Intelligent Investment

Industrial Occupiers' Flight to Quality Leaves Behind Vacant Older Space

September 24, 2024 3 Minute Read

Robust absorption of the nearly 2 billion sq. ft. of new industrial space delivered since 2021 has left a raft of vacant older inventory in its wake. The new facilities are attracting occupiers of older properties with opportunities to upgrade their space, including higher clear ceilings, more power and other amenities needed for modern distribution.

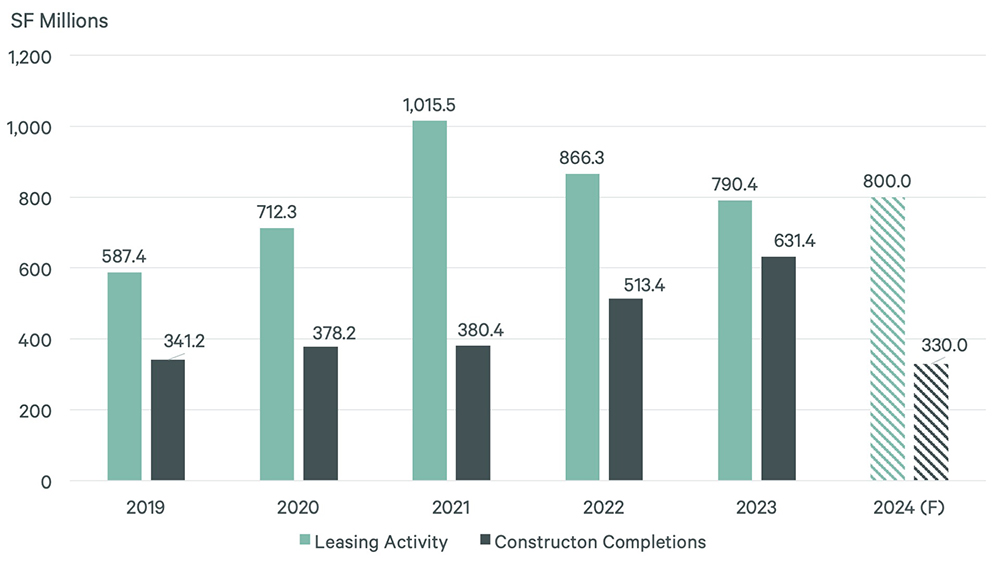

Figure 1: U.S. Industrial Leasing vs. Completions

Source: CBRE Research, CBRE Econometric Advisors, Q2 2024.

The flight to quality has been a major driver of robust leasing activity that CBRE Research forecasts will reach 800 million sq. ft. in 2024, which would be the third highest annual amount on record.

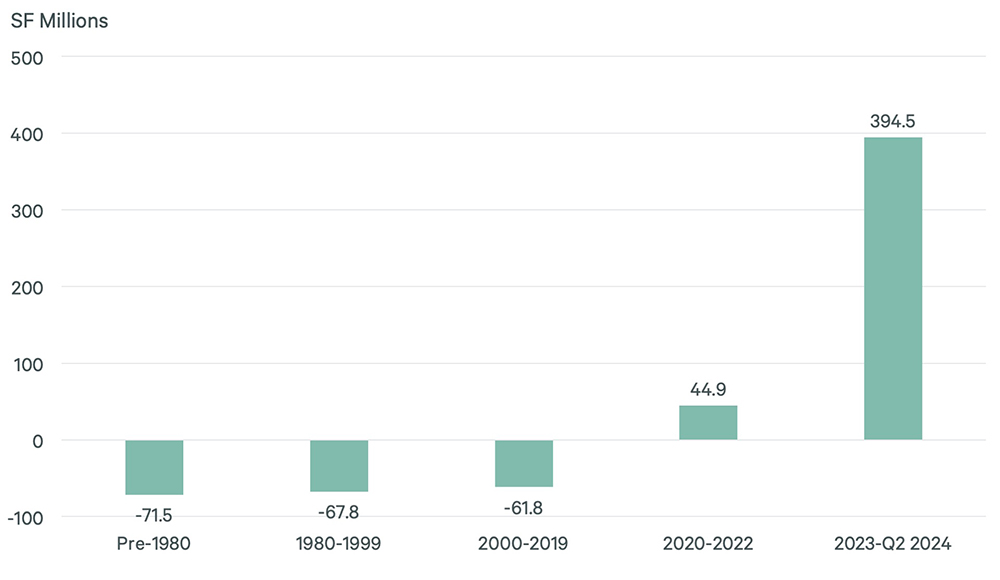

As new space becomes available, many occupiers are moving out of older facilities that lack modern amenities. Buildings completed between 2023 and Q2 2024 have recorded 395 million sq. ft. of positive net absorption since Q1 2023, while those built between 2000 and 2022 have seen 17 million sq. ft. of negative net absorption. Buildings that are 25 or more years old have suffered the most, with 139 million sq. ft. of negative net absorption over the same period.

Figure 2: U.S. Industrial Net Absorption Since Q1 2023 by Year Built

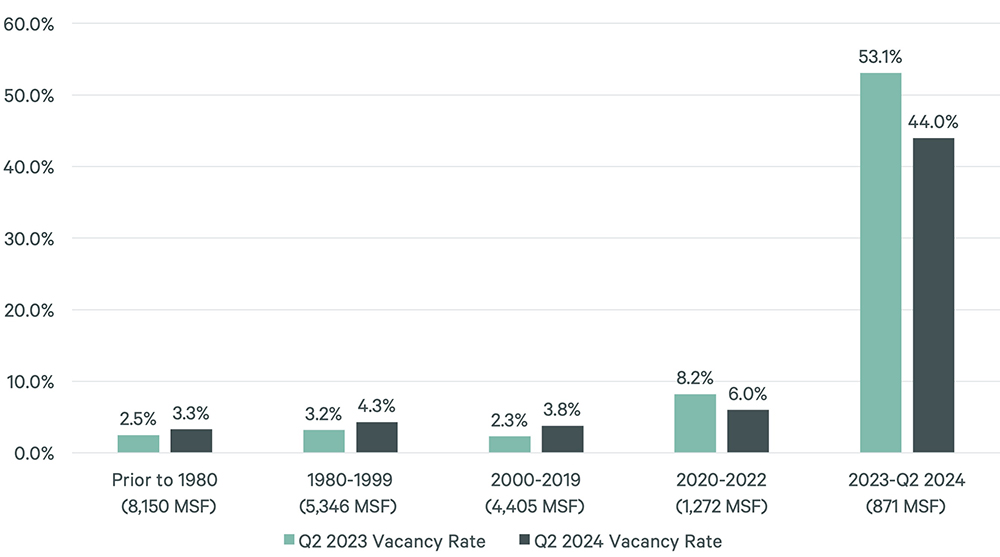

Despite the large amount of negative absorption in older buildings, their overall vacancy rates remain much lower than that of newer buildings: 3.6% for pre-2000 buildings vs. 44.0% for those completed after 2022. However, more than 13 billion of the country’s 20 billion-sq.-ft. total industrial inventory was built before 2000, so even a small increase in vacancy equates to significant negative absorption.

Figure 3: Overall Vacancy Rate & Total Inventory by Year Built

As occupiers leave older facilities, investors should consider either selling them to the growing pool of owner-occupiers, renovating them to meet modern standards or converting them to other uses. Another option for well-capitalized investors is to hold these assets until market conditions for secondary and tertiary product improve. CBRE will produce a series of Briefs in coming months exploring each of these options in more detail.

Related Services

- Property Type

Industrial & Logistics Investor Services

Purchase, lease, and manage and sell your assets with proven real estate strategies for industrial investors, property owners, developers and landlords.

- Industrial & Logistics

Intelligent Site Selection

Make smarter location decisions with a comprehensive and holistic approach that weighs factors around real estate, labor and incentives.

Related Insights

-

Report | Creating Resilience

Rising Consumer Demand Boosts North American Cargo Volume

September 10, 2024

Cargo container volume at the 14 major North American ports tracked by CBRE increased by 11% year-over-year in 02.

-

Brief | Intelligent Investment

Mega Leases Make Up Greater Share of Top 100 Industrial Leases

July 18, 2024

Despite high interest rates and economic uncertainty, significantly more million-sq.-ft. and larger leases were completed in 2024’s first half (31) than in the same period last year (24).

Contacts

James Breeze

Vice President, Global Industrial and Retail Research

John Morris

President, Americas Industrial & Logistics, Advisory Services