Intelligent Investment

Singapore Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- Singapore is one of the few markets in Asia-Pacific with a full end-to-end value chain—manufacturing, research and development (R&D), sales and logistics—bolstered by supportive government policies. Its biomedical manufacturing sector—notably medical technology—has been the fastest growing among various manufacturing sectors (8.3% CAGR from 2000-2023 for biomedical manufacturing vs 4.1% for overall manufacturing).

- Singapore’s life sciences startup ecosystem remains vibrant, with nearly 500 biomedical startups attracting nearly $2 billion in venture capital funding in recent years.

- CBRE Research estimates Singapore has roughly 37.4 million sq. ft. of business parks, high-tech and manufacturing space with life sciences operations. Leasable, multi-tenanted space totals nearly 7 million sq. ft. in business parks, high-tech space (including R&D) and some manufacturing properties.

- Singapore’s growth as a life sciences hub benefits from its developed infrastructure, political stability, business-friendly policies, skilled workforce and favorable intellectual property laws.

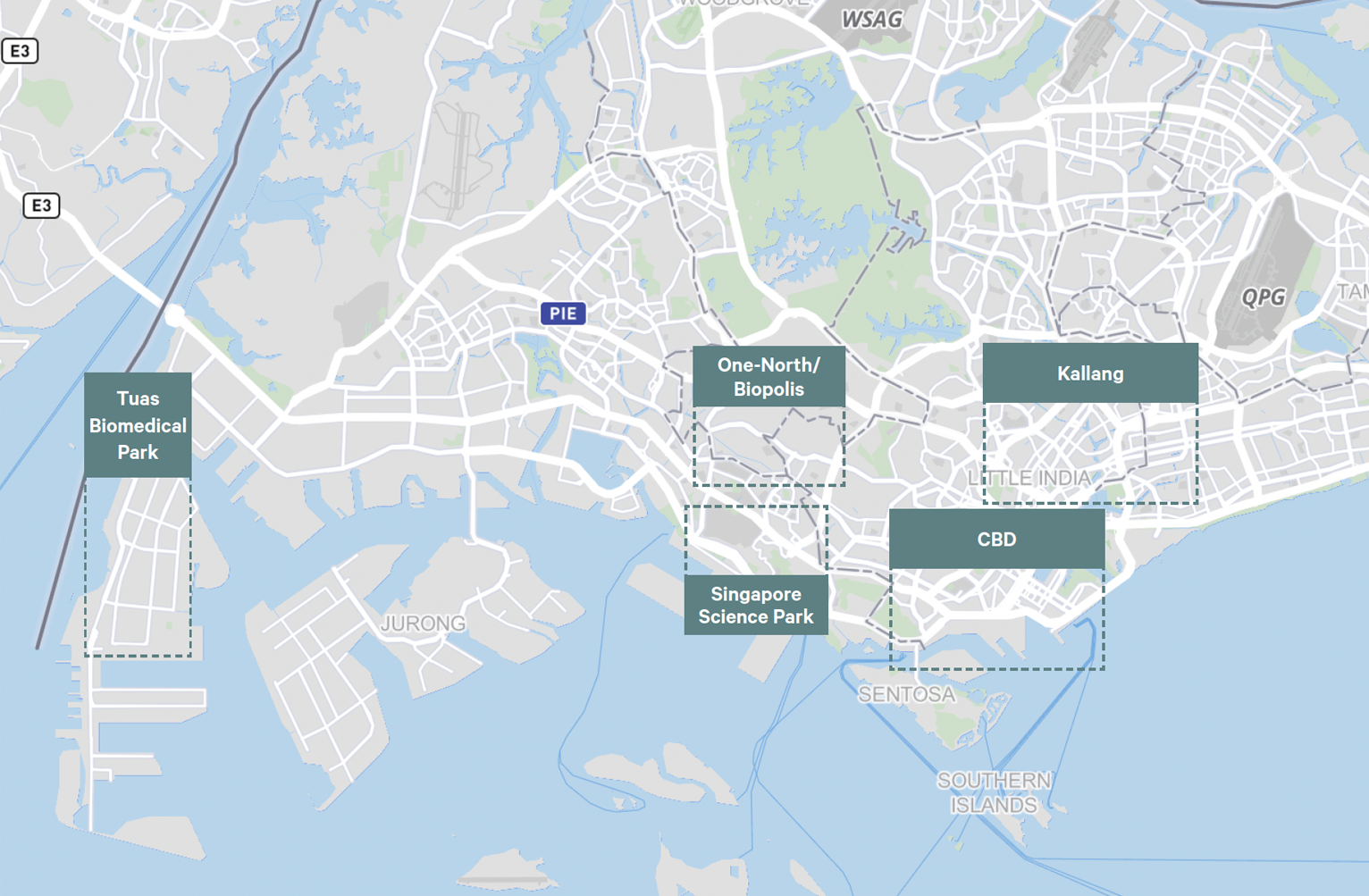

Submarkets

- Biopolis: The nucleus for growth in the biomedical sector, located within one-north, Biopolis boasts six phases, totaling 2.4M SF of prime business park space.

- Singapore Science Park: The oldest cluster in Singapore and home to a thriving ecosystem of leading agritech, biotech, IT, life sciences and specialty chemical companies. Currently undergoing rejuvenations to become a new life sciences and innovation hub with new building completions to take place in 2025.

- Tuas Biomedical Park: Many major life sciences companies have established their own build-to-suit manufacturing facilities.

- Kallang: A budding life sciences sub-cluster on the city fringe, providing a central location for manufacturing and R&D users in high-spec industrial buildings. It is currently home to established life sciences companies like 10K Genomics and GenScript Biotech.

Industry Presence

- More than 26,000 employees work in the biomedical industry

- CBRE Research estimates roughly 37.4 million sq. ft. of business parks, high-tech and manufacturing space with life sciences operations. Leasable, multi-tenanted space in business parks, high-tech space (including R&D), as well as some manufacturing properties totals nearly 7 million sq. ft.

- Four of the world’s top 10 drugs are manufactured in Singapore (by global revenue)

- Nine of the top 10 biopharma companies have a presence in Singapore

- More than 80 manufacturing plants for the pharmaceutical and medical device industry

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Life Sciences Clusters

Development Pipeline or Activity

- Nearly 1 million sq. ft. of new deliveries scheduled in 2025 at Singapore Science Park

Featured Projects:

- 1 Science Park Drive

- Net Leasable Area: 531,000 sq. ft.

- Expected delivery: Q2 2025

- 1A Science Park Drive

- Net Leasable Area: 283,700 sq. ft.

- Expected delivery: Q2 2025

- 1B Science Park Drive

- Net Leasable Area: 270,100 sq. ft.

- Expected delivery: Q2 2025

- 10X Genomics

- Abbvie

- GenScript Biotech

- Illumina

- Johnson & Johnson

- MSD

- Novartis

- Pfizer

- Roche

- Sanofi

- Takeda

- Thermo Fisher Scientific

- Vanda Pharmaceuticals

- Vertex Pharmaceuticals

- A*STAR – Agency for Science, Technology and Research

- Nanyang Technological University

- National University Hospital

- National University of Singapore

- Singapore General Hospital

- Singapore Polytechnic