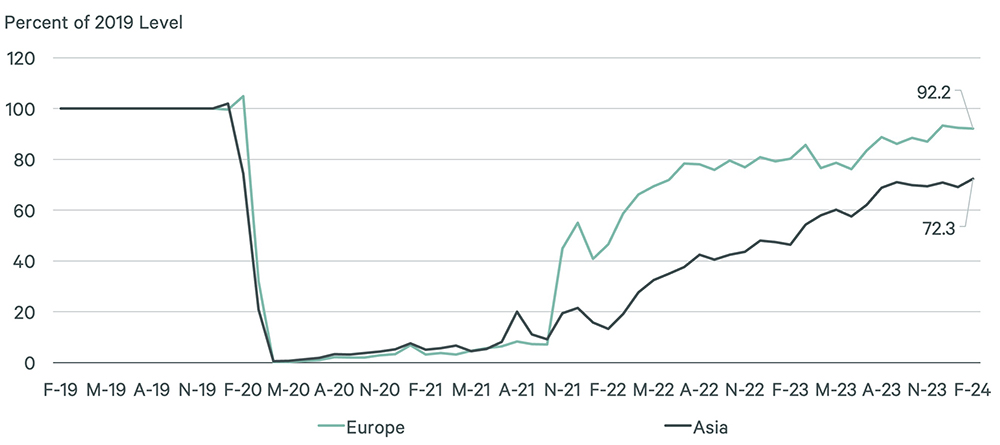

Retailers in densely populated, high-income metro areas are seeing more out-of-town visitors and tourists. As of February 2024, tourism from Europe was at 92% of pre-pandemic 2019 levels, while tourism from Asia was at 72%. In turn, occupancy rates for top-tier hotels in prime retail districts increased to almost 70% in 2023 from 66.7% in 2022 and 55.7% in 2021.

Figure 2: U.S. Inbound Overseas Travel by Region

Note: Excludes Canada and Mexico

Retailers that want prime space within high-street districts appear willing to wait for the right location. For example, Chicago retailers that are unable to find space within the Oak Street/Gold Coast district will often reject any space not located on the main thoroughfare. Anecdotal evidence suggests that tenant/landlord negotiations are now occurring three to four years in advance of lease expirations, which is one of several factors that has shifted the market in favor of landlords.

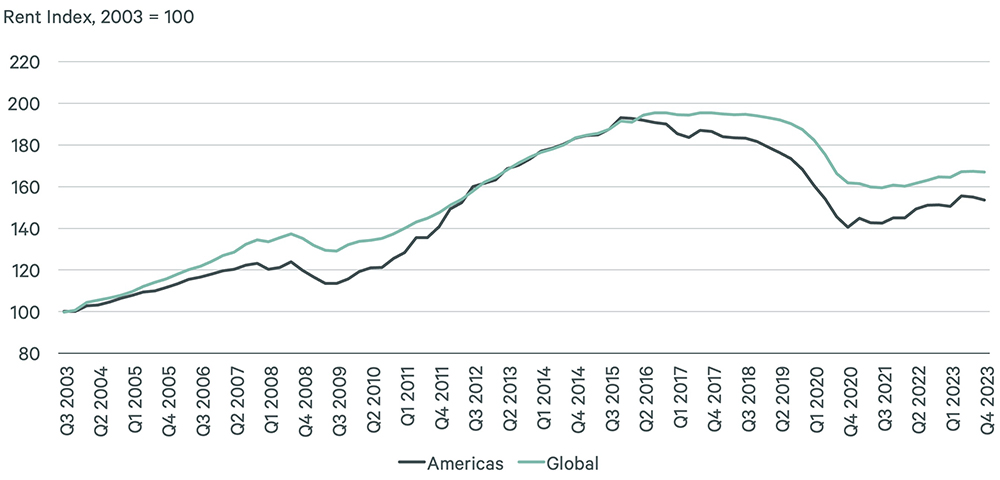

Following sizable decreases in 2020 and 2021, rents for prime retail space have increased by more than 9% in the Americas vs. 4.8% globally. Some retailers capitalized on the lower rents in 2020 and 2021 by leasing more suitable spaces for new flagship stores that will host their brands for the next few decades.

Other retailers have purchased their own space, affording them greater control over operations. Such investments appear justified, as the street retail outlook is favorable. For example, Acadia Realty Trust, one of the few REITs with an extensive street retail portfolio, reports that its high-street properties have a higher net-effective-rent growth trajectory than other retail types.

Figure 3: Global & Americas Prime Rent Index

Alternative Street-Retail Districts

Although retailers that want to establish a high-street presence are often unwilling to settle for inferior locations, some retailers believe they can achieve synergies by establishing locations in multiple street districts within the same market.

For example, some retailers in Los Angeles can have successful stores on both Rodeo Drive and Melrose Avenue, while those in New York City can have locations along Madison/Fifth Avenue and in Soho, and Williamsburg. The additional stores can provide more convenience for local consumers, especially for digital purchase pickups and returns.

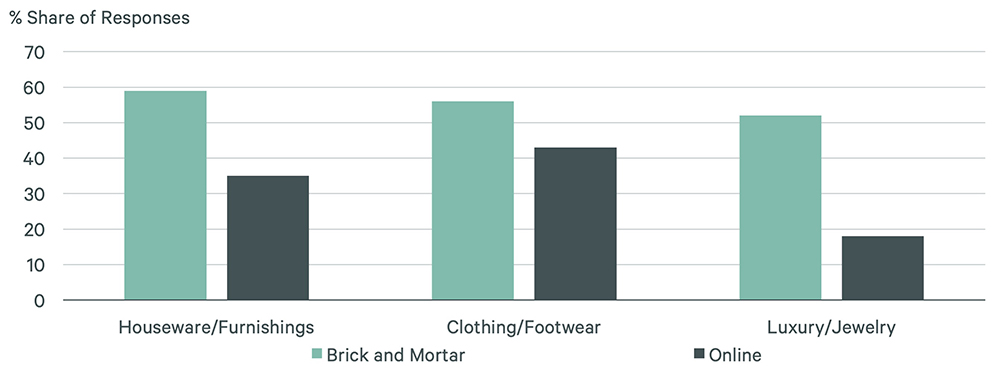

Alternative street-retail districts can also offer retailers opportunities for brand expansion. Food & beverage operators and certain apparel and personal care brands, for example, can perform better in alternative or neighborhood street retail districts, where rents are lower and build-out regulations are often less restrictive. They are also attractive for emerging brands that are leaving department stores and occupying their own street-retail storefronts. According to CBRE’s Global Live-Work-Shop report, a majority of consumers still prefer in-store shopping, which makes it critical for emerging brands to have a brick-and-mortar presence.

Figure 4: Shopping Preferences by Channel

Physical Stores Needed to Drive Digital Sales

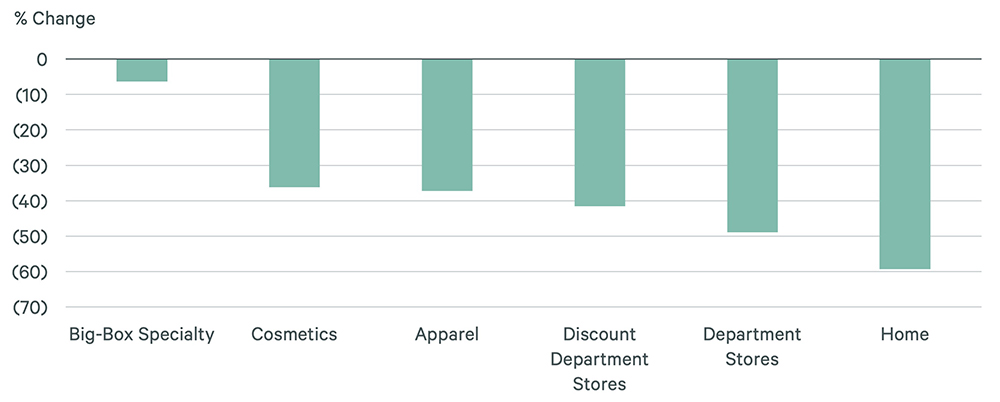

Like their mass-market counterparts, storefront retailers also rely on digital sales for a meaningful share of their total revenue. Shopping center industry association ICSC reports that opening a physical store increases a retailer’s digital sales by 6.9%, while closing a store decreases such sales by 11.5%.

Figure 5: Change in Online Retail Sales by Scenario

Source: ICSC.

Figure 6: Impact on Total Trade Area Sales When a Store Closes

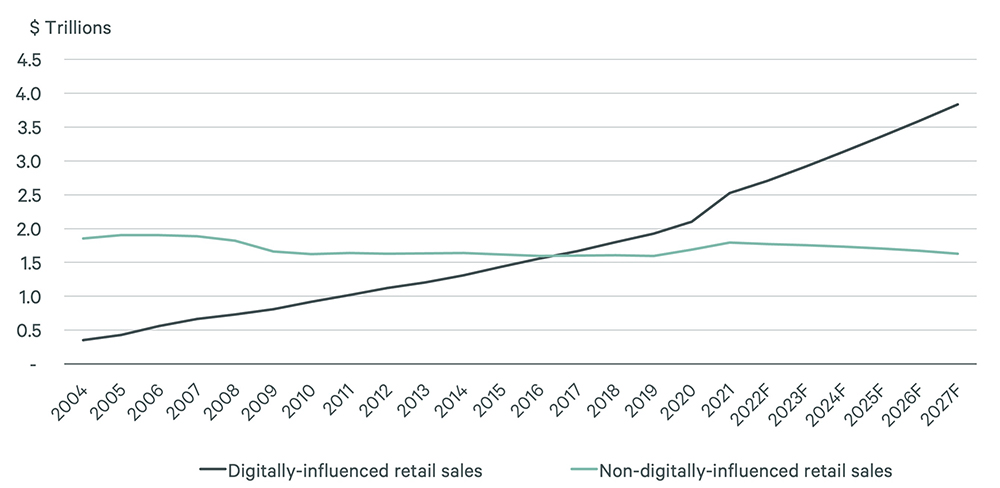

In a world where almost 70% of retail sales are digitally influenced, meaning that consumers research a product online before purchasing it in-store, this could have a make-or-break effect. CBRE therefore believes it is essential for retailers to operate robust multichannel platforms to be competitive at scale. Limiting digital sales by closing stores or failing to capitalize on a rise in digital traffic at an existing store is counterproductive.

Figure 7: Digitally- vs. Non-Digitally-Influenced Retail Sales

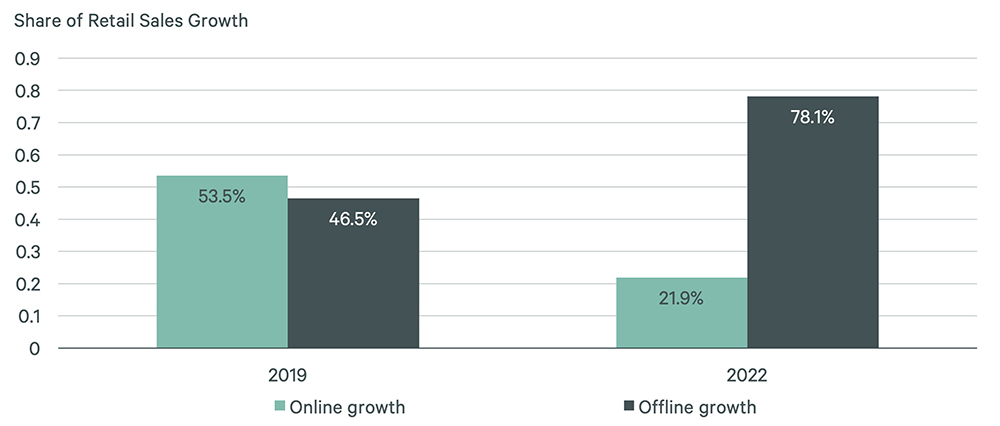

Retailers with effective digital platforms can realize other benefits by opening physical stores. A recent study of 60+ multichannel retailers by Forrester found that digital orders fulfilled at the store level or through “click and collect,” if counted as in-store sales, would increase a store’s per-sq.-ft. sales by an average of 11%. CBRE data shows that retail sales per sq. ft. have increased by 26% nationwide since 2019 as the primary driver of sales growth shifted to brick-and-mortar retailers. By 2022, 78% of sales growth came from in-store sales versus 46% in 2019.

Figure 8: Share of Retail Sales Growth by Channel

Source: 2023 Retail Competition Tracker, U.S., Forrester, September, 2023.

CBRE’s Global Live-Work-Shop survey found that consumers who shop online continue to utilize brick-and-mortar stores. Globally, 56% of survey respondents stated that they like to physically see items in store before purchasing online. Stores are also critical for customer satisfaction over returns; 54% of U.S. online shoppers prefer returning items in-store. Additionally, 31% of survey respondents said they prefer picking up online orders in-store. Each of these scenarios creates an opportunity for retailers to convert returns to alternative sales or at least provide in-person customer service that helps retain customers long-term.

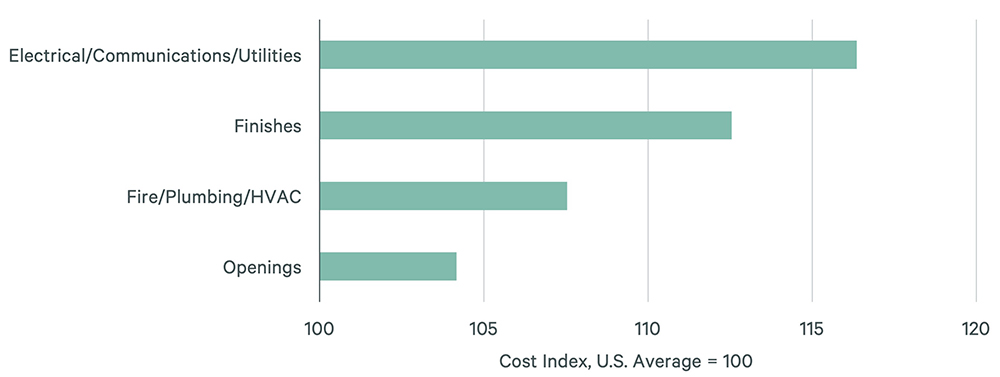

Higher Build-out Costs a Challenge

Interior build-out costs can be higher and more challenging in urban markets than in their suburban counterparts. Average interior build-out costs in U.S. and Canadian prime rent districts range from 4% to 16% above the overall U.S. average.

Figure 9: Interior Build-out Costs Index, Prime-Rent Markets

Operational costs, such as rents, utilities, and employee salaries, are also higher in urban markets, putting greater pressure on store performance.

Street Retail Will Remain Popular

Retail real estate is the only type of commercial property where people choose to spend their spare time, whether to do holiday shopping, meet friends at a restaurant, buy essential products for a trip or just stroll a street retail district. This is part of who we are as a society.

Retailers therefore require a store presence diverse enough to attract consumers at any time. What little store space remains available in historic street retail districts will be keenly sought after, even as the economic climate ebbs and flows.

Although the e-commerce share of total retail sales continues to rise, there is no chance that e-commerce will render brick-and-mortar retail obsolete. Rather, e-commerce will continue to act as a catalyst for more in-store sales.

This is even more true within the street-retail segment, where the experiences are unique and cannot be replicated by technology.

Related Insights

-

While many retailers were shuttering stores during the pandemic, menswear retailer Psycho Bunny took the opposite approach. Chief Development Officer Kenny Minzberg and CBRE’s Drew Schaul discuss Psycho Bunny’s strategy to aggressively add brick-and-mortar stores to their wholesale and e-commerce ecosystem.

Related Services

- Property Type

Retail Services

With integrated solutions, unique insight, and unmatched experience, we deliver successful outcomes for retailers, restaurateurs, investors, owners, a...

- Retail

Street & Urban Environments

From global high streets to emerging districts, CBRE provides seamless and comprehensive real estate advisory and transaction services to both retaile...