Intelligent Investment

Greater Tokyo Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- Greater Tokyo offers Japan’s most comprehensive life sciences industry presence from research and development (R&D) to front office and headquarters locations.

- Greater Osaka also offer a significant Japanese life sciences industry presence, but not to the same degree as Greater Tokyo.

- Strong growth in Japanese R&D expenditures in recent years has coincided with growing interest in leasable lab spaces, as more companies look to restructure their R&D facilities/systems to allow for more collaboration with other companies/institutes as well as to enhance staffing.

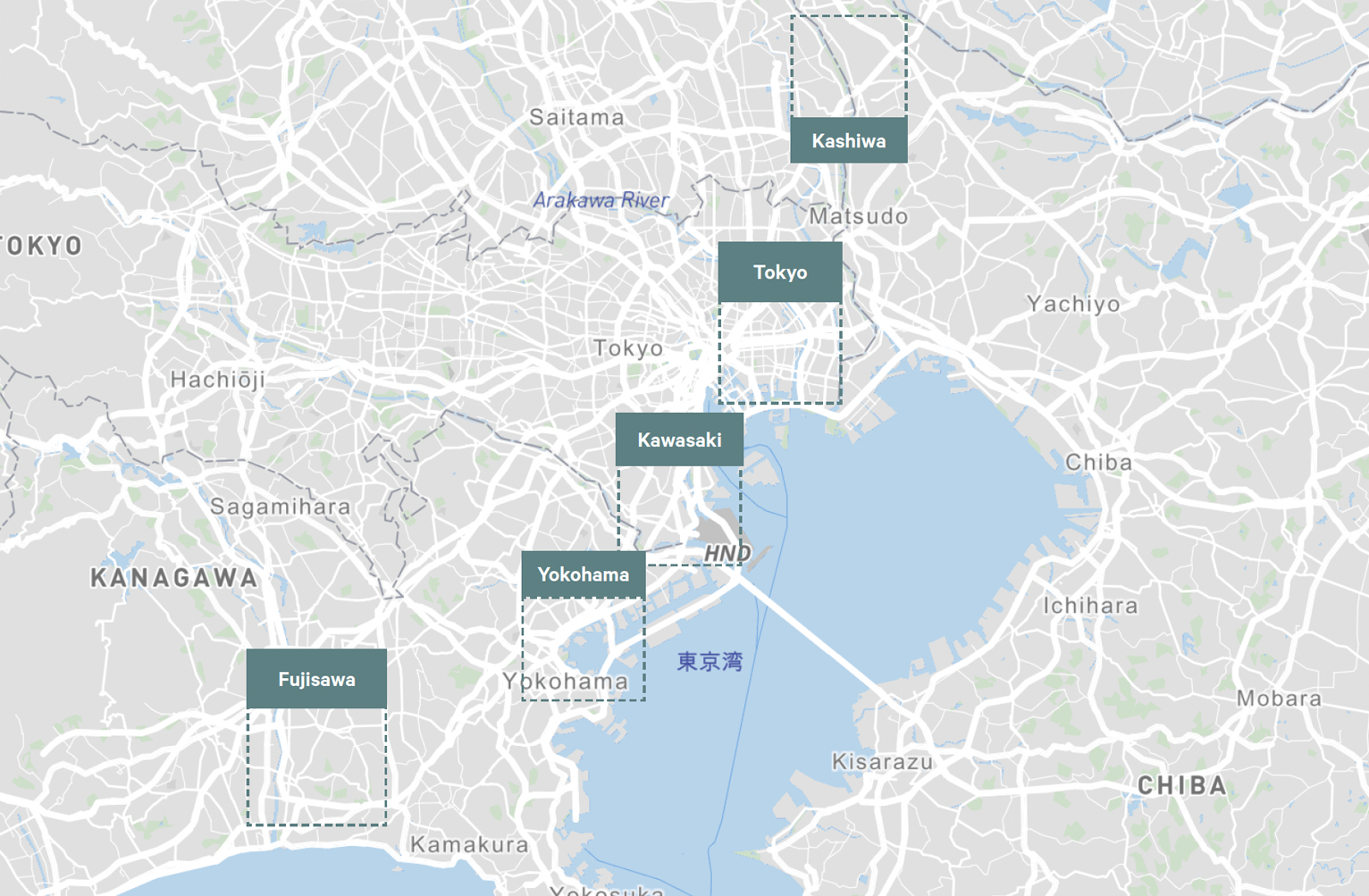

Submarkets

- Total leasable space of wet labs in the Greater Tokyo Area is estimated to be 134,000 tsubo (c. 4.8 million sq.ft.), many of which are concentrated in Yokoyama and Kawasaki.

- New construction lab rents, Tokyo CBD $49-$54.

Figure 1: Number of Life Science Related Researchers in Japan

Figure 2: Leasable space of wet labs in Greater Tokyo (‘000 tsubo)

Life Sciences Venture Capital Investment Trends

Figure 3: Greater Tokyo Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 4: Leasable space of wet labs by City (‘000 tsubo)

- Astellas Pharma Inc.

- Chugai Pharmaceutical Co., Ltd.

- Daiichi Sankyo, Inc.

- Eisai Co., Ltd.

- Fujifilm Holdings Corp.

- Kyowa Kirin Co., Ltd.

- Ono Pharmaceutical Co., Ltd.

- Otsuka Pharmaceutical Co., Ltd.

- Shionogi & Co., Ltd.

- Sumitomo Pharma Co., Ltd.

- Takeda Therapeutics