Intelligent Investment

San Diego Market

Global Life Sciences Atlas

April 11, 2025 5 Minute Read

Overview

- San Diego is one of the top three U.S. life sciences clusters. More than 89,000 people work in the local industry, over 17,000 of whom are in life sciences research and development (R&D) roles.

- San Diego has 27.3 million sq. ft. of life sciences lab/R&D space, the third-largest cluster in the U.S., with another 1.6 million sq. ft. under construction. As of the end of 2024, supply of space is outpacing demand, causing the region’s lab/R&D vacancy rate to reach its highest level in years.

- Between 2019-2024, San Diego life sciences companies secured roughly $19.7 billion in venture capital funding—the third-highest amount in the world.

- San Diego’s dynamic life sciences ecosystem is supported by world-renowned universities (University of California at San Diego, San Diego State University) and leading healthcare research institutions (Scripps Research Institute, Salk Institute, Sanford Burnham Prebys Medical Discovery Institute, among others).

- The National Institutes of Health (NIH) allocated more than $1 billion in FY 2024 to organizations in San Diego for healthcare and life sciences initiatives.

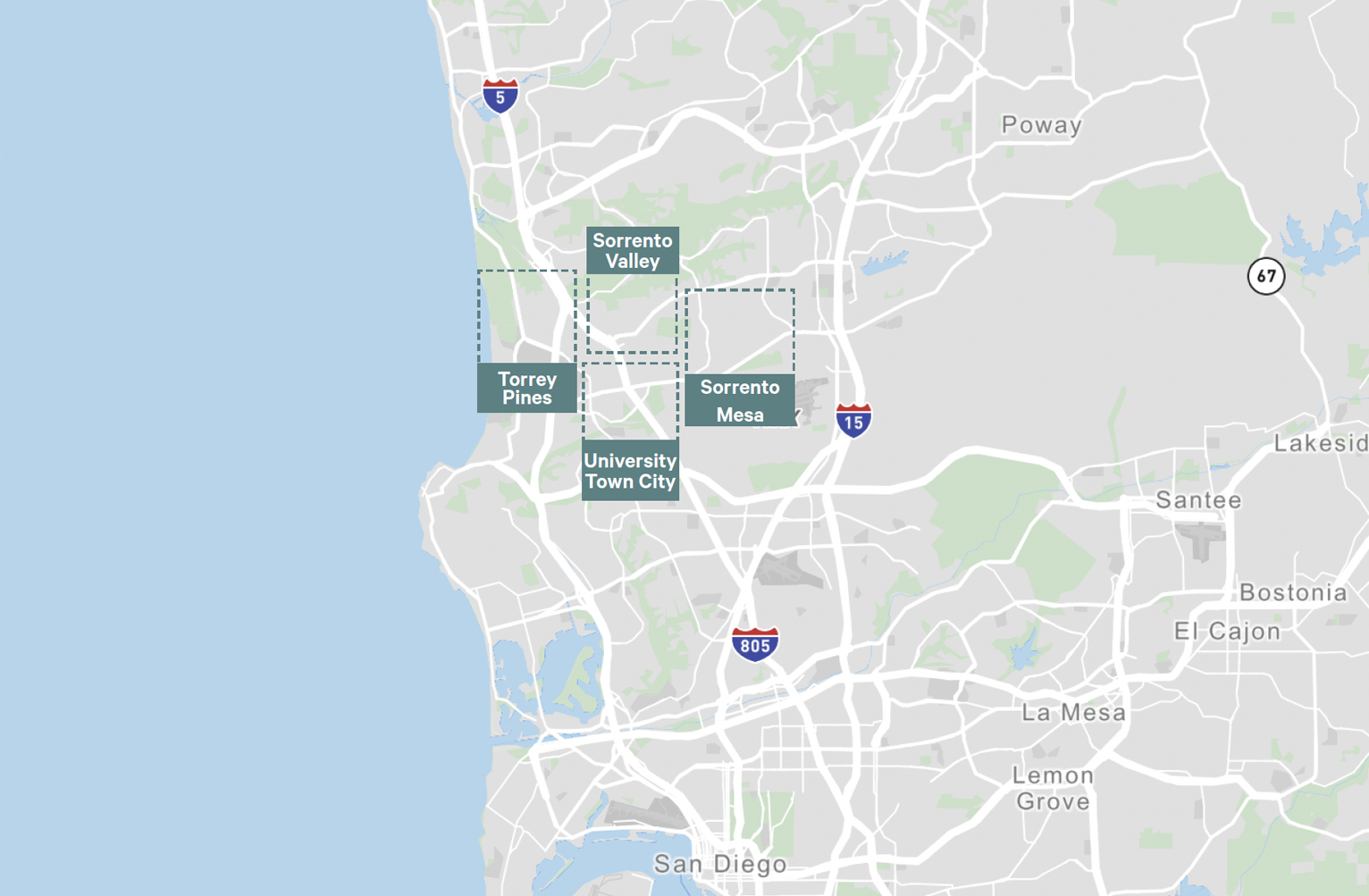

Submarkets

- San Diego’s premier destinations for the life sciences industry lie north of the city, in four key submarkets that comprise over two-thirds of the metro’s life sciences lab/R&D inventory.

Industry Presence

- More than 89,000 people work in the region’s life sciences industry, the nation’s third-largest workforce. This number comprises 6.9% of San Diego’s total employment, a far higher density than the U.S. average of 1.4%.

- San Diego has more than 17,000 people in life sciences R&D roles, the nation’s seventh-largest number.

- San Diego life sciences companies secured more than $3.3 billion of venture capital funding last year—the third-highest amount in the world.

Life Sciences Venture Capital Investment Trends

Figure 1: Life Sciences Venture Capital Funding

Life Sciences Market Stats

Figure 2: Market Overview

Development Pipeline or Activity

Figure 3: Lab/R&D Space Under Construction

- Bristol Myers Squibb

- Eli Lilly

- Illumina

- Neurocrine Biosciences

- Novartis

- Salk Institute

- San Diego State University

- Sanford Burnham Prebys Medical Discovery Institute

- Scripps Research Institute

- University of California at San Diego