Intelligent Investment

San Francisco Bay Area Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- The San Francisco life sciences cluster is the largest on the U.S. West Coast. More than 147,000 people work in the local industry, over 42,000 in life sciences research and development (R&D) roles.

- The San Francisco Bay Area has 51.3 million sq. ft. of life sciences lab/R&D inventory, the second-largest amount in the U.S., the vast majority of which is multi-tenanted space. Another 2.7 million sq. ft. is under construction. Space supply is outpacing demand as of the end of 2024, causing the region’s lab/R&D vacancy rate to reach its highest level in years.

- San Francisco Bay Area life sciences companies secured more than $51 billion in venture capital funding between 2019-2024, the second-highest amount in the world after Boston-Cambridge.

- The Bay Area’s dynamic life sciences ecosystem is supported by world-renowned universities (Stanford, University of California at Berkeley, University of California at San Francisco, among others) and leading health care institutions (UCSF Medical Center, Stanford Hospital).

- In FY 2024, the National Institutes of Health (NIH) allocated almost $2 billion to organizations in the San Francisco Bay Area for healthcare and life sciences initiatives, the third-highest amount in the U.S.

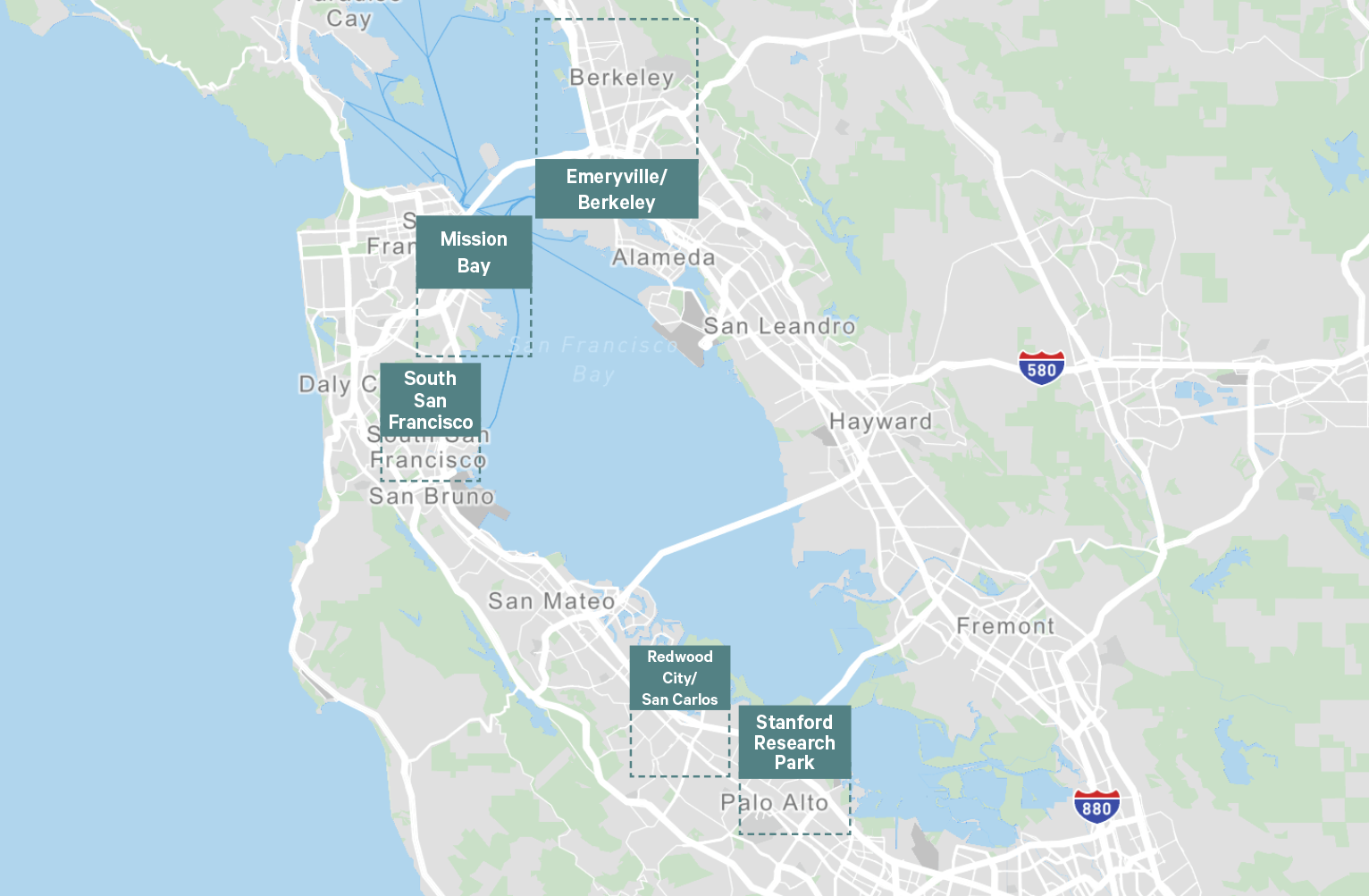

Submarkets

- The San Francisco Peninsula is the region’s largest cluster of life sciences companies.

Industry Presence

- San Francisco Bay Area life sciences companies secured more than $8.6 billion of venture capital funding last year, the largest amount anywhere in the world.

- More than 147,000 people work in the region’s life sciences industry, the nation’s largest workforce. This number comprises 4.7% of total employment in the San Francisco Bay Area, a far higher density than the U.S. average of 1.4%.

- The San Francisco Bay Area has more than 42,000 people employed in life sciences R&D roles, the nation’s third-largest number.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

Featured Projects:

- ACLS (Alexandria Center for Life Science) Millbrae – Phase I

- City: Millbrae

- Owner: Alexandria Real Estate

- Total Size: 285,905 sq. ft.

- Preleased: 285,905 sq. ft.

- Notes: Fully preleased to Eikon Therapeutics

- Elco Yards

- City: Redwood City

- Owner: IQHQ

- Total Size: 592,000 sq. ft. (128,000 sq. ft. of office space, 464,000 sq. ft. of life science space)

- Preleased: 115,000 sq. ft.

- Notes: Two full floors preleased at The Shop (building name) to Chan Zuckerberg Institute for Advanced Biological Imaging

- Vantage

- City: South San Francisco

- Owner: Healthpeak

- Total Size: 346,000 sq. ft.

- Preleased: 240,000 sq. ft.

- Notes: Preleased to Astellas and Neurona Therapeutics

- Abbvie

- Amgen

- Bristol Myers Squibb

- Exelixis

- Gilead

- Illumina

- Roche

- Gladstone Institutes

- Stanford University

- University of California at Berkeley

- University of California at Davis

- University of California at San Francisco